Troilus Gold – Encouraging Initial Assay Results Returned From The Phase II Gap Zone Drill Program

Justin Reid, CEO of Troilus Gold Corp. (TSX: TLG) (OTCQX: CHXMF), joins us to review the encouraging initial assay results from its Phase II Gap Zone drill program at the Troilus Gold Project. Troilus holds a strategic land position of 142,000 ha (1,420 km²) northeast of the Val-d’Or district, within the Frôtet-Evans Greenstone Belt in Quebec, Canada.

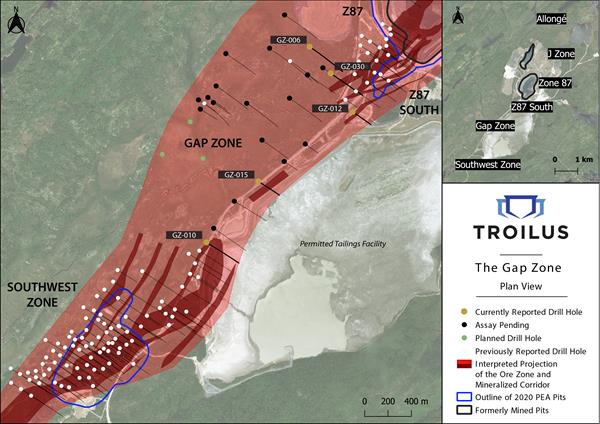

Today on June 29th Troilus announced drill assays from the Gap Zone of 1.73 g/t AuEq Over 6 Metres and 1.04 g/t AuEq Over 13m showing that there is new mineral continuity beyond the Main Zone and trending over to the Southwest Zone. Since the Southwest Zone has become the new center of gravity for the Troilus Gold Project, their team is encouraged by the same style of mineralization extending into the Gap Zone, which further connects the two growing resource areas into one larger deposit. There are currently 4 drill rigs turning in this new untested area and continuing to define resources beyond the known boundaries.

A key milestone for the Company is the continued work towards the Pre-Feasibility Study slated to be released to the market in late July or early August, which will wrap updated economics and projected production metrics on the overall project. In addition, towards the end of Q3 of this year the Company will also be releasing an updated Resource Estimate, that will incorporate over 160,000+ meters of drilling completed since the last resource estimate, and this will also include the inaugural reserve.

If you have questions for Justin regarding Troilus Gold, then please email us at Fleck@kereport.com and Shad@kereport.com.

.

https://www.troilusgold.com/news-and-media/news-releases/

.

The Worse the Bear Market, the Better for Gold

Jordan Roy-Byrne CMT, MFTA – The Daily Gold – June 21, 2022

“Many of us in the gold community fear bear markets because they can inflict some damage to gold and silver stocks. That is a fair concern even though some go overboard.”

“That aside, it’s vital to understand that these bear markets are the catalyst for big moves and bull markets in Gold. Let’s take a trip down memory lane…”

https://thedailygold.com/the-worse-the-bear-market-the-better-for-gold/

Does anyone else know why Atico Mining (ATY) was up about 27% today on 5 times the volume.

It was the biggest mover in my portfolio today, and don’t see any discernable reason for the move based on any news. Anyone have any thoughts, because Copper was also under pressure today and all month, so just curious where all the buying pressure is coming from?

Tomorrow we get the close for the monthly candle of June as well as the candle for the 2nd quarter, so it will be interesting to see where things wrap up.

As I had mentioned in both late May and early June a few times here on the blog, I’ve been really interested to see if Gold could close the month/quarter above $1835. Even better would have been $1850, but that seems like a stretch with only one day left.

Early this morning Gold shot up to $1834, before retreating and closing at $1817, so it looked like there was a legit chance. That level at $1835 swatted Gold right back down as resistance (formerly it was support), so if there is any way the yellow metal can reverse back up and close above it tomorrow, that would be a technical win.

So far Gold isn’t looking that hot to kick off the last day of the month/quarter, bouncing in a range between $1802 and $1826 overnight, (currently at $1819) but maybe that changes by the end of the day.

Silver still hanging out in the mid $20’s at $20.51

‘This recession will be the most severe yet’: Peter Schiff called the 2008 financial crash and now says the next downturn will be worse. Here’s what he likes for safety

Jing Pan – MoneyWise – Tue, June 28, 2022

“Anyone thinking this recession will be mild doesn’t understand recessions,” he wrote in a tweet on Monday.

