Tarachi Gold – Recapping high grade gold results from the Jabali Concession

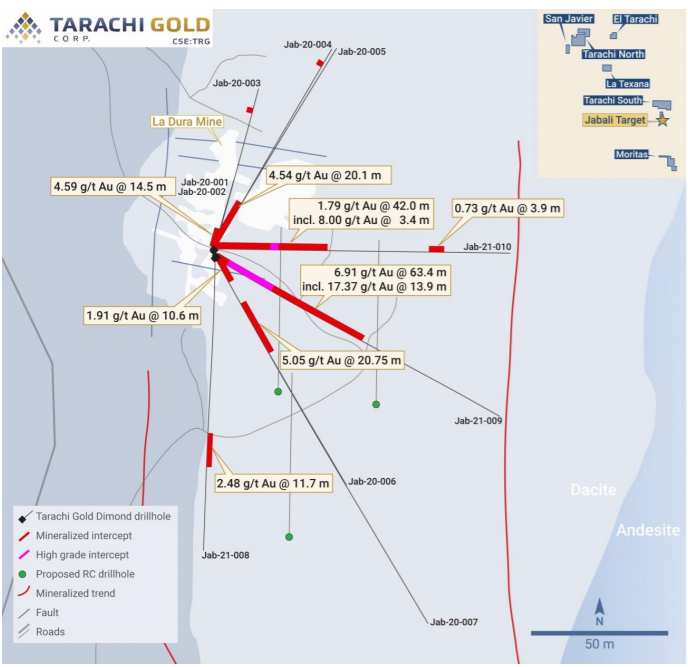

Cameron Tymstra, President and CEO of Tarachi Gold (CSE-TRG – OTCQB:TRGGF) joins me to recap two recent news releases highlighting the drilling at the Jabali Concession in Sonora Mexico. The drilling was focused around the past producing La Dura Mine. Drill results include high grade gold intercepts and visible gold in RC cuttings that are not back from the lab.

Please email me with any follow up questions you have for Cameron. My email address is Fleck@kereport.com.

Click here to read over the recent news releases.

It’s really nice to Gold & Silver and really all commodities continuing to breakout.

Gold currently at $1867

Silver currently at $28.31

Dr. Copper still at all time highs at $4.71

Platinum up, Zinc up, Nickel up, Lead up, Tin up, Oil up, Soft “food” Commodities are up…. As a result, my portfolio hit another all time high today. Boom!

Interesting post from another not PM blog I visit………………

Most of the major bullion retailers accept Bitcoin, but few accept altcoins. So as the crypto complex sinks, traders who desire to purchase bullion must first convert altcoins for either BTC or fiat.

APMEX has an impressive pricing system. They generally succeed at adjusting product premium to ensure they do not run out of stock. Presently, they have 115 green monsters (boxes of 500 1-oz American Silver Eagle coins) for sale. The lowest price works out to $41.24 per coin, a $13 premium on $28.24 spot silver.

I am watching for a few whales to move on these dealers and clean them out. If the crypto dam busts, it will happen, perhaps in the next few days or weeks…

Prices kept me busy this morning. Took a small amount of Vizsla profits and added to Emerita during the morning pullback. Emerita has had some good EOD finishes, so hoping they have another one. Bought Reyna again. I think it is about a year since I had it the first time. With the current trend, it might get to be in trade, although drill results will be important. With the loose change added some to Trevalli as it is stagnant today. Other than that, looking to see if shares can get more excited about prices. It is always something. But, it is a good day.

David, i like Emerita at this price. I like it a lot! As per DrJimJones they have huge zinc tonnage.

Mentioning Trevali brings me back to 2016 when zinc inventories were headed below 100,000 and Trevali was in the mid-30s. You should do well with it even with that bloated share structure–its still the only zinc-only play out there. Reduced refining fees will help a lot.

Cheers.

Emerita has a bunch of everything – Zinc, Lead, Silver, Gold. Quite a bunch of insitu metals in the ground that have recently started to get a nice re-rating (in no small part thanks to Doc Jones articles and awareness he has brought to them).

As for good ole’ Trevali, (TV) is my largest Zinc holding at present, with Sierra Metals (SMTS) in second position as a polymetallic company (Copper/Zinc/Silver/Lead/Gold), and I recently got back into Tinka Resources (TK) again after abandoning them in tax loss selling season last December, as I still believe their Zinc/Silver/Tin resource is robust enough to attract a key JV partner or takeover.

Of course, most of the Silver companies I own, also have substantial Zinc/Lead credits, so from that standpoint, I’m pretty excited in the moves upwards in the base metals lately as it is only going to underpin the Silver miners even further.

Ever Upward!

