Greenspan: Price of Gold Will Rise

Here is the latest from our friend Axel Merk. Thank you to for posting this today on the forum.

To visit Axel’s site for other great articles click here.

Any doubts about why I own gold as an investment were dispelled last Saturday when I met the maestro himself: former Fed Chair Alan Greenspan. It’s not because Greenspan said he thinks the price of gold will rise – I don’t need his investment advice; it’s that he shed light on how the Fed works in ways no other former Fed Chair has ever dared to articulate. All investors should pay attention to this. Let me explain.

The setting: Greenspan participated on a panel at the New Orleans Investment Conference last Saturday. Below I provide a couple of his quotes and expand on what are the potential implications for investors.

Greenspan: “The Gold standard is not possible in a welfare state”

The U.S. provides more welfare benefits nowadays than a decade ago, or back when a gold standard was in place. Greenspan did not explicitly say that the U.S. is a welfare state. However, it’s my interpretation that the sort of government he described was building up liabilities – “entitlements” – that can be very expensive. Similar challenges can arise when a lot of money is spent on other programs, such as military expenditures.

It boils down to the problem that a government in debt has an incentive to debase the value of its debt through currency devaluation or otherwise.

As such, it should not be shocking to learn that a gold standard is not compatible with such a world. But during the course of Greenspan’s comments, it became obvious that there was a much more profound implication.

Who finances social programs?

Marc Faber, who was also on the panel, expressed his view, and displeasure, that the Fed has been financing social programs. The comment earned Faber applause from the audience, but Greenspan shrugged off the criticism, saying: “you have it backwards.”

Greenspan argued that it’s the fiscal side that’s to blame. The Fed merely reacts. Doubling down on the notion, when asked how a 25-fold increase in the Consumer Price Index or a 60-fold increase in the price of gold since the inception of the Fed can be considered a success, he said the Fed does what Congress requires of it. He lamented that Fed policies are dictated by culture rather than economics.

So doesn’t this jeopardize the Fed’s independence? Independence of a central bank is important, for example, so that there isn’t reckless financing of government deficits.

Greenspan: “I never said the central bank is independent!”

I could not believe my ears. I have had off the record conversations with Fed officials that have made me realize that they don’t touch upon certain subjects in public debate – not because they are wrong – but because they would push the debate in a direction that would make it more difficult to conduct future policy. But I have never, ever, heard a Fed Chair be so blunt.

The maestro says the Fed merely does what it is mandated to do, merely playing along. If something doesn’t go right, it’s not the Fed’s fault. That credit bubble? Well, that was due to Fannie and Freddie (the government sponsored entities) disobeying some basic principles, not the Fed.

And what about QE? He made the following comments on the subject:

Greenspan: “The Fed’s balance sheet is a pile of tinder, but it hasn’t been lit … inflation will eventually have to rise.”

But fear not because he assured us:

Greenspan: “They (FOMC members) are very smart”

Trouble is, if no one has noticed, central bankers are always the smart ones. But being smart has not stopped them from making bad decisions in the past. Central bankers in the Weimar Republic were the smartest of their time. The Reichsbank members thought printing money to finance a war was ‘exogenous’ to the economy and wouldn’t be inflationary. Luckily we have learned from our mistakes and are so much smarter these days. Except, of course, as Greenspan points out it’s the politics that ultimately dictate what’s going to happen, not the intelligence of central bankers. And even if some concede central bankers may have above average IQs, not everyone is quite so sanguine about politicians.

Now if they are so smart, the following question were warranted and asked:

Q: Why do central banks (still) own gold?

Greenspan: “This is a fascinating question.”

He did not answer the question, but he did point out: “Gold has always been accepted without reference to any other guarantee.”

While Greenspan did not want to comment on current policy, he was willing to give a forecast on the price of gold, at least in a Greenspanesque way.

Greenspan: Price of Gold will rise

Q: “Where will the price of gold be in 5 years?”

Greenspan: “Higher.”

Q: “How much?”

Greenspan: “Measurably.”

When Greenspan was done talking, I gasped for air. I’ve talked to many current and former policy makers. But at best they say monetary policy is more difficult to conduct when fiscal policy is not prudent. It appears Greenspan has resigned himself to the fact that it was his role to facilitate government policies.

