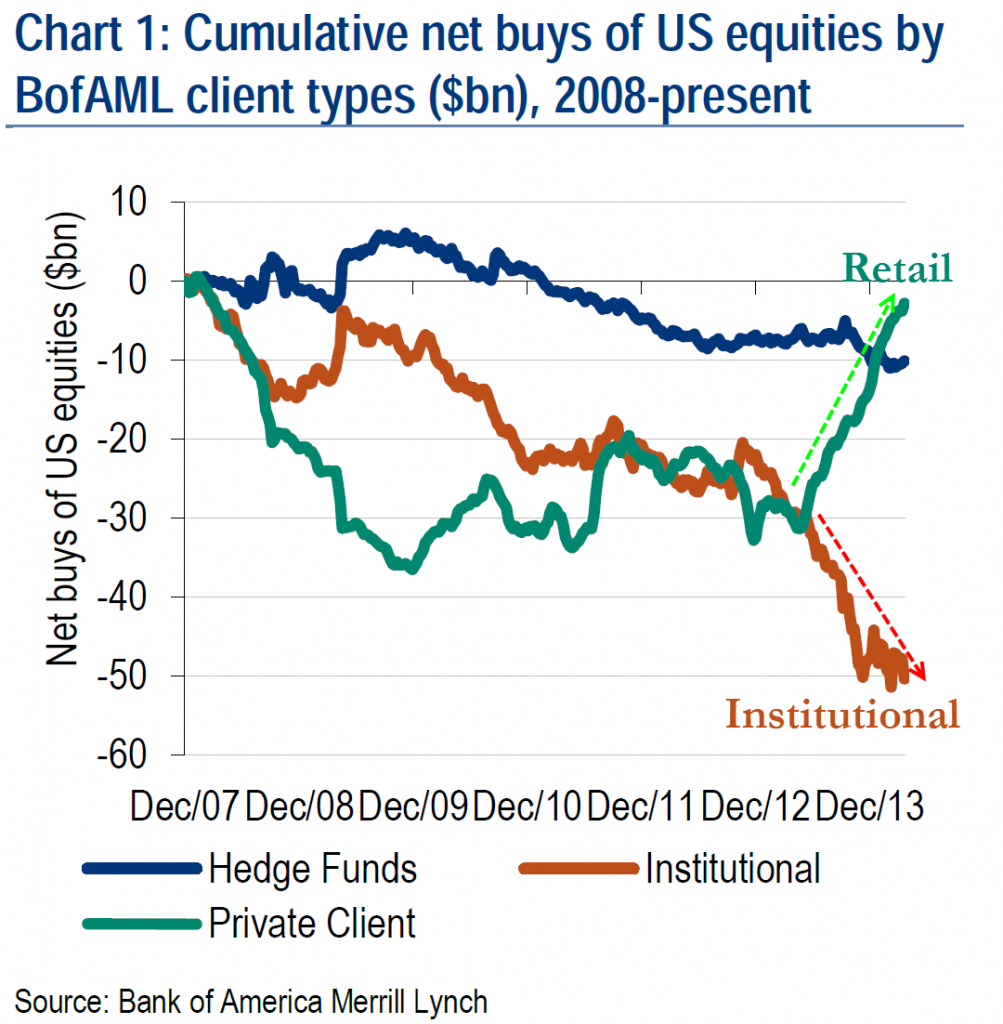

Professional investors are shorting while individual investors are diving in

The article linked below brought to my attention that professional investors have been shorting US stocks while individual investors are throwing their money into the markets. Short interest in the S&P 500 hit 1.76% recently (for the median stock), a level that has not been seen since September 2012. While individuals have drastically increased their exposure to US equities. Just look at the divergence between the Pros and Joes below.

Many people say the markets reach their final top when the individual investor goes all. While we are not there yet if this trend continues we could see some more very sad stories about the average American getting screwed in the market again.

Click here to read the article that brought this topic to my attention.

Whats supposed to happen july 20th?

