Earnings – S&P 500 and Energy Companies

Below are two articles from FactSet that summarize the earnings forecasts and expectations for Q2. I find that we hear a lot about weak earnings but the post related to the S&P 500 earnings tell a different story.

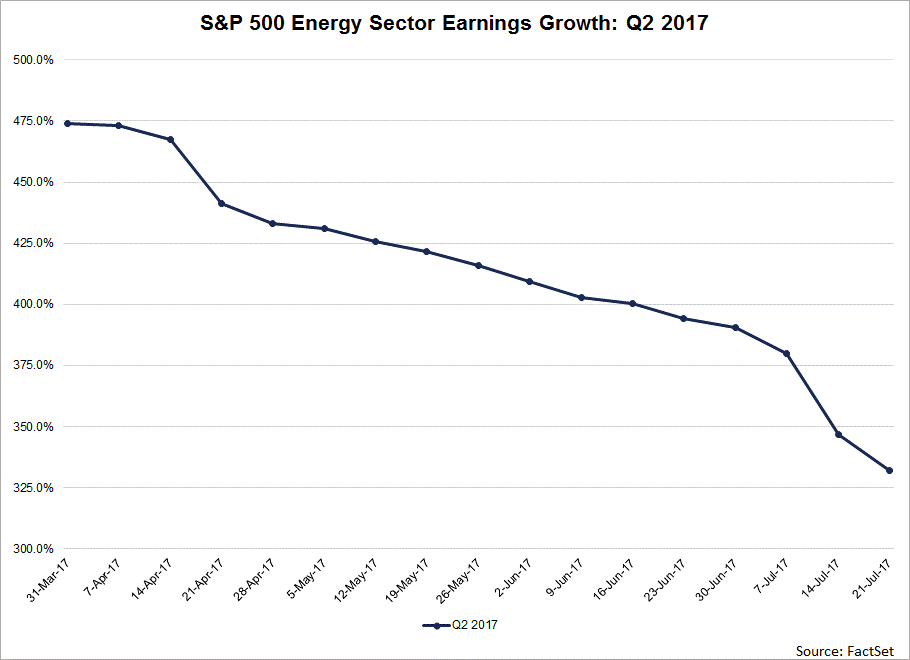

As for energy it is interesting to see the unwind in optimism for earnings results. With oil staying low this could start to become a bigger issue than it currently is.

