Interesting Changes in Passive vs Active ETF Money Flows

This post below courtesy of FactSet outlines the changes in money flows over the past two month. Passively managed ETFs (Vanilla ETFs) have been the preferred choose for investors to park their money for years but in the past two months actively managed ETFs have started to pick up funds. All the data is laid out below but as a general comment I think if this trend continues and actively managed ETFs continue to grow I think that is good for the metals and other sectors outside of the general markets. This will take time but we will follow along to see if this short term trend grows into a longer term sustainable trend.

Click here to visit the original posting page at FactSet.

…

What a difference a month makes.

In April, I wrote, “At the margins, in small increments, equity ETF investors actively chose active management. That’s new.”

I was pointing out that actively managed ETFs had started breaking out from their niche segments—fixed income, mostly—and were beginning to gain market share in the highly competitive equity space. April’s gains were small. So small that some of my colleagues laughed at me for pointing them out.

Then came May. Actively managed ETFs blew away their competition in the race for asset gathering. Nothing subtle: $656 million of market share gain in competitive equity segments.

But maybe not, because of some tailwinds in May: outflows to big vanilla ETFs that made every other fund and strategy look stronger. I’m talking about you, SPY (SPDR S&P 500 Trust) and your pal IWM (iShares Russell 2000 ETF), with your $4.67 and $4.88 billion in May outflows. Losses like that in a month that saw net inflows to U.S.-domiciled ETFs of $32.83 billion definitely shake things up.

And we haven’t even gotten to cannibalization yet.

In the end, May fund flows left us guessing about the future of active management in the ETF space. Were the big wins really a victory for active management, or were they more a transfer of assets from mutual funds to ETFs — a cannibalization of an existing client base? Will active equity funds continue to gain market share if the big trading vehicles see resumed inflows? Will the cost war start to bite into the actively managed equity space?

Let’s look at the data first.

May Flows By-the-Numbers

Two-thirds of the $656 million in market share gains, $424 million, seeded a single fund, Principal Active Global Dividend Income ETF (GDVD-US). But GDVD had company. Six other actively managed ETFs increased their market shares by $10 million or more, each in a different, competitive equity segment. Here’s the list:

| Ticker | Name | Segment | AUM 4-28-17 ($Millions) | Increase in Market Share ($Millions) |

| GDVD | Principal Active Global Dividend Income ETF | Equity: Global – Total Market | 0.0 | 424.0 |

| CCOR | Cambria Core Equity ETF | Equity: U.S. – Large Cap | 0.0 | 100.0 |

| AMZA | InfraCap MLP ETF | Equity: U.S. MLPs | 368.1 | 50.7 |

| RFDI | First Trust RiverFront Dynamic Developed International | Equity: Developed Markets – Total Market | 128.0 | 35.4 |

| SYG | SPDR MFS Systematic Growth Equity ETF | Equity: U.S. – Large Cap Growth | 24.2 | 35.0 |

| ARKK | ARK Innovation ETF | Equity: Global – Total Market | 20.4 | 19.1 |

| ARKQ | ARK Industrial Innovation ETF | Equity: Global Technology | 33.0 | 18.2 |

Keep in mind that, as of the start of May, only five actively managed equity ETFs had assets above $100 million, and only one had managed to cross the $1 billion line: First Trust North American Energy Infrastructure Fund (EMLP-US). The average actively managed equity ETF was far smaller, at $67 million. All the active equity ETFs together were worth just $3.95 billion, or 0.17% of the equity ETF landscape. No doubt about it; $656 million of market share gain for actively managed equity ETFs is a big deal.

May Flows Ignore Two Trends, Intensify Another

It gets bigger. May’s triumph for actively managed equity bucked two industry trends: the dominance of plain vanilla strategies and the slashing of the industry’s weighted average expense ratio. Vanilla funds lost market share in May, after many months of running the table, as readers of my ETF Insight series will recall. Yet the trend to lower expenses continued, especially in segments where funds and strategies compete for investor dollars. Actively managed equity ETFs gained market share despite their higher overall costs.

The cost pressure is intense, with no sign of slackening. Through April of this year, 50% of the net inflows went to just 25 ETFs, with a median expense ratio of .07%. May was no different in terms of a drive to lower costs; funds that gained market share cost only 0.20% on a weighted average basis, while market share losers cost 0.26%. Equity ETFs saw an even wider spread, with market share winners charging a weighted average 0.19% vs. 0.26% for the losers. But it gets more interesting when you sort equity ETFs by strategy.

Here’s a breakdown of costs by strategy in the U.S. Equity ETF space, focusing on segments where strategies compete for investor dollars. By separating funds into two groups—those that gained market share and those that lost it—we can see how investors are making choices. The chart below focuses on the expense ratio, shown as a weighted average by AUM.

| Strategy Group | Winners | Losers |

| Vanilla | 0.16% | 0.21% |

| Strategic | 0.23% | 0.34% |

| Idiosyncratic | 0.31% | 0.39% |

| Active | 0.88% | 0.92% |

| All Equity ETFs | 0.19% | 0.26% |

While investors in all equity strategies rewarded lower cost funds, those who piled into actively managed equity ETFs were less demanding and tolerated far higher fees than those favoring other strategies. Note that actively managed equity increases in market share went to funds that were only 0.04% cheaper than the competition, while strategic beta investors demanded more: an average of 0.11% cost savings.

