Maple Gold Starts Drilling Step-out Targets at the Douay Gold Project

This is going to be an exciting year fro Maple Gold Mines. In my last conversation with the President and CEO Matthew Hornor he outlined the drilling plans for this year which includes more exploration drilling from the prior year. Now we have the news that the first drill rig has been mobilized with a plan to bring as many as 6 diamond drill rigs to site. With already a well defined 2.8million oz gold deposit if this drilling hits constant grades this project could get a whole lot bigger.

I am a shareholder and will be following up with Matthew when we start to see some results. Please listen to our most recent interview (linked below) for a full recap on the plans and goals of the drilling and email me with any questions you have.

Click here to listen to the most recent interview outlining the 2018 plans.

Here’s the news…

January 18, 2018 – Montreal (Quebec): Maple Gold Mines Ltd. (“Maple Gold” or the “Company”) (TSX-V: MGM, OTCQB: MGMLF; Frankfurt: M3G) is pleased to announce that the first drill-hole has commenced at the Company’s Douay Gold Project (the “Project”). The first drill-rig has arrived to site (pictured below) and has been mobilized to one of the priority infill and step-out drill targets from the 55 existing permits currently in place. Permit requests have been submitted for the balance of planned drill-holes (see press release dated January 10, 2017) and the Company anticipates receiving permits and ramping up to the full complement of (5-6) diamond drill rigs within approximately three weeks.

Maple Gold’s President and CEO, Matthew Hornor, stated: “We are excited to break ground with the first drill-hole of the 2018 drilling campaign. Our technical team deserves a lot of credit for all of the hard work that preceded today’s milestone. We look forward to additional drill rigs arriving shortly and drill results this winter and spring.”

Pictured above: (left to right) Luiz Amaral; Christian Makang; Marthe Archambault; Hubert Mvondo. Maple Gold geologists stand at the first drill site as drilling commences at the Douay Gold Project. At the time of writing, the first drill-hole had reached 45 metres, intersecting syenite from 33 metres depth.

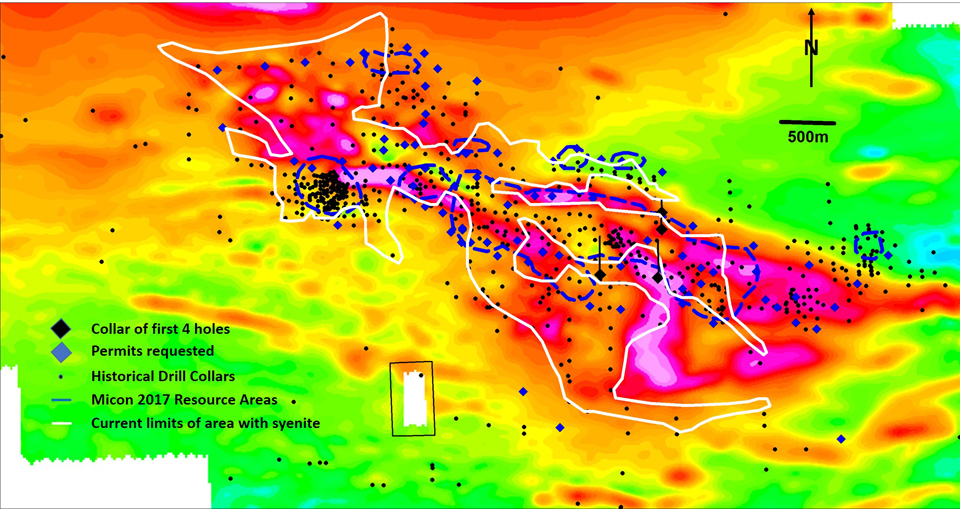

Fig. 1: Resource Area drill plan on first derivative magnetic base map showing first four holes to be drilled, including drill-hole (DO-18-203) currently underway. View the figure above with historical drill-hole locations included by clicking here.

The figure above highlights the extent of syenite, or mixed syenite and basalt, in comparison with the existing resource areas as defined in the latest report by Micon in 2017. Note also the rough coincidence of syenite with a characteristic bimodal (high/low) magnetic response. The anomalous geophysical pattern combined with the extent of syenite, defines what Maple Gold views as the greater Resource Target Area, which will be the focus of step-out and infill drilling during the current campaign.

Qualified Person:

The scientific and technical data contained in this press release was reviewed and prepared under the supervision of Fred Speidel, M. Sc, P. Geo., Vice-President Exploration, of Maple Gold Mines. Mr. Speidel is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Speidel has verified the data related to the exploration information disclosed in this news release through his direct participation in the work.