…

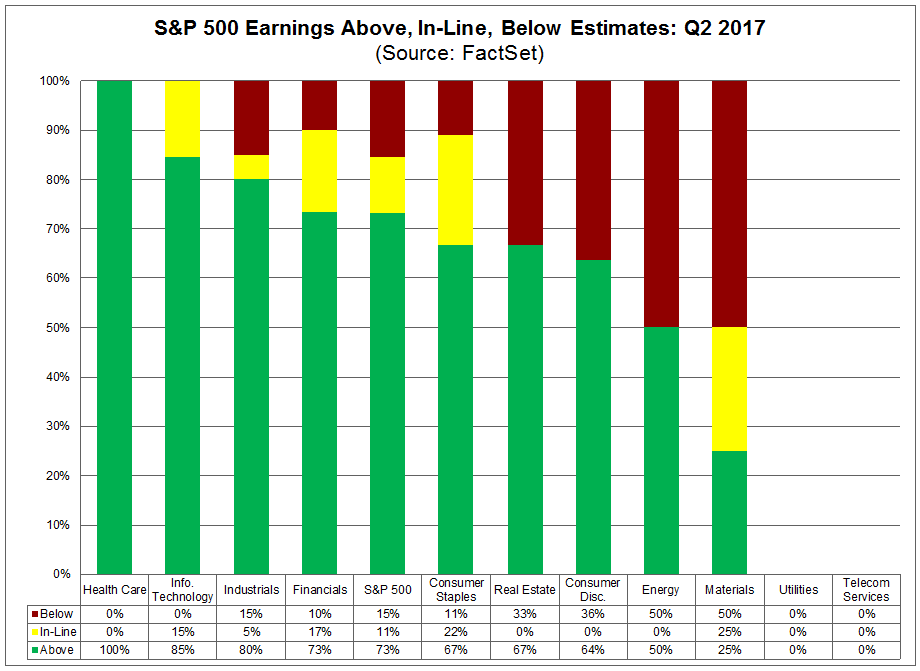

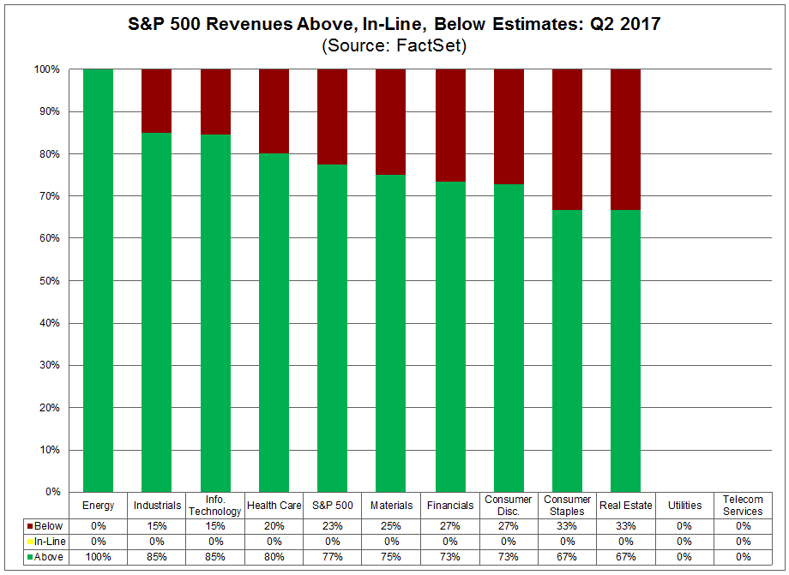

To date, 19% of the companies in the S&P 500 have reported actual results for Q2 2017. In terms of earnings, more companies (73%) are reporting actual EPS above estimates compared to the 5-year average. In aggregate, companies are reporting earnings that are 7.8% above the estimates, which is also above the 5-year average. In terms of sales, more companies (77%) are reporting actual sales above estimates compared to the 5-year average. In aggregate, companies are reporting sales that are 1.3% above estimates, which is also above the 5-year average.

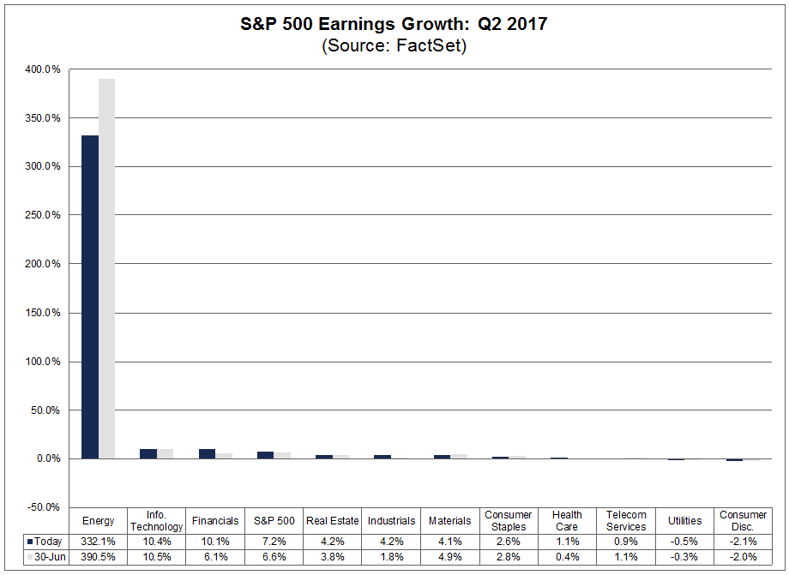

The blended (combines actual results for companies that have reported and estimated results for companies that have yet to report) earnings growth rate for the second quarter is 7.2% today, which is higher than the earnings growth rate of 6.8% last week. Upside earnings surprises reported by companies in the Financials sector were mainly responsible for the increase in the earnings growth rate for the index during the past week. Overall, nine sectors are reporting or are predicted to report year-over-year earnings growth, led by the Energy, Information Technology, and Financials sectors. Two sectors are reporting or are projected to report a year-over-year decline in earnings, led by the Consumer Discretionary sector.

