Silver and Gold: Are We On Our Way To The Final Lows?

Note – This post was written by Avi over the weekend.

For the last three weeks, since we struck the most recent highs in the metals, I have been searching for a pattern which provides us greater confidence that we are finally on our way to lower lows. Unfortunately, such a pattern would likely be a leading diagonal, especially in GDX and GLD. And, for those of you that have read me long enough, you will know that I do not favor leading diagonals as strong trading cues. Nevertheless, should one complete, it would have me take a more immediate bearish perspective of the metals charts.

But, I am going to warn you before you begin reading the upcoming analysis . . . the patterns we are dealing with will be more complex than normal and this is going to be a highly technical Elliott-Wave based update.

Within the leading diagonal pattern that I have been tracking, we have completed 3 waves down off the highs. Furthermore, the current bounce would likely be considered part of the 4th wave, with a push higher still needed to complete this 4th wave, followed by a lower low in a 5th wave still to be seen to confirm at least a leading diagonal down from the highs. But, if this is truly 4th wave in that leading diagonal, I would need to see one more micro rally taking GLD back towards the 119 region. That would fill in the 4th wave of the diagonal quite perfectly, which, if followed by lower lowers, would provide us with wave 1 down in the metals. Again, I MUST have all 5 of those waves down completed, before I would even consider an immediate bearish bias.

The other potential, which is what I have had as my primary count on the daily GLD chart, is that we are completing a (b) wave bottom in a larger b-wave for this 5th wave down in the metals. Should this play out, it would push the lower lows we expect out towards the summer, and maybe even as late as the fall, depending on how slowly this market decides to move. For this to play out, one of two things will be the key. First, it is possible we see a lower low now in GLD before we strike the 119 region. To me, that would look best as a bottom to a c-wave in that bigger (b) of b wave, which would likely be followed by an impulsive move higher to begin the (c) wave of the b-wave back towards the 126 region. The other confirmation scenario for this (c) of b-wave rally is a move through the 120 region before completing all 5 waves down.

However, the only issue I have with a lower low being made right now – before GLD completes its full 4th wave to 119 – is that it could count as a completed 5 waves down in silver. So, should we see a lower low in metals early this coming week, before one more push higher towards 119 GLD, it places us in a very precarious position in my mind.

It would mean that, if a lower low is seen in metals early this coming week before GLD approaches 119, GLD could be signaling the start of a (c) of b-wave rally back to the prior highs of January, while silver would count best as a wave ii retrace off the January highs. This scenario does not lend itself to a confident market directional call for the next few weeks.

Therefore, in only this scenario, where a lower low is made before GLD strikes 119, it will be of utmost importance to focus on the structure of the first move off that lower low. Should it be a CLEAR 5 wave move off that low, then it gives the (c) of b-wave rally much more teeth. Should it be corrective in nature, then I will be simply adding to my hedges in the metals, and be more aggressively shorting if we see another (1)(2) set up after that corrective bounce completes.