About Maple Gold:

Maple Gold is a well-funded gold exploration company focused on advancing a district-scale gold project in one of the world’s premier mining jurisdictions. The Company’s 370 km² Douay Gold Project is located along the Casa Berardi Deformation Zone within the prolific Abitibi Greenstone Belt in northern Quebec, Canada. The Project has an established gold resource that remains open in multiple directions, with excellent infrastructure and several large scale operating mines within 150km. Maple Gold has a significant drill campaign under way to expand on the known resource areas and test new discovery targets within the Company’s 55 km of strike along the Casa Berardi Deformation Zone. For more information, please visit www.maplegoldmines.com.

ON BEHALF OF MAPLE GOLD MINES LTD.

“Matthew Hornor”

B. Matthew Hornor, President & CEO

For Further Information Please Contact:

Mr. Joness Lang

VP, Corporate Development

Office: +1 416.682.2674

Email: jlang@maplegoldmines.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS PRESS RELEASE.

Forward Looking Statements:

This news release contains “forward-looking information” and “forward-looking statements” (collectively referred to as “forward-looking statements”) within the meaning of applicable Canadian securities legislation in Canada. Forward-looking statements are based on assumptions, uncertainties and management’s best estimate of future events. Actual events or results could differ materially from the Company’s expectations and projections. Investors are cautioned that forward-looking statements involve risks and uncertainties. Accordingly, readers should not place undue reliance on forward-looking statements. Forward-looking statements include, but are not limited to, statements with respect to the Company’s opinions and beliefs, financial position, business strategy, plans for drilling and re-logging, characterisation of gold mineralisation, geological modelling, data integration, establishing high-quality inferred resource expansion targets, testing target areas, the Company’s goal to deliver significant value, drill campaigns, and plans and objectives of management for future properties and operations. When used herein, words such as “anticipate”, “will”, “intend” and similar expressions are intended to identify forward-looking statements.

Forward-looking statements are based on certain estimates, expectations, analysis and opinions that management believed reasonable at the time they were made or in certain cases, on third party expert opinions. Such forward-looking statements involve known and unknown risks, and uncertainties and other factors that may cause our actual events, results, performance or achievements to be materially different from any future events, results, performance, or achievements expressed or implied by such forward-looking statements. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Maple Gold Mines Ltd.’s filings with Canadian securities regulators available on www.sedar.com or the Company’s website at www.maplegoldmines.com. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

Currently trading at $1.46

Why? I knew this dilutive financing, with a full purchase warrant, was coming sooner than later. This company has diluted the living beejesus out of its long term shareholders. I’m surprised that this wasn’t published as a “very special update” on the ke website. Rye Patch is a joke of a company that hasn’t executed with the efficiency and forthright honesty that I would expect from a mining company. For that reason, I will not invest in any company to which it’s Board comprises of any Rye Patch members. They join the growing blacklist of incompetent, dishonest and stupid mining executives.

Hi Rand. Yes, you were correct about the financing showing up right after the reverse split, and it was anticipated by most of the market. Otto over at IKN relishes over the chance to throw a few elbows at the Rye Patch team on a weekly basis. To both of your points, they have been a bit overly dilutive to longer term shareholders, but they’ve also gone from Explorer, to a Developer with a Royalty stream they won from Coeur , to a Producer — something that 99% of companies will never pull off.

Personally, I don’t care for the delays, dilution, or capital raises any more than the next guy, and will agree that they’ve taken way longer to get into commercial production than originally planned, but that is par for the course with Jr miners.

Most gold or silver Developers miss their deadlines making it into commercial production, and the vast majority have a few snafus ramping up production in their 1st year. However, over the next few quarters of results the rerating takes place and the valuations improve.

If they were incompetent or stupid they never would have been awarded the royalty stream off of Coeur, or bought back their own shares in the past, or excelled at delineating Lincoln Hill or Wilco, or brokered the deal to purchase Florida Canyon for pennies on the dollar.

Longer term, being a solid producer in a good jurisdiction like Nevada will get a better premium, but the Rye Patch team needs to stop burning through money, and start delivering solid production results that equate to revenues and cash flows. They also need to get the debt monkey off their backs.

If RPM gets down to $1.30 where they did this financing or anywhere below that, then I’ll be adding shares at that point. Their economics will be underpinned and leveraged to rising metals prices later in the year.

Ex,

Appreciate your commentary and respect your input. After being burned so many many times in the junior market, I’ve become extremely skeptical. I perhaps share that skepticism with Otto. Nonetheless, there are some interesting plays in the market. One that I’ve done a fair amount of DD on is Nexoptic NXO.V. They may have a disruptive lens technology that is currently being implemented into a forthcoming sport optics product. This discovery may be used in numerous revenue-generating verticals. Worth a look, and I may just buy some shares. Rand

Rand – Thanks for the kind words and the heads up on NXO.

