Brazil’s major decline and its contagion

While the media has been focusing on China and Iran the horrible economic data out of Brazil has slipped flown under the radar relatively speaking. The article below briefly outlines the issues faced in Brazil and further relates how these issues will flow to the US and China.

Click here to visit the Dollar Collapse website where this article was posted.

…

For about a decade there, Brazil was the Latin American country that got it right. Under a socialist but apparently reasonable government they kept their budgets under control, managed the population shift from farm to city, and developed some efficient export industries that brought in plenty of hard currency. The Brazilian real held its own on foreign exchange markets and inflation was, as a result, moderate.

Then it all fell apart. The US dollar spiked, commodity prices tanked, and it was discovered that a whole range of big local players were gaming the system in various ways, sparking a corruption scandal that reaches all the way to top.

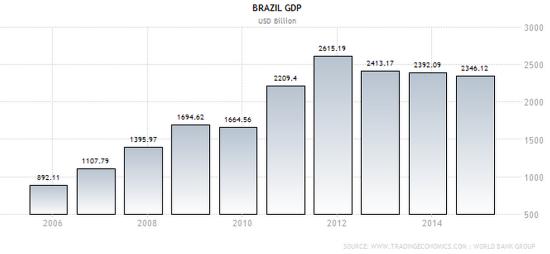

Brazil’s real is now the worst performing major currency (in a world of badly-performing major currencies), its budget deficit is 8% of GDP, the interest rate on its 10-year bonds exceeds 15%, and GDP is apparently about to fall off the table.

There are calls for the impeachment of the president and rising speculation that the finance minister, unable to get spending cuts through the legislature, is about to quit. The latter’s departure will remove the last prop from Brazil’s investment grade credit rating, making it even harder to borrow, necessitating even bigger spending cuts, and sending the country into a stereotypical LatAm death spiral. Just in time for it to host next year’s Olympics.

A big part of the problem is the decision by major Brazilian companies like oil giant Petroleo Brasileiro to fund their rapid growth by borrowing tens of billions of US dollars. When the real was rising and dollar interest rates were low, this strategy was a double winner. But when the dollar spiked in 2014 the true cost of those loans went through the roof.

In this sense Brazil is one of the high-profile casualties of the currency war. And with the US about to raise rates while most other countries lower theirs, it’s only going to get uglier. Which means (here’s why this matters beyond Brazil itself) the big US banks and other major creditors are looking at multi-billion-dollar losses in 2016. Turns out that China has been on a lending spree in Latin America, extending more than $100 billion in credit to various state-run oil and mining companies since 2005. And whenever there’s a South-of-the-Border crisis, Citigroup, Goldman and JP Morgan are in the mix, demanding a bail-out so year-end bonuses aren’t affected. The Mexican peso crisis of 1994 was, in fact, the genesis of the Greenspan put that turned the money center banks into giant hedge funds.

So Brazil will illustrate the differences between now and then — if there are any.

Actualy, a new Mercebes-Benz C180 is cheapper here in Brasil than in US.

That might have something to do with import duty or other requirements imposed.

No, CFS, that’s because the cars was bought from deales in 2014 with old dollar quote.

I didn’t think the C180 was available in the U.S. If it is, it must have happened in the last few years.

IS the engine different……I know they use to make different models which would not meet usa emission standards……is this 180 engine set up for straight ethanol..?

I know 100% ethanol runs hotter than blends of ethanol which we have in the usa…

is that 180 a remake of the 190 e model of 1984……

Peter, your link shows that the 180 is not available. Click on “models” and you’ll see that the lineup starts with the C300.

I doubt it is available in the usa………

check the engine size………180….

BENZ has all different size engines for different markets………

The Olympics effect is still working….we saw it after Russia hosted the games and same shortly after Greece was the host. Repeats again and again. No idea why bu maybe someone does know.

Thanks for the article Cory !

Best to you,

LPG

South Korea is another one to keep an eye on.

Oh Oh….now you have me worried.

Cory , the article is not completely true. Brazil is a completely self-sufficient country and are either suffering from the devaluation of the Real. In fact, we are exporting more than ever , in addition to producing everything, even Ipad. The biggest problem is that the population was super indebted due to easy credit policy , which consequently cooled the economy , causing many industries to close or stop , thus laying off many workers . However, many business oportinudades are appearing . I have faith in my country.

At least it is not as bad as the 1980s.

I remember bus fares in Rio changing every Tuesday as the Cruzeiro sank.

This is EXACTLY what Armstrong has been warning about, a higher US$ creating Sovereign debt defaults

Well he paints a pretty disturbing picture,, jj. That I would agree with. Maybe my differences are just timing related since he seems to be talking about longer cycles. Isn’t it obvious though….the dollar must not rise. Not too far anyway.

What crisis might precipitate a devaluation like that of 1933 to square the books then and stop this in its tracks?

Here is the thing….I believe that the commodity bear is almost over and that runs completely at odds with what Armstrong is saying. Unless the dollar is going to rise WITH commodities this time then none of it makes sense to me.

OK jj, now square that article from Armstrong with this one from Short Side of Long where he sees a bottom in emerging markets stocks. Obviously we have information discord here. Only one can be right.

