Steve Penny Reviews The Technical Outlook On The US Dollar, Bond Yields, Gold, and Silver

Steve Penny, Publisher of the SilverChartist Report, joins us to share a number of key charts on the US dollar, bond yields via the 10 year note, gold, and silver. (all charts are posted below so you can follow along). We intermix some macro market insights and recent news related to the greenback, interest rates, and precious metals to balance the technicals with the fundamentals. Steve also provides some insights into some of the strategies he has around short-duration trading versus longer-term investing, and some good sentiment principles to keep in mind along one’s investing journey.

Click here to visit the SilverChartist website

.

Steve Penny – Silver Bottom? Time To Buy Physical

Liberty and Finance – August 29, 2022

“Steve Penny, founder of Silver Chartist, sees that silver is about to turn around amid a pullback in yields. While silver could fall lower, he believes it is more probable for it to turn up from here. “If you are looking to buy physical,” he says, “I think this is a fantastic time.” That being said, he believes everyone needs to have their own strategy for when accumulating metals and mining stocks, whether that be buying the dips or dollar cost averaging on a regular basis.”

0:00 Intro

1:10 Metals update

2:30 Fed rate hike

3:28 Ten Year yield

4:50 Gold chart

6:03 Strategy

9:08 Miners

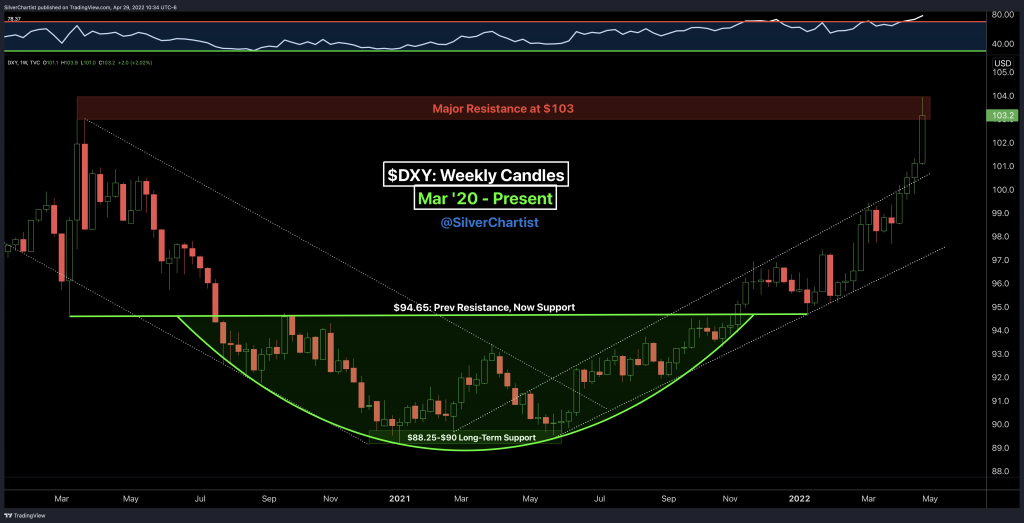

13:30 DYX

16:05 Silver Chartist

16:55 Miles Franklin

The biggest problem is the derivative/swaps debts of the banks. They are working as hard as they can to transfer the fraud to retail. If they fail, which they will, they will drain the Treasury as fast and as hard until it fails. Then continue to point to retail. We have been fools and they worked the room.

It seems I am pretty much in agreement with Steve Penny across the board. We might differ slightly about the near term potential for the dollar. Based on the weekly chart in isolation, I’d say that a top of some kind is imminent but based on the monthly chart, I would not be surprised if we see an extension of the move to at least 106+ before a multi-week to multi-month pullback begins. The monthly chart isn’t always relevant to near term action but I believe it is now. It just scored its best monthly close since November 2002 and did so with its first RSI(14) reading above 70 in 7-8 years. Such RSI action can often be a better buy signal than a sell signal and based on other monthly and quarterly indicators, I think this could be one of those times. A caveat to my view is that there are almost too many sources of resistance to count around 103-104 so a convincing break above 104 now could spark a quick move significantly higher than I expect.

https://stockcharts.com/h-sc/ui?s=%24USD&p=M&yr=30&mn=0&dy=0&id=t2032354809c&a=1152923411&r=1651346821697&cmd=print

My preferred scenario would be an intraweek spike and reversal to set a bull trap.

https://stockcharts.com/h-sc/ui?s=%24USD&p=W&yr=6&mn=7&dy=0&id=t3176585766c&a=653766793&r=1651347206755&cmd=print

Thanks for sharing your technical outlook and charts Matthew. Both you and Steve are very sharp technicians and good to have you both sharing ideas of probabilistic outcomes with the KER crew.

Gold Bears Set Sights on Critical Support Level into Fed Week

David Erfle – Friday April 29th, 2022

“Panic selling has triggered margin calls in the marketplace over the past week, as investors have finally decided it is time to prepare for the worst-case scenario — a Federal Reserve-induced recession. As suspected in this space last week, the suddenly strong miner and silver relative weakness after a false miner breakout foretold heavy selling in gold this week as well.”

“The gold price has been sold down aggressively since last Monday to a confluence of support at the $1890-$1900 region. After failing at the key $2000 level for the second time this year two weeks ago, Gold Futures reversed over $100 lower due mostly to the sharp rise in U.S. Treasury yields and the U.S. dollar zooming past the psychological 100 level on the DXY.”

“These moves have been supported by a steady rise in market expectations of Federal Reserve interest rate hikes and hawkish future monetary policy likely to be announced after the completion of the FOMC meeting next Wednesday…”

https://mailchi.mp/3f8c009dedc2/david-erfle-weekly-gold-miner-sector-op-ed-1600894