Some interesting market and economic facts

I wanted to update something I said on the market wrap becasue the number has significantly changed. It’s scary that Fed Heads can still move markets and data by just a couple comments but it is the world we live in. What I am referring to is the updated rate hike odds for March… I stated in the market wrap that these odds stood at 54%. Well that has changed quite significantly.

After headlines stated “FED’S DUDLEY: CASE FOR RATE RISE MORE COMPELLING, CNN REPORTS” and “DUDLEY SAYS FAIRLY SOON MEANS RELATIVELY NEAR FUTURE” we now stand at 70%! In all fairness Dudley is a known dove but this is a major move from around 50% at the market open to now around 70%. Just wanted to update everyone on these numbers.

Now for some other data I find interesting…

India – After all the worries out of India after Modi banned 85% of India’s cash we are seeing how the economy is doing… It turns out quite well. Q4 GDP was up 7% and Consumer Spending also up 10%! (See the full table below.)

I have to say I am surprised and more than a little impressed.

US Stock Markets – I think we all can agree that the US markets have ben very boring as of late. Just how boring?

This from Ryan Detrick who I follow on Twitter. “Today was the 50th consecutive day the S&P 500 didn’t trade in a daily range of greater than 1%. The previous record was 34 days from 1995.”

This is more an interesting stat than anything to trade on.

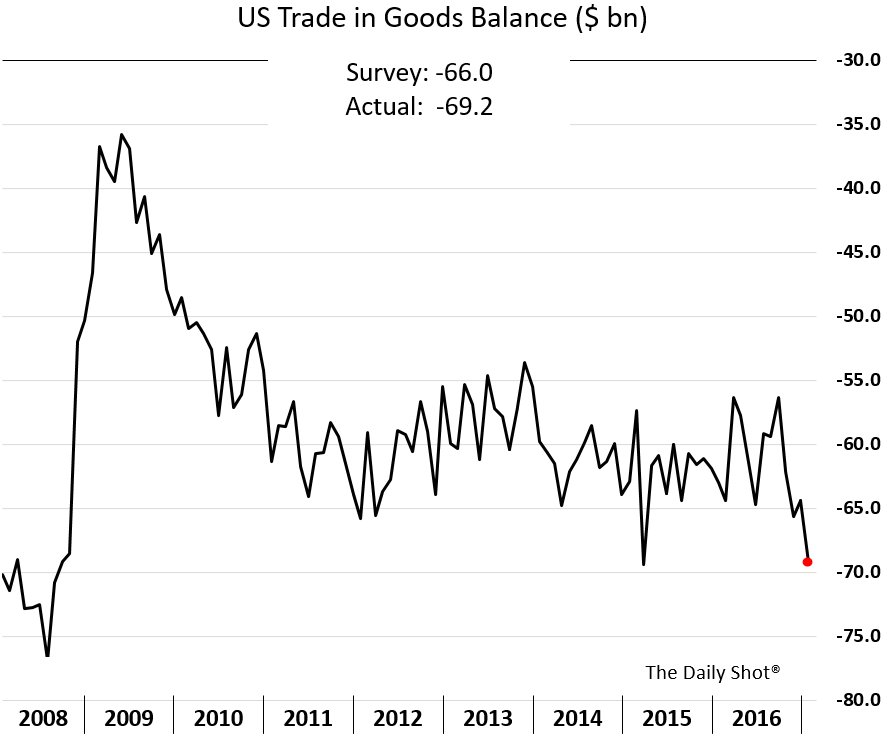

US Economy – Recent data on US trade. In short the deficit got worse.

I will leave you with this chart below. It outlines perfectly the discrepancy we are seeing between optimism and what the economy is actually doing. They use the terms soft data and hard data…

I hope everyone has a great evening. If you are watching the Trump speech have fun!

OFF topic and not covered in MSM:

Christians are fleeing Northern Egypt after ISIS issued a kill list and threatened to attack places of worship

(ISMAILIA, EGYPT) Christian families and students fled Egypt’s North Sinai province in droves on Friday after Islamic State killed the seventh member of their community in just three weeks.

A Reuters reporter saw 25 families gathered with their belongings in the Suez Canal city of Ismailia’s Evangelical Church and church officials said 100 families, out of around 160 in North Sinai, were fleeing. More than 200 students studying in Arish, the province’s capital, have also left.

Seven Christians have been killed in Arish between Jan. 30 and Thursday. Islamic State, which is waging an insurgency there, claimed responsibility for the killings, five of which were shootings. One man was beheaded and another set on fire.

“I am not going to wait for death,” Rami Mina, who left Arish on Friday morning, said by telephone. “I shut down my restaurant and got out of there. These people are ruthless.”

Sectarian attacks occur often in Egypt but are usually confined to home burning, crop razing, attacks on churches, and forced displacement.

Trump signs legislation to improve employment of US females with STEM degrees:

https://youtu.be/tLO6n6e_5Z8

Trump signs Executive Order favoring Black education:

https://youtu.be/z5UPiOzXYU0

Can you believe the insanity of non-cooperation?

https://youtu.be/gaZlus0aPWc

FRANKFURT, Germany (AP) — A top European Central Bank official is warning that the bank’s stimulus measures are easing pressure on indebted governments to straighten out their finances.

Jens Weidmann of Germany said Wednesday that current low borrowing rates offer “few incentives for governments to consolidate their budgets” since debt does not incur high interest costs.

Weidmann sits on the ECB’s governing council by virtue of his post as head of Germany’s Bundesbank, or national central bank. He has been a steady critic of the ECB’s decision to use newly printed money to purchase government bonds and corporate bonds, driving interest yields down.

He is just one vote on the 25-member council. Stimulus critics, however, have grown louder as the eurozone economy recovers and inflation nears the bank’s goal of just under 2 percent.

Inflation figures due out Thursday could intensify pressure on the ECB to signal when it intends to start withdrawing the bond-purchase stimulus, known as quantitative easing. In December, the bank decided to continue purchases through the end of this year while reducing them from 80 billion euros a month to 60 billion euros a month from April.

Cory:

Thanks for the Bloomberg data chart. As they say, hope springs eternal. Fundamentals count, but sentiment controls the dimmer switch and so at the moment, few can see…..

Great analogy Silverdollar!

Cory, surely you don’t believe those numbers coming out of India, I would have thought differently of you until now. DT