Putting the current bear markets in Gold and Silver into a longer-term perspective

I greatly respect Peter Brandt as a technical trader. He has a proven track record over a long time frame. However this post may rub some silver bugs the wrong way. Peter explains why he things gold is a good investment at these depressed levels but silver remains a fools game. It is an interesting read in which Peter presents some valid points on why he things silver could be heading further down.

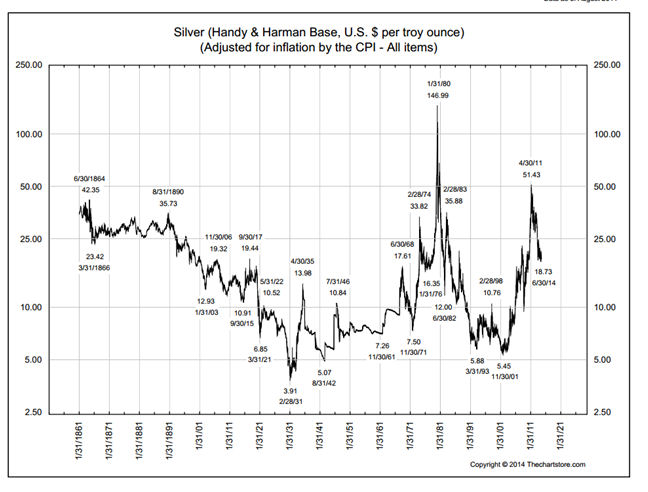

One point that Peter mentions relates to the price of silver adjusted for inflation. He states “Silver could drop all the way back to $6 to $8 and remain in a long-term bull trend. There is one other chart of Silver worthy of display — the price of Silver adjusted for inflation (i.e., purchasing power as a function of “fiat” money). On this chart we see that Silver is right in the middle of a 100-year trading range — and in fact, has spent many more years in the past century below the current price than above the current price.”

We will also be having Peter on the weekend show for a market recap.

The link is updated and working now.

The link worketh not.

Did you read my comment?

Gold is going down. For now.

However, with a Fed Gov that owes between $60 trillion and $200 trillion in unfunded mandates, mostly in new social security payments, over the next 5 years or so, there are only three options:

1) Austereity – can you say “riots in the street?”

2) Raise taxes to pay for it – to the point the entire economy will collapse anyway.

3) print more money.

If you were the Fed, which one would you do?

When all the smoke clears, this is bare bones reality. So eventually, GOLD WILL HAVE TO GO “UP” (or more accurately, the dollar will have to go down) . . . and it isn’t going to be a small amount either.

That said, buying at the lowest possible level, as gold drops, will simply maximize the returns later. Let gold go down for all I care . . . today at least.

Phil,

The Government does not owe anything close to $200 trillion. This number is just some guy’s guess of what it will be in about 75 years from now which is based on a number of assumptions that could change. Most of the future unfunded liabilities are from Medicare not Social Security. And of course there will likely be changes in the Social Security system and Medicare in the coming years. It also does not include all the assets the Government has which would offset some of these liabilities.

You list three options and ask which one would you do? Why not do a combination of all three? Just asking?

Ha! So true JMiller, everyone forgets to mention the income streams that offset the accumulating debt burdens. Like taxes will end or government revenues will stand still for a generation even as expenses keep rising. Thanks for the dose of sanity!

Bird,

I do think that taxes (revenue) are already included in most peoples unfunded liabilities number. But that number can change over the years just like the expenses (liabilities) can change such as in Medicare, Social Security , Defense spending, etc… This unfunded liabilities number given by different people sure has a wide range.

But the Government has assets such as land, oil and gas, minerals, military hardware and probably gold that is estimated to be worth well over $100 trillion. Of course some of those assets are not too easily accessible and most probably can not be quickly sold.

How’s this for a perspective:

Gold and silver are now in bear markets and will be that way for at least the next 5-10 years, if not longer.

GIVE UP! THIS MARKET IS TOAST!

Only gold promoters and other shameless hucksters are promoting gold and silver ownership now.

Oh, I think you forgot all the buyers of gold and silver companies that are keeping share prices relatively high as the bottom falls out of the gold and silver price.

You and your toast Joe. You’re just another ‘shameless huckster’.

My main problem with his ideas is that I think the G/S ratio is about to change favourably for silver. The second is this: how high does he think the G/S ratio could go without ending up in fairly unprecedented waters? Markets can do crazy things but I am not sure he is right in this respect. In 20 years the G/S ratio has seen a low of 10 and a high near 100 with a median weighting near 60. Anyone out there got a long term chart….like a century, that might make more sense.

