PEAK GOLD vs. PEAK SILVER: Must See Chart

Here is a recent article from SRSrocco Report. There are some interesting facts brought up regarding the energy consumption of primary silver and gold miners.

Click here to visit the SRSrocco Report and the page where this story was first posted.

…

If you are a precious metals investor, you need to see this chart. Matter-a-fact, this is the first time (to my knowledge) in the history of precious metals analysis that the information in this chart has been made public. One look at this chart and the investor will see the the huge difference between the cost to produce the precious metals.

In addition, the information in this chart will show why the peak of primary gold production will occur before the peak of primary silver production. However, global silver production will likely peak soon after world gold production. Thus, individuals understanding the difference, will likely enjoy a rewarding investment strategy most are currently unaware.

As I have mentioned time and time again, ENERGY IS THE KEY to the value of the precious metals. This goes well above and beyond the percentage of raw energy (oil, natural gas, coal, hydro & nuclear) consumed in the production of an ounce of gold or silver. Unfortunately, investors do not realize that 90-95% of the value of an ounce of gold or silver is directly related to the amount of energy consumed IN ALL FORMS and IN ALL STAGES in the their production.

Labor is a form of energy. Upper management pay, is a form of energy (highly skilled energy). The materials consumed in the gold and silver mining industry get their value from the energy consumed IN ALL FORMS and in ALL STAGES of their production-transportation-distribution. The mining equipment used in the production of gold and silver also get their value from all the energy consumed in their manufacture (in all forms and stages).

While the market understands that energy is large percentage of the cost to produce gold or silver, they fail to realize LABOR, MATERIALS and EQUIPMENT are all “Energy Derivatives.” Even though labor, materials and equipment are listed as different itemized costs on the precious metals mining company’s balance sheet, they are all ENERGY COSTS when we break them down to their simplest form.

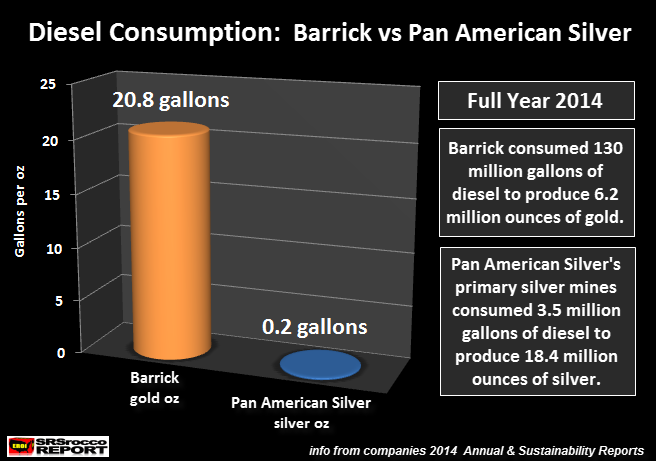

That being said, let’s look at the huge difference in the consumption of diesel in the primary gold and silver mining industry. I selected Barrick because they are the largest gold producer in the world and Pan American Silver is one of the largest primary silver mining companies. While other companies such as Fresnillo located in Mexico produce more silver than Pan American Silver, I was able to obtain diesel consumption data from Pan American Silver more readily as they just released their 2014 Sustainability Report.

If we look at the chart below, we can see just how much more diesel is consumed in the production of gold than silver:

According to the data from the two companies 2014 Sustainability Reports, Barrick consumed 20.8 gallons of diesel to produce an ounce of gold while Pan American Silver only used 0.2 gallons to yield an ounce of silver. Basically, it took Barrick 100 times more diesel to produce an ounce of gold in 2014 than it took Pan American Silver to produce an ounce of silver.

That said, let me clarify a few things. First, these mining companies state their energy consumption figures in various metrics. For example, Barrick listed their energy consumption in giga joules and Pan American Silver in cubic meters. So, we have to make some conversions to gallons to make a comparison.

Secondly, I took all of Barrick’s estimated diesel consumption and divided it by the total amount of gold produced in 2014. However, I only used Pan American Silver’s five primary silver producing mines to calculate their diesel consumption. Pan American Silver has two additional mines (Dolores & Manantial Espejo) that produce a great deal of gold. Thus, these two mines consume a lot of energy, similar to primary gold mines.

Furthermore, the revenue obtained from Pan American Silver’s Dolores and Manantial Espejo Mines was higher in percentage of gold than silver. So, I omitted these two mines when calculating a more ideal energy consumption metric for the primary silver mining industry.