Here, BB. http://www.youtube.com/watch?v=QYmViPTndxw

I don’t believe it myself. But some people are convinced the great reset is going to happen on July 20th.

They could be right. The race to the bottom has been accelerating these past few months. There was also some interesting developments during the BRIC meeting today.

Well, its funny a person in her position would be mentoning numerology.

If its a reset we just gonna have to see what they have planned.

I would rather be a peasent today than in 1200 ad.

They keep making our lives better, like now we get flush toilets for example.

Retail investors ….always a Dollar short and a day late……………..

They have now tried the theory that The Great Depression of 1930 could have been avoided if only the banks backed by The Fed would have pumped liquidity into the markets at the end of October 1929. We now know This Depression would have been forestalled but not avoided and instead we will see a massive coronary in the public markets which has been made much worse by their recklessness and disregard for free market policies. KABOOOOOOOOOOOOOOOOOOM!

Dick Tracy, why are you so pessimistic? Didn’t you read the Globe and Mail- Canadian housing prices are going UP UP UP. Nothing but clear skies up here in the Great White North.

Chris, Blue skies smiling at me, The great crash of 1929, http://www.youtube.com/watch?v=KE9aFqEyUhA

That is a great documentary, BTW. The more things change, the more they stay the same. We’ve learned nothing since the stock market crash of 1929.

Jerry, DT and Chris,

THE MORE THINGS CHANGE….THE MORE THEY STAY THE SAME…..same old – same old…giminy…when will WE ever learn…….

the answer Marc…………..is never………..

Marc, do you think there is a chance that several states might break away from the union? I can see North Dakota and Texas giving the finger to Washington, DC.

People can not remember what they had for dinner last night.,,How, many times have we gone over the same BS, for the last 6 years………..same ole, same ole, and everyone wants to put a different spin on the same BS……..NAMES and FACES CHANGE, the subject matter is the same…………..GOVT.POLITICAN, BANKSTER, all the same

Chris………..did you read anything about the CIVIL WAR……same situation, there is no way ….if,it could have happened , it would have happened in 1861.

J, you’re correct, the chances of something like that happening is slim. But you never know.

Chris,,,,,,,,,,,,,,,,you are correct…….ONE never knows………..

Humans have been screwing up for thousands of years………doing the same old things,fighting the same old people, for the same old reasons……….hate, greed, power.

Just look at California. The DC and State criminals have practically given the state back to Mexico.

Chris,

I really believe that state succession is NOT going to happen….but I DO SEE a general revolt of citizens…fed up with the GREAT ECONOMIC DIVIDE and other perceived injustices and such….AS GERALD CELENTE points out….WHEN PEOPLE HAVE NOTHING ELSE TO LOSE…..THEY LOSE IT…..very, very true……

I think some parts of the US are now losing it………….

Short arms with long pockets maybe trying again tonight to dump more gold futures, 3rd time lucky?

This could be their turtle moment where they roll over on their backs with legs kicking at the air.

is it a snapping turtle…………..if so,,,,,get a stick…….and do not use your fingers, or your arms will become shorter………..

That is not out of the question. They can do a lot of damage in a thinly traded market. We might even see MAD’s $1224 target if that happens. My gut feeling is telling me we are going to have ONE more big one, then up and away with a lot of volatility.

Lagarde is no God…. she doesnt determine whats goin to happen on 20th of july… while this article just states how retailers will be screwed… just a signal … not an absolute conclusion… while im a bit ignorant… I mean to comprehend the graf… to see the label from 7 dec to 13 …. just for 7 days … how much could retailers buy within 7 days… by the way it’s for 2013 .isnt it? Yet were are now in the 7th month of 2014… I cant see any significant about the date chosen…. why not showing graph labelled with the whole 2014 days? That would be a more reliable data

Nice chart. The retail investor is always late to the party. It’s always been like that.

Off topic: I am guessing most people have seen Lagarde’s video on YouTube. Does anybody believe something is going to happen on July 20th? I am being serious.