THE SILVER MARKET DISCONNECT CONTINUES: 2 Must See Charts

While I continue to believe that physical flows in metals will continue to have little impact on price it is interesting to watch changes in these flows.

The other potential take away from this article is a potential shift away from silver being looked at as an industrial metal and more as a precious metal. This shift will take a while but I feel with the slowing economies around the world pricing as a precious metal would provide a better narrative for silver.

Click here to visit the original posting page over at SRSrocco Report.

…

According to the mostly recently released data, the disconnect in the silver market continues. Now, when I say a disconnect, I am referring to the interesting change in supply demand trends in the silver market. Currently, we are witnessing an abrupt change in normal silver market dynamics.

For example, industrial silver demand has been the leading indicator for the silver market by a majority of official sources. There have been many reports published by banks and institutions on the growth and outlook of the silver market based on future industrial demand. Basically, the health of the silver market was forecasted by the amount of growth in the industrial sector.

However, something changed over the past several years to muck-up all this hard work and analysis by our wonderful counterparts in the financial industry. For one thing, I don’t think any bank or brokerage analysts could foresee that physical silver investment demand would skyrocket 282% from 2007 to 2014. The jump in physical silver investment demand makes the growth of industrial silver demand… quite embarrassing.

That being said, new data released by the U.S. Geological Survey (USGS) confirms my forecast that the situation in the silver market continues to detach itself from normal supply demand dynamics. Thus, normal trends in the silver market are being disrupted by this present surge of physical silver investment demand.

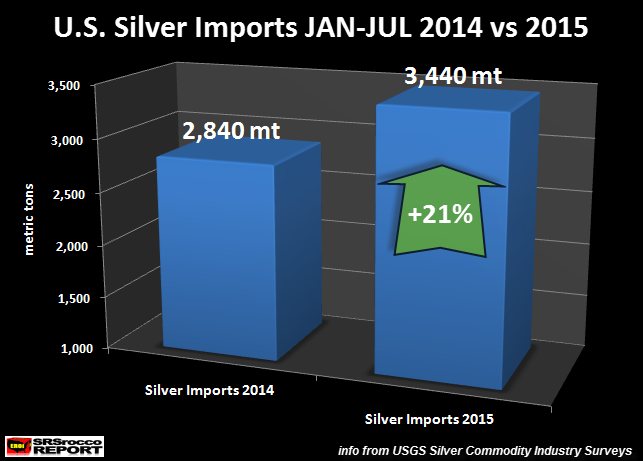

For example, the United States continues to import a record amount of silver even though leading indicators in the financial industry show a drop in economic growth. I have been publishing articles showing the recent surge of U.S silver bullion imports, and according to the recent data by the USGS, this trend continued in July:

The USGS reported that the U.S. imported another 474 metric tons (mt) of silver in July, up from 457 mt in June for a total of 3,440 mt for the year (109 million oz-Moz). As we can see from the chart, this is 600 mt more (21%) than the same time last year. The U.S. imported a total of 4,960 mt (159 Moz) in 2014, but if the current trend continues, silver imports may reach a total of 6,000 mt (193 Moz) this year.

So, why all this extra silver? What gives? It’s definitely not due to increased industrial demand, because I have the data to prove it. The USGS also provides other forms of silver imports besides bullion, Dore’ bars and concentrates. These other silver imports are more associated with industrial fabrication. Let’s take a look at some of these figures:

Other Silver Imports JAN-JUL 2015

Other unwrought silver = 138 mt (-5%)

Metal Silver Powder = 389 mt (-17%)

Semi-manufactured forms = 201 mt (-61%)

Silver Scrap = 2,920 mt (-21%)

According to the import data, other U.S. silver imports (associated with industrial fabrication) were down between 5-61% for the first seven months of the 2015 compared to last year. So, why would the United States need an extra 600 mt of silver bullion and Dore’ bars (Dore’ bars are silver bars poured at the mines needing further refinement) if industrial fabrication was lower? If not industrial demand, maybe increased silver jewelry demand is the culprit.

