Technical charts on stocks, bonds, GLD, and a rundown on key news events

This post was brought to my attention on Stockcharts.com. Click here for a number of other great technical posts by Author Hill.

Stocks Sink as Bonds Surge – GLD and USO Tests Resistance

It was a rather strange week for stocks. DIA and SPY were up around .50% as of Thursday’s close, but Friday’s decline in stock futures wiped out this small gain and they ended the week slightly negative – for all intents and purposes. IWM was up around 2% at Thursday’s close and leading, but was also hit with selling in the futures market on Friday. Overall, there was more selling pressure than buying pressure last week, and the bulk of the short-term evidence is bearish. There are some interesting pockets of strength though. The Home Construction iShares (ITB) hit a new high last week and the Solar Energy ETF (TAN) rose over 4%. Also note that interest rate sensitive groups were strong last week and should benefit from Friday’s decline in the 10-YR Treasury Yield ($TNX). The Utilities SPDR (XLU) gained 2.13% through Thursday and the Telecom iShares (IYZ) was up over 3%.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Short-term Overview (Monday, 6-April-2015):

- Short-term breadth is bearish.

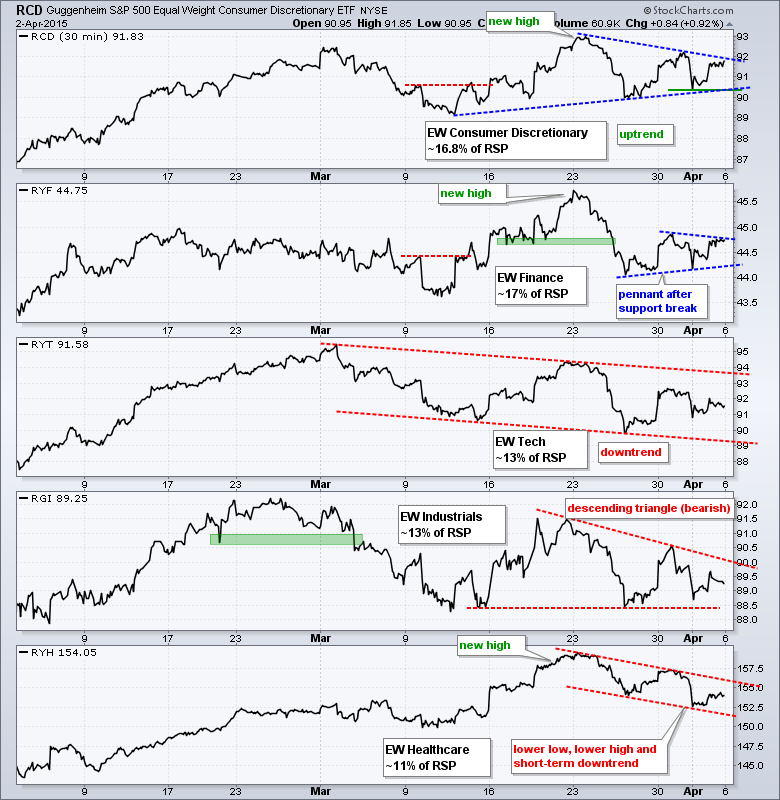

- Three of the five big sectors are in short-term downtrends.