“The longer interest rates are held too low during a boom, the more mistake that must be corrected during a bust. Since rates have never been so low for so long, this recession will be the most severe yet.”

https://www.yahoo.com/finance/news/recession-most-severe-yet-peter-204500912.html

The people have to pay for the dishonesty of the leadership they have chosen to enable.

Euro Bruised As Inflation Fears Send Safety-Seeking Investors To Dollar

By Rae Wee and Alun John – Reuters – Jun 30, 2022

“The euro struggled to regain its footing on Thursday after tumbling overnight against a resurgent U.S. dollar, which benefited from safe-haven demand on renewed worries about higher rates and a global recession.”

“The common currency was at $1.0453, up 0.13% on the day, after losing 0.75% on the dollar the day before.”

Dollar Gains, Yields Ease After Powell Inflation Comments

By Caroline Valetkevitch – Reuters – Jun 29, 2022

“U.S. Treasury yields eased for a second consecutive day and the dollar rose on Wednesday after Federal Reserve Chairman Jerome Powell said there is a risk the U.S. central bank’s interest rate hikes will slow the economy too much, but the bigger risk is persistent inflation.”

“The S&P 500 ended slightly lower, and looked set to put in the worst first-half for the U.S. benchmark index in more than five decades.”

“The clock is kind of running on how long will you remain in a low-inflation regime. … The risk is that because of the multiplicity of shocks you start to transition into a higher inflation regime and our job is to literally prevent that from happening and we will prevent that from happening,” Powell said at a European Central Bank conference.

Dow Climbs, But Powell’s Tough Inflation Talk Stokes Fears

By Yasin Ebrahim – Investing.com – (Jun 29, 2022)

“The Dow closed higher Wednesday after Federal Reserve Chairman Jerome Powell reiterated the central bank’s commitment to keep tightening monetary policy to bring down inflation just as U.S. quarterly economic activity slipped for first time in two years.”

“The way to do that [curb inflation] is to slow down [economic] growth, but ideally keep it positive,” Powell said on Wednesday, though conceded that there “is a risk” that the fed may go too far and cause a recession. The Fed chief, however, stressed that the biggest threat to the economy isn’t the Fed overshooting monetary policy tightening, but rather “failing to restore price stability.”

U.S. consumer spending rises moderately; inflation pushes higher

Reuters – Jun 30, 2022

“U.S. consumer spending rose less than expected in May as motor vehicles remained scarce while higher prices forced cutbacks on purchases of other goods, another sign that the rebound in economic growth early in the second quarter was losing steam.”

When The Smart Money Says ‘Sold To You’, Part Deux

Jesse Felder – The Felder Report – June 29, 2022

“Back in December I noted that, even as retail investors were putting on risk in the equity markets to a degree we had never seen before, corporate insiders were taking the other side of the trade and selling at the fastest annual pace on record. And while many are now marveling at the damage that has been done to some of the stock market’s speculative favorites, I think it’s important to not lose sight of the fact that the insiders at many of these companies were sending a very clear caution signal in the lead up to the recent crash.”

https://thefelderreport.com/2022/06/29/when-the-smart-money-says-sold-to-you-part-deux/

Ex. Is there any indication that we will see a bounce in the miners any time soon? Just when you think the miners cannot go lower, they do.

Hi Biggus – The miners are getting a bit oversold at this point, but with the metals prices remaining under pressure, as well as many general equities, then the miners are simply following suit.

It will depend on the actual miner individually, but we typically see the turn higher in the larger producers and royalty companies first, and then it takes the smaller junior longer to wake up . However, even with those big boy miners in the GDX and GDXJ, they still remain under selling pressure, and broke down through key support yesterday, and are threatening to go lower today.

In fact, GDX looks to be breaking down below $28 in pre-market trading, making a new intermediate lower low here on the last day of the month/quarter. Same thing with GDXJ where it broke below $37 yesterday, and is now down below $33 in pre-market trading. Not pretty.