I have seen estimates that lower silver prices have sparked increased silver jewelry demand in the U.S. of approximately 10% in the first half of 2015. But, this isn’t really all that much when total silver jewelry fabrication in the U.S. was only 397 mt in 2014 (GFMS World Silver Survey 2015). Thus, a 10% increase of half of that amount (199 mt) would only be a growth of 20 mt. The U.S. imported an extra 600 mt from JAN-JUL compared to last year, so a lousy 20 mt increase in jewelry demand doesn’t account for the recent surge in U.S. silver imports.

As I have stated several times, I believe the increase of U.S. silver imports is tied directly to the jump in physical silver investment demand. Not only are many small investors adding to their stash of silver bullion, I believe several large entities are also acquiring a great deal of the shiny metal.

My Assumption Was Correct: U.S. Silver Exports To India Surged Again In July

This past weekend I spoke with Doc and Eric at Silver Doctors. If you haven’t yet listened to the SRSrocco & Silver Doctors Interview, you might want to check it out as we covered some interesting information and data.

One of the items I mentioned during the interview was that the huge increase in Indian silver imports were starting to put stress on the overall market. This stress made its way over to the U.S. Silver Market as the U.S. started exporting silver bullion to India… something it hasn’t done for many years.

The United States exported virtually no silver to India over the past two years, but this jumped to 39 mt in May and 75 mt in June. I stated in the interview, even though the USGS data for July, August and September were not yet out, I believed we would see possibly even higher U.S. silver exports to India in the following months.

Well, call it luck on my part… the U.S. did export another 113 mt of silver bullion to India in July:

What’s even more interesting than the exponential increase of U.S. silver imports to India over the past several months, is the percentage of total exports. The U.S. imported 227 mt of silver bullion to India JAN-JUL which accounted for 45% of the total 523 mt.

Get this. The U.S. only imported about 1.5 mt of silver bullion to India in 2014 of the total 382 mt exported during 2014. Again, this shows more evidence how much the silver market has disconnected from its normal supply demand dynamics.

What has changed to mess up the silver industry market dynamics? It was Physical silver investment demand that grew a stunning 282% since 2007:

Growth Segments Of The Silver Market (2007-2014):

Silver Bar & Coin = +282%

Silver Jewelry = +17%

Silverware = +1%

Industrial Fabrication = -10%

(Data from the Silver Institute)

As we can see, the other segments in the silver market have grown or fallen marginally over the past seven years compared to Silver Bar & Coin demand. Furthermore, the current surge of physical silver investment demand, whether it be from India (silver bar) or North American (Official coin), continues to put stress on the silver market. This stress is forcing a disconnect in normal supply-demand forces that will likely get worse if the world experiences more financial turmoil or stock market panics in the future

The problem is that the amount that small holders have won’t do them any good at projected prices unless the prices of everything else is damned near expunged.

This looks like a great place for a big reversal.

Here we have good “fork action” and a reverse H&S bottom in play:

http://schrts.co/h2wKHi

Bear-to-date:

http://schrts.co/1NAXXQ

This move could turn into a melt-up:

http://schrts.co/BwWmXn

At Fib arc resistance:

http://schrts.co/4uKlTg

I haven’t altered this chart in any way since I first put it up over a month ago:

http://schrts.co/swhx0y

I think 18+ is coming, but one step at a time…

Looking at the silver demand chart for imports by INDIA……..I DO NOT see any way silver is going back to $5 per oz. Considering there are 1.5.BILLION people that adorn themselves with metals, and gold is way to expensive for the majority. That could leave silver as the economics alternative…. And that demand should keep silver way above $5 per oz. in the future………..just thinking…………..OOTB ,CCF

Jerry..ditto that….multiple times…+ infiniti…

There’s been a lot of places that looked like a good place for a reversal

A melt up?

You still are really grasping at straws going on 4 1/2 years

I found the best evidence that gold and silver have bottomed. Al and team has removed the gold & silver charts from the left side of this page. 🙂 🙂 🙂

GOOD ONE…………….

Anyway, lets change the subject for a minute. I left a pair of comments on Ricks thread about ETF’s. You are a pretty smart guy Matthew and I generally appreciate your comments on the markets. Maybe you have thoughts on the liquidity risks of ETF’s versus buying and holding company shares directly.