USAS wow! Anyone have any thoughts on the stock getting hammered after the first quarter report? Will that mine open as reported? Put in a stink big? It’s gotta be about the only silver stock down today…….yep mining is risky, a good reminder me thinks.

Isn’t USAS one of those with a road blockade in Mexico. Not sure of the status if it is…but price is down.

Yep, that is the one. First quarter report , double ugly! Stock right now down 25%. Short interest 5 five days to cover, so not too big. “They” say mine to open this quarter. Just thinking of a stink bid as I own a little now.

Maybe their site or presentation has a discussion as to what the block-aide is about…disgruntled miners, environmental concerns, local town people wanting a cut …etc. Is it in Court? Each one of these situations could be different and could be a legal issue or not. Then make your own determination best you can of resolution and over what time frame. Might be a throw of dice or something that might be foreseeable. Depends on your risk level….sorry, no help. May be call the company…I am sure they are prepared for the question.

Agreed guys. As for Americas Gold & Silver, I had mentioned selling my USAS on March 18, due to the concerns I had about Mexico making an example out of them with their Cosala operations, and at that time, I saw other quality opportunities I wanted to rotate those funds into (Caliber, Wesdome, Equinox), and sure glad I did.

Keep in mind it wasn’t just the blockade, but the Mexican government wanted to force their hand in accepting new union leadership. In addition to that USAS has continued doing further dilutive capital raises for some time, since the mining in Mexico was down and now halted, in addition to the many hurtles getting Relief Canyon up and working as projected. They also had to do a large write-down on Relief Canyon, which was not a good market signal.

USAS put out their operations report today, and it went over like a lead balloon.

_______________________________________________________

(USAS) (USA) Americas Gold and Silver Corporation Reports First Quarter 2021 Results and Provides Operational Update

17 May 2021

https://ceo.ca/@businesswire/americas-gold-and-silver-corporation-reports-first

Ahead in Mexican Standoff

Bloomberg – By Eric Martin – March 22, 2021

“Americas Gold and Silver Corp.’s top executive said he’s optimistic a dispute that has shuttered one of its mines in Mexico for about 14 months can be resolved through meetings with Mexican federal cabinet ministers this week.”

“Chief Executive Officer Darren Blasutti is betting that high-level meetings will provide enough sway to break a deadlock that has kept his company’s mine in Mexico’s western state of Sinaloa shuttered since former workers began blockading the site in January 2020. The standoff is over contracts for non-labor issues including haulage and concrete transportation, according to the Toronto-based company.”

“We’re asking the Mexican government to basically uphold the rule of law, to remove the criminal actors, and to help us very simply reopen the mine and keep it open safely,” Blasutti said Sunday in an interview.

“The dispute has caught the attention of Mexican President Andres Manuel Lopez Obrador. Asked about it at a news conference last week, the president raised the possibility of revoking Americas Gold and Silver’s concession if the company didn’t accept new union leadership at the site. Since taking office more than two years ago, Lopez Obrador has repeatedly pledged to champion Mexican workers and unions, and has often clashed with international investors and the nation’s business community.”

Thanks for the comments. I will keep my position for now, but not add to it. Yep, it was ugly news today all around for this company. I bought thinking the pissing contest over the mine closure was about over……….”based on results”…..not so much!

You bring up a good point Chris about where things are at as of this afternoon, after the big selloff today.

At this point, after such an escalation down in valuation and selloff, then it’s possible most of the downside is priced in at this point. I’m still very concerned about them getting the Mexico operations back on track, and fixing the Mexican government demands for their labor union cronies, in addition to the roadblock, and less concerned about them getting Relief Canyon optimized, but still management has missed some key deadlines/metrics that were sent as market guidance, so they need to do something to instill investor confidence again.

Having said that, sometimes the best value with mining stocks is buying them when the problems have mounted up and investor sentiment is at it’s lowest, for the potential “Turn Around” narrative. USAS definitely needs to get their ship turned around, but it could be an interesting time to see if they can do just that. There are too many companies running on all cylinders for me to have a larger position in USAS, but I’m considering taking out a small initial tranche in them for the speculation that they will eventually get things fixed in Mexico and operating correctly in Nevada. As for their Idaho Galena mine, they gave 40% of that away to Eric Sprott, so it looks like he got exposure to the best operating mine of the 3 at this point, but if they can grow their Idaho operations faster than planned as a result of that capital infusion, then maybe 6 months to a year out, Americas Gold & Silver may surprise folks. I’ve followed them for a long time, and want things to work out positively for them, but exited when the risks were mounting too much a few months back. Now after such a selloff, it is a less risky speculation than it was back then.