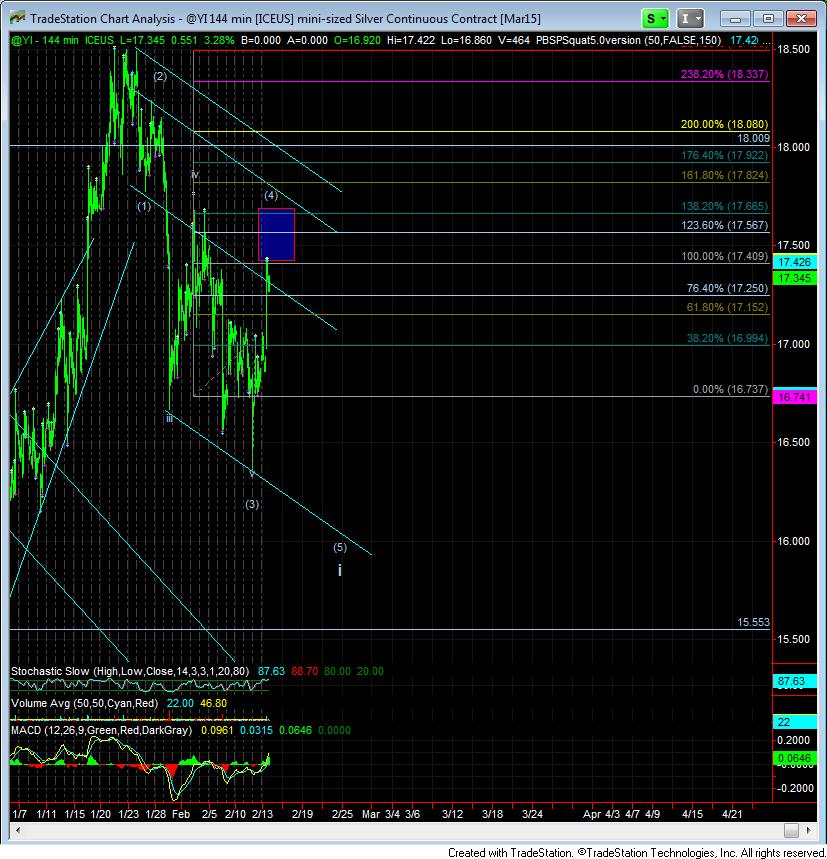

I also want to add another note for silver. During the week, I noted that I would not want to see silver exceed the 17.70 level, since the 1.382 extension off the lows would be the 17.67 level. However, as you can see, I have redrawn the silver downtrend chart with a leading diagonal in mind, and it can allow silver to stretch to the 1.618 extension for this wave (4), which is in the 17.83 region.

So, for the moment, I will say that I still have no confident structure to which I may point for a high probability trade. I am still awaiting more clues before I am able to confidently trade this one way or the other in the shorter term. However, that being said, with enough waves in place at the highs, I want to provide caution to all those who think that trading the upside here in metals is a slam dunk. In my humble opinion, there is nothing that has told me that upside is a slam dunk here. I would need to see GLD take out 120 before I can consider the (c) of b-wave rally taking hold.

I and those who have followed me for the last 3 years have done quite well in metals. But, there are times when one may miss a trade due to the lack of appropriate higher probability signals. This is one of those times in my mind. For me, personally, I still have no reason to be aggressively shorting this market YET, though I may be proven to be wrong when all is said and done.

In summary, should GLD remain below 120, pressure will remain to the downside in metals. Should we see 120 broken to the upside before GLD completes all 5 waves down in the leading diagonal, then we have a strong presumption that we are heading back towards the January highs, with the potential to exceed them to complete a larger degree b-wave in GLD and larger wave iv in silver. That would then be a shorting opportunity.

Being an amateur I have no charts to present to back up my views. However, I am braced for lower gold prices this year. I don’t expect things to start looking good for the metals until 2016 or later. I expect the dollar to continue to stay strong this year. Europe is a basket case this year. We will be a basket case later on. I have no idea how exactly things will unfold but I do believe we should enjoy life while we can this year. The 2016 thru 2020 timeframe may be more stressful in my humble opinion. I hope Greece defaults so we can begin the process of dismantling the failed Euro zone experiment. Lets get this party started. The Euro is doomed anyway.

So many pundits. You have to do your own due diligence and then read it back to yourself and see if it makes sense.

I agree Glen the US dollar still looks strong. Therefore the key period will be the next cyclical decline in the dollar, probably from 2016/17 util 2024. That is when gold has a change to make new highs (however in the 1980s there was a similar down cycle in the dollar from 1985-1992 including a dollar crash from 1985-87 and gold did not make new highs).

http://1000gold.blogspot.co.uk/2015/02/essay-on-gold-comparing-current-gold.html

This is all just wishful thinking until it actually happens. The good gold stocks are not breaking down on $25 moves south in gold today. This is because they are making okay profits and have technically strong chats. Sure if $960 magically appears I will be backing up several trucks along with millions of other Avi’s out there….not sure what you will be able to purchase when this “perfect imaginary storm” appears. Either way Avi will be making money.

Having said that, Avi sure is good at painting the above trading senarios…WOW!!!

The gold price action since the $1130 low in November 2014 has been a rally then a correction:

As of last weekend:

In US dollars it is a 51% retracement of the rally, 1130.40 to 1307.80 and back to 1216.50.

In British pounds it has retraced 50% of the rally almost exactly 712 to 872 then back to 792.

In Euros, this gold correction has retraced 36.5% of the rally, 907.40 to 1160.50 then back to 1068.10, almost a 38.2% Fibonacci ratio.

These are good levels for a chance of a bounce.

If it moves lower, perhaps it might get away with doing a 61.8% correction in USD and GBP and a 50% one in Euros but that’s about the limit, surely. Those targets would be $1198, 1034 Euros and 773 GBP.

It should stop there, otherwise it is a bear market.

As of Wednesday 18 February it looks like gold is wanting to do the 61.8% corrections!!

Wednesday’s lows were $1198, 1050 EUR and 776 GBP, getting very close to the lower targets given above.

$CAD gold price has manfully broken out, like it has in other currencies. It’s only a matter of time before the $U.S. breakout. Volatility is on the decline, meaning we have already seen the low.

http://scharts.co/1AB2sR1