Maybe raising interest rates gradually won’t prove to be such a good idea.

Another strong jobs report on Friday led to muttering in the financial markets that the Federal Reserve was in danger of being too slow to lift borrowing costs — and could drop even further back if it goes ahead with a plan to increase rates gradually after a widely expected liftoff later this month.

“There has been a risk they’d be behind the curve, this report may add slightly to that perception,” said Michael Feroli, chief U.S. economist at JPMorgan Chase & Co. in New York and a former Fed economist. Next year policy makers may “find that they have to hike a number of times, perhaps more than the market expects and perhaps even more than they expect.”

Traders in the federal funds futures market are betting the central bank will raise rates two or three times in 2016 after an initial move later this month. Policy makers have penciled in four rate hikes next year, according to the median estimate of their projections released in September.

Employers added 509,000 workers to their payrolls over the last two months, the biggest back-to-back increase this year. Hiring was widespread, with the diffusion index that measures the breadth of job gains across industries at its highest level since February.

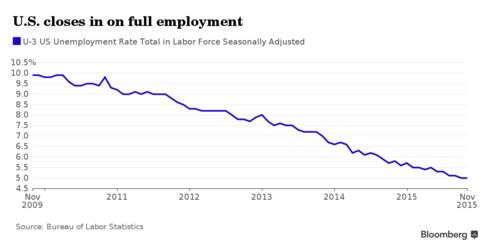

The unemployment rate held at a more than seven-year low of 5 percent, just above the 4.9 percent that U.S. central bankers reckon is equivalent to full employment, according to their median estimate from September. Joblessness below that level theoretically should lead to bigger wage gains and faster inflation.

Because interest-rate changes affect the economy with a lag, central bankers can’t afford to wait until inflation is approaching dangerous levels before acting. They have to move preemptively or else risk falling behind the curve.

Fed officials are “going to be comfortable letting the job market run hot for a while because that’ll get inflation back to their target more quickly,” said Ryan Sweet, a senior economist at Moody’s Analytics Inc. in West Chester, Pennsylvania. “But if we continue to string together employment reports like we got in October and November, the Fed’s likely going to have to be a little bit more aggressive in 2016 because they don’t want to fall behind the curve.”

As measured by the personal consumption expenditures price index, the Fed’s favorite gauge, inflation rose just 0.2 percent in 12 months through October, well below the central bank’s 2 percent goal.

Policy makers reduced their target for the fed funds rate to a range of zero to 0.25 percent in December 2008 and have held it there ever since. They next meet to map out policy on Dec. 15-16 in Washington.

Hawks Ascend

The jobs report “leans slightly in favor of the hawks” on the Federal Open Market Committee who want to raise interest rates faster, Krishna Guha, vice chairman of Evercore ISI in Washington, said in a note to clients. But it “will not radically change the internal debate about the path of rates in 2016.”

The 211,000 advance in payrolls in November was more than double the monthly gains that Fed Chair Janet Yellen says are needed to soak up new entrants into the labor force. She pegged that number at under 100,000 in an appearance before Congress’s Joint Economic Committee on Dec. 3.

While payroll gains would need to be larger than that to encourage discouraged workers back into the labor force, even that threshold would still be “quite a bit less” than 200,000 per month, she said.

There were signs in the Friday jobs report that Yellen’s efforts to entice disheartened Americans to resume looking for work were starting to pay off. The labor force participation rate — the share of working-age people who are employed or looking for work — rose to 62.5 percent from 62.4 percent. That was the first increase since May.

Still Gradual

In spite of the big increase in payrolls, growing participation should allow the Fed to stick to its strategy and “normalize rates gradually,” Neil Dutta, head of U.S. economics at Renaissance Macro Research LLC in New York, said in a note to clients.

Yellen has said that she’ll be watching the pace of wage gains for signs that slack in the labor market is disappearing. On that score, Friday’s report suggested that some remains. Average hourly earnings for all workers rose 2.3 percent in November from a year earlier, down from 2.5 percent in October.

The annual gain though could pop up to 2.6 percent next month, according to Joe Carson, director of global economic research at AllianceBernstein LP in New York. That’s because earnings fell 0.2 percent on a month-on-month basis in December last year so even a flat reading this December would boost the annual gain.

Wage Growth

“If the Fed is looking for evidence of wage growth — it has arrived,” Carson said in a note to clients.

To be sure, fear of an overheating economy is far from the dominant concern in the financial markets. The yield on 10-year Treasury note, after all, it still just 2.27 percent as of 12 p.m. on Friday in New York. But that’s up from 2.04 percent in late September as inflation expectations in the bond market have climbed.

“The Fed should have started to begin hiking rates earlier this year,” Charles Lieberman, chief investment officer for Advisors Capital Management in Ridgewood, New Jersey, said in a research note. “The economy is quite healthy, so interest rates need to be normalized as quickly as possible in order to avoid disruption.”

No inflation in sight, imho.