Matthew. With the impact Kootenay and Brixton we discussed this past weekend I’m interested in how you would go about things at this stage as far as accumulating them. Would you be a buyer of all three evenly or would you put a heavier weighting on the ones showing signs of moving higher (impact and kootenay ) or would you be buying heavier of Brixton which seems still stuck in neutral??? Thanks.

Wolfster, that’s a good question and one that I always ponder with myself. Brixton is the only one of the three that I bought today but that doesn’t answer your question since I already have plenty of all three.

If I had no positions in any of them, I would buy all of them today. Such juniors have been lagging their larger peers lately so I would bet on them pulling back much if any if we see a pullback soon for the sector in general.

I still view Impact as the no-brainer for various reason including its production and roughly $20M in cash. It will be the one to move most like clockwork as silver goes up but Kootenay has proven to be nearly as consistent and very capable of quick leaps higher. If silver is going where I think it is during this intermediate advance, Kootenay is likely to surprise us in ways that it never has. That’s because so much of its silver is uneconomic at or near the current price of silver. Millions of ounces will jump almost overnight from zero value to significant value and the shares will reflect it just as quickly.

Brixton probably has the most treasure to be discovered but is the least likely to move in a predictable way until it gets more assets into 43-101 compliance or some spectacular drill results. Still, I see it as low risk (not low volatility risk) because of its large and diverse properties in great jurisdictions as well as the fact that it has no production so there’s no way disappoint the market on earnings, production or labor disputes. Of course, Impact is among the safest in Mexico when it comes to labor and government relations.

I should proof read. Ponder with? 🤦♂️

Impact looks like it will be unleashed very soon.

https://stockcharts.com/h-sc/ui?s=IPT.V&p=W&yr=5&mn=11&dy=0&id=p63136643334&a=954897842

Thanks as always Matthew…..appreciate your insights

Matthew – Good thoughts on those 3 Silver Juniors (Impact, Kootenay, and Brixton).

I concur that Impact Silver (IPT) is the biggest no brainer on that list for when Silver starts breaking out. Not only will rising metals prices continue to help in their economic margins from production, but it allows them to access and exploit deposits that they shelved when the metals prices were lower down in the teens.

In addition, the sheer upside from an exploration standpoint that Fred and the team have to go after is what really gets me excited. They’ve had some really great drill holes in years past, and have found some great smaller deposits, but on that land package there could be some real company makers and I’m interested to see how their high grade silver targets for this year’s exploration season goes, in addition to them revisiting the promising work at Valley of the Gold for further exploration.

Kootenay (KTN) has a nice optionality factor in that they’ve already found a great deal of bulk-tonnage Silver in the ground at Promontorio & La Negra, and in addition they’ve recently vectored in on some nice higher grade mineralization at 2 deposits – Columba & Copalito, that has received more market traction for the company.

Jim McDonald is a solid CEO, and they’ve had solid JV partners in the past with the big boys (Pan American did some work at Promontorio for a few years up through 2019), 2x Fred with Centerra Mining, La Minta with Capstone Mining, and they have a promising JV currently with Aztec Minerals. In addition they have a solid roster of key stakeholders like Coeur Mining, Agnico Eagle, Pan American Silver and Eric Sprott.

I like impact, its been so long since I did dd I cant remember why now tho.

I have a hunch Ex and Mat pretty much refreshed my memory. 😉

Hey b, everyone should do their own DD as you mentioned, but Impact is a very frugal and well-run company in my opinion, and I like the leverage that the smaller and somewhat higher cost producers have when the metals prices take off as their economic margins go up substantially compared to the larger more stable operations that are already more fully valued. Also, Impact is very much a hybrid company where they are smaller producers, but due to their smaller market cap, and the massive exploration potential, they can actually move a lot on good exploration success at some of their targets. Also, IPT tends to front-run the movements in Silver prices fairly well, spotting turns early, and tracks the SILJ fairly well, but with a nice multiplier effect, so I see it as a good bellwether stock for the Silver miners. I hold over 2 dozen Silver stocks in my portfolio at present, and the top weighted ones get moved around between Silvercrest, Alexco, Silvercorp, Endeavour, Santacruz, Silver Tiger, etc… but Impact Silver is consistently in my top 5 largest silver positions and has been throughout the ups and downs of this bull market. I trade around the position often increasing it on pullbacks, and reducing it on big runs higher, but until something radical happens that would change things, then I’d anticipate personally keeping a healthy exposure to IPT as the bull market in the PMs marches on…

Looks like they capped the miners then walked back the close. Up is always better…but green in any form is preferred.

It’s nice to get an update on Tarachi Gold and their recent drilling success. Good luck to Cameron and their exploration team to keep hitting paydirt.