The reason this is most relevant is because many politicians think there’s unlimited money to spend. And, of course, if the Fed’s printing press is at the disposal of politicians, the temptation to use it is great. Not only is there the temptation, some politicians truly believe the Fed could and should help out any time. As Greenspan now acknowledges, these politicians have a point.

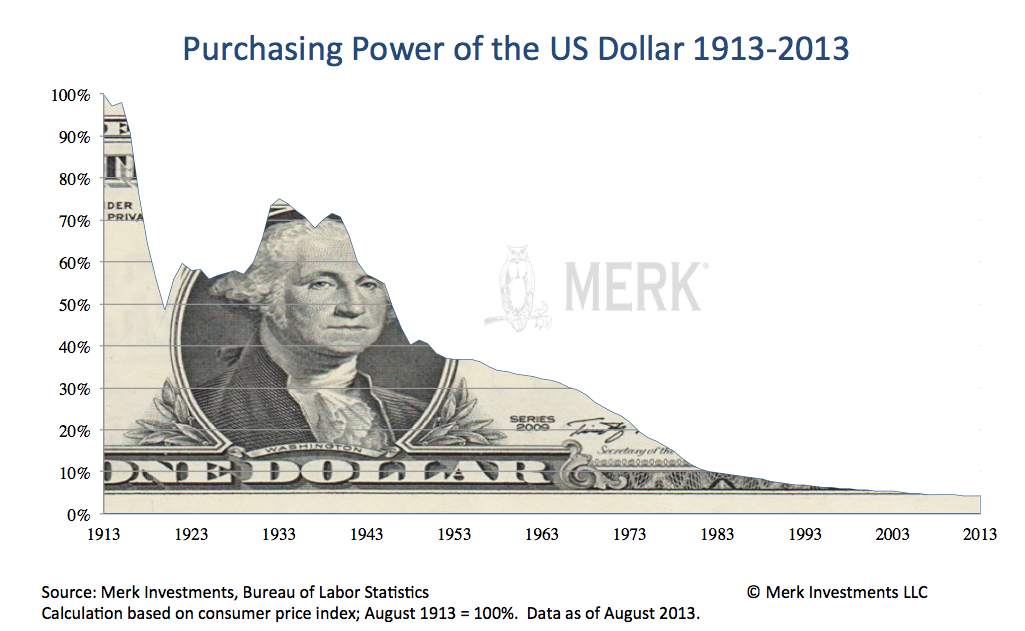

While we have argued for many years that there might not be such a thing anymore as a safe asset and investors may want to take a diversified approach to something as mundane as cash, Greenspan’s talk adds urgency to this message. The dollar has lost over 95% of its purchasing power in the first 100 years of the Fed’s existence.

We now have a “box of tinder” and an admission that the Fed is merely there to enable the government. We are not trying to scare anyone, but summarize what we heard. My own takeaway from Greenspan’s talk was that anyone who isn’t paranoid isn’t paying attention. Did I mention he said the promises made by the government cannot be kept? Mathematically, he said, it’s impossible.

As part of the panel discussion, the topic of Switzerland’s vote to force its central bank to hold 20% of its reserves in gold came up. We will have an in-depth discussion of this vote in an upcoming Merk Insight (to ensure you don’t miss it, register to receive our free newsletters). Marc Faber spoke from my heart when he argued that the only credible gold standard is one that an individual puts in place for oneself; one should never trust a government to adhere to a gold standard. On that note, please register for our upcoming Webinar on November 20, 2014, where we will discuss how investors can build their personal gold standard.

For more of Greenspan’s comments, please review my tweets at twitter.com/AxelMerk (please follow me to instant analysis of events affecting the dollar, gold and currencies).

Axel Merk

Axel Merk is President & CIO , Merk Investments

Manager of the Merk Funds

This report was prepared by Merk Investments LLC,and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Merk Investments LLC makes no representation regarding the advisability of investing in the products herein. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice and is not intended as an endorsement of any specific investment. The information contained herein is general in nature and is provided solely for educational and informational purposes. The information provided does not constitute legal, financial or tax advice. You should obtain advice specific to your circumstances from your own legal, financial and tax advisors. As with any investment, past performance is no guarantee of future performance.

That sounds like a line from The Proclaimers’ ‘Letter to America’.