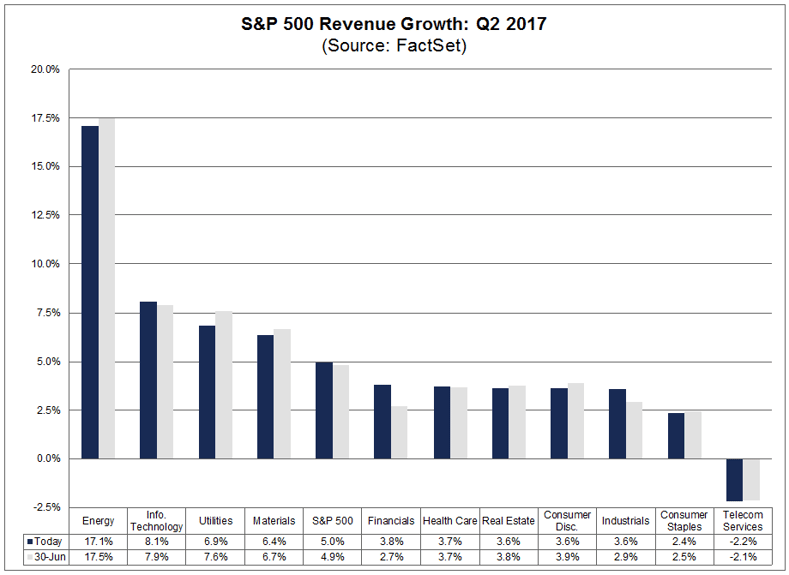

The blended sales growth rate for the second quarter is 5.0% today, which is equal to the sales growth rate of 5.0% last week.

During the past week, upside sales surprises reported by companies in the Financials sector were mainly offset by downward revisions to sales estimates for companies in the Energy sector, resulting in no change in the revenue growth rate for the index. Overall, 10 sectors are reporting or are projected to report year-over-year growth in revenues, led by the Energy sector. The only sector predicted to report a year-over-year decline in revenues is the Telecom Services sector.

During the upcoming week, 191 S&P 500 companies (including 13 Dow 30 components) are scheduled to report results for the second quarter.

For Q3 2017, seven S&P 500 companies have issued negative EPS guidance and seven S&P 500 companies have issued positive EPS guidance.

The forward 12-month P/E ratio is 17.8, which is above the 5-year average and the 10-year average.

….

Exxon Mobil and Chevron will be focus companies for the market this week, as both companies are scheduled to report earnings on Friday, July 28. The current mean EPS estimate for Exxon Mobil for Q2 2017 is $0.84, which is below the mean EPS estimate of $0.89 on June 30 and below the mean EPS estimate of $0.99 on March 31. The current mean EPS estimate for Chevron for Q2 2017 is $0.86, which is below the mean EPS estimate of $0.98 on June 30 and below the mean EPS estimate of $1.13 on March 31.

Exxon Mobil and Chevron are not the only companies in the S&P 500 Energy sector that have seen EPS estimates for the second quarter decrease since the end of the second quarter. In fact, 25 of the 34 companies in the sector (74%) have recorded a decline in their mean EPS estimate for the second quarter since June 30. As a result, the earnings growth rate for this sector has fallen to 332.1% today from 390.5% on June 30. This marks the largest drop in earnings growth of all eleven sectors since the end of the second quarter.

Despite the drop in earnings growth, the Energy sector is still expected to be the largest contributor to earnings growth for the S&P 500 as a whole. Excluding the Energy sector, the blended earnings growth rate for the S&P 500 falls to 4.8% from 7.2%.

However, upside earnings surprises reported by companies in other sectors (particularly the Financials sector) have more than offset the impact of the decrease in earnings in the Energy sector over the past few weeks. Since June 30, the blended earnings growth rate for the S&P 500 for Q2 has increased to 7.2% from 6.6%.

Analysts have also cut full-year EPS estimates for the Energy sector during this time. Overall, 29 of the 34 companies in this sector (85%) have recorded a decline in their mean EPS estimate for CY 2017 since June 30. As a result, the estimated earnings growth rate for this sector for CY 2017 has fallen to 236.4% today from 275.6% on June 30. The estimated earnings growth rate for the S&P 500 for CY 2017 has fallen to 9.3% from 9.8% during this same time frame.