For those who like to see the actual data, here it is below:

BARRICK 2014

Total Diesel Consumed = 129 million gals

Total Gold Production = 6.2 million oz

Diesel consumed per oz of gold = 20.8 gal

PAN AMERICAN SILVER 2014

Diesel Consumed by 5 Primary Silver Mines = 3.5 million gals

Total Primary Silver Production (5 mines) = 18.4 million oz

Diesel Consumption per oz of silver = 0.2 gals

Yes, it’s true that Pan American Silver produced 26.1 million oz (Moz) in 2014, but remember, I had to subtract the 7.7 Moz supplied by the Dolores and Manantial Espejo Mines as they were more a primary gold mine with silver by-product (or co-product) credits.

Peak Gold vs Peak Silver: How Will This Play Out?

The question many investors may ask after reading the information above is… What do these figures mean? This is a good question. Why? Because, I believe it will provide some favorable investment strategies for precious metals investors that aren’t presently understood.

One of the things I try to do on my site is to show how energy will impact the precious metals, the miners and the overall economy going forward. However, when I post an energy article, it goes over like a FART IN CHURCH. My energy articles receive a tenth of the readership compared to some of my more popular precious metal articles. And this is quite a shame, because ENERGY IS THE KEY to understanding how the world collapses or evolves going forward.

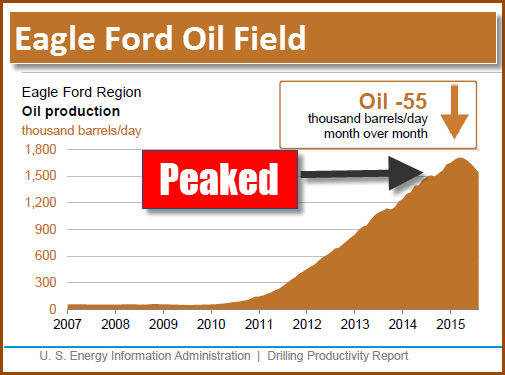

As I stated in a recent article, U.S. Shale oil production already peaked earlier this year. ITS A DONE DEAL. So, for all the folks who continue to believe the CRAPOLA put out by the U.S. Govt or MSM that the U.S. is still on track to be energy independent…. WAKE UP, it’s a big lie.

With the peak of U.S. Shale oil production already in the rear-view mirror, I believe we will see the peak of global oil production very soon. Thus, the world will have LESS and LESS oil in the future each year to run the system… and this includes the mining industry.

If we consider that it takes the primary gold mining industry (on average) 100 times more diesel to produce an ounce of gold than the primary silver mining industry, peak oil will impact the gold mining industry a great deal more than the primary silver mining industry. Which is why I believe we will see a peak of primary gold production before primary silver production.

However, that doesn’t mean global silver production will peak many years after primary gold production. Why? Because 70% of global silver mine supply comes as a by-product of base metal and the gold mining industries. As global oil production peaks and declines, it will also cause World GDP to fall. Falling Global GDP means less economic activity… thus less demand for base metals.

We will see less available diesel for the base metal mining industry, or less demand for the metals. Either way, global peak silver production will be a result of the peak of base metal mining, not primary silver mining. Matter-a-fact, I actually see growth in the primary silver mining industry for several years after peak oil due to two factors:

1) The relatively small amount of diesel consumed in producing primary silver

2) The skyrocketing price of silver (due to the collapse of fiat money and paper assets) and its positive impact on the primary silver mining industry.

While most analysts continue to push resource stocks as wise investments, there are very few worth owning. For example, the folks at Stansberry & Associates have been cheerleaders for the U.S. energy industry, and in many cases… the shale energy companies. I have said from the beginning, Shale Oil & Gas Companies (for the most part) are dogs and will continue to be dogs. I just read in a recent Stansberry Portfolio Update the following:

….we are closing the XXX (can’t provide energy stock name) position and will no longer cover the stock. We will record a loss of 153% on margin (31% on capital at risk) in our official portfolio.

I don’t want to seem brazen here, but if some of their investors read my articles on energy FOR FREE instead of paying Stansberry & Associations an ARM & LEG for their investment advice, they wouldn’t have lost 153% of their money investing in one hell of a lousy shale energy company stock.

Now, don’t get me wrong, I am not singling out Stansberry & Associates… as we in the precious metal community deserve some blame for underestimating how long the Fed and Central Banks could prop up the markets and drive the paper price of gold and silver much lower. However, owning most resource stocks that will only go lower in value is different from owning physical precious metals that will only go higher in the future.