We may be getting closer to low at this point, but there isn’t much data showing that strong buying is coming in yet, so we may have more weakness to work out in July/August (months where gold and miners often sniff out a bottom seasonally) . We also have another Fed rate hike coming in July (likely another 75 basis points), and so far those have continued to pressure the markets and PM sector. There is still another rate hike on tap for September, but if we saw CPI data or PCE data start trending lower, then the market might start looking forward to the Fed easing off the throttle a bit, and that may be a boon to markets.

The other area of concern, as noted a number of times, is if Silver falls out of bed and heads down to that $18.75 area, which would further hit the silver mining stocks, and usually the PM miners move in sympathy with Silver more so than with Gold. We’ll see if it can hold here in the mid $20s but a move down briefly below $19 would not be a surprise at this point.

The US Dollar is up above 105 this morning to 105.20, to a new intermediate peak higher. That is also acting like a headwind for the commodity sector. So much for those that felt it had already rolled over. So far in 2022, Brent Johnson’s “dollar milkshake” theory from 2 years back that eventually the greenback would be like a straw sucking up investor funds and strengthening while most other sectors weakened doesn’t seem as silly as some felt it was at that time.

Of course, much of the US Dollar strength is merely a symptom of Euro and Yen weakness, but therein lies the trend of global investors fleeing to hide in the perceived “strength” of the greenback. It is only the illusion of strength compared to other equally troubled fiat currencies, whereas real purchasing power is being eroded by over 8% by inflationary pressures, but that isn’t stopping people from cowering in cash.

Copper Crushed As Funds Turn Negative On Recession Fears: Andy Home

Andy Home – Reuters – June 28, 2022

“Copper prices collapsed to a 16-month low last week amid mounting concerns that inflationary pressures in western economies will morph into outright recession.”

“Investors are repositioning themselves in copper, with the last few remaining bulls retreating and bears flexing their muscles on the short side.”

“Copper is just one component of the broader reconfiguration of expectations playing out across the financial spectrum. All the industrial metals traded on the London Metal Exchange (LME) have been hammered in recent days, spectacularly so in the case of tin, which has halved in price since March.”

Bitcoin back down below $20k again, down to $19,160 at present.

Ethereum back down near $1k again, down to $1030 at present.

Here’s an interesting acquisition in the Silver space:

(GSVR) Guanajuato Silver to Acquire 100% of (GPR) (GPL) Great Panther’s Mexican Mining Assets

29 Jun 2022

“GSilver’s operations will expand from two mines and one production facility to five mines and three production facilities.”

“The acquisition includes the Topia mine, located in Durango, Mexico which is currently producing concentrates containing silver, lead, zinc, and gold.”

https://ceo.ca/@nasdaq/gsilver-to-acquire-100-of-great-panthers-mexican

Thanks EX. Even although it’s probably way too late I think I will raise some cash by selling some of my larger silver and gold miners.

Hi Biggus. Well, it is a bit late at this stage to start trimming the fat in the mining stocks, after most are already down substantially, but how much cash we raise and have on hand is a personal call that only we can make individually. Personally I did blow out a few dogs from my portfolio last month and this month, and while I’ve mostly redeployed those funds into fortifying existing positions, I’ve also raised about 4% dry powder funds and have been trying to be patient to deploy those. (which hasn’t been easy with everything getting cheaper and cheaper each day).

I found this to be an interesting listen and like what he says about PMs come September.

https://marketsanity.com/lior-gantz-this-recession-is-already-in-motion/

This is the lowest monthly volume for IPT since the low of May, 2019, less than half the volume of two months ago when it traded from .58 to .39. Compare that with the 2017 fall into August in which monthly volume rose to 5 times this months volume…

https://stockcharts.com/h-sc/ui?s=IPT.V&p=M&yr=13&mn=0&dy=0&id=t0389084703c&a=581706450&r=1656610217786&cmd=print

GDX is finally testing (currently below) its anchored VWAP based on the September 2018 low:

https://schrts.co/PJDWtsyr

If the pullback since 2020 was the start of a big picture bearish turn and not just a correction, it probably wouldn’t have taken 2 years to get to this important level.

