I had the pleasure of speaking at the 2015 World Nuclear Fuel Market (WNFM) Conference in Paris, France, this month, and I returned with three important takeaways that you need to know if you are an energy investor.

- The disconnect between the nuclear utilities and the realities of the uranium producers and market is at its highest point ever

- Kazakhstan is the elephant in the room that nobody wanted to talk about

- One company created a buzz and was the hot topic at the conference. I’ve scanned through the recent articles on Seeking Alpha about this company. Honestly, there’s a lot of misleading information from well-intentioned investors who are simply too far removed from this market to understand key factors. Let’s set the information straight now.

Before I dig into these, a few words about the event itself.

This was the 42nd annual meeting of the global organization solely focused on the nuclear fuel cycle and as such represents the key players who make up the supply and demand of this important energy commodity and related services. Nuclear fuel engineers and procurement specialists, executives of large nuclear utilities, uranium traders, government officials and uranium producers made up the attendees’ list.

It was not a conference for investors. But if you want to understand the uranium sector, this is the place to do it, as it’s where the uranium spot and long-term contracts are discussed and signed.

Though I was invited to speak in a key session on financial impacts on the uranium market, I was the only fund manager in attendance. I went because I wanted to get an industry insider’s perspective, and compare that with my own thoughts and ideas on the uranium sector. These are what help me form my opinions, and I like to challenge them. And who better to be challenged by than the nuclear scientists who run the industry?

I was well rewarded. The insights I gained exceeded my own expectations.

The first takeaway was the massive disconnect between the nuclear utilities and the realities of the uranium producers.

The tension was obvious.

US nuclear utilities have failed to understand the realities of the uranium sector. They are so focused on current spot prices that the majority of them are actually cannibalizing their own domestic production.

Let me explain.

For example, one senior executive of a large US nuclear utility stated during a keynote session that if uranium prices went up any more he would have to shut down his 8 operating nuclear reactors. He even went on to dramatize the situation, stating that what keeps him up at night is wondering what the price of uranium will be.

I had many industry insiders who work at the biggest US utilities tell me that the big disconnect is because of the Utility Commission’s archaic mandates, as addressed below. The US utilities will struggle in the coming years because of this dysfunctional set up and the nexus to uranium prices was complete nonsense.

Even executives within his own firm rolled their eyes and laughed off the idea—as blatantly false and very misleading.

The fact is that the actual input cost of uranium makes up less than 5% of the operating cost of a nuclear reactor at US$60/lb. uranium. At current spot prices, it constitutes only about 3.5%.

That particular presentation may have been off base, but it did give an important glimpse into the minds of the nuclear fuel buyers. Being a presenter, I was introduced to all of the speakers, movers and shakers within the nuclear industry, and was allowed into the private, by-invitation-only events. Over drinks, many of these scientists opened up on their subjects (with a little bit of encouragement on my part).

