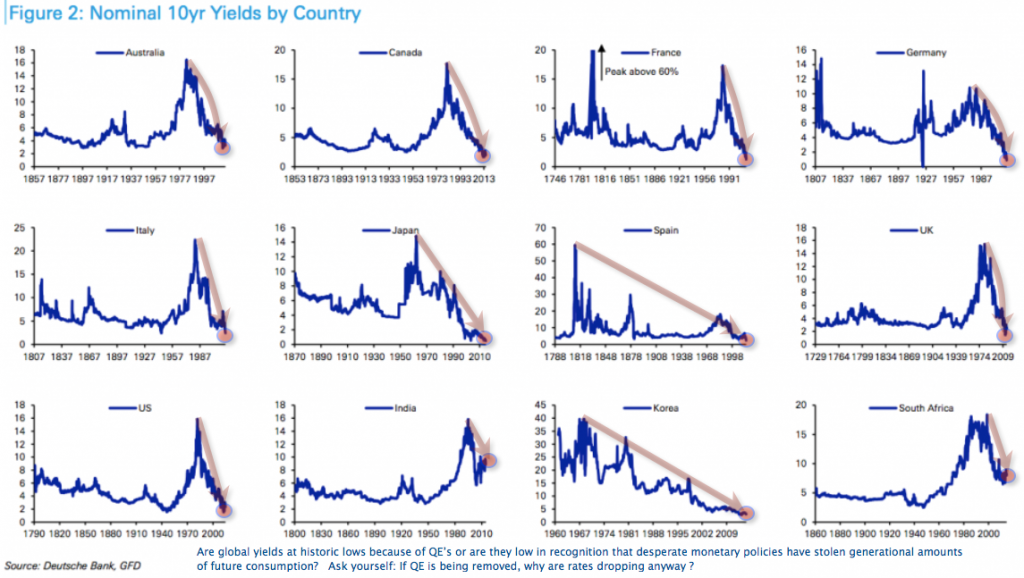

The big picture on low rates

Taking us back over 200 years in 12 of the world’s largest economies the graph below plots the nominal 10-year treasury yields in each economy. We can see every chart is in a downward trend. The post goes into why rates have ended up so low at this point in history all with the motive to grow demand even if this is only through growth.

While I do not totally agree with the author’s conclusion I did find this post interesting.

Best line in that article was “The world is awash in more non-productive goods than we can use”. And that is the truth. From what I have read about the past depression it was the length of time that it took for all the past consumption to be burned off that was notable. In the end folks were actually burning furniture and parts of their homes just to stay warm. But that was also about the time when real demand was returning as most everything of use had been consumed, sold off or destroyed by then. We are swimming in the purchases of the past. That will become a major barrier to growth once another downturn strikes. Most especially if hoarding of money again becomes vogue.

While I have generally agreed with Ms. Park on most things, I disagree with her belief that interest rates are low because no one wants to borrow money.

Interest rates are low because the world is being flooded with newly “printed” money.

Because central banks are buying treasuries, bonds and even stocks.

The market place is no longer a place where values are set by supply and demand, but by different degrees of manipulation.

I believe this is partly by collusion between central banks, partly just a random follow the actions of other banks occurrence.

I believe this flooding of money must and will lead to inflation. When and how much I am not sure, but I expect it could be hyperinflation.

Do the Central banks expect inflation?

I think so; since this is a viable way to reduce government debt as a fraction of GDP.

A way of extracting a hidden tax from all citizens, at a time when almost all Governments have taxed their populace to the limits of acceptability.