I generally steer clear of biotech companies, because I have a harder time valuing the intellectual property, trials, approvals, competitive landscape, etc….

There are just as many fly by night companies in Biotech as the Jr miners, but there are also explosive gains/losses and volatility that make them fun to trade for the same reasons. Very few biotech companies end up working out longer term, so most turn into pump & dumps just like the Jr Explorers. Of course, there are always a few quality companies in any sector though, and spotting one early, can reap amazing rewards.

At least with the miners I understand the basics on what good drill results are, or the permitting process, or or quarter over quarter improvements in production numbers, or metals recovery rates improving, etc…

Investing in miners sure isn’t easy though, since there are so many half-truths, ways of grade smearing drill results to inflate resource estimates, ways of massaging the AISC numbers, or companies that change names and commodities like most people change their undergarmets.

To complicate matters there are an endless trove of newsletter writers pandering to the dreams and schemes of get rich quick minded subscribers that don’t want to do any real research on their own. People create small flocks of followers that buy into or exit positions in mass, leaving most as road kill, and sometimes they promote projects that are thrilling narratives but just absolute garbage. It is hard to dissuade the fanatical “believers” that it is just a pump-n-dump until it is too late, and the hate mail starts surfacing from all the mindless bagholders that can’t wait to place blame on this terrible person that “made them buy a stock”. Very few investors take personal responsibility or accountability for their own actions. Nobody makes anybody hit buy or sell – it is ALWAYS an individual choice, so every investor needs to own the decisions they make and learn over time what works for them.

Mining is also a very tough business with endless challenges and hurtles that throw a wrench into the best laid plans. Just when everything looks like a perfect setup….. Kaboom!!

As for being skeptical about Jr miners, I think that is a very wise approach. There are PLENTY of miners I just simply won’t touch at all, and many of them are actually the giant Majors that are too slow and boring and large to have much torque, but they have had crippling levels of debt, terrible acquisitions at the top of the markets where they overpaid, and they are operating massive mines with huge capital requirements that many local citizens will want to stop at every turn. The other names I generally steer clear of are the popular “momentum” names that suddenly come in vogue, have lots of promotion, but little hope of being economic for some time (if ever). Look at (SX) St Georges Eco-Mining the last 2 weeks for example, or New Nadina over the last 2 months. Yikes!!

Most of us on this blog have had our fair share of getting burnt bad, but that teaches valuable lessons about risk management, taking some profits while they are there, vetting management teams, and getting better at understanding the cyclicality of the underlying commodities. I generally trade many companies with one foot always out the door because of my skepticism, but you still got to be in it to win it.

After a while one picks up on the price moves during different stages of a company from exploration to development to production to growth & acquisition. Also by studying prior takeovers it helps hone down which companies may make future acquisition targets or that the big boys may be interested in.

I’m also particularly found of Turn-Around stories where a company has been destroyed in value, but has real assets in a commodity with a future, and a vision of how they can turn their company around into a more economic operation. As a result, most often when I start getting real serious about positioning in a company, most consider it a dog or dead in the water. Sometimes that ends up being the case (like with Primero) and other times they end up being quite epic (like Claude or Americas Silver or Silvercorp).

I’m with you though, most of the Junior markets are garbage, but my perspective is that it also helps not to get too jaded or skeptical or great trades will continue to pass by and opportunities will be lost. There are some commentators that only look for flaws, but that doesn’t make them all “Fatal Flaws”. So often someone will find just 1 issue with a company and then throw the baby out with the bathwater.

On the other side of the equation there are certain prominent investors that only like just 1 or 2 companies in a sector at the exclusion of all else, and they’ll tear down all other companies except their precious pet stock. They are usually wrong about it being the best performer, and sit on these for huge spans of time during a downturn, and miss many of the larger percentage moves in the smaller or mid-tier companies in the meantime because it didn’t have (Mr. Important) as the ceo, or because they weren’t Tier 1 or whatever other garbage they’ve brought into their belief system. If someone is really interested in the percentage returns and making money investing, then going with the best leverage to price increases is far more important than finding the biggest or best deposit, and there is far less competition or eyeballs following the smaller stories, so they are usually not valued correctly. The perception / value arbitrages make it fantastic grounds for picking up out-sized gains.

Yes, there are some companies that botch an asset or make a poor decision, but I like to see their plan on how they will turn things around, and I may give them a chance.