Can Greenspan really be trusted when we look at his record at The Fed, Greenspan is all about Greenspan.

You now the FARAOS ONLY ME ME ME !

PH Franky not F!

AL OK ! Canasil up date real up date thanks !

When reality Hits ! https://www.youtube.com/watch?v=FCSBoOcGFFE

Here is a story that should be getting more attention. It’s in German but press the translate button on the top right corner: http://www.faz.net/agenturmeldungen/unternehmensnachrichten/deutsche-skatbank-erhebt-negativzins-fuer-besonders-hohe-guthaben-13237144.html

Highway robbery in plain sight, is all I have to say.

Why would this time be different?

I know pretty much everyone here knows Andy Hoffman of Miles Franklin. In the past he was involved in the wall street industry as a sell side analyst. As most here know he does not like the mining stocks and thinks the sector is dead man walking so he dosen’t get any air time at this site. I don’t think big Al could bear the communities meltdown after his interview. It would be epic.

Interesting snippet from him today:

“Clueless miners continue to fund the World Gold Council. At current prices, it won’t be long before the gold mining industry implodes; starting with year-end reserve write-downs, if prices remain anywhere near the current historically depressed levels. Given my experience as a sell-side analyst covering the energy sector in 1999 – when oil prices briefly plunged below $10/bbl. – I expect 2015 to be the year the mining industry completely halts due to “merger paralysis”; starting with the inevitable combination of two of the three largest gold miners, Barrick Gold and Newmont Mining, whose stocks have plunged to lows last seen in 1993 and 2001, respectively.”

Should be interesting to watch this play out. He has clearly thrown his hat and reputation into the ring with respect to what he thinks this sector is going to do over the next few years.

I don’t think the gold and silver mining sector is going away but I do think a whole bunch of companies are!

Vortex,

I feel this might be true. Who knows whether the end game is for Wall Street to acquire bankrupted miners. Unfortunate, US is not top PM producer. The companies in other countries may have to close. However, metals do not come out ground by itself. There is no government stockpile for silver. It is consumed.

I may have to trim my PM equity position and change it to physical.

Great info V………..by the looks of this morning activity Friday……gold down TWENTY FOUR………..profits are going to evaporate along with the mismanagement teams.

The whole gold mining industry implodes?

I think it might end up seeming that way.

Very few gold miners I know of actually make money, and the ones I do know make money are at about 800 an once.

Should gold go somewhere around $1000 for an extended period, (no need for too long so many have been losing $ for some time now) a lot could be out of business, slim margins indeed. Not too many retailers I know of can stay in business at a 25% profit margin.

Only an optimist would invest in them, to say the least.

Gold mining imploding? Entirely possible.

Maybe First Majestic wants the “cartel” because they know how desperate they really are.

They don’t need cartel. They just need some common sense

$900 gold and $12 silver on its way. Mining stocks implode. Sprott forced to liquidate because of investor redemptions. Peter Schiff goes bankrupt. The bottom will be in when there no companies able to afford sponsoring websites and radio shows.

Just don’t know where industry gets their metal.

Well Bill, these sites could always change to talkin about, guns,booze and pot stocks.

All 3 should remain popular depression or not.

Greenspan said it was a great time to get a adjustable mortgage right before he started raising rates and crushed everyone that did back in 2007.

Japan expanded QE significantly

Wow,

I have been one of only about 4-5 people on here saying for months that gold is going lower, but even I am stunned at the unrelenting pressure its under.

I mean gold is getting taken out to the woodshed again tonight.

As I type this snippet gold is down another $12 dollars to $1186. If this were a person in the E.R. receiving medical care this situation would be classified as critical.

Gold is approaching serious downside support levels and if the $1180 support does not hold, this thing could go super nova to the downside.

Who knows where this is going, but at this point playing with gold other than buying some in physical form is a mug’s game. Get you some physical insurance if you like but other than that get the hell out of the way.

let’s how low gold can go. The attack was powerful, straight down about $17.

Hope to pickup some cheap silver tomorrow morning.

Lawrence, even I’m stunned at the powerful down draft.

This might be the only way to break the support.

I just don’t quite get what they want. Money supply increase will raise gold price eventually. Only effect is to punish the current gold investors and miners. Once miners are dead, who can supply them with the PM?