Emerging Markets Bottom!

https://shortsideoflong.com/2015/08/emerging-markets-bottom/

The other thing jj….I have been reading Martins articles for awhile now and I have to tell you I have NO IDEA what he is talking about when he refers to a collapse in government after 2015.75.

It might just as well be ancient Greek I am reading since it makes zero sense to me.

Maybe I am the only one who does not get it.

Its the trust in government action that he is suggesting, loss of confidence in our global governments which will have voters electing the extreme parties demanding extreme change and we all know how WW2 started

A.L. thanks for the link, my first reaction when that chart appeared was wow! we have a long way to go yet, down!

The global growth expansion we saw out of the 2000 lows mostly China driven which had the world in a growth more, then the financial melt down of 2009 hits for many reasons and then cheap debt has everyone from ma and pa to countries taking on cheap debt driving the global commodities higher off the 2009 lows, now the debt levels and a STRONG $ are killing economic growth, the CRB index had many levels of which it should have held off the 2011 highs, 292, 266-72, 247, 227, 200-06 and now we are at 2001 levels 181-185, sure a bottom here makes “common” sense but where is the global growth? how is Europe going to get its 50% unemployed youth back to work?

Deflation is gripping the globe, where it ends nobody knows but as a boomer who is debt free I won’t be looking to take on any debt no matter how cheap it becomes, who, what is going to drive global consumption higher?

Its like a perfect storm as the ECB and BOJ and PBOC are all looking to devalue their currencies lower and yet Yellen is suggesting raising rates all these events will continue to drive the $ higher as Rick A and Armstrong have suggested 120+ and Doc a 61 cent cdn$ is not US$ bearish

I am staying debt free too jj……just in case the worst comes to pass. We might think we know what is coming next but there sure as heck are no guarantees. The most odd part of this though is that I don’t personally feel negative about the future at all. Maybe I have become disconnected or its just information overload.

I don’t think you real know how n why wwll was Started. It was started by England, France n the Ashkenazi non-simetic zionist that killed over 20 million in Russia n 10 millon in the Ukraine ,from1932 to 1933

Anyone look at the yearly S&P chart? MASSIVE “M” below the moving average and that last leg of the M just keeps getting longer. Can’t wait to see what happens when we get the first full post Summer trading week.

This fork action is too perfect:

http://stockcharts.com/h-sc/ui?s=%24WTIC&p=W&yr=10&mn=0&dy=0&id=p24824223639&a=423119093

I am not a user of forks Matthew. What is that chart telling us?

It’s telling us that the fork is valid and offering strong though declining support. Notice that it took three attempts spanning seven months to briefly pierce support which resulted in a very quick 30% gain on record volume.

But is the fork predictive? That is what I am mostly interested in knowing. Or is it mainly used to confirm an existing idea? In this case for example that support is strong at the lower bound for oil prices and perhaps suggesting a bottom at some point not too far distant. Based on my own readings we are at or near the final bottom in oil prices. I could be wrong of course. Nobody knows for certain but does this offer validation?

In some cases they can be predictive but the important thing in this case is that it provided such clear, obvious support that resulted in a very positive response.

Well-drawn support/resistance lines, including forks, fans and arcs, can tell us where to look for a reaction of some significance. In the following example, we can see that GDXJ might run into some selling at the next Fibonacci fan line around $20 next week. Note that the “battle” around the “382” line in Q1 helped to validate this fan’s usefulness. Other action did so as well.

I tend to fine tune target areas using multiple approaches while oscillating indicators aid in looking for a turn.

Like I mentioned yesterday, I think oil has bottomed.

http://stockcharts.com/h-sc/ui?s=GDXJ&p=D&yr=1&mn=2&dy=22&id=p08174342222&a=378247309&listNum=1

great info on the fans…..for the fans………….

I still think you should be part of the cast……………….. 🙂

OK thanks. That’s pretty helpful. It’s also interesting to me that we are coming to the same conclusion on oil but by different methods.

That is pretty much the story of liquidity vanishing that Bob Moriarty has been talking about. The thing is that there is just not enough bonds to go around. And the strange irony is that once they are all hoovered up then yields could explode higher. Such are the mysteries of life I suppose.

This would tie in perfectly with another Nov-Dec low in gold and the miners this year

http://www.efxnews.com/story/30251/3-reasons-usdjpy-range-shift-higher-where-target-bofa-merrill

WHAT A WEEK……………..

It sounds cool and trendy not to blame China for being the back breaking straw.

It sounds factual and logical not to blame China.

We are running out of patsies here!

you can blame the worlds troubles on a strong US$ as every country is trying to devalue against the rise of the $, PBOC is no different

irishtony, so why is Armstrong a stooge, following his advice these past for years you would have made a zillion % return shorting silver, gold and the miners and buying US equities, if that a stooge, well done, you have a mirror at home, try looking into it!

JJ, what do you think the reason is for Martin to state that arguing against the central bank is to argue for Marxism? Is he really that clueless or is he someone’s stooge?