Pressure at the Pump

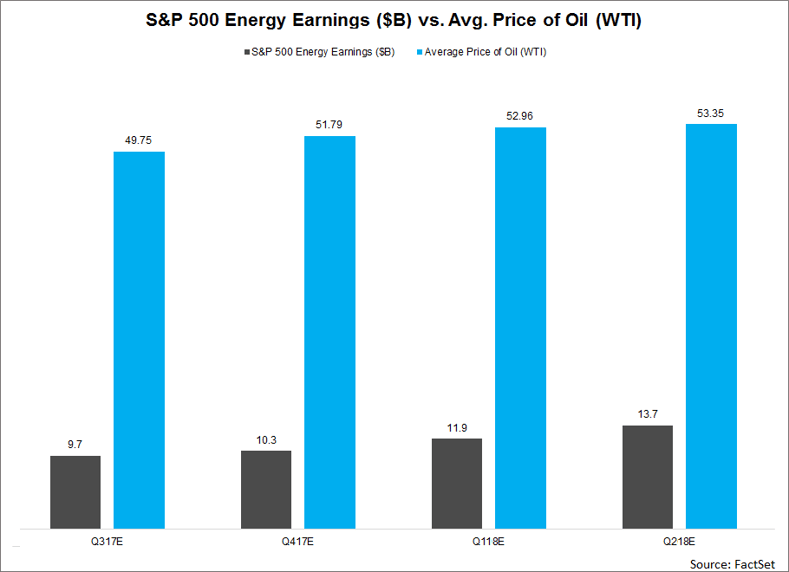

It is interesting to note that as of July 20, the price of oil closed at $46.92. Analysts are still calling for the average price of oil to be above this closing price in the second half of 2017. If oil prices do not increase as expected, analysts will likely continue to lower earnings estimates for this sector for all of 2017 (as they have already done this month).

Sorry for my typos…..My sight is poor today.

The reason the above graphs do not make sense is the lack of volatility in oil price.

Basically it assumes a CPI cost growth, ignoring seasonal effects, and ignoring all supply-demand perturbations; ignoring the fact we are probably going into recession.

Ignoring any interest rate changes, etc. WITHOUT stating the assumptions upon which the projections depend.

A discussion about Trump, Healthcare and Education in the U.S.

Barnhardt….interesting as usual….jmo

Have to agree with her on both subjects.

I hope people listen to the above youtube discussion on healthcare.

The only thing Ms. Barnhardt forgot to discuss was the drain of resources going to the legal profession and attorneys…….and of course, many politicians come from the legal profession.

You forgot the CPAs

What did you think concerning the college education system?

Ira’s metals TA

https://youtu.be/dVB1BvRfdsI?t=32

I wonder if Trump will have the sense to remove Kushner, when he removes Sessions and Mueller.

No I bet he keeps him for the Jewish fake state

Hi Big Al and Excelsior, I have joined you in the Rye Patch boat today. I hope they will find a huge gold deposit in NV and go to $50 a share. Do Doc and Matthew own RPMGF too?

Now I’m waiting for AUG to tumble so I can get on board. NSRPF was up another 16% today!!! Hooray!

I do not own it but that’s not due to anything negative about the company. As Doug Casey says, you can’t kiss all the girls.

http://stockcharts.com/h-sc/ui?s=RPM.V&p=D&yr=1&mn=2&dy=0&id=p98327824896&a=536192066

Thanks, Matthew. I think I recall Doc saying he owns Rye P.

Bonzo Barzini – Welcome aboard the Rye Patch boat. (I think it’s done taking on water).

Good times – I was also buying a bit more RPM today as well. They are not getting enough credit for the revenues that will start coming in from the Florida Canyon Mine, and they do have Lincoln Hill and Wilco deposits to keep feeding that mine in close proximity. They also have Garden Gate Pass as a kicker down the road.

Really, I’m surprised at just how low the share price is, but feel some of it is due to the recent investor concern from their capital raise and because they sold their forward interest in the Rochester royalty from Coeur to access the funds and help move Florida Canyon along. If the mine grows like Bill & team says it will, then it will have been worth the candle for the increased production revenues.

The downside risk in Rye Patch seems limited compared to the upside potential over the next 3-6 months. If there is any further fireworks, then I’ll buy a big bottle of Rye whiskey to ride out the storm.

Yes, I saw Novo continuing to propel higher. Now I feel like a goofball for trimming that position down to size, but it is mind-boggling that the gold nuggets have created so much buying pressure in this stock.

Someone summed it up well earlier today:

@Highheat – “Thanks to $NVO we now know a tool more powerful than the Truth Machine. A video of two skinny old miners with a jackhammer finding a gold nugget and saying. Shit! Shit! In a cool Aussie accent.” 🙂

I’m a big fan of (NVO) for the larger picture that Quinton and the team have laid out but this move up has gotten a bit silly just off the nugget video and metal detector momentum. It just goes to show the power of the miners to make ridiculous gains if investors really get behind a story.