V……..WOODSHED, NO ……. TO THE SAWMILL, this will be all the buzz today…………….best…………………………………J

Good luck all, Gold has broken support at $1180, down $25 dollars.

Silver is 0.06 away from reaching the $15 handle.

This could get out of hand.

Its funny to watch from the sidelines.

This is a precursor to the 2nd half of next years final washout imo.

I keep saying low 900’s (AT BEST).

Do you think miners can last that long? I feel at least silver producers are going to drop dead. Their cost is high. Silver is actually consumed unlike gold. Anyway, I will keep buying silver trust but may have to sell miners

TO

D

A

M

O

O

N

!

!

!

!

Backbone is broken now in gold

There will be rallies for those who are nimble in the meantime

But

The final washout yet to come will be devasting.

Ultimately it will be a wonderful thing….I’m all smiles.

There will be great opportunities come late next year imo.

Skeeta,

no need to through salt in the wounds of our fellow posters.

Skeeta,

This sector in general is so beaten and battered that at this point there is no doubt in my mind this complex is going lower just like you said and Gary Savage has said well into 2015.

There will be a few bounces along the way but this vicious bear is in full control. The full blown capitulation phase somewhere off in the distance is going to be epic in its brutality.

By the time we get to the bottom, in some cases you will be able to buy bigtime well known producers at explorer prices.

I guess this is going to make some one really rich

Going to destroy others also unfortunately Lawrence & Vortex

Its never a win win situation for both parties.

I maybe all smiles atm but I’m not dancing in the street just yet….my call of low 900’s (at best) is still a long, long way from fruition.

….but I’m still confident.

New flash………that someone is suppose to be you. There has been plenty of warnings that this was going to happen, and lots of folks told you so.

But being apart of a gang to many people is more important than is listening to the trends and uncomfortable truths.

I don’t see a problem just buying metal itself. Gold and silver will never go to zero but fiat currencies have to go to zero since they are digitally produced like there is no tomorrow. Japan just doubled down today. If they can succeed now, others should have done it at least once during the last few thousand years. Not like people can not print money. There is no high tech there

I agree Lawrence,

Physical holdings will do very well in the longer term if your patient.

Gold stocks will be interesting to watch in the next 12 months.

Many juniors will disappear / merge / etc.

Gold Bulls will scream manipulation & to da moon all the way down though…pathetic.

Just you watch.

BOO………………….IT IS HALLOWEEN,,,,,,WHAT DID YOU EXPECT…………

At 03:22 AM New York Time Silver has officially reached the $15 dollar handle at $15.98.

Not sure this came from lBMA or globex. Asia is closed now I guess

The Russians and Chinese keep laughing to themselves as the West hands the future to them on a paper platter.

Leveraged play can controlled the price but there is severe consequences later at delivery time unless they don’t intend to deliver

Matt,

The west has already transferred power to the east a number of years ago. This is just the piper being paid phase where the arrogant delusional western leaders think they still have control.

Literally Americas leaders and the west in general has ensured their populations new homes will be in cardboard box’s residing under a highway overpass.

There will not be enough cardboard to go around for all the signs that read….”will work for food”…………….go long cardboard……..

GOOD ONE MATT……………

Ha ha, very good one!

Gold at 1175. Another spanking for the miners in the next session by the looks of things.

IMO this will ultimately be great for the industry.

Getting rid of Juniors who promise everything, but deliver sweet FA.

Many only continually dilute shareholders interests with capital raising to fund their own executive wages & jet trips to conferences.

So many have cr@p management / cr@p business plans / cr@p ground.

I’ve said before. Many are no better than Politicians. They are only interested in themselves not their shareholders.

When we finally get rid of these shucksters.

Then the gold bull will resume….I look forward to its return

Hide the knives

CLOSE ALL THE WINDOWS ABOVE THE SECOND FLOOR………………

This could be the start of the correction, thank you larry for the short call.

It is either a FIRE………..OR A FIRE SALE…………………

One Word = DEFLATION !!!!!!!!

In deflation, stock will drop faster than gold. Stock is up

We need the death of the permabull, at what point will it happen? 650? 900? Who knows!

We don’t need, government need gold bulls to die.

DUST up over 20% yesterday, what will today bring? The ,$100 gold moves? No, I doubt it.