Karma is against this guy for coming out of the gates calling people idiots. What comes around goes around. I agree that silver is due for a bounce up and then whatever… prolly down.

Peter Brandt’s perspective on Silver is a joke. I cant believe you guys linked it to this site. I do not think Silver is going to the moon but they data he references to suggest it could go to $6 to $8 dollars and to suggest that the “price of production means nothing” without any reasoning is laughable. He doesn’t not mention supply/demand at all which is slightly more important (I mean infinitely more important) than the price adjusted for inflation chart he shows. Who cares about the price adjusted for inflation chart, unless you discuss it in the context of supply/demand. Please don’t post shitty unsubstantiated articles like this one any longer. Frustrating…. Guy is either a total fool or buying silver hand over fist.

Here is a good article on the possible short covering which could happen soon and how there is a fight going on between the money managers paper market and the bullion banks.

http://www.financialsense.com/contributors/alasdair-macleod/strong-dollar-undermines-precious-metals

To summarize: while currency instability has introduced short-term uncertainty over the price outlook for gold and silver, buyers looking to close profitable bear positions outweigh sellers by far. Dramatically oversold futures markets are likely to lead to an unexpected technical rally rather than significant further downside, given that bearish activity appears to be concentrated in the paper markets while physical demand continues unabated.

Thanks Paul, that is right in line with my own comments lately on gold stocks rising even as metal prices fall.

Sorry if I am preaching to the converted….

Gold has been going down, down, down but I am surprised that many of my gold stocks the last week have been holding steady or even going higher. FWIW, I am a long term/fundamental investor and don’t believe in a lot of the short term cycle theory. I have been trying to stay away from the major indexes and chart cycles and trying to cherry pick stocks that will go up on improving fundamentals. The fundamentals could be revenue growth as a mine comes on line or it could be news driven as a permit or financing is granted and the company is de-risked. I think these kind of stocks can go up even in the face of a stagnant or falling gold price. These kind of companies also attract buyouts and I think major buyers are accumulating whatever they can now. We shall see….

Think of it this way….you are on a really big supertanker in the ocean. The engine dies but the ship keeps moving for another 10 kilometers even without power. There is no more fuel available for weeks at best because of your location and food is running low. Do you get off the boat and catch a lift with a passing freighter or do you invest in decorating schemes for the kitchen and dining hall?

Often, a rising stock after a long decline in the underlying commodity can be your last chance to sell off on the bounce. Don’t get suckered into any thinking that somehow mysteriously the stock itself will outperform despite its main product falling in price.

Like the big ship, you might want to get off before it stops moving.

The 30-day gold lease rate is approaching zero.

http://www.kitco.com/charts/popup/au0030lrb_.html

The manipulative hand of the Treasury is clearly visible and this artificially low price is transferring gold from the West to the East in a massive form. However, when Asian exchanges mandating contracts to be delivered with physical metal get going, that will see an exodus from the paper gold market of COMEX ending its shell game and that is when all the chickens will finally come home to roost.

ULYSSES……You sir have hit the nail on the head.

I remember buying 1,000 oz of silver for $5 per oz in 1981 and sold it because it went nowhere.

Now I just buy gold and silver and wait for higher prices to sell.

Monthly charts are on the bottom so all the naysayers can convince somebody else of their distaste for precious.

Yes, you waited for the bottom after the silver crash in81 but still never earned a profit. What makes you sure this next bottom will be any different? It could also go on and on for a decade before there is a major break. I am dead serious. If silver keeps dropping like this the recovery could be a long one. And that is why I won’t buy any physical. Until I see it move it is going there without my help. Just a trade in the interim. Not even a good one lately.

Silver $6? $8? Under $10? Wait wait wait… I want to make fiat money as much as I can…. then I buy silver as much as I can.. even at $10 …. please do it mr cabal… but please take your time… give me 5 more years… 2000 pieces ASE…. 2000 pieces maples … 2000 pieces libertad….. 2000 pieces buffalo … 2000 pieces sunshine round …. 2000 pieces crocodile … 2000 pieces symphony… 2000 pieces armenian coins…. 2000 pieces silvertowne … 2000 pieces scottsdale … ok thats enough…. give me 5 more years… hehehe

Link is broken Cory. Maybe this will work instead: http://peterlbrandt.com/