Silver Continues To Drain From The Shanghai Futures Exchange and the COMEX is getting on board

Silver continues to flow out of the Shanghai Futures Exchange (SHFE) and the COMEX. Some key facts include:

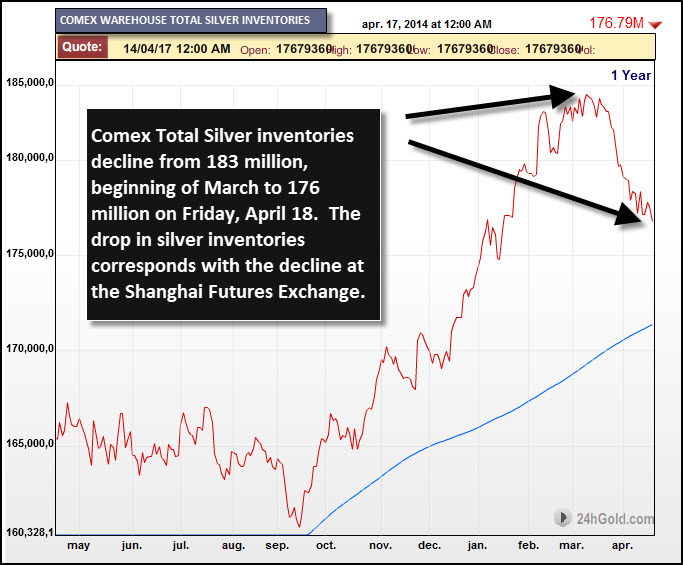

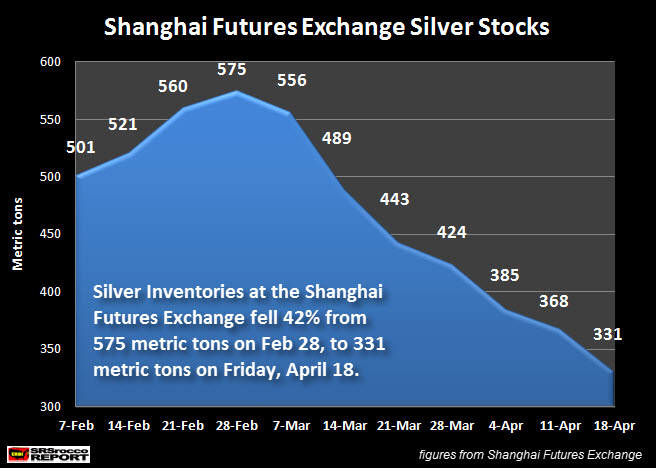

- Since March a total of 14.5 million ounces of silver were removed from the COMEX and SHFE.

- The SHFE silver warehouse stocks are down 70% from their peak 1 year ago.

Just look at the charts…

We can see the COMEX actually added silver during the second half of 2013 the chart for the SHFE is far more depressing.

The question I have is where is all this silver going? Are the average investors around the world accumulating or is it the big players getting ready for something big?

undervalued….ASSET…ooops

Maybe…….China is buying it back, with cheap gold………maybe the lend lease is up after 10 years as someone suggest……..MILE FRANKLIN I THINK…….posted by CFS.

Jerry,

Maybe….its a buy??? Say it isnt so..Jerry..:)

I post , that something is happening over in the HONG KONG market, check the charts for the last couple of day ….there is a lot of buying of silver…………forget the charts here…………..this is not a logical market here………..look outside the box…….ootb

The misguided, will just be more misguided, they do not have it together….it is the BIG PICTURE…….has always been the big picture, with a lot of moving pieces…..

MILES……not Mile

Harry Dent says Silver going to $2 / ounce and Gold under $200/ounce — Harry say’s he’s always right

Sure..a loaf of bread will by 5 cents and a pack of gm a penny too!!!

gum

Also claims Dow 6000 in 2014!

HAS Harry had any good calls , in the last 5 years………….

This fool has yet to explain why miners spend 23 dollars to produce an once of silver and get 2 dollar back. Only he is so stupid. All his predictions have been wrong including 2008. He was bullish before the crash. I listened to him. He is a liar. His talk a big talk just to sell his garbage book

HARRY IS correct ……………please send me all the $200 gold you have, and the $2 silver, I will pay all freight charges………….respectfully………hurry…

Silver goes to $4 to complete the round trip journey.

It is what it is…

In the United States I think silver is more popular than gold … Americans like to have a big pile of something to pick up an look at. Americans are also real short on cash right now … hence, the popularity of the smaller gold coins (.25 oz) to go along with the big pile of silver coins. Ya get a lot more silver coins to look at for a given amount of cash. As for investment – I needed a ratio of some kind to set as an investment goal, hence, for no particular reason I hold a pound in silver for every once of gold. I don’t think either metal has an investment advantage over the other and I doubt the decline in silver inventory on any exchange has anything to do with our future net worth. We hold metals ’cause the fiat currency is gonna burn (some day). Get real tired of you guys always blogging ’bout how much money you might make – lets talk about how much money we won’t lose instead.

Rothschild and the Comex fraud are put on the back burner and silver goes back to it’s historic ratio to gold-16:1.

324 Years of the Gold Silver Ratio and $195 Silver.

http://www.gold-eagle.com/article/gold-and-silver-ratio

I go to work and get paid in fiat money.

After taxes, I buy Constitutional money.

Gold and Silver are mentioned in the Constitution as money.

By IRS rules, sovereign minted coins are exempt from taxes.

I connect the dots and am OK with the results.

Best to all.

PHYSICAL SILVER IS THE MOST UNDERVALUED ON THE FACE OF THE PLANET…PERIOD…EXCLAMATION POINT. It is rare, precious, utilized in hundreds and hundreds of industrial applications and has a historical, bonified history of thousands of years of use as actual MONEYS….and oh, BTW, SILVER MEANS MONEY in over one hundred languages around the world. You are trying to tell me MR. MARKET that you can get for $19.50 paper dollars an ounce????!! Gimminy…….you are shi….in me!! My apologies………ladies….what a BUUUUUUY!!!!