Where in the World Can Value be Had in the Equity Markets?

This post was brought to my attention by Jesse Felder of the Felder Report. Investors are always looking for value but in markets that have been going up for 9 years it can be hard to find.

Recently we have been discussing the money flows out of US equity ETFs and into European and EM ETFs. This is an example of investors looking for value. However within US markets there has been a rotation where again investors are trying to find value. The post below outlines some of the sectors within the market that are overvalued vs undervalued – using a median company price to book ratio relative to a 10 year average.

Click here for the original posting at the Knowledge Leaders Capital blog.

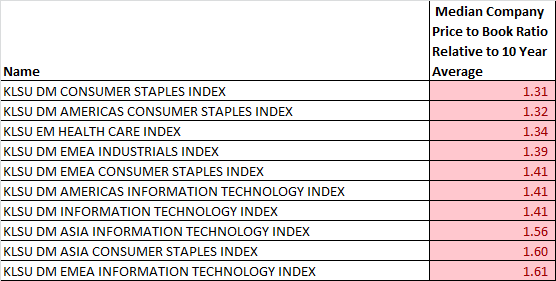

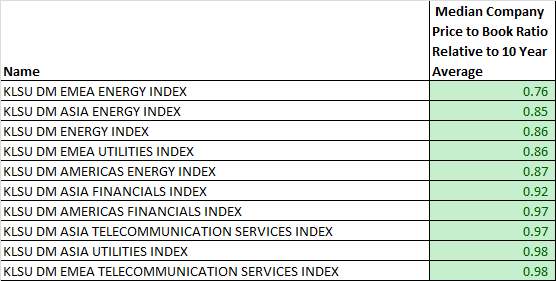

To say that value is difficult to find in the global equity markets would be an understatement. In fact, when we look at all 44 of the developed market regions and regoin/sectors, what we find is that in only ten of them is the median company trading at a discount to its own 10-year average multiple. Furthermore, six of ten of those aggregates are either in the energy or financials sectors and the rest are in either telecom or utilities. Thus, value stock picking has become incredibly concentrated in just a few areas of the global equity market.

Alternatively, stocks trading at a premium to their historical average are in large supply. The most expensive ten sectors by this measure trade at a 31-61% premium to historical averages. These most expensive aggregates are concentrated in consumer staples, health care, industrials and tech sectors. From this data it seems to be almost a unanimous consensus that “value” can be had in consumer staples and tech while energy and financials are nothing but “value traps”. Only time will tell.