Looking forward to seeing more action like this in the Jr miners.

So far I have not sold any Novo but am considering it.

I am waiting for Big Al, Bob M., and Jay Taylor to sell their NSRPF before I do.

Thank goodness you didn’t sell any yet. Man Novo Resources just continues to surge higher and higher. Wow!!!

well, I just listened to the president’s speech.

What a waste of time. Trump is unfocused and rudderless.

He says Congress should repeal and replace Obamacare, but offers little direction as to how any replacement should be made within any VIABLE budgetary concern. He just wants bigger, and bigger government.

He does not understand EXCESS government. He does not understand the drag on any economy of EXCESS borrowing and EXCESS taxation.

Typical New York Liberal.

Will Trump voters from alabama still support Trump , If he continues to attack Jeff Sessions his AG ??? Will Trump go ahead and fire him , even tho it may make hard core fans of Jeff Sessions angry ?? More to come on this front. Market may be anticipating Pence take over later this year. Article 25 removal could be very quick and Impeachment can be as quick as congress wants it. Impeachment is virtually anything that congress says it is, no restricktion on speed on Impeachment. Best of health and wealth to you all S

Teranga drills 34 m of 6.08 g/t Au at Golden Hill

2017-07-24 17:15 ET – News Release

Mr. Richard Young reports

TERANGA GOLD REPORTS GOLDEN HILL DRILL RESULTS, INCLUDING 6.08 G/T GOLD OVER 34 METRES AT NAHIRI PROSPECT

Teranga Gold Corp.’s early-stage drilling continues to yield high-grade, near-surface oxide and deeper fresh-rock gold mineralization at its Golden Hill property in Burkina Faso, West Africa.

I’m jazzed about Golden Hill. It’s in the South Hounde belt right by Sarama Resources, Savary Gold, Rox Gold, and Endeavour in Burkina Faso. I’d like to see Teranga takeover Sarama Resources, since their JV partner Acacia is royally screwed in Tanzania and Acacia has some complaints about the mining conditions at their projects. While Acacia is getting their tail ends handed to them, Teranga should nab Sarama and combine those projects with Golden Hill for a killer consolidation in that area.

Nice lil nugget there, Excelsior!

Thanks Chartster. When I say Acacia is royally screwed with Tanzania, here whats up:

______________________________________________________________________________

$ACA.L $ABGLF Acacia Mining Slapped With Shocking $190 Billion Tax Bill In Tanzania

Anna Golubova Monday July 24, 2017 #Wowzers

“Acacia Mining is continuing to struggle in #Tanzania, with the government now billing the country’s top gold producer a staggering $190-billion in alleged fines and unpaid taxes from two of its mines.

“Tanzania government sent a $40 billion tax bill along with an additional $150 billion in penalties and interest owned, according to a statement released by Acacia on Monday.” “The shocking tax bill of $190 billion is also equal to two centuries worth of the gold producer’s revenue, Bloomberg reported on Monday. To put things into perspective, Acacia’s total reported revenue for 2016 was just $1.05 billion.

“Some other incidents this summer included Acacia’s North Mara #gold mine being taken over by more than 500 residents from nearby villages at least three times in late-June, as they clashed with police in an attempt to steal gold ore.”

“At least 66 people were arrested by Tanzanian security forces. More than half of those detained were women, who were reportedly used as human shields, according to Reuters.”

It is a shame for Tanzania, for the stakeholders inside and outside of the country, and asking for 2 centuries of the production from $ACA.L is ridiculous and FAR from realistic.

When I saw the news break about them asking for 190 Billion Dollars….. all I could think of was this clip from Dr. Evil. #GoldMafia

**** 100 Billion Dollars!

Consolidation key to Sarama’s success in Burkina Faso’s best gold belt

Here is a MAP showing where Teranga’s Golden Hill is located relative to Sarama Resources other properties. Teranga could clean up shop if they acquired Sarama. Sarama has already done a good job of consolidating the district, and their partner on one Acacia, is not in any position to grab them. Now would be the time for Teranga to make their move…..

https://www.juniorminingnetwork.com/images/news/May_2017/Sarama_Resources_5-16-2017_1.jpg

2017-07-24 16:08 ET – News Release

Mr. Darren Blasutti reports

AMERICAS SILVER CORPORATION PROVIDES SECOND QUARTER PRODUCTION AND COST UPDATE

Americas Silver Corp. has released its consolidated production and operating cost results for the second quarter of 2017 and individually for its Cosala operations and Galena complex. All figures are in U.S. dollars unless otherwise indicated.

