The zero rate trap

I found this article from The Economist to nicely summarize the problem with zero interest rates.

Click here to visit the original posting page.

…

SO THE Federal Reserve didn’t push the button after all. All the speculation and the debate will now have to focus on October or (more probably) December for the first increase since 2006. On balance, we feel this was a sensible decision; the Fed didn’t want to join the ranks of banks that tightened too soon.

But the zero rate regime illustrates the old adage that “it is better to travel hopefully than to arrive”. And that is neatly illustrated in a new blog post from a Bank of England staffer, May Rostom. Most British homeowners have variable rate mortgages (or short-term fixed rate deals) so interest rate cuts staved off a potential disaster in the housing market. The good news is that fewer people were forced out of their homes; the bad news is that the housing market didn’t “clear” as it did in the US, with prices returning to more affordable levels.

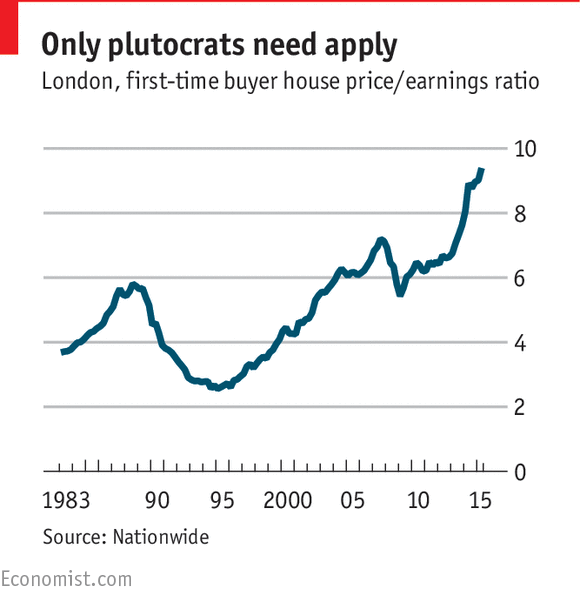

As the economy recovered in 2012-13, house prices took off again, particularly in London. The ratio of house prices to first-time buyers incomes in London, which was 2.6 in 1996 and 7.2 at the last peak in London, is now a staggering 9.4. As Ms Rostom points out, this has inter-generational implications. Those born in the 1971-1980 and 1981-1990 cohorts have faced sharply-rising debts as they try to get on the housing ladder (some may have student debt too). But their incomes have not risen anything like as fast; the 1971-1980 and the 1981-1990 cohorts earn pretty much the same.

This is not just the life cycle at work (younger people take on debt and they pay it off as they reach middle age). Since 1995, the debt of older generations has barely budged; but the debt burden of those of 25-45 has shot up in real terms.

Low rates mean that, if you can put together a deposit, mortgage payments are affordable. But sluggish income growth means it is very hard to pay off that debt. As Ms Rostom writes

It is possible to imagine a world where younger households will reach 65 and still have debt.

Furthermore, by boosting asset prices, the low-rate regime has made older generations (the people that own the assets) wealthier; this is an intergenerational transfer. She adds that

It seems that the widening gap between the haves and the have-nots isn’t just across income or socioeconomic categories – as some have been (correctly) arguing – but also across generations.

In a sense, if the Bank of England were to push up rates and force down house prices, that would be a boon for young people, but only for those who had yet to put a foot on the housing ladder. For those struggling with high debts, it would be a disaster. And it is hard to see a way out of this dilemma; low rates mean high prices, and high prices mean high debts, which mean the Bank can’t push up rates (at least not very far). It is a trap.

One way out of this trap, of course, would be to build a lot more houses. But even on the most optimistic assumption, it is unlikely to be enough. Last year. Savills forecast a 55% rise in housebuilding over a five year period, but that would still result in 167,000 units in 2018, well short of the 240,000 estimated requirement. Savills added that

Historically, we have seen periods of similar growth in the 1980s and noughties but there is no precedent for faster growth over a sustained period

Changes to planning rules, more public spending on infrastructure; these would help. But not quickly enough to solve the Bank’s dilemma.

One could argue that a similar trap faces the Fed. Low rates have also pushed up global equity prices. But it seems like the August collapse in stockmarkets played its part in spooking the Fed and preventing it from raising rates. Can the Fed really tighten policy if investors are panicking?

It looks like an almighty bubble with no market breadth to me.