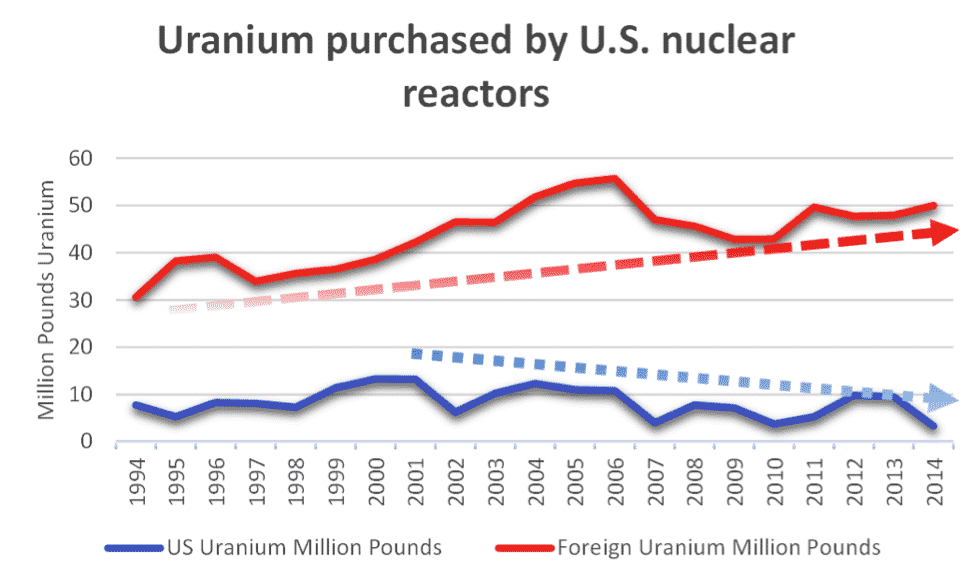

The following chart I created illustrates a big talking point at the conference. The US utilities during 2014 purchased 94% of their uranium from foreign, non-US sources:

Since I wasn’t talking to investors, I knew I was going to make many in the crowd feel uncomfortable. And that proved to be the case, specifically among the Americans.

As I presented chart after chart, I noticed that the Russians within the nuclear industry nodded in agreement with my analysis, but the Americans acted as if I were exposing an awkward secret.

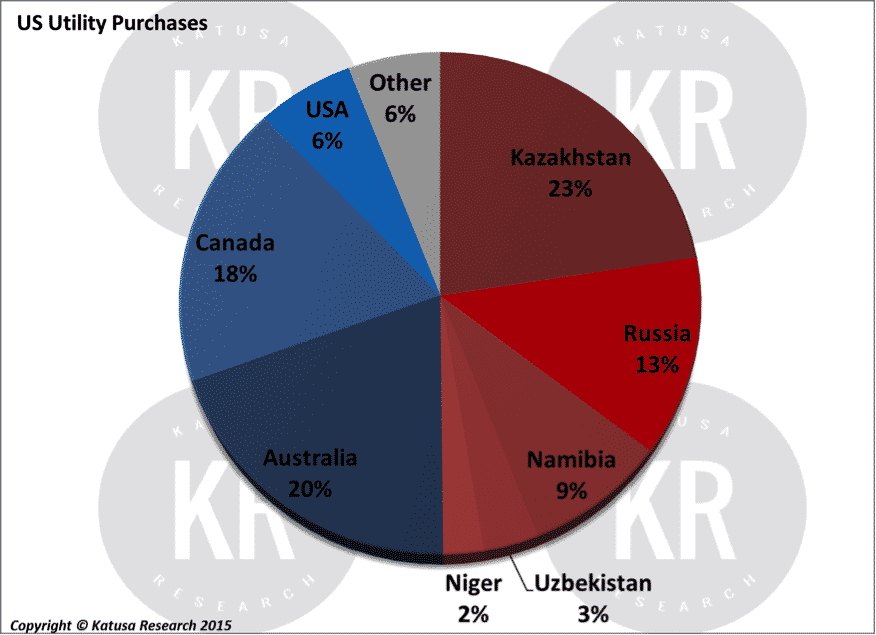

Here’s a supplement to the previous chart:

Note that the shades of red denote nations in good standing with Russia, and not so much with the US.

The amount the US has become dependent on non-stable foreign sources of uranium is unprecedented, and the utilities are completely ignoring this reality.