Cannibalization a Win?

How did Principal, among others, convince investors to pay up for active management, in a world that’s generally trending to dirt-cheap vanilla?

Principal has an affiliated investor to thank (in other words, an internal client with funds at the ready, according to Paul Kim, Principal’s Managing Director for ETF Strategy). As of June 5, Kim had not commented on whether GDVD cannibalized existing Principal funds. It is possible that GDVD’s success is less of a victory for actively managed ETFs than it is a defeat for the mutual funds or separately managed account structure.

Even the cannibalization explanation begs the question of how active equity ETF investors justified the extra cost, but a bit of context might help. GDVD’s expense ratio of 0.58%, though more than five times expensive as cost-leader Vanguard Total World Stock ETF (VT-US), is the lowest among the actively managed funds in the global total market segment and is also competitive with the segment’s strategic funds, which cost 0.53% on an asset-weighted-average basis. Perhaps it is fair to say that May’s most successful active ETF launch is competing against complex rules-based funds rather than the cheap vanilla strategies. Game on. Cost now matters everywhere, in both the mutual fund and ETF world.

For Once, Vanilla Funds Fall

With the clear drive to lower cost ETFs, it is all the more curious that May’s flows broke the trend of investors favoring vanilla funds. Vanilla ETFs, funds that track a broad-based, representative, cap-weighted index, are generally the cheapest and most efficient of the ETF strategies. Indeed, vanilla funds have been increasing their market share for a few years.

But not in May. May brought a massive headwind to vanilla ETFs, in the form of outflows to SPY and IWM. There was some underperformance in the buy-and-hold funds, too.

While the rotation from high to low-cost vanilla funds continued, some short-term trading vehicles (notably, SPY and IWM) lost not just market share, but actually suffered outflows. Put simply, Vanilla funds as a group will be under pressure any time dollars flow out of SPY-US.

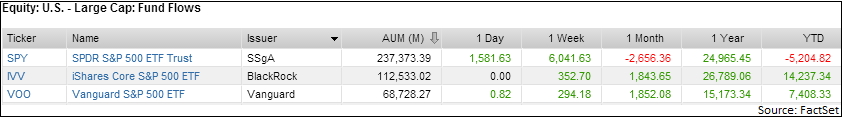

SPY has long been more volatile, flows-wise, than its S&P 500-tracking competitor, showing that each fund has a different user base. Compare IVV and VOO’s steady growth to SPY’s short-term give-and-take as of June 2.

Market share gains and losses to the trading vehicles can distort the picture for all other ETFs. This is equally true when funds like SPY have month-over-month inflows as when they have outflows, especially if the overall market is going the opposite way.

Here’s an easy way to think about the effect SPY’s heavy outflows: the 113 other U.S. Large Cap ETF gained $4.42 billion in May inflows, almost enough to offset SPY’s losses. Even more striking, SPY’s two competitors, Vanguard S&P 500 ETF (VOO-US) and iShares Core S&P 500 ETF (IVV-US), each brought in about $1.8 billion, for a joint total of $3.64 billion. It’s hard to say that U.S. ETF investors spurned the S&P 500 in May. It’s more that SPY is an easy-come, easy-go vehicle used to make short-term bets.

Excluding SPY, the U.S. Large Cap segment showed the flows patterns we have come to expect in 2017: outperformance by Vanilla funds, moderate underperformance by strategics, and severe underperformance by idiosyncratics. Interestingly, actively managed funds’ net flows seem much more in line with the rest of the segment.

| Including SPY | Excluding SPY | |||

| Strategy Group | May Flows ($ Millions) | May Flows Gap ($ Millions) | May Flows ($ Millions) | May Flows Gap ($ Millions) |

| Active | 103 | 103 | 103 | 0 |

| Idiosyncratic | 106 | 141 | 106 | -944 |

| Strategic | 137 | 154 | 137 | -371 |

| Vanilla | -588 | -391 | 4,078 | 1,223 |

Trading vehicle losses are not all that ailed vanilla funds in May. Most equity segments don’t have ultra-high volume funds that flow with daily market sentiments or that serve as an overnight equitization vehicle. Interestingly, some of these non-hotshot segments showed investor interest in complex, non-vanilla strategies.

