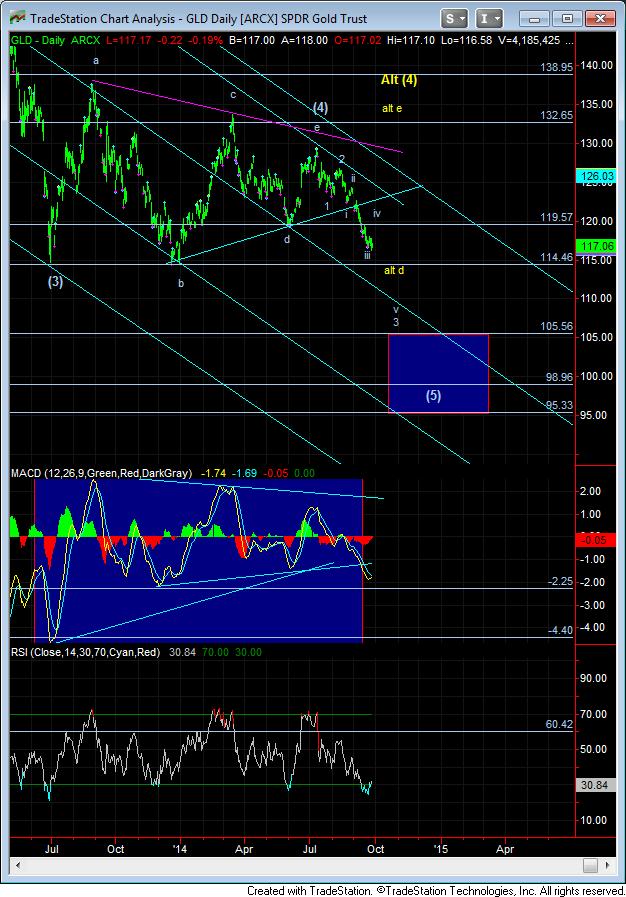

Has The Break-Down in Gold Been Averted For Now?

While the GLD had the set up to break below the 2013 lows early this past week, and chose to invalidate that set up, it is starting to become more likely that the earliest we will see such a break down would be several weeks away. The reason I say this is based upon our silver chart, which has served us well over the last few months.

And, at this time, silver has what looks to be an almost full pattern into the bottom of wave (v) of 3 of iii, which came within .05 of our ideal target. This makes me look at silver as an exceptionally dangerous short trade at this time, at least until we see a solid bounce in wave 4 of iii. The ideal target for wave 4 would be between 18.15-18.37. Any move over 18.37 would get me a little more concerned about continued downside potential, with a break out over 18.75 potentially putting me in the c-wave to 22/23 camp, depending upon what the pattern looks like at the time.

In the GLD, it would seem we are destined to re-test the 121 region. So, I am expecting that same wave 4 of iii in GLD to take us back to at least the 119.50-121 region. A break out over 123 would also have me looking to 130-133 once again. But, I still cannot rule out one more trip in GLD down to the 115-155.50 region before we see the bottom of this wave (v) of iii. So, while I could be wrong, I don’t think we are about to break down below the 2013 lows just yet. Rather, I think we are about to see a test of resistance as the next bigger move in the metals.

As for the technicals, silver is following the fractal we noted back in 2013 almost perfectly, which also began a 4th wave of iii just about where we stand at this time. The technicals on the daily chart from 2013 are an almost exact copy of where we stand today. This means that larger degree positive divergences should begin developing for waves 4-5 of wave iii and then for wave iv and v of this final 5th wave down in the 3+ year corrective decline.

This means that those that want to attempt to take a VERY aggressive short trade in silver will be doing so for wave 5 of iii down into the middle of October, which is when the chart estimates we see the bottom of wave 5 of iii. And, my suggestion to all is to begin aggressively buying long term positions as that wave is bottoming. While we certainly can see lower levels in wave v, which is what I do expect, the potential exists that I could be off by one wave degree and the bottom is actually seen in October. Remember, should you be buying that low, you can always hedge it if all we see is a wave iv off that low.

Again, the count, fractal and technicals all point to TWO more lows to be seen, as represented in our current count on the 144 minute chart on silver. While one can attempt to trade for wave 5 of iii down into October, the only shorts I would suggest for wave v down would be hedges for the long positions you acquire at the bottom of wave 5 of iii. Furthermore, as we move down in wave v, you can then sell those hedges on the way down, and buy more long positions with the proceeds.

So, yes, this is the first time I am noting that, should we see that bigger decline to lower lows in October – especially one in which gold breaks below its 2013 lows – then you now have the green light to begin buying LONG TERM positions (towards the bottom of wave 5 of iii) in preparation for the start of the next major trend change, which should take us into the next phase of the bull market in metals.

One last caveat for the next move up in metals which I am expecting very soon. Should that move up break out over resistance I have cited, then, as I have mentioned many times before, this correction will be taking us into 2015 before we see lower lows. In fact, I would say that this is the last opportunity for the market to prove it wants to push the long term lows to complete the 3+ year correction out to 2015. For if we get only a wave 4 playing out, followed by a wave 5 of iii, my expectation is the GLD will likely break its 2013 lows on that wave 5 down, and that would be the final nail in the coffin, in my humble opinion, for this correction ending in 2014. 2015 will then set itself up as a very bullish year for metals.

Nonsense!!!! There will be no $1050 gold. Rambus is already putting out charts with $900 gold into 2015. That is what complacency will do to you when you get cought in bearish thinking at all time.

We are putting in tripple bottom. The brake down out of trinable is a fake out for bear slaugher orchastrated by one cowboy bank bankster. Just like bulls got slaughtered at $1900 they are setting up bears that are short and new bears that are setting up their new short trades seein in COT. And Tech analysis gurus projecting those lows will be left at the station watching train blowing past their station.

I told you once and will tell you again. Lows been put in and we’re about to go way higher into next major bull gold cycle.

stewie, famous last words eh, the ‘lows (have) been put in’…..we’ll see.

Im going to frame this comment thread for future LOLS after Gold breaks $1050

Haha, I think any of you trying to play gold right now in either direction is playing with fire.

Off Topic:

In the light of the southern US border being porous, you might read:

http://news.yahoo.com/mosquito-borne-virus-spreads-latin-america-180903793.html