Big Investors Continue to Bail on Gold ETFs

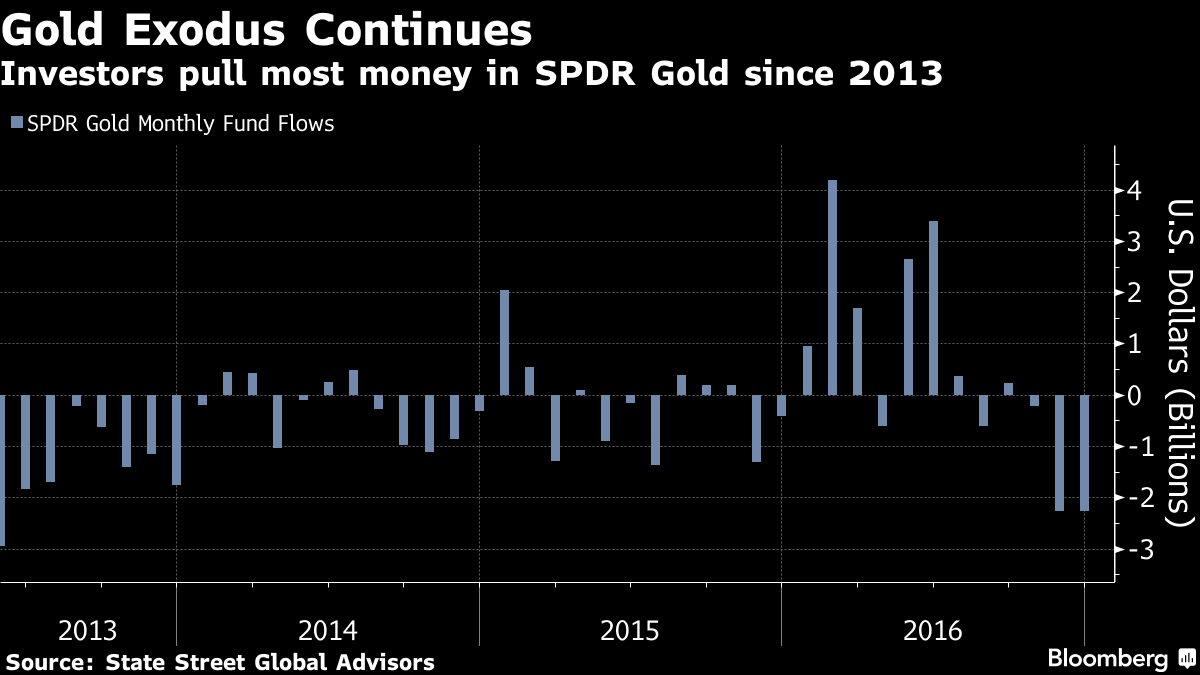

This trend has to change if we want to see the gold price move higher. As you can see below large investors such as hedge funds have been bailing on the gold sector over the past 3 months. The GLD has not seen these type of outflows since 2013. This trend could change very quickly but when you look at the amount of negative months vs positive months since 2013 we need some consistent inflows and not to extreme levels. Big money drives markets and contributes to the FOMO herd mentality and right now it is against gold… Give investors time to realize that all of the optimism around a Trump presidency is ahead of itself.

Here is the post from Bloomberg…

-

SPDR Gold withdrawal reaches $2.27 billion, most since 2013

-

Money managers pare bullish bets to smallest since February

Investors just keep bailing on gold.

In December, $2.27 billion was pulled out of SPDR Gold Shares, the world’s largest exchange-traded fund backed by the metal. That was a third straight monthly loss and the biggest since May 2013. Money managers have also turned less bullish on bullion, cutting their net-long positions for a seventh straight week to the smallest since February, U.S. government data showed Friday.

Bullion lost favor at the end of last year, posting the worst quarterly loss since June 2013 as equities rallied and the dollar gained amid improving global growth prospects and increasing odds that the Federal Reserve will keep boosting U.S. borrowing costs this year. That’s hurt the investment appeal of gold because it doesn’t pay investors yields or dividends.

“The reality is the trend is not in gold’s favor right now,” Bob Haberkorn, a senior market strategist at RJO Futures in Chicago, said in a telephone interview. “You’re fighting the trend if you’re trying to buy gold at this level. It’s going to take geopolitical events or a change in the tone of the Fed on interest rates to push gold higher.”

Gold futures for February delivery swung between gains and losses on Tuesday, adding 0.3 percent to $1,155.10 an ounce at 9:58 a.m. on the Comex in New York.

The Stoxx Europe 600 Index advanced, poised to enter a bull market as data showed China’s factories and services both ended 2016 on relatively robust notes. In the U.S., the S&P 500 advanced in Wall Street’s first session of the new year. The Bloomberg Dollar Spot Index climbed 0.8 percent.

Hedge funds and other large speculators pared their net-long positions by 23 percent to 41,247 contracts in gold futures and options in the week ended Dec. 27, according to U.S. Commodity Futures Trading Commission figures published three days later. That’s the smallest since Feb. 2, data compiled by Bloomberg show.

This article is BS in its implications…..WHERE do you think the banks get their gold from?

HUGE ACCUMULATION OF GOLD EQUAL TO 31 TONNES BY JPMORGAN WHICH GOES ALONG WITH ITS 550 MILLION OZ OF SILVER.

Cuomo is a big spending idiot.

http://www.nytimes.com/2017/01/03/nyregion/free-tuition-new-york-colleges-plan.html?_r=0

The only thing his plan has going for it is the fact that about 25% of all Federal student loans are currently in default.

College indoctrination (so-called education) is increasingly becoming irrelevant.

Separation of education and state!

Its just buying and selling, its all the same bank.

At least in the west.

https://youtu.be/HVAI07f-5M0

usa watchdog link.

Gold bugs will love this one, PMs to the moon and a bonus of finding out the “truth” about aliens.

He doesnt say if they are long headed aliens or not tho.

In any case, seems we are all in for a big surprise.

I made $200 on NUGT on Friday. Made $5.00 on ASM today. And banked $996 on BITCF today as well. Also bought back into NUGT and I am up about 5%.

http://deviantinvestor.com/wp-content/uploads/2017/01/Hack-Elections.jpg

He may speak fluent German and good English, but he lacks in spelling…

FRT 2017 and Celente

https://www.youtube.com/watch?v=zG7EdOL6s44