The Dow just broke a pretty dubious record

This is an interesting recap of what has been happening in the conventional markets so far this year.

Story courtesy of CNBC – click here to visit the site.

…

Investors have watched with interest as stock market indexes this year have set several new highs.

The latest record to fall, though, is for not doing much of anything at all.

On Thursday, the Dow Jones industrial average swung to a negative year-to-date return, the 21st such time it has moved to either side of breakeven for 2015. No other year has been so fickle, the closest being the 20 times the blue chip index swung in both 1934 and 1994, according to research compiled by Bespoke Investment Group. The Dow was off more than 1 percent for the year as of Friday.

That the Dow has topped the mark with more than four months of trading to go exemplifies a lack of conviction that stretches back to November, even though the index has posted multiple record highs during the period.

“That should catch us by surprise not at all,” said Art Hogan, chief market strategist at Wunderlich Securities, of the new record. “To trade sideways for November to date, you would have to spend a lot of time on either side of the line. We tend to get stuck in a range, and lo and behold there we are.”

For the broad market indexes, 2015 has been a bumpy road to nowhere, highlighted by the continuing Greek debt crisis, an economic slowdown and bear market in China, and anxiety over when the Federal Reserve will start raising interest rates.

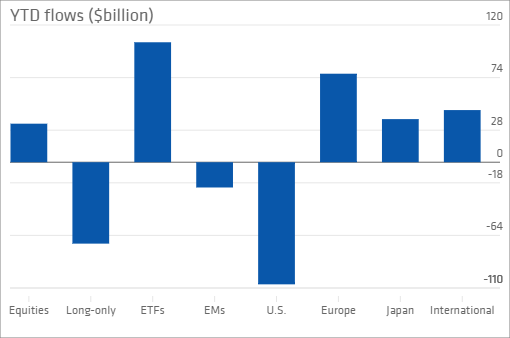

Those headwinds have given folks plenty of reason to run, and investors have ripped cash out of U.S. equity funds to the tune of $106.8 billion year to date, according to Bank of America Merrill Lynch and EPFR.

Still, the big drop that many investors have been awaiting has not materialized, though several sectors have undergone their own corrections.

Energy stocks on the broader S&P 500 have fallen 12.3 percent year to date and the sector is about 30 percent off its 52-week high. Utilities are down 10.3 percent in 2015, and you can throw in materials as well, which are off 6.8 percent year to date but down nearly 13 percent from their 52-week high. The index itself is up 1.6 percent and set its own odd record in June, when for the first time it went through the first half of the year without moving more than 3.5 percent in either direction.

Earnings have provided some solace. Heading into Friday, 73 percent of companies that have reported so far have topped estimates. Stocks still look expensive, however, with the S&P 500 trading at 17.6 times its 12-month forward price-earnings ratio, according to S&P Capital IQ.

“You’re heading into a period where you don’t have conviction that global growth is going to drive earnings significantly higher,” Hogan said. “You end up finding a pretty clearly defined trading range. The only good news is it doesn’t collapse through the support level. But it doesn’t break through the resistance level, either.”

Trends in exchange-traded funds help paint a picture of where investors have looked for returns with the S&P 500 and Dow struggling and the tech-driven Nasdaq surging more than 8.5 percent.

ETF flows have gone to funds that hedge against currency weakness, with the two top funds in the category, the Wisdom Tree Europe Hedged Equity and Deutsche X-trackers MSCI EAFE Hedged Equity, pulling in more than $26 billion combined year to date. In all, eight of the top 10 funds in terms of inflows are globally focused.

On the outflow side, the SPDR S&P 500, which tracks the U.S. large-cap index, has hemorrhaged $35.6 billion. Many of the others also are U.S. large-cap focused as well.

At least in terms of sentiment, the trend does not appear in the domestic market’s favor.

“How much longer can this run on the treadmill last?” Bespoke’s Paul Hickey said in a note. “Let’s just hope that the end of the road isn’t a trip and fall.”

FUNNY…………………..

I don’t get it. Can you be more specific Andrew. What does SGT Report have to do with Korelin report?

…Scroll down to Mark Dice.

Why?

Why not? Nothing makes sense anymore…

ditto on NOTHING MAKES SENSE….,

REV…a good listen to at usawatchdog….Craig Paul Roberts…..talks about the DOLLAR, FED. AND EU.

ESPECIALLY…………check out the comments at about 30:00 mark…..pass it on…….

As for example Frank…

Heard it Frank PCR never fails to my mind, although Andy Hoffman believes the Fed will raise rates this year unlike Roberts. Best, A

I did not hear that one……….when did you hear that…..

I get his daily news letter…..btw……Must have missed it thanks

ANDY REV…………..check out DEATH BEFORE THE PLUNGE at FSN(FINANCIAL SENSE NETWORK)…………….bottom of the page…………Hoffman thinks it would be crazy to raise rates.

