SWOT Analysis for Gold

Frank Holmes provides a look into the gold sector via a SWOT analysis on an almost monthly basis. Below is his latest.

Click here to visit Frank’s US Global Investors website.

…

Strengths

- The best-performing precious metal for the week was platinum, up 4.80 percent. The World Platinum Investment Council forecasts that platinum is to remain in deficit through the next six years.

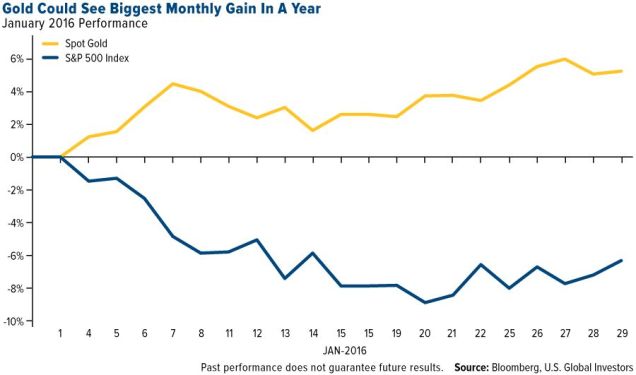

- Bullion for immediate delivery rallied 5 percent in January, according to Bloomberg, the best gain in a year as seen in the chart below. Following the $15 trillion rout in global equity markets since May, the precious metals’ lure has reawakened. Bloomberg also points out that investors bought gold through exchange-traded funds for the past seven days straight, the longest stretch in a year.

- According to Bloomberg News, China’s imports of gold from Hong Kong jumped 67 percent in December to the highest level in more than two years on the back of market turmoil and anticipation of further weakening in the nation’s currency. In addition, Barclays forecasts that the People’s Bank of China (PBOC) will buy 215 tonnes of the precious metal this year, as the country “seeks to diversify its reserves.”

Weaknesses

- The worst-performing precious metal for the week was palladium, still up 0.37 percent. Total ETF holdings for both platinum and palladium declined this past week, but nearly twice as many ounces of palladium were liquidated compared to platinum.

- Eldorado Gold plans to write down the value of its assets up to $1.6 billion, reports the Canadian press this week, with a majority of concerns related directly to its mining operations in Greece. Aureus Mining has also run into some trouble with its plans for the New Liberty mine in Liberia. The company has deferred declaring commercial production following last-minute plant problems.

- The top forecaster from OCBC, Barnabas Gan, says gold is “shiny today,” but will be “dull tomorrow,” according to a Bloomberg article. Gan sees the precious metal at $950 by the end of 2016. In a similar statement, Richard Jerram with the Bank of Singapore thinks gold’s stellar start to the year won’t last as the U.S. jacks up interest rates.

Opportunities

- In the final quarter of 2015, total gold supply dropped 7 percent, according to data from Thomson Reuters, due to an estimated 4 percent drop in global mine output. Based on prior long-term price declines for the gold, Bloomberg reports that gold production may drop more than 20 percent in the next five to 10 years.

- RBC Capital Markets released its Global Gold Outlook this week. In the report, the group cites five themes that are new or look positive for the gold price: 1) Gold has been resilient in the face of a strong U.S. dollar, 2) The gold price has been in a corrective phase since late 2011, 3) A bimodal global economy is benefitting non-U.S. dollar holders of gold, 4) Central banks are now net buyers, and 5) Gold ETF positions have grown.

- Orex Minerals announced that its assay results for the first hole of the 2015-2016 diamond-drilling program on the Sandra Escobar Project hit 61 meters from surface-grading 359 grams per tonne of silver. According to the company’s president, Gary Cope: “This is an excellent high-grade and thick drilling result… and although it is early in the program, silver has been detected in outcrops over a strike length of 700 meters.”

Threats

- According to Freeport-McMoRan, one of the world’s biggest gold miners, it continues to operate after its export permit expired without receiving renewal. The Indonesian government has asked for a $530 million deposit on a new smelter in return for renewing the permit. A similar gloomy outlook was announced last Friday by Moody’s – the group put 55 mining and metals companies on review for downgrades to their credit ratings, citing “slowing growth in China.”

- This year investors are paying almost twice the average premium to own the most-recently auctioned 10-year notes, according to data compiled by Barclays. Bloomberg reports that part of the cracks in the bond market can be explained by turmoil in the financial markets, which have boosted demand for haven assets. The article goes on, however, to state “beyond those issues lie deeper concerns about the very structure of the U.S. bond market, and whether post-crisis rules intended to present another financial catastrophe have ultimately left it broken.” It seems the cure killed the patient!