Maybe I should have first asked if you agree with his assertion. I asked LPG but all he wanted to do was hug someone. lol 😮

It says a lot about his followers if they think there’s even a shred of validity to such a claim.

P.s. – You don’t have to point out that you can’t trade that b.s.

for the average guy in the street its a waste of time to argue against big business, local and federal governments and big banks, basically the establishment, just look at what the US has become spy on your fellow American.

I make money off what the global central banks create, so for me I don’t complain I benefit from central bank madness, I wasn’t aware about M.A. opinion as I don’t follow his blog for his opinions which mean nothing to me only his computer data = capital flows

Thanks, good to know it’s just about the computer data for you but on the commentary side, the “stooge” question remains a valid one.

Most of you probably remember this chart of GDXJ priced in GDX.

http://stockcharts.com/h-sc/ui?s=GDXJ%3AGDX&p=D&yr=1&mn=8&dy=0&id=p47308114891&a=414643240

It is important because it shows that the relatively more risky junior producers have been in a strong uptrend vs the senior producers. As of today, GDXJ:GDX is up more than 27% since March. However, after the whole sector peaked more than 13 months ago, the seniors (GDX) outperformed the juniors (GDXJ) until mid March. Both ETFs plunged vs the dollar but GDXJ plunged as much as 35% vs GDX. This makes perfect sense since, as a group, the juniors are riskier.

The reason I’m bringing this up again is that the riskiest juniors, as represented by the ETF GLDX, are doing even better. ETF.com says: “GLDX is designed for the most aggressive gold investors, as it comes with a laundry list of risks. It targets the small exploration firms whose riskiness—which is inherent in their early-stage business status—manifests itself in increased volatility.”

Not only is GLDX currently up 41% since March when priced in GDX, but GLDX:GDX has broken out to a high not seen since January 2013 -before the several hundred dollar plunge in gold.

So there is a big appetite for leverage and the risk that comes with it. It has been somewhat stealthy but there it is and it is BULLISH.

GREENSPAN on US fiscal problems:

Greenspan refers to China displaying military might, supposedly to celebrate the winning of WWII.

The really funny thing, of course, is China did not win WWII. IN FACT Mao ZEDONG was cowering in caves in far western China (as far as he could get from Japan) at the end of WWII. (He was not even in power at the time) China is attempting to rewrite history. Those in power know their legitimacy is tenuous, achieved by violent revolution and massacres of 20 million to possibly 80 million people. (The true number is unknown) Power is held by suppressing dissent. Remember Tienanmen Square?

CFS , this is not a fair comment. Whether China won the war or not is one issue but saying Mao ze tung not fighting Japan is totally wrong. First he arrested Jiang. Instead of killing him, mao asked Jiang to sign an agreement to cease fire among two parties and fight Japan together. Millions of communist soldiers died fighting Japan. They lost about 9 million fighting Japan and national party. Look at map of China, Shaangxi is at middle of China. They blocked Japan from crossing yellow river and Japan tried and never be able to move to the west of the river. Japan was planning to occupy whole china but stopped by nationalists in the south and communists in the north. MAO also sent many soldiers to the northern central area to carry out garrilla war in the vast rural area. Japan was very brutal. Their policy toward communist controlled area was to burn all, kill all and loot all. People joined communist troupe because they lost relatives. Many bloody battles were fought. My wife’s grand uncle was under cover communist. The communist troupe killed 30 Japanese soldiers around their village, Japanese came and wanted to kill all the villagers. He talked them out of doing it. Even though communist fought only a few large scale battles with Japan but small battles was going on throughout the region. Japanese soldiers did not dare to get out of town in small numbers and not stay out during the night. Communists had control for 90% rural area and Japanese had control of 10% of cities and towns. You should know communists settled in Shaangxi by escaping from nationalist attack due to loss of wars in early 1930s and they only had 30 THOUSAND men. If they fought formal war, they can be destroyed in no time. So garrilla war was the only choice. The north central China region was controlled by nationalist prior to Japanese invasion and abandoned after losing the battles. communists filled the vacuum. From the start of the war in 1933 and full scale war of 1937 to 1941 of Pacific war, China fought Japan for many years without any help. Japan started pacific war because it’s resource had been exhausted. They need resources from the south east Asia. It was why Japan started that war. During the 8 year’s full scale war, China lost about 17-20 million people. Japan claimed they would occupy China in 3 months but the result was a long lasting war which Japan could not afford. Winning WWII in asia was a joint effort just like European war. No single country could beat Japan. China suffered the most and fought the longest and faced the biggest amount of Japanese soldiers. As for the communists, if they did not fight Japan, they would not be able to win the civil war in 2.5 years and capture north Korea from US in matter of months.that period was the the darkest time in Chinese history. A backward economy and warring factions in China gave Japan a perfect time to invade but they still failed.

The words you quoted was propaganda after communists became enemy of the west. Logically if China did not stop Japan from advance, Japan would have occupied whole china instead the east coast region only, which was less than 2/5 of China. They would have won since it is many years after Japan attacked south east Asia and US.

I mean 4.5 years after they entered full scale war with China in 1937 before they started the Pacific war.

James Turk

http://radio.goldseek.com/nuggets/turk.09.03.15.mp3