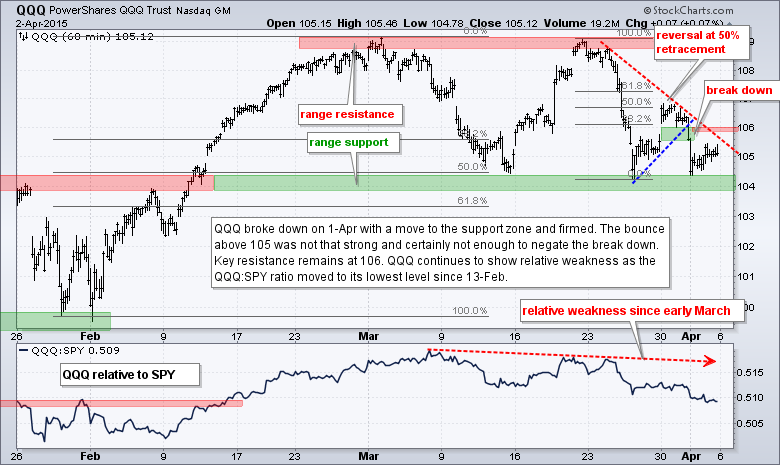

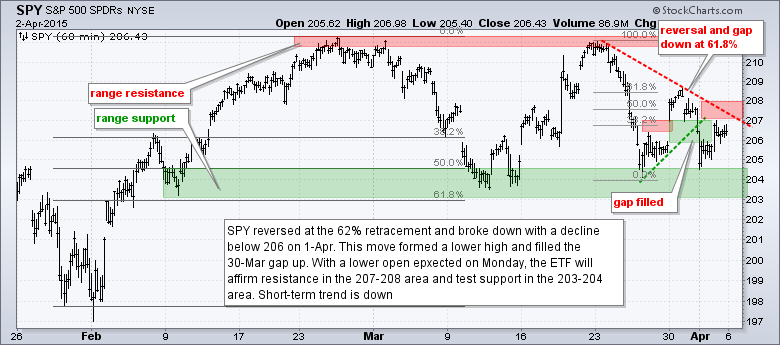

- SPY and QQQ filled Monday’s gaps and broke short-term support on April 1st.

- IWM continues to hold Monday’s gap zone and shows relative strength.

- TLT extended its bounce off support and remains in a short-term uptrend.

- UUP reversed at the 50% retracement and broke short-term support last week.

- USO is in a short-term downtrend defined by a small falling wedge.

- GLD broke out last week and is in a short-term uptrend.

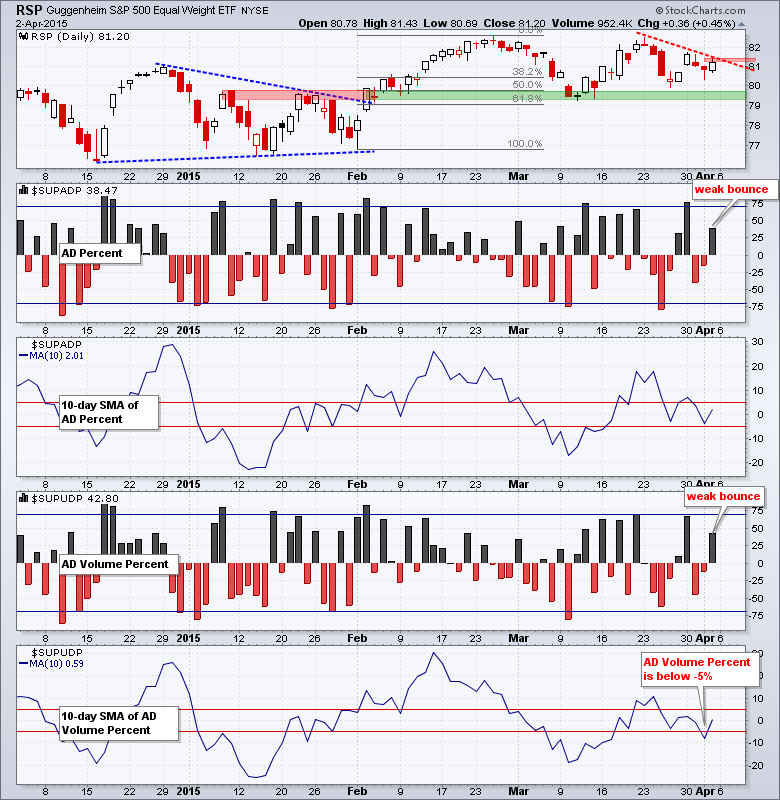

The Equal-Weight S&P 500 ETF (RSP) bounced on Thursday, but the futures were down on Friday and the ETF is likely to open lower Monday morning. This means resistance can be set at 81.5 for this downswing and the ETF will test the March lows. S&P 1500 AD Percent ($SUPADP) and S&P 1500 AD Volume Percent ($SUPUDP) bounced on Thursday, but the bounce was not that strong because neither exceeded +50%, and fell well short of the +70% level. The 10-day SMA for S&P 1500 AD Volume Percent ($SUPUDP) broke below -5% on Wednesday to turn bearish and remains bearish until there is a counter signal with a move above +5%.

With stocks set for a weak open on Monday, I am assuming that the five equal-weight sector ETFs will also move lower on the open. Three of the five sectors are in downtrends and the other two are up for big tests. This means the Equal-Weight Consumer Discretionary ETF (RCD) will form a lower high at 92 and test support in the 90 area, a break of which would be bearish. The Equal-weight Finance ETF (RYF) will test the lower trend line of a pennant. RCD and RYF are the only sectors holding up right now and breakdowns in these two would be bearish for the broader market. The Equal-weight Technology ETF (RYT) has been trending lower since early March, the Equal-weight Industrials ETF (RGI) peaked in late February and formed a bearish descending triangle and the Equal-weight Healthcare ETF (RYH) is in a downtrend since March 23rd.