- Gary Cohn, president of Goldman Sachs Group, says that Treasury yields will likely rise, according to Bloomberg, while Morgan Stanley is predicting just the opposite. Treasuries are heading toward their biggest monthly gain in a year, earnings 1.5 percent in January. Tumbling oil and equity prices are driving investors to the “relative safety of government debt”—and gold.

I just see gold going up in the FACE of tumbling oil and equity prices. Gold seems to be on its own. Not looking around, looking ahead. Discounting something in the future. Gold probably sees it before we do.

That is a good point of Gold being forward looking Jerryck.

That is physical demand and absolutely true in those markets in the East.

However, the paper prices in the US are going up lately when the market have gotten worrisome to others, and this safety bid has returned since August. Today is a good example, markets down, volatility up, Gold/Silver/Platium/Palladim are up. That isn’t a result of buyers in India and Russia.

The question today is can gold take out $1128.20?

That was the temporary peak last Wednesday.

Well gold just went up and tested it right on the mark at $1128.20 and pulled back.

Now if it tests it again…….. (?)

Gold made it above $1128.20 after a few attempts to a new recent high.

Gold Apr 16 (GCJ16.CMX) -COMEX

1,129.00 Up 12.60(1.13%) 2:27PM EST

EX…….LOOK who is talking platinum……., Frank must have been reading our reports……………lol

Yeup. 😉

FFM – As we’ve been discussing Sibayne Gold took a huge position in PGMs last year with their Platium mine acquisitions. Now they are eyeing Base Metals. My prediction is they’ll have a name change soon where they drop the “Gold” and transition over to a commodity conglomerate:

__________________________________________________________________________

Sibanye Mulls Move Into Base Metals, Overseas on Stock Surge

February 1, 2016 – Kevin Crowley

Sibanye Mullion Metals LLC. (Lead Lithium Copper)…… this will name will cover it all… 🙂

Maybe Owl and Cory………could get a theme song going…………. .lol

…. and the KER Yacht. Floating analysis from one shore to another…….

I’m going to tie Frank Holmes, Investing Yachts, Gold analysis, and John Doody mentioned from his GSA day all together in one video blast from the past:

Yellen Won’t Lift Rates – Frank Holmes

Feb 23, 2015

SWOT not SWAT

Why merely correct, when you can educate:

SWOT = Strength, Weakness, Opportunity, Threat

“SWOT analysis aims to identify the key internal and external factors seen as important to achieving an objective. SWOT analysis groups key pieces of information into two main categories:

internal factors – the strengths and weaknesses internal to the organization

external factors – the opportunities and threats presented by the environment external to the organization”

Oops sorry guys, the title is fixed now.

Judging by the Utilities index, ETF FUTY, it also appears investors are looking for higher interest rates than given by CDs.

CDs with the risk of BAIL INS……………

funny, eldorado is going to write down assets, they own one of the top 5 highest grade mines under construction in the world right now.

So someone invests on the excellent news and progress of one of the best mines in the world, price of company compared to peers etc etc and out of the blue, a write down.

Mining is risky, investing in mining is risky.

Sure, risk can be reduced, but its still risky. lol

Thats why Im interested in potential large returns only, there are enough risks from different places to make them seem almost incalculable.

I think the next bull in metal…is gonna be huge, I could be wrong of course, maybe gold goes to $400, dont think so but it could, but if I didnt think the next bull was gonna be huge I wouldnt be bothering.

Maximizing is good, but whats gonna matter more, just be in it.

Unless we go to $400. lol

Mining is incredibly risky, and most mines (and most businesses for that matter) fail in their first 5 years. This is why I don’t just go all in on a few names all at one time. It is wise to spread the risk around in different sized companies, different jurisdictions, and different commodities or energy sub-sectors.

I agree that continuing to try in Maximize is the advantage of picking individual stocks over a mutual fund or ETF. If you just want blanket exposure by the fund or ETF.

that should have said If you just want blanket exposure “buy” the fund or ETF.

(USERX, TGLDX, GLDX, GDX, SGDM, GDXJ, SGDJ, SIL, SILJ).

Gold And Silver Outperforming, Attracting Hedge Funds, Money Managers – CFTC

By Kitco News – Monday February 01, 2016

I do not see significant evidence that tumbling oil and equity prices are driving investors into gold. the demand in gold seems to be coming from China, India, Russia and a bit from eastern Europe.