Precious metals investors haven’t lost value in their physical gold and silver holdings, unless they are unwise and sell them now. This is much different from investing into worthless resource stocks that will only continue to lose value going forward.

Okay, if you follow my drift on why primary gold miners will peak before primary silver miners, the Primary Silver Mining Industry may offer a much better investment strategy in a peak oil environment. Of course, there are no guarantees, but I do see the primary silver mining industry growing for a while, even after the world peaks in global oil production.

I believe silver will become one of the most sought after physical assets to own in the future as the majority of paper and physical assets lose value. This will make the primary silver miners’ margins-profits quite handsome… as well as their stock price. However, if you are going to invest in the primary silver mining “producers” (not explorers), do so with money you can lose. Make sure you have your nest egg of gold and silver bullion first before you invest some throw-away money in the primary silver miners.

The reasoning here is… if the primary silver mining stock you purchased is either nationalized or shut down for whatever reason in the future, you only gambled money you didn’t need. This not only allows one to sleep better at night, but it also is a smart way to invest one’s capital.

If you want to get a better understanding of how ENERGY impacts the primary silver mining industry, I would suggest you read the information in my recently released THE SILVER CHART REPORT. It gives a good background on falling ore grades and yields in the primary silver mining industry as well as how the price of oil impacted the value of silver over the past 100+ years.

PLEASE NOTE: This report is not just made up of charts. Each chart has a page of explanation.

If you haven’t checked out THE SILVER CHART REPORT, there’s a great deal of information on the Silver Industry & Market not found in any single publication on the internet. There is one chart in this report (Chart #19) that I can guarantee that 99.9% of precious metal investors haven’t seen before.

Most analysts focus on a certain area or sector of the silver market. However, the information in this report illuminates a holistic view of many sectors of the silver industry, capturing the relationships that connect many parts of the market.

Most analysts focus on a certain area or sector of the silver market. However, the information in this report illuminates a holistic view of many sectors of the silver industry, capturing the relationships that connect many parts of the market.

One of the important aspects of my work is to look at many industries and markets from a bird’s-eye view. From this perspective, we can see how industries and markets impact each other to a much larger degree than by just focusing on individual sectors.

CLICK HERE: For The Silver Chart Report

I use this bird’s-eye approach when I create my easy to understand charts. The Silver Chart Report is a collection of my top silver charts from articles published over the past six years, and includes in-depth, never-before-seen charts and content that indicate that silver is on the rise. There are 48 charts in the report, broken down in five sections.

NOTE: Anyone who purchased but did not receive the report, please use the contact page to contact me.

Please check back for new articles and updates at the SRSrocco Report.

It cannot be worse than the humpy-pumpy gold junk spewed by Gary Christensen that Cory keeps posting up every week. As if the simple-minded people here will be persuaded by that propaganda.

I mean, sure….we all appreciate that Cory needs to put up something that the advertisers will approve of but give us all a freaking break. Times have changed. Its pretty obvious what the metals trajectory is saying.

Christensen is a humping, pumping metals-gold-tard who keeps finding the one positive gold flake in a sea of the worst bear market in golds history. Nobody even bothers to argue it either. And nobody needs to read anymore of Gary’s naive fantasy.

It is why almost nobody posts on those threads when they get posted.

Pretty obvious. We don’t want Gary Christensen anymore. We want the facts man!

Many folks feel this way, so I will certainly discuss it with Cory.

I don’t feel that way at all, Al. The first two comments above are pure BS.

Matthew

1000 percent agreed………again!

The return of the mythical gold bull is starting to look like a script from a bad science fiction novel, Matthew. Anyway, you can always go to Christensen’s site at Deviant Investor and join in the fun. All the gold losers eventually end up over there.

I Don’t feel Gary Christensen is bad at all. I am not impressed with this particular post but I still feel his opinion is worth listening.

Interesting that you say that Lawrence because the above post is not by Gary Christensen.

Btw, it is absurd that “A Listener” thinks Gary doesn’t deal in facts.

I thought Cory posted gary’s post, no? A listener seems thinking that way. Maybe my mistake

The above is by SRSrocco. “A Listener” just decided to drag Christensen into his complaining.

Christensen is not balanced where reporting or analyzing gold is concerned. He does not therefore deserve to have a platform here when he already has his own public web site. Maybe Gary should be picking up Al’s interviews with the Doc or Rick instead.