Second quarter highlights

Consolidated silver production for the quarter was approximately 558,000 silver ounces and 1.2 million silver-equivalent ounces, representing increases of 7 per cent and 6 per cent, respectively, when compared with Q1 2017, and increases of 1 per cent and 18 per cent, respectively, year over year.

Consolidated cash costs for the quarter were approximately $6.31 per silver ounce, a decrease of 40 per cent when compared with Q1 2017 and 45 per cent year over year, while consolidated all-in sustaining costs were approximately $9.74 per silver ounce, a decrease of 30 per cent when compared with Q1 2017 and 33 per cent year over year.

Notice the leap in year-over-year “silver equivalent” ounces. That’s due mostly to their zinc production (which, along with lead and copper, is hardly a silver-equivalent)…

Second Quarter Highlights

Consolidated silver production for the quarter of approximately 558,000 silver ounces and 1.2 million silver equivalent ounces, representing increases of 7% and 6%, respectively, when compared to Q1, 2017, and increases of 1% and 18%, respectively, year-over-year.

Darren has mentioned in the last several interviews and in a few press releases that they are really going to milk their Lead & Zinc credits while those Base Metals are performing so well. They are letting the high-grade Silver slopes in Idaho and Mexico simmer, and have decided to make hay while the sun is shining on Zinc/Lead. That makes all the sense in the world and is actually a brilliant strategy.

When San Rafael comes on -line in September/October they expect that the base metals credits will push their AISC on Silver equivalent ounces down to around $3. That’s fantastic and most investors have not been following their strategy and not baking in how fat their margins are going to be later this year and moving into 2018. The future for Americas Silver looks quite robust.

___________________________________________________________________

(USAS) #CorporatePresentation #VIDEO from European Gold Forum

April 6, 2017 – Zurich, Switzerland

http://www.europeangoldforum.org/egf17/company-webcast/USA:CN/

I Zinc this is a good place to post this article:

_______________________________________________________

Zinc Rally Set to Last as Producer Sees Best Price in Decade

By Swansy Afonso – July 20, 2017

“The rally in zinc prices has the potential to jump this year to levels not seen in a decade as demand continues to outstrip supply amid mine output disruptions, according to Hindustan Zinc Ltd., Asia’s biggest producer by market value.”

“Prices may rise to about $3,000 a metric ton on the London Metal Exchange in the next couple of quarters, Sunil Duggal, chief executive officer of the Vedanta Ltd. unit, said in a phone interview from Udaipur in Rajasthan. The last time prices hit that level was in 2007, according to data compiled by Bloomberg.”

Ex, thanks for the heads up on this stock, all I can say is USA, USA, USA. Tomorrow we should get some traction. DT

+1

I’d say it’s common sense to focus on the metals that are high and agree that the future is bright for USA even if a huge part of their revenue comes from metals that have no business being considered “silver equivalent” ounces. Only gold should be considered equivalent to silver and vice versa.

Matthew – I hear ya on the Zinc & Lead not being “precious” but that is what almost every Silver producer does. They use their Zinc, Lead, Copper credits and count it into their Silver Equivalent ounces to have a standard measure of reporting production throughput or ounces mined. It is the exact same with Gold miners counting Copper, Cobalt, Zinc, Lead towards their Gold Equivalent ounces.

It’s an inferior approach that some would call deceptive, that’s all.

From one standpoint, it can confuse those that interpret Gold eq. ounces or Silver eq ounces as all Gold or Silver, but if they’ve converted over the Base Metals credits on the concentrates or the throughput/production over the same value as Gold or Silver at the time of reporting, it’s really the same measure of value at that specific point in time when they sell the metals.

For reporting purposes, all I care about is how much was produced, and what the margins are to see if they are starting to make money. That’s the main thing, since it is a business of selling metals, and all Silver producers are polymetallic by nature.

Right now with Zinc & Lead & Copper so elevated, due to real supply/demand fundamentals, I’d produce as much of those Base Metals as possible (because may not be as valuable at other points in the commodities cycle).