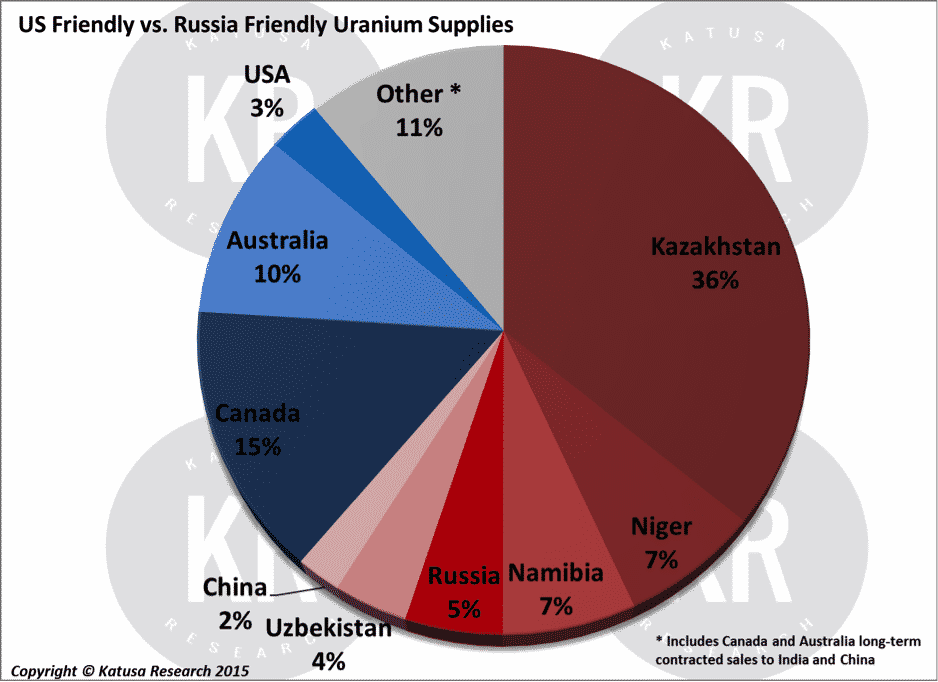

Here is an even scarier chart that really got the American attendees squirming, while putting a smile on the faces of the Russians as they nodded agreement:

Again, we can see that the Americans—who depend on imports for 94% of their uranium purchases, and increased imports from Kazakhstan alone by over 80% from 2013 to 2014—are losing influence in the global uranium sector. In contrast, the Russians are increasing their influence.

In a private meeting, one of the key executives of a major US utility that buys a lot of uranium stated that it’s the Utility Commission that needs an overhaul—not the management of the utilities. Off the record, the reason for this large gap is that the people running the utilities have so many restrictions placed upon them.

Another executive told me that federal rules prohibit the utility companies from actually participating in the development of domestic uranium assets. Even though they want to, they cannot.

Hence my ongoing argument that the worst thing an American uranium company can do in the current market is to deplete its permitted resources, because a company could not replace and permit new resources at today’s uranium price. It just makes no sense to deplete resources in this market. Everyone agrees in principle, and yet the situation is only getting worse.

Kazakhstan-The Elephant in the Room

One of the reasons you read my research is to get information like this second takeaway from the Conference.

It’s all about Kazakhstan, which went from virtually no uranium production 15 years ago to becoming the world’s largest producer, contributing 40% of global primary uranium production. Zero to hero in less than 20 years.

Put another way, Kazakhstan is four times more important to the global nuclear markets than Saudi Arabia is to the global oil markets. Even worse, Kazakhstan is more important to the uranium sector than the world’s five largest oil producers (US, Russia, Saudi Arabia, China and Canada) are to the oil markets, combined.

But what nobody is asking is this: What happens to a nation’s resource production when reinvestments into the sector—such as replacing wells and past production—never come about because the state uses the cash proceeds to fund social programs instead?

Well, Mexico is a perfect case study. Pemex, the national oil company of Mexico, has one of the largest oil deposits in the world, called the Cantarell Field. At its peak, in 2003, the field was producing over 2.1 million bopd. Today, production is down over 75%, and the field is barely producing 450,000 bopd.

Why? Oil proceeds make up about 1/3 of Mexico’s overall revenue, and the government siphoned that money off for other purposes, rather than supporting the industry. Thus Pemex wasn’t able to make the necessary reinvestments in its fields, and production plummeted.

I’ve been writing about this phenomenon for years, and I call it the pinch point of national resource production. The reality is, governments are poor stewards of their natural resource sectors when they, instead of private industry, are running the show. They too often use the proceeds to fund their own political agendas, never worrying about the harsh realities that neglect of reinvestment inevitably brings.

The Soviet Union is another great example of what happens to production when the state fails to continue reinvesting money into the producing assets. At its peak, the Soviet Union produced over 10 million bopd. With oil prices crashing in the 1980’s, the Soviet government had less money to fund its budget from oil revenue. Yet social programs were being continually expanded. Thus reinvestment into resources suffered. Eventually, oil field production was down by over 50%, at its low point.