There are no perfect companies in the mining space and they’ve all done dumb things in the past, and many live on to prosper. I don’t expect perfection….. just progress in a reasonable amount of time.

Many times investors spend insane amounts of time doing due diligence on a company and while they are “getting ready to get ready” they miss a 50% or 100% move, and typically jump in right before a corrective move because of a fear of missing out. Often after all this laborious research for huge swaths of time, they still get nailed with something out of left field that nobody was expecting. I think it is important to check out the primary flagship & commodity, the management, the economics, the share structure, the debt, etc…. but not to get analysis paralysis.

I guess if I was only going to invest in one company or 2 companies I’d want to be pretty sure as well, but even then someone can research till the cows come home, call the ceo, go to a million conferences, and subscribe to 1000 newsletters and still be wrong in the end. There is no way to anticipate all the future roadblocks that a company may get hit with, so I’m more interested in a point where the trend may change, or where steady improvement is being made, or resources are expanding, or wise acquisitions, etc… At the end of the day one just needs to be able to buy a stock for a lower cost basis than the sell it for, and it doesn’t have to be perfect – it just has to get more valuable in a set time parameter.

Personally, I’m always searching for companies that may have a short term (1-3 month) catalyst, or a medium term (3 month – 1year) catalyst, and a few longer term plays [like Lithium back in 2015 or Uranium now].

Sorry for this rant as I’m sure it is long and riddled with spelling & grammar errors, but I can only see 4 lines at at time 🙂

Ever Upward!

A Sprott favorite:

2018-01-16 08:19 ET – News Release

Mr. John Burzynski reports

OSISKO INTERSECTS 76.5 G/T AU OVER 5.0 METRES AT WINDFALL

Osisko Mining Inc. has provided new results from the continuing drill program at its 100-per-cent-owned Windfall Lake gold project located in the Abitibi greenstone belt, Urban township, Eeyou Istchee, James Bay, Quebec. The 800,000-metre drill program combines definition, expansion and exploration drilling in and around the main Windfall gold deposit and the adjacent Lynx deposit (located immediately northeast of Windfall).

Significant new analytical results from 57 intercepts.

Another Sprott favorite:

Kirkland to increase production to +620,000 oz in 2018

2018-01-17 07:51 ET – News Release

Mr. Anthony Makuch reports

KIRKLAND LAKE GOLD TARGETS HIGHER PRODUCTION, IMPROVED UNIT COSTS IN 2018 GUIDANCE, ANNOUNCES NEW SHAFT PROJECT FOR MACASSA

Maya Gold’s Zgounder produces 44,130 oz Ag in December

2018-01-18 12:26 ET – News Release

Mr. Noureddine Mokaddem reports

ZGOUNDER SILVER MINE PRODUCES 44,130 OUNCES OF SILVER DURING DECEMBER 2017

Maya Gold & Silver Inc. produced 44,130 ounces (1,373 kilograms) of silver during the month of December, 2017, at its Zgounder silver mine in Morocco.

Maya produced a total of 517,135 ounces (16,085 kg) of silver during 2017, up 0.87 per cent over 2016 despite the fact that the Zgounder mine’s water supply pipelines were washed out following unusually heavy rainfall in the month of July (previously reported Aug. 18, 2017), significantly reducing production for approximately two months.

Here we go again.

Knock down precious, to prop up dollar.

(CNX) CALLINEX INTERSECTS 9 METERS OF 10% ZINC AND CONTINUES TO EXPAND THE NEAR-SURFACE NASH CREEK DEPOSIT

January 18, 2018

The Periodic Table of Commodity Returns

Jeff Desjardins – The Visual Capitalist – January 18, 2018

http://www.visualcapitalist.com/periodic-table-commodity-returns-2017/

Well…. Here’s the dilutive financing (after the 1:6.5 share rollback) as anticipated.

It looks like picking up RPM anywhere near $1.30 is the place to start buying.

(RPM) RYE PATCH GOLD CORP. ANNOUNCES $15 MILLION BOUGHT DEAL PRIVATE PLACEMENT; ESTABLISHES STRATEGIC REVIEW PROCESS

“…the Underwriters have agreed to purchase, on a bought deal private placement basis 11,538,500 units of the Company at a price of $1.30 per Unit, for aggregate gross proceeds of $15,000,050. Each Unit will be comprised of one common share and one transferable common share purchase warrant. Each Warrant will entitle the holder thereof to acquire one common share of Rye Patch at a price of $1.65 for a period of 24 months following the closing of the Offering.”

http://ryepatchgold.com/rye-patch-gold-corp-announces-15-million-bought-deal/