Overall, I’m actually extremely impressed that they are holding back the Silver for when the pricing improves back up into the $20s. Why blow out the Silver at low prices, when you can shelve some of those, and make it rain with Zinc/Lead/Copper. They are still producing plenty of Silver along with those Base Metals of course, but they are purposely letting those values flat-line in favor of the better economics on the BMs. They’ve been very open about it, and Silver equivalent ounces or Gold equivalent ounces is the industry standard most companies use.

That’s where we disagree. For reporting purposes, all I care about is how much actual silver was produced and what the costs were. knowing this is more useful if you care about how much leverage to silver to expect from a company.

I DO care about how much leverage i get which is why my top three silver positions (by far) 18 months ago were IPT, AXU, and USA. Each went 10-11 bagger in about 6 months while SILJ did almost half as well. Today, I think IPT has retained more of what gave it such leverage than either USA or AXU.

One last point. The fact that companies have been open about their reporting does mean that investors understand the flaws in such reporting.

Those are some valid points concerning a companies leverage to Silver prices Matthew and I appreciate you sharing them.

I do agree that IPT has some of the most leverage to Silver, and always attributed that to how pure of a Silver producer they were. This is also why investors like First Majestic so much. The high grade Alexco has been hitting at Bermingham and Flame&Moth has upped their leverage to Silver as well. The fact that they worked things out with Silver Wheaton where they now have a sliding scale will also help out on leverage. Excellon is about to tap into their higher grade sections of the mine that have been underwater for years. They have 5+ years of really high grade material to mine, and are exploring and continuing to grow those resources, so that should give them excellent leverage as well.

I like that IPT’s revenue comes mostly from silver but that is just a small part of where the leverage comes from. There are many more important factors to consider when trying to figuring out how much leverage to expect.

Yes , agreed. I mostly look at costs, margins, production guidance, reserves, the pipeline of projects, and exploration upside. I’m still learning every day though, and enjoyed your comments on only looking at how the precious metal portion will perform for a given company, and using the base metal credits to recalculate their costs. Thanks for the insights as always.

To be clear, I’d prefer it it if companies like USA would just apply their base metal credits to the costs of producing actual silver (and gold, if any) rather than using such production to inflate their silver equivalent ounces.

Notice that the following site does not include base/industrial metals in its definition of gold equivalent ounces.

https://www.goldminerpulse.com/terms.php

“Gold Equivalent Ounces. Gold and silver ounces are expressed as gold equivalent ounces using the most recent spot market closing prices for gold and silver.”

Agreed in principal, but in practice Gold & Silver producers almost all count Copper, Zinc, Lead, Cobalt, Antimony, whatever…. towards their Gold or Silver equivalent ounces. It isn’t something unique to USA.

No, it’s not unique to USA but that doesn’t mean USA should do it. IPT’s management knows better.

IPT has had a much higher Silver percentage at 89% so it was the most pure silver producer, but it is dropping to the mid 70% range this year, and they are also producing more Zinc & Lead than in years past, so it will be interesting to see if they convert those over to Silver Eq Ounces as well.

Its the same for the vast majority of the companies in the Silver space as none are 100% silver. All are polymetallic by nature. Honestly, many of the ZINC companies are doing the exact same thing, only they count their Silver and Lead as Zinc Equivalent Ounces. 🙂

I think you’re missing my point, Ex. Getting those base metal credits is fine and dandy but they should not be called “silver equivalent” ounces. They are not. They should simply be applied to the costs necessary to produce silver or real silver equivalent ounces (Ag+Au). IPT’s management agrees and does it right.

The same goes for gold companies regardless of how many are doing it wrong. Base metals are not monetary metals and, therefore, have different drivers.

P.s. – IPT is unlikely to “convert” base metals to AgEq ounces as long as the current management is in charge.

I agree that it would be better to adjust costs using the Base metals credits and only report in the Silver or Gold ounces. Even though the AISC numbers get massaged all kinds of ways, it’s at least one metric to watch in those regards. That’s why I’ve mentioned how significant it will be with San Rafael coming online in September or October for (USA) (USAS). They’ll be dropping it from around $10 to $3 as far as how they report their All In Sustaining Costs. That’s a major improvement.

The only other “Silver” miners I’m aware of that have costs that low are Silvercorp and the projected costs for MAG Silver when they come on-line.

There’s no dispute about the robust economics but an AISC number for AgEq ounces will be much different than one for actual Ag ounces. I care more about the latter while much of the industry wants investors to focus on the former.