Once the USSR collapsed, though, reinvestment came back in. And two decades later, the Russians have been able to increase their oil production to the previous Soviet highs.

The pinch point is coming to Kazakhstan, and it will happen faster than most expect. Uranium prices have been low, and the government has been using the funds from production to subsidize its political agenda. Once again, reinvestment has been sacrificed as a result.

This is the elephant in the room. I had more than one industry insider at the conference come up to me and say that they completely agreed with the my ideas, but they could never say anything like this publicly because it’s such a small industry. One American executive who read my book, came up to me to introduce himself and stated to me he spent years in Kazakhstan working in the uranium mines, and he couldn’t emphasize enough how bad the coming decline to their production will be.

I like to remind people that it also happened in the US. In the 1960’s, the US was the world’s largest producer of uranium, and produced over 35 million pounds of uranium annually. Last year, the US produced less than 5 million pounds. That is more than an 85% decrease in production.

This is a huge risk to the US. Rather than finding alternative sources of uranium to feed its 99 operating reactors (which need 50 million pounds annually), the US increased imports of Kazakh uranium by over 80% from 2013 to 2014. That’s insanity. And it’s going to be a disaster if the US utilities continue on this self-destructive course. They need to develop other sources of supply.

Which brings me to my third takeaway.

Truthfully, many of the talks at the Conference were incredibly dry and boring. Sorry if I’m offending any of the other speakers.

But there was one speaker who stood out, and created quite a buzz with the uranium buyers. Amir Adnani.

Amir is President and CEO of Uranium Energy Corp. (UEC), and he was the star of the show. Ok, my goal was for me to be the star of the show by bringing up some controversial topics. Which I did. But my stardom lasted only until Amir stepped up on stage.

I’ve known Amir for a long time, and he is as smart as they come. For years I’ve been saying that Amir is the next Robert Friedland or Ross Beaty. Well, after watching his presentation at the WNFM, it’s evident that Amir has rightfully taken his spot at the table among the best mining executives. He gave by far the best mining presentation I have seen in years. Other attendees, not easy to impress, were awestruck actually – unexpectedly, the conference had changed.

Amir laid out what his company has done and why, and what their future plans are. But it’s the contrarian approach his company has taken that really set him apart.

Everyone talks about “buying low and selling high,” but how many of us have the guts to actually do it?

Since Fukushima collapsed the uranium market in early 2011, UEC hasn’t missed a beat. The company has purchased six new assets; made a the only new uranium discovery for large ISR project in many years; drilled more uranium holes than the rest of the US companies put together; and has been able to attract some of the world’s most successful investors, such as Hong Kong business magnate Li Ka-shing.

Amir has more than doubled UEC’s uranium pounds in the ground when most companies are going bankrupt. But the biggest takeaway from his talk was his strategy moving forward, which I totally agree with.

I’ve read the articles that are negative on UEC. Let me share my thoughts with you.

I have been to every producing US uranium mine; I have over a decade of experience and a long successful track record in the uranium sector.

There is a lot of misinformation in these articles. But the focal point for all the articles, which was true, was the low cash position of UEC.

The shorts made a big deal out of this, and even claimed UEC would go bankrupt. Absolutely absurd.

Something the UEC shorts are learning is that Amir is able to raise a lot of money very quickly from some very large institutions that want exposure to UEC for the years to come. UEC is not going bankrupt, nor is anywhere near such an outcome.

I own a lot of UEC stock because I believe UEC is the best-positioned uranium company to maximize shareholder returns when the price of uranium moves higher.

UEC just closed a $10 million financing at $2 despite the share price trading below that level. The financing was completed in just a few days, which is very rare for a resource company these days.

Investors will argue, “But UEC raised money at $2, and the stock was over $2.80 just a few weeks ago”.