Well there you have it glen!

You did it again with your call of breaking 1180..

Great job :)..

Still on sidelines awaiting markets to open. We are 85% into the low.

gold/silver ratio spiking towards 74.. Cory,doc,matt,bird my target of 78-80 is very close. Im getting ready to pull the trigger but not just yet.

Bird,

Are you there? Bird seems to fly away every time I feel we are close to a rally..

HeHeHe

I have 15.20-15.30 on silver target and like I said yesterday I believe she holds.. If this target is taken out then someone on here said 12-15 would be ideal. Im still on sidelines. I keep moving targets down as my gold/silver ratio formula needs to hit. Gold is going down just as fast as silver

WTI oil is now 79 and on track for my 78 target. 2 days before elections. Looks good.

gold/silver ratio spike to 74 and very close to 78/80 target of mine. Double top.

All indicators are oversold at this point. At the very least and at some point next week or after we will get a rally of some type.

Day 19 of gary’s daily cycle in gold today. Remember Gary says typical of 18-24 days I believe. Can stretch a bit longer. I like the timing of it with elections.

Expect some major news shortly after elections.

What will it be? Not sure but a sure black swan or default of some kind.

Expecting ecb to stimulate or do something major as euro is dropping like a stone.

It was ALL about the big $YEN move….120= much, much lower gold!!!

But yen is not gold. It is another fiat

OMG Lawrence open your eyes man!…$YEN going to 120 will send massive amounts of capital into the US equity markets…yen at 120 will have the Euro$ falling to 120 also as the US$ heads much higher sending gold UNDER $1000….Just as gold rose while the US$ index fell from 121-71 as it climbs to 90-95-100 gold will fall…its that SIMPLE!!!!

This is smoke and mirror by the elites. Logically, at least gold and dollar should enjoy same level of safe haven buying so dropping of Yen should boost both of them. Gold should be tetter since it is not printed as the dollar is. It is going this way is because a powerful force is pushing it this way. Lucky I don’t look gold from US dollar point of view. I look from Canadian dollar point of view.

In the extreme case if all currencies die, do you think gold die with it?

This is way over done at least for silver. It is back to 2006 level. The cost of production has tripled. I am buying more silver trust. As for miners, i don’t have a lot but I will lighten up if price recovers. Their survival is questionable

This could turn around very fast, nothing is normal anymore, up is down and down is your guess, this is a very volatile time, more so then ever you need physical.

Silver is not as weak as I thought. Hope gold comes down more so I can buy silver trust.

Glen, GSR is not rising. Geez. Can’t wait but I don’t want to chase either.

lawrence be patient. If you can’t start purchasing in tranches. Very slow. We are very close. It could reverse today but as jj said it’s highly doubtful. Regardless everything is parabolic in every direction. Its blow off tops and bottoms very soon.

The 4-5 guys in here lead by bird that all say under 1000 are of the thinking of a 50% fibinocci retracement. The odds favor them lawrence and that’s the cold truth. At this point unless it turns up with power then that’s were we are headed.

38% fib is pretty much gone now. That was about 20 points higher i believe.

The problem is you never know how low this can go if the short disregard the survival of the miners. If only for short period of time, physical demand is not problem either since the delivery is a few months out.

Today is perfect day for the shorts since all markets other than COMEX are closed. It is also end of month and the contract roll over. More they hit the market, they get more.

Plus end of QE and Japanese QE overdose.

lawrence may i add that gold/silver ratio can spike from current 73/74 to 78/80 in a nano second. There is high volatility.

Yes, agree. But this is strange since slver always drops twice as fast, GSR should be 76-78 by now already.

It’s sure good to be short gold

I been short since $1805.

Ive been short since 1,807

Shorting is more tactical. There is no fundamental reason gold should go down other than government intervention. Gold will go up regardless how hard they try. Just look at history. how far gold has gone since 1971.

Gold has no fundamentals because there is no gold standard. It is just an highly taxed, no dividend asset class.

Really, no fundamentals? Not all of us are highly taxed on it.

Its funny, everytime a member of the controlling cartel mentions anything about rising gold, it ALWAYS goes down. When they sy it will go down, it ALWAYS goes up.

1200 $ GOLD NO MORE ! opinions ?