This becomes clear when we look at the U.S. total market segment. Even buy-and-hold vanilla funds like Vanguard Total Stock Market ETF (VTI-US) fell short. VTI’s $927 million of inflows was less than half of what VTI’s market share would imply, given the overall flows to the U.S. total market funds. Strategic funds, especially the iShares Edge suite, strengthened their market share. Here are the six U.S. total market funds that shifted their market shares by $100 million or more in May 2017:

| Ticker | Name | Strategy | May Flows ($ Millions) | May Flows Gap ($ Millions) |

| VIG | Vanguard Dividend Appreciation ETF | Dividends | 68.6 | -550.4 |

| QUAL | iShares Edge MSCI USA Quality Factor ETF | Fundamental | 756.6 | 660.6 |

| DGRO | iShares Core Dividend Growth ETF | Fundamental | 254.2 | 217.4 |

| USMV | iShares Edge MSCI Min Vol USA ETF | Low Volatility | 718.1 | 389.9 |

| MTUM | iShares Edge MSCI USA Momentum Factor ETF | Momentum | 728.9 | 661.8 |

| VTI | Vanguard Total Stock Market ETF | Vanilla | 927.5 | -1,071.9 |

Vanilla funds fared poorly in May, sometimes because of trader’s whims, other times because investors opted for more complex strategies.

Here’s how things turned out, with SPY back in the picture. The table below shows gains and losses to market share for equity funds in segments where strategies compete with each other:

| Strategy Group | May Flows ($ Billions) | May Flows Gap ($ Billions) |

| Vanilla | 13.61 | -2.04 |

| Strategic | 6.47 | 0.99 |

| Idiosyncratic | 0.13 | 0.39 |

| Active | 0.74 | 0.66 |

SPY’s outflows made every other strategy look good, especially active management in the equity space, among competitive segments.

Active’s Time at the Top Waning?

Will active’s winning streak continue in June?

Maybe not. Active management lost its appeal in May in every asset class outside of equity. In commodities, for example, active management lost $75.4 million in market share, with plain vanilla funds picking up the gains. This is how it looked in the broad commodity segment, for all funds with a change in market share of $10 million or more:

| Ticker | Name | Strategy Group | May Flows ($ Millions) | May Flows Gap ($ Millions) |

| GSG | iShares S&P GSCI Commodity Indexed Trust | Vanilla | -5.3 | 49.8 |

| USCI | United States Commodity Index Fund | Strategic | -17.4 | 12.2 |

| DJCI | ETRACS Bloomberg Commodity Index Total Return ETN | Strategic | 4.1 | 10.2 |

| RJI | Elements Rogers International Commodity Index-Total Return ETN | Strategic | -22.7 | -10.2 |

| DBC | PowerShares DB Commodity Index Tracking Fund | Strategic | -123.5 | -11.6 |

| FTGC | First Trust Global Tactical Commodity Strategy Fund | Active | 33.0 | 39.5 |

| PDBC | PowerShares Optimum Yield Diversified Commodity Strategy No K-1 Portfolio | Active | -151.8 | -120.0 |

PDBC, which actively tries to outperform DBC, lost 25% of its assets, while DBC lost only 6%. Even the no K-1 perk couldn’t stem the tide.

Active management fared no better in fixed income this May. Fixed income market share winners included the bullet maturity vanilla funds, fundamentally-oriented VanEck Vectors Fallen Angel High Yield Bond ETF (ANGL-US), and the duration-hedged ETFs.

May fund flows may have left us guessing about the future of active management in the ETF space, but one thing is certain. I can’t wait for the results of June.

Or Trump could give the Fed one silver bar and say, thanks for the 100 year goat roping, you’re done! Paid-in-full! Bye bye Fed!

Jim Willie:

Jim Willie:

Did Willy finally catch on to bitcoin……I thought he was not in favor of bitcoin….”THE VOICE” told him something……….

WASHINGTON (AP) — House Speaker Paul Ryan said Wednesday that he won’t commit to holding a vote to increase the government’s borrowing authority this summer.

The Wisconsin Republicans instead says the House will vote on such debt legislation before the government defaults — but not necessarily by an August deadline requested last month by Treasury Secretary Steven Mnuchin.

“We’re going to address the debt ceiling before we hit the debt ceiling,” Ryan told reporters.

Increasing the so-called debt limit is needed to avert a first-ever default on U.S. obligations such as interest payments and Social Security benefits.

Increasing the debt limit requires legislation by Congress and is invariably a headache. Conservative Republicans say they would like to condition lifting the government’s almost $20 trillion borrowing limit on passing cuts to other government programs.

Mnuchin wants an increase in the debt limit as quickly as possible and has said spending cuts can wait until later.

But White House budget director Mick Mulvaney has said he would like spending cuts to accompany a debt increase. Such a public difference of opinion is unusual, but it has now become clear the Mnuchin is taking the lead for the administration.

“The Treasury secretary is and should always be the person in charge of debt limit negotiations, debt limit legislation. That’s a natural thing. Every Treasury secretary is in charge of that,” Ryan said.

Ryan won’t commit to a debt measure that’s free of add-ons. He supported the most recent debt increase, negotiated with the Obama administration, which was paired with a two-year budget plan that lifted agency spending limits and imposed modest spending cuts.

CFS Comment: Ryan displays his cronyism!