Seriously Matthew, why do you promote him? How is Christensen your interest?

I am not promoting him, I am defending him because your assessment of him is wrong.

Thanks Al. Sorry but I did not mean to sound hard on Cory. It just came out that way in my rant against Chistensen. Probably would have been better if I did not put his name in my post.

Gary makes a few interesting connections and points sometimes, and personally I enjoy reading a range of opinions and making up my own mind.

I agree with some of your points A Listener, but feel you are being a little harsh on Gary and Cory, and if you don’t like it then just don’t read it. Pretty simple concept.

Bingo!

BINGO, BONGO,MUGO, and the guys agree…………………the claw

THE DIESEL CONSUMPTION CHART was very interesting……………….ootb

The Christensen material is metals propaganda so it does not do anything at all to advance our knowledge or present an alternate opinion that is balanced and helpful. All I am saying is that what he writes is part of what has kept people hanging on in this market past its due date.

All we need to know is that Christensen has been dead wrong for the past 4 years and yet he still keeps pumping out the same sunshine week after week. Guys like him are what are behind the losses for many of the people who are persuaded by what he writes.

So why should he keep getting promoted on this site?

More baseless and irresponsible BS.

Christensen has his own site Matthew. He has been an unabashed promoter of the virtues of gold and silver all through this long bear market. He has not relented yet despite some of the most damning technicals now finally revealing themselves. Why don’t you just go there directly if you need a dose of propaganda.

Meanwhile I think we are getting excellent unvarnished assessments on this market from Doc and Rick and the gang. Too bad it is being diluted with the mixed messages from the Deviant Investor.

Your attacks on him are propaganda. What was he “dead wrong” about? Did he make some bottom calls or give targets that were wrong? How about some specifics/examples?

It’s funny that you’re not so critical when it comes to the real and consistent purveyors of propaganda.

Christensen is right about the cockroaches:

http://deviantinvestor.com/7238/gold-use-the-cockroach-strategy/

Are you related to this guy or something? You seem to take it as a personal affront that I don’t appreciate his metal-humping style. What the hell do you care? It’s my opinion and as Al pointed out there are many others who share it.

Meanwhile the truth about Hillary is coming out:

https://www.lewrockwell.com/2015/07/andrew-p-napolitano/hillarys-lying-war/

That is more than just a little amazing. More coming from us, I promise.

Trump hits Huma, if you can only imagine, I’m glad The Donald pointed this out:

http://www.dailymail.co.uk/news/article-3180305/Trump-launches-attack-Huma-Abedin-deviant-husband-Anthony-Weiner-claims-pair-access-Clinton-s-secret-classified-emails.html

Holy smoke, Mr. Tracy, Trump has major cajones!

Anthony Weiner has major cahones but we don’t want to see them again! DT

I certainly did not mean Mr. Weiner. Common, Mr Tracy. I meant the person telling the story!

Al, Are you sure that is what you want me to believe. DT

If I was a woman and my husband Anthony Weiner had done what he has done would you stay with your partner, I think the answer is no, and Trump has won again. DT

Sometimes one comes across something one wishes to have authored; from the Daily Reckoning and the pen of Bill Bonner:

Never, since the beginning of time up to 2015, has government ever added to wealth. It has no way to do so. And no intention of doing so. All it can do is to increase the power, wealth, or status of some people – at others’ expense.

That is a perfectly satisfactory outcome for most people, at least in the short term.

But the more this tool is used – the more some people’s power, status, and wealth is taken away – the more the wealth of all of them declines.

Yikes, are people are still clinging to PMs? They are dead…. DEAD!

Get ready for a bear market in PMs that’ll last for a decade.

BTW, if you want a good laugh, listen to that clown Bo Polny in his latest interview with Kerry Lutz. He babbles and rambles like a deranged lunatic. You can hear the absolute desperation in his voice, it’s almost disturbing how pensive he is while he blurts out his BS cycle theories.

He AGAIN is saying gold will hit it’s all time highs by end of year. Yeah… I heard that before… about A YEAR AGO.

What a joke. People, do yourselves a favor and dump your metals now while they are still worth something.

Don’t know about the “dump your metals now” thought. My thought is stop listening to certain folks!

Joe –

This tirade you just spewed is just another indication we are at a bottom…..except Polny….I agree with you.BUT you are dead wrong on the long term direction of the PM market……and NO you cant have any of mine…..buy your own….