The short-term evidence is bearish and Friday’s decline in the futures market suggesting a weak open on Monday. SPY and QQQ are in short-term downtrends, but IWM remains in a short-term uptrend and shows relative strength. Breadth is bearish because S&P 1500 AD Volume Percent ($SUPUDP) triggered a bearish signal and Thursday’s bounce was weak. The sectors are bearish because three of the five are in short-term downtrends.

**************************************************************

**************************************************************

**************************************************************

**************************************************************

**************************************************************

**************************************************************

**************************************************************

***************************************************************

Key Reports and Events (all times Eastern):

Mon – Apr 06 – 10:00 – ISM Services Index

Tue – Apr 07 – 10:00 – JOLTS

Wed – Apr 08 – 07:00 – MBA Mortgage Index

Wed – Apr 08 – 10:30 – Oil Inventories

Wed – Apr 08 – 14:00 – FOMC Minutes

Thu – Apr 09 – 08:30 – Initial Jobless Claims

Thu – Apr 09 – 10:30 – Natural Gas Inventories

Tue – Apr 14 – 08:30 – Retail Sales

Tue – Apr 14 – 08:30 – Producer Price Index (PPI)

Wed – Apr 15 – 07:00 – MBA Mortgage Index

Wed – Apr 15 – 08:30 – Empire State Manufacturing

Wed – Apr 15 – 09:15 – Industrial Production

Wed – Apr 15 – 10:00 – NAHB Housing Market Index

Wed – Apr 15 – 10:30 – Oil Inventories

Wed – Apr 15 – 14:00 – Fed’s Beige Book

Thu – Apr 16 – 08:30 – Initial Jobless Claims

Thu – Apr 16 – 08:30 – Housing Starts & Building Permits

Thu – Apr 16 – 10:00 – Philadelphia Fed

Thu – Apr 16 – 10:30 – Natural Gas Inventories

Fri – Apr 17 – 08:30 – Consumer Price Index (CPI)

Fri – Apr 17 – 10:00 – Michigan Sentiment

Fri – Apr 17 – 10:00 – Leading Economic Indicators

Wed – Apr 22 – 07:00 – MBA Mortgage Index

Wed – Apr 22 – 09:00 – FHFA Housing Price Index

Wed – Apr 22 – 10:00 – Existing Home Sales

Wed – Apr 22 – 10:30 – Oil Inventories

Thu – Apr 23 – 08:30 – Initial Jobless Claims

Thu – Apr 23 – 10:00 – New Home Sales

Thu – Apr 23 – 10:30 – Natural Gas Inventories

Fri – Apr 24 – 08:30 – Durable Goods Orders

Tue – Apr 28 – 09:00 – Case-Shiller Housing Index

Tue – Apr 28 – 10:00 – Consumer Confidence

Wed – Apr 29 – 07:00 – MBA Mortgage Purchase Index

Wed – Apr 29 – 10:00 – Pending Home Sales

Wed – Apr 29 – 10:30 – Oil Inventories

Wed – Apr 29 – 14:00 – FOMC Rate Decision

Thu – Apr 30 – 08:30 – Initial Jobless Claims

Thu – Apr 30 – 08:30 – PCE Prices

Thu – Apr 30 – 08:30 – Personal Income & Personal Spending

Thu – Apr 30 – 09:45 – Chicago PMI

Thu – Apr 30 – 10:30 – Natural Gas Inventories

Fri – May 01 – 08:15 – ADP Employment Report

Fri – May 01 – 10:00 – Construction Spending

Fri – May 01 – 10:00 – ISM Manufacturing Index

Fri – May 01 – 10:00 – Michigan Sentiment

Fri – May 01 – 17:00 – Auto-Truck Sales

This commentary is designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to really learn. Second, we are the only ones responsible for our decisions. Think of these charts as food for further analysis. Before making a trade, it is important to have a plan. Plan the trade and trade the plan. Among other things, this includes setting a trigger level, a target area and a stop-loss level. It is also important to plan for three possible price movements: advance, decline or sideways. Have a plan for all three scenarios BEFORE making the trade. Consider possible holding times. And finally, look at overall market conditions and sector/industry performance.

Great post, thanks Cory. It’s like a one-stop shop for technical analysis on some of my favorite trading vehicles. Much appreciated! For one thing it got me thinking about giving less credence to the Futures market considering last Friday’s reaction to jobs. Almost as if it was a CME set-up for the PPT. Who knows wit deez guyz? Anyway, you’re right. As long as I stick to my trading plan, I’m golden.

There is a lot to be known about manipulation/gold movement just from watching the chart it itself:

Relatively flat until London opens….sharp rise on opening (probably as shorts cover)

After Hong Kong closes: steady drop (probably due to steady buying from Hong Kong dropping out)

Then just random up and down movement until NYMEX opens, then slow rise again with random meanderings until now.