Silver has 16 and 60 quarter (4 and 15 year) MA support just below today’s low:

https://stockcharts.com/h-sc/ui?s=%24SILVER&p=Q&yr=50&mn=11&dy=0&id=p93626130920&a=1139425735&r=1656611390183&cmd=print

Powell’s words are aligned with my message of the last several months and not the message of the “pivoters” or those calling for aggressive cuts like Stephanie Pomboy (who has apparently learned nothing after getting the Fed’s policy decisions so completely wrong to begin with).

https://www.wsj.com/articles/powell-says-pandemic-could-alter-inflation-dynamics-11656509259?mod=hp_lead_pos3

Not only is Pomboy wrong, her unearned certainty is cringey (much like one self-professed contrarian around here)…

Pomboy: “Either reading comprehension is a major problem in this country or that somehow wasn’t clear enough. So let me try again. The only way for the Fed to avoid the complete deflation of the bubble (it created) and the devastating blowback to the economy that would result is to cut rates aggressively…now.”

https://kingworldnews.com/pomboy-fed-has-to-cut-interest-rates-aggressively-now-to-avoid-economic-disaster-plus-look-at-these-twin-collapses/

The second half of the year is likely to be ugly for stocks whether there’s a sizeable relief rally first or not…

https://stockcharts.com/h-sc/ui?s=%24NDX&p=M&yr=25&mn=0&dy=0&id=p22953666509&a=1194245810&r=1656619245178&cmd=print

18.40s-.30s are next for SLV…

https://stockcharts.com/h-sc/ui?s=SLV&p=W&yr=2&mn=5&dy=0&id=p33456633843&a=1196367837

The senior gold and silver miners (XAU) ended the month on an ugly note but there’s multiple supports not far below including two Schiff forks, a 6 year uptrend and the 360 month/30 year MA and EMA:

https://stockcharts.com/h-sc/ui?s=%24XAU&p=M&yr=18&mn=11&dy=0&id=t5166100746c&a=1030155748&r=1656621544396&cmd=print

Oh yeah, there’s also Fibonacci support in the mix at 104.

At a minimum it looks like there will be more pain to start July.

Definitely. The question is how much.

Agreed. I looked at several 60 minute charts today and saw a few that had double bottom potentials which was encouraging.

One chart/stock I have been watching for a while is FCEL. If you get a chance, look at the chart and tell me what you see.

I generally like what I see in FCEL but wow that’s some crazy volatility. Based on the charts, the technical state of the whole sector and the fact that it might need to base-build for quite awhile after falling 90%, I would watch this one closely but not expect to take a significant position soon. It is a worthy spec in my book but probably not yet.

https://stockcharts.com/h-sc/ui?s=FCEL&p=D&yr=1&mn=7&dy=0&id=p81173543507&a=1197505084

Yes I agree. I have a small starter position in it for tracking. That quarterly chart is very insightful. Seems like it could be a few quarters yet.

Matthew – What is your take on SAND here?

It’s a buy in my book. It took out its May low by one cent and I doubt that it “needs” to test its December low. The intraday charts look good.

Daily:

https://stockcharts.com/h-sc/ui?s=SAND&p=D&yr=1&mn=7&dy=0&id=p92688632742&a=1197883178

The weekly chart doesn’t need my annotations:

https://stockcharts.com/h-sc/ui?s=SAND&p=W&yr=2&mn=0&dy=0&id=p79356421423

5 year weekly instead of 2 plus Fibonacci fan and speed lines:

https://stockcharts.com/h-sc/ui?s=SAND&p=W&yr=5&mn=0&dy=0&id=p13497460323&a=1197888525

Fib fan and speed lines based on the December low:

https://stockcharts.com/h-sc/ui?s=SAND&p=W&yr=5&mn=0&dy=0&id=p13497460323&a=1197889141

I do not own it, btw.

Thanks and understood.

I added an uptrend support line to that last chart based on the lows of 2018, 2020 and 2021 and the bears missed reaching it today by over 10 cents. The only thing this nearly 7 percent reversal lacks is volume but the holiday alone could account for that. Tuesday should be interesting and telling.

The Macro is Pivoting To Gold Stocks

Jordan Roy-Byrne CMT, MFTA – The Daily Gold – June 19, 2022

“Gary Tanashian, publisher of NFTRH, joins us to comment on and analyze recent developments in the economy and markets, and how that impacts precious metals.”

“Although Gary is worried there could be a final liquidation in gold stocks, not unlike 2008 or 2020, he says the macro situation is turning in favor of gold stocks.”

https://thedailygold.com/the-macro-is-pivoting-to-gold-stocks/