Joe

http://www.plata.com.mx/mplata/articulos/articlesFilt.asp?fiidarticulo=266…read this and re-evaluate your opinion……for some strange reason, Price would be just a little…..JUST a little….mind credible in critical thinking than your blather…with all due respect…..JOE!!…..:)

more credible..:)

Buy when there is blood in the street………….buy low………..the claw

the stupid will be broke , because they know nothing about history or money……

this is tulip bulb mania for the dollar, per Turk.

Unless government control inflation, the mining cost will keep increasing. Without new mine production, government has to supply the metals. In the case of silver,There is very little official holding. With the leaking of money from banks and government spending to general public, it is hard to keep inflation down. A decade is a long time.

BUY LOW……..Buy when there is blood in the street……rothchild i think ……..ootb

One by one the gold rats are leaving the ship.

Now Casey Research “Big Gold” and Jeff Clark are no more.

The publication has a new name, new author, and the focus has changed to cover “resources”, but still monitoring some PM positions.

Some of the positions that took years to build are now “sell”.

Makes me wonder when Santa and Schiff will say “Auf Wiedersehen”.

Me? I’m still holding ounces.

I subscribe and no…most of the gold and silver stocks that were buys are STILL buys!!

To big gold and international speculator

I’m looking at it now:

7 sells

8 holds

7 stink bids

As am I Irwin, (ounces that is) and we will continue to do that.

Please believe that I have never listened to the “all your eggs in one basket” folks and I never will!

Yep, my ounces will still be in the family after I’ve turned to dust.

In my area, at these prices, an acre of productive dry-land can be had for 2 to 3 ounces of gold. The land produces a return but takes a lot of work. I think of ounces as land that requires no maintenance, and is a lot less hassle to pass on to someone else.

I had a nice visit with Jeff at the Sprott conference. His ass was fired. Stansberry is running the show now, they bought out Casey & he has no control of any kind. Everything is changing at all the Casey publications. TWT if for better or worse.

I like Doug Casey but not Stansberry. Too bad the good one is gone.

Yeah, it’s kinda like Walmart acquiring Target.

Totally agreed. There’s been a major shakedown at Casey Research from what I can see. Ed Steer gone. Marin Katusa gone. Jeff Clark gone? First I heard. Even Doug’s pal David Galland is gone, I think.

Now we get those nasty infomercials that spend a half hour making you a pitch, if you let them. I won’t let Stansberry give me the time of day.

ditto on stansberry comical picture company…………….

I tend to agree GH. I check out their stock picks, due my own homework, and follow those companies independently without the hype.

thanks for the info……….I knew it changed…………..

When it is all about the books and tapes…………you know it is time to leave.

If I said anything like this, I’d be in jail:

Unbelievable!

It is totally unbelievable, Professor!

ditto

Guess where a portion of our society is heading Professor?

to the morgue………………………………..

Farrakhan is making problems worse, and has been calling for a violent retaliation for years. What a huge double-standard and I disregard almost any words that come out of his mouth. That speech was over the top crazy and will not help with the challenges that face the US.

srsrocco omitted that gold sells for how many more x than silver…

US trade deficit is close to 60 billions, even under such low oil price. Who said strong dollar is good for America? Even stranger is the 10% rise with the deficit with China, whose currency is pegged.

http://mobile.reuters.com/article/idUSKCN0QA1FV20150805?irpc=932

http://mcalvanyweeklycommentary.com/wp-content/uploads/ica2015-0805.mp3

As usual Mcalvany very pro-precious.

GOLD BACKWARDATION LONGEST IN HISTORY…………………usawatchdog……

James Turk speaks on the backwardation of the spot price vs. future price…..

Someone is buying spot and dump future.

but , as he says……..this can not continue, listen to the segment….and see what you think……..

CONNECTING ALL THE DOTS……………………………the claw

THANKS JERRY…all the best.man!!

no problem MY FRIEND…………………………………………….J………

PREPARE FOR MASSIVE RALLY……….jdsmineset

SOC GEN………Edwards says ………gold going to $9900………jdsmineset

From SOC GEN too……wow interesting..watch…this guy will be in the unemployment line tomorrow!!…Ha! AKA.. kinda like.that guy that pressed Yellen in the FED meeting last time..oopppss better not get too specific or detailed on my questioning it just might hit a nerve…hahaha!!

thought that might get some attention…………………………….the claw

Another bs analysis

Turn the page, nothing to see here