Bird…It’s always better to hold the shares in your hand , ( not in a brokers computer ) the same as G&S if we buy & hold these things & they go south before we have a chance to sell them then that’s our fault , but any amount of entity’s could fail & we could lose everything , & as you know a lot of these entities are standing on the edge of a cliff right now ….Happy Hunting.

You know Tony, I really think this is an important subject for us to talk about and maybe the guys will pick it up on the show. We think physical when we talk about metals but rarely do we consider the actual paper that proves our claims on companies. I was reading somewhere (Zerohedge maybe) that there could be competing counter-party claims on the same stock. I have no idea if there is truth to that though or if the risk is real. If anyone does know I would sure like to hear it.

Ditto Irishwolfhound…….on the HOLD IN YOUR HAND…….., not in the brokers computer.

I agree. But most of us don’t anymore. Ever since “buy and hold” died in the age of online trading the idea has become kind of archaic. For the most part it has just become normal to hold all our portfolios electronically. And in the case of ETF’s I have never even asked because most of these are bought and sold with frequency so its a waste of everyone’s time since a lot are short term trades. Just curious but do you still request paper shares?

Look at the strength of silver relative to gold. PM is bullish. The will head up with a lot of volatility. Anyone who is not committed is going to be shaken out. No exception. Money printing->Inflation->gold price up.

LOOKS like everyone is FROZEN …in place……really no movement……

It is supposed to be. Mob behavior.

Shorts on silver paper is one thing,,,,,the real world is another……..I have dealers calling me …..that is a change.

I said yesterday…………..WICKED WEDNESDAY………..should be interesting what happens today.

Really..Jerry..WOW….my dealer got some Austrialian “some’ sovereigns in…but when he is out….he says nothing left to sell….he can still get 1000 oz bars….in about a week….what the hell…….

1000 ounce bars? If that is the only thing left, we are in trouble. It has the effect of scaring away retail buyers. I am really confused about these manufacturers, Gold and silver is not like copper or iron, there are million tons produced each year. The amount is tiny and margin is large. If all the gold we put in a cube we can circle it in a few second.

It means the products is no longer made for retail if only 1000 ounce bars are left. Later on might be nothing available or you have to buy by the ton.

Gold is not Money. —-Goldseek.com

http://news.goldseek.com/SpeculativeInvestor/1444220303.php

“The only practical definition of money is: the general medium of exchange or a very commonly used means of payment within an economy. By this definition, gold is not money in any developed economy today”.

A.L. I thought there are 5 attributes of money. The above is only one. According to definition of money, nothing is money now.

http://business-finance.blurtit.com/3013187/what-are-the-attributes-of-money

There is only currency no money in the world now.

Dragonite………..my dealer says 1000 oz bars are available, but 100 oz and smaller are on short supply…..that was TUES.

A. L. this is trading talk, on the phyz, not a talk on money…….this is trading time, because there is something happening for sure in the USA…..check out the spot, plus premium price. Does not make any difference….this is a trade and advantage in the market place this very moment…….JMHO…….STREET TALK…

OH……..do your own DD………..not trading advice….just street observation….

German to publish their bar list in all locations. It looks like they are either grow impatient or there is some hard feelings.

If the Germans do not have their phyz……..they are not going to get it.

But Germans are the most determined people. Pissing them off you get bad things happen.

Germans have the list……..and the phyz. is with other countries……..maybe they will settle for paper, like most of the comex people will have to when the final tally is done.

I don’t get certificates.

I prefer shares to etf,s

You got me wondering, we have all heard there are 100 claims for every physical once, how do we know?

Another thing is millions more onces traded daily than produced, so?

A bearish thought, should China tank, a lot of people could sell their gold for liquidity.

It won’t happen, women are quite protection e to their jewelry. Also China may crash in the west MEDIA but reality.

Protective to their jewelry. Cell phone problem

Makes me wonder why haters of gold are even here when they are not wanted and or sane siding with the fascists and psychopaths while trumpeting their fiat mantra.

The only metal I can imagine being summarily dumped in copious supply is Silver when the price gets high enough.