Scottie Resources – More High-Grade Gold Results Extending The Strike Length Of The Blueberry Zone

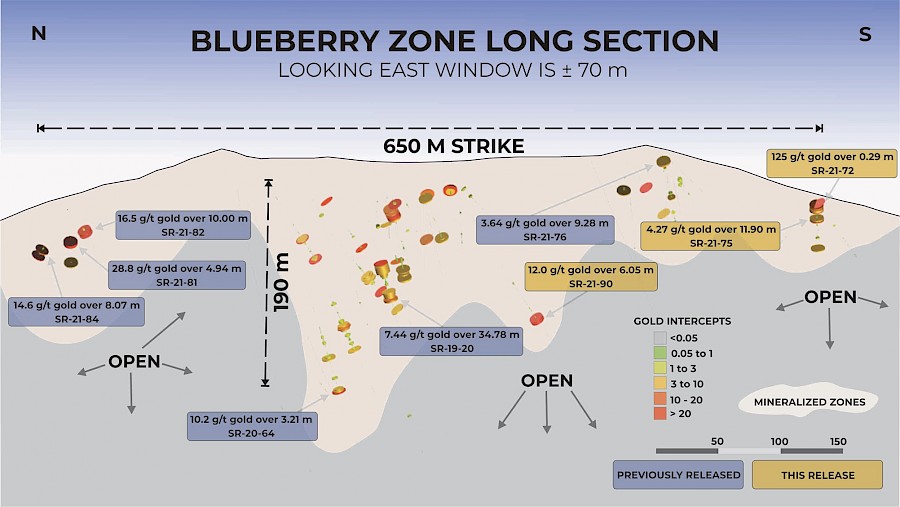

Brad Rourke, President and CEO of Scottie Resources (TSX.V:SCOT – OTC:SCTSF) joins me to recap the drill results released yesterday, November 8th, reporting high-grade drill results from the Blueberry Zone on the Scottie Gold Mine Property. Headline results include 12g/t gold over 6.05 meters and 4.27g/t gold over 11.9 meters.

Brad and I discuss these results in terms of the expanded size of the gold mineralizaed zone and recap all the high grade intercepts so far at the Blueberry Zone (see Figure 1 from the news release posted below). We also look ahead to the around 12,000 meters of drill core that is still waiting assay results. This drill core is from 4 different zones including at the Georgia River Property.

Please email me with any follow up questions for Brad regarding Scottie Resources. My email address is Fleck@kereport.com.

Click here to read over the full new release highlighting the drill results.

That’s a good point Mike. I’d have thought Scottie would have received a bit of a bump in sympathy to the Pretium takeover, just like Ascot, but many investors haven’t picked up on their strategic land position all around that part of the Golden Triangle yet.

.

This map does a good job of showing which companies own what land positions:

.

https://scottieresources.com/projects/claims-overview/

Isn’t Dolly Varden(DV) in the golden triangle area? It was up as much as 15% today. Whenever I think of that company, reminds me of fresh caught dolly varden trout for breakfast and Dolly Parton singing about her Tennessee mountain home.

Yeah, Dolly Varden (DV) is in the Golden Triangle, but even further down in the southern tip, and they are more focused on Silver than Gold (like Pretium, Ascot, Scottie are). Dolly Varden is adjacent to both Hecla mining (their most likely suitor for a takeover) and Fury Gold (at their Homestake project).

.

https://www.dollyvardensilver.com/dolly-varden/

When DV shot up like that today, I was worried HL was making an offer to take them over at these depressed share prices, and got concerned. Then I was hoping they finally put out newsflow from their 10,000 meter drill program. No dice.

I checked their newsflow and it was just a new addition to their corporate team from yesterday’s announcement.

.

__________________________________________________________________________________________________________

.

Dolly Varden Silver Strengthens Technical Team with Andrew Hamilton, P.Geo.

– November 9, 2021

.

https://www.dollyvardensilver.com/dolly-varden-silver-strengthens-technical-team-with-andrew-hamilton-p-geo/

Something is going on with the Dolly and sure don’t want to lose her for a lousy 22% premium.

Terry: How did you come up with a 22% premium?

Mike, wasn’t that the premium on PVG deal give or take? Holders of undervalued juniors would be expecting much larger gains.

Agreed. I’d prefer to not see Dolly Varden taken over at these low valuations in the sector, but sometimes that is when they happen, when the larger companies get more opportunistic. Historically most takeovers are at a 30%-50% premium, but still, I don’t want to see DV get taken over until after they have time to grow their resources more. They haven’t even received their assays back from this years 10,000 meter program yet, and then all of those need to be put into an updated resource estimate, etc… Plus, it is likely silver could go on a run to higher levels (at least to the upper end of the range at $28/$29), and in 2022 I believe we’ll see a $30+ handle on Silver.

If DV got picked off before all that, then it would severely truncate the potential returns.

After Newcrest grabbed Pretium for a song I’m surprised Scottie didn’t get more of a bump. Ascot Resources did go up a tad and I was only able to grab a few shares. I figure Newcrest may want to open up the petty cash drawer and go shopping again to grow the Pretium project..

By-the-way, I’m seeing some serious gripping about Newcrest’s purchase as they claim it highly undervalues Pretium. Sounded like my statements re: the buyout of Corvus. I’m betting there won’t be any other bidders on the Pretium purchase – looks like bidding wars ain’t gonna happen this time..