Lets compare notes………..appreciate……..thanks ……………..JOOTB FRANK

Thanks Frank. Re Hoffman’s comments I may have got that wrong. 20 mins into the interview he says that interest rates must go up but doesn’t specify quite when! Best, A

http://sgtreport.com/

thanks A……..jootb

Yeah but he said by 1/10%!

In the Kerry Lutz podcast ‘It has all come undone’.

Coming to the US soon?

If the Islamic dictator of the US has his way!

meanwhile the scum in congress deny due process:

Home capitol in Canada just severed ties with forty-five mortgage brokers after they found falsification of records, you would think Canadians would learn from their cousins south of the border, Fat Chance!

http://business.financialpost.com/investing/home-capital-group-inc-says-45-brokers-suspended-after-discovery-of-falsified-income?__lsa=8f8f-b058

What about the other banking institutions I won’t be surprised if this practice is widespread.

I know that I posted the following chart last week, but it’s worth another look. GDXJ priced GDX has touched the upper channel line again since then and it looks like it wants to go higher (GDXJ to outperform GDX).

http://stockcharts.com/h-sc/ui?s=GDXJ:GDX&p=D&yr=0&mn=11&dy=0&id=p20695279079&a=414643240&listNum=1

Interesting chart. Do you think the trend will just continue channeling to the upside?

I do.

It self-updates so click on it again to see today’s bull hammer.

It’s heading toward the upper side of a longer term down channel

http://stockcharts.com/h-sc/ui?s=GDXJ%3AGDX&p=W&yr=10&mn=0&dy=0&id=p75320740282&a=418074702

I put up this chart a month or two ago:

http://stockcharts.com/h-sc/ui?s=GDXJ%3AGDX&p=W&yr=5&mn=6&dy=7&id=p29249913349&a=407352347

I do believe that the ratio made its bear market final low in March.

Silver continues to look good relative to gold.

SLV:GLD

http://stockcharts.com/h-sc/ui?s=SLV%3AGLD&p=D&yr=1&mn=1&dy=0&id=p20700702161&a=415279966

Silver is down another 15 cents this morning. So much for looking good.

Shad…….put out a great chart on silver supply……as CRAIG PAUL ROBERTS says, economic 101 supply and demand, and the manipulated markets are not agreeing.

industry, if there going forward is going to need supply.

Yes, there are a few good articles, editorials, and videos posted on Gary’s blog that I thought people may enjoy checking out. Cheers!

Lol Bird Listener, NOT.

Will the dollar continue higher tomorrow or was today’s action a Fed day blip?

http://stockcharts.com/h-sc/ui?s=UUP&p=D&yr=0&mn=6&dy=9&id=p25895514803&a=414690808

MAYBE they are thinking , that they might just be forced onto Obama care,,,,,if the citizens figure out that CONGRESS EXEMPTED THEMSELVES from Obamacare, and that the citizens expect congress to have the SAME PLAN as everyone else forced onto OBama scam

Citizens are getting the bill……….and the young peoples rates are going higher, and the youth…….can VOTE………..I think you are going to see a back lash from the educated YOUNG citizen. EDUCATED UNEMPLOYED VOTERS are next at the polls.

So much for the convincing argument that oversold conditions in gold and silver would guarantee a big bounce because both metals are off another percent this morning. Gold traded as low as 1081 so far.

PAPER………..promises to rule…………………for awhile…………the claw

USD 97.26 +0.11

Crude Oil 48.89 +0.10

Gold 1085.40 -11.30 -1.03%

Silver 14.65 -0.15

Platinum 985.00 +1.00

Palladium 618.00 +1.00

As of 4:07 am Central Time. The dollar strength is playing a factor in suppressing Gold/Silver, but doesn’t appear to be holding back Oil or Platinum/Palladium at present. Interesting divergence in those commodities in relation so the USD strengthening the last few days.

Silver has made a move I don’t remember I have seen. Gold down and silver down but not to gold’s degree. Then gold drifts lower slightly and silver spiked. There no clue of silver’s move from gold’s chart.some thing is happening with silver

This might be of interest to some:

http://stockcharts.com/h-sc/ui?s=FELP&p=D&yr=1&mn=1&dy=0&id=p06360360822

“Foresight also announced that the Board of Directors of its General Partner

approved a quarterly cash distribution of $0.38 per unit, an annualized rate

of $1.52 per unit. This distribution represents an increase of 2.7% from the

prior distribution and a 12.6% increase over the minimum quarterly

distribution of $0.3375 per unit established at the time of its IPO. The

distribution is payable on August26,2015 for unitholders of record on August

14, 2015.”

http://www.bloomberg.com/article/2015-07-30/acHuJNBcInBs.html

Wowzers.

Yup! I own it.

Hats off to everyone on the KER site…

http://sgtreport.com/