That’s a really interesting vantage point, and I haven’t really looked at things with that type of filter before. Good lesson to ponder today. Thanks.

I’m not smart enough when reading over balance sheets and financials to really calculate what the true cost for the Silver ounces are, so I’ve defaulted to AISC numbers as one of my key metrics, but those have all the base metals intertwined.

Do you have a quick calculation for rooting out a companies real costs that you utilize? (one that can be used by dummies like me 🙂 )

DNI METALS — INITIAL DRILL RESULTS THAT INCLUDE 4.5M OF 10.59% GRAPHITIC CARBON

DNI Metals Inc. has received the first batch of drilling assay results from its Vohitsara graphite project in Madagascar, including six mineralized holes from the Southwest zone and the first three holes from the Main zone. Drilling has confirmed that free-dig saprolitic weathered material has been developed to depths of 17 metres to 42 metres below surface, averaging 28 metres.

Hey i just checked at ask dot com . on the length of time it took for impeachment articles to pass house and end of trial on Senate for Andrew Johnson . It was about 8 weeks long. It could literally take a few days if they congress is aggressive. There is NO requirement that chief justice of Supreem Court make rules or even be allowed to manage the trial in the Senate. Its just a custom addopted from the A Johnson trial tha was continued in the Clinton trial. Obviosly the REPUBS will have to initiate and lead the way on Impeachment. pray for our country . S

On what grounds could they impeach??

Shakey grounds … 😉

DNC….needs to get those computers back from the FBI….before they think of any impeachment. Wasserman is in deep doo doo if the justice department is doing their job…jmo

DC police seem to be like the Chicago police.

Silver held up well today:

http://stockcharts.com/h-sc/ui?s=%24SILVER&p=W&yr=3&mn=9&dy=11&id=p72944737714&a=500464214

I pointed out the following backtest of broken support last week and, no surprise, the bears were emboldened today:

http://stockcharts.com/h-sc/ui?s=%24GDM&p=D&yr=1&mn=0&dy=18&id=p25005592799&a=528708013

The Canadian dollar reached resistance today but not before bullishly exceeding its 2016 high.

http://stockcharts.com/h-sc/ui?s=%24CDW&p=W&yr=3&mn=7&dy=0&id=p88172245081&a=529054473

GDXJ filled last week’s 18 cent gap today while the 89 week MA bullishly crossed above the 233 week MA:

http://stockcharts.com/h-sc/ui?s=GDXJ&p=W&yr=2&mn=2&dy=0&id=p58250177043&a=522006460

ira’s end of day

Jul 24 U.S. Lawmakers Seek to Criminally Outlaw Support for Boycott Campaign Against Israel The Intercept MUST READ in case you wonder just who rules the US @321 gold

And the christians will love them for it, step right up and get your chip, lol

Christians have not done their homework….Many will come in my name…kjv

SLV:GLD is at resistance but probably not for long:

http://stockcharts.com/h-sc/ui?s=SLV%3AGLD&p=D&yr=0&mn=6&dy=11&id=p98092875586&a=533646134

Why doesn’t USAS convert it’s silver into zinc equivalent ounces? I don’t think HL ever converts it’s lead and zinc into silver equivalent oz. They just lower their cost of silver production.

Those candles followed bullish gaps, spanky. That mitigates any bearish implications at least beyond the very short term. There’s no reason why that 7/17 gap shouldn’t be filled.

If I were Jim Sinclair I’d be worried about having so much of my money tied up in TRX in Tanzania. Rye Patch in Nevada seems safer.

Ditto

Miners being sold into strength as per usual.

This is the narrowest gdx:gld has been in 5 or more years, FWIW:

http://stockcharts.com/h-sc/ui?s=GDX%3AGLD&p=D&b=5&g=0&id=p41607722629&a=536312833&listNum=1

S. Silver drills 17m of 154 g/t Ag at Cerro Las Minitas

2017-07-25 09:41 ET – News Release

Mr. Lawrence Page reports

SOUTHERN SILVER HITS HIGH-GRADE EXTENSION AT CERRO LAS MINITAS

Southern Silver Exploration Corp. continues to identify high-grade mineralization from the current core drilling program on the Cerro Las Minitas project, Durango state, Mexico.

ira’s morning TA

Who was thew idiot that made those estimates?

I have rarely seen such rubbish.