That is true. But considering the circumstances and market volatility the company was experiencing, it makes sense to remove equity market risk and strengthen the balance sheet with only a 5% dilution effect. Also, I take a longer term perspective. The 12-month low is $1.02, and the 12-month high is $3. The 12-month VWAP (volume weight adjusted price) is $1.96.

Put into perspective, although I would have liked to see UEC raise equity at a higher price, the $2 raise was done under extreme pressure from the large short position but still at no discount to market and was completed very quickly by two institutional investors.

Nevertheless, let us be very clear on something.

I highly doubt that the people behind the large short position expected over 17 million shares of UEC to trade on Friday, June 19, and for UEC Bulls to come out of the woodwork.

I purchased shares on June 19th personally.

With over $12 million in cash in the bank, UEC now has the financial flexibility to execute their business plan.

Another item I would like to discuss, which the short articles focused on, is the company’s debt.

Two groups, both of which are big supporters of UEC and Amir Adnani, hold the debt. How do I know? One of the principals of Sprott is Rick Rule. Rick is a partner of mine in one of my funds. Rick thinks very highly of Amir Adnani and UEC.

The other holder of the debt is Li Ka-shing, who is one of Asia’s wealthiest men. Again, both groups intend on working with UEC and Amir Adnani for years to come.

When you compare the amount of debt UEC has on their books vs their peer group, it’s not an issue at all. Clearly, I would prefer no debt on the books. Unfortunately, the real world of resources is a difficult place, and my money is on Amir to figure out how to navigate through this difficult market.

Avoid Sellers Remorse

It takes a minimum of 10 years to define, permit and build a uranium mine. Less than 1 in 3000 exploration targets ever becomes an economic mine. After beating the odds of 1 in 3000, Amir has decided that UEC will not deplete its resource in a low commodity price environment.

I endorse this strategy 100%, as do many of the largest fund managers I know in the business. It’s absurd to deplete your resources when the commodity is at such a low price that new production cannot be brought on line.

Rather than burning through its resources, UEC is continuing to permit other uranium project that can feed its Hobson processing facility, which is just 1 of 3 processing facilities in the US. UEC’s Hobson plant has the capacity to produce up to 2 million pounds of uranium annually if it were to produce at full capacity.

I’ve spoken to many producers who wish they weren’t depleting their resources but they aren’t in a position to do otherwise. It may be because they signed contracts to finance their projects into production and had no alternatives, or they may have conventional mines where it’s not feasible to decrease the labor force. Each operator has its own reality. And every single one of the operators I have spoken to recognizes that the commodity price will be higher in the future. They know they are depleting their best resources in a low-price environment. They don’t like it, but can’t help it. This is what I call seller’s remorse.

It’s no secret that I and my subscribers have been long shares of UEC for a long time, and we are sitting on big gains. I am long UEC because it has by far the best management team in the uranium sector. They are doing the right things in a bad resource market.

UEC has made big acquisitions, made a major uranium discovery in the US, obtained their required permits for further production and have a fully permitted and operating uranium processing facility.

Not to mention, rather than depleting its resources in a bad market, UEC has positioned itself as the only unhedged uranium producer in the world, with maximum leverage and the flexibility of ISR production to come online when the price of uranium goes higher, which it will.

The US utilities will have a reality check soon enough, as Kazakh production approaches the pinch point. I’ve already positioned myself in the best uranium company, with maximum upside when the price of uranium turns. Have you?

“What happens to a nation’s resource production when reinvestments into the sector—such as replacing wells and past production—never come about because the state uses the cash proceeds to fund social programs instead?”

This should be taught in every Macroeconomics 101 class in every college across the world. Industry is not a “cash cow” for local (and even foreign) governments to tax for their own largess. This is socialism, which is a self-defeating philosophy. Even fascists push socialism as a form of punishment upon their competitors. “Eventually, you run out of other people’s money.”

The only thing the mining companies can do is not reinvest in the countries that are limiting them like this, and be prepared to “jump ship” when the inevitable nationalization happens, or the tax rate gets too onerous to continue. This is the “slum lord” attitude to “rent controlled” apartments in large cities, with many parallels to the mining community.