The global economy will sputter along this year as China’s slowdown prolongs a commodity slump and contractions endure in Brazil and Russia, the World Bank said.

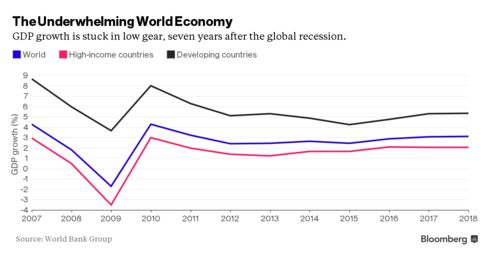

The Washington-based development bank lowered its forecast for 2016 growth to 2.9 percent, from a 3.3 percent projection in June, according to its bi-annual Global Economic Prospects report released Wednesday. The world economy advanced 2.4 percent last year, less than a forecast of 2.8 percent in June and slower than the 2.6 percent expansion in 2014, the bank said.

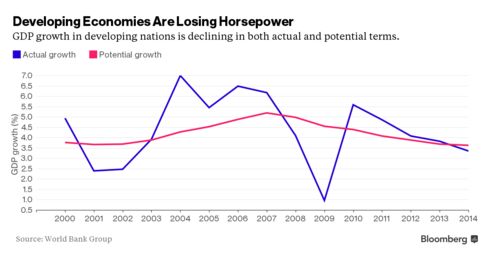

The deteriorating picture in emerging markets is a big reason for a fifth straight year of global growth below 3 percent. The World Bank cut its outlook for China’s growth in 2016 to 6.7 percent, from 7 percent in June, and a 6.5 percent increase is estimated for next year. Brazil’s economy will shrink 2.5 percent this year, while Russia’s will contract 0.7 percent, the lender said.

“The global economy will need to adapt to a new period of more modest growth in large emerging markets, characterized by lower commodity prices and diminished flows of trade and capital,” World Bank Senior Vice President and Chief Economist Kaushik Basu said in the report.

Jitters about China were evident this week, as the government stepped in to prop up equity prices following a 7 percent rout to open the new year.

China’s high debt levels are the nation’s main short-term risk, the World Bank said, noting that debt to output ratios are larger than in most developing countries. Still, the government has ample room to use public spending to stimulate growth in the “low-probability scenario” of a faster-than-anticipated slowdown, the bank said.

The bank also trimmed its projection for U.S. growth to 2.7 percent this year, down from 2.8 percent from June, citing the dampening effect on exports of the surging U.S. dollar.

Loose monetary policy should continue to sustain “fragile” recoveries in Japan and the euro area, the bank said.

“This outlook is expected to be buttressed by recovery in major high-income economies, stabilizing commodity prices, and a continuation of low interest rates,” Basu said. “All this does not rule out the fact that there is a low-probability risk of disorderly slowdown in major emerging markets, as U.S. interest rates rise after a long break and the U.S. dollar strengthens, and as a result of geopolitical concerns.”

Under the bank’s base case, global growth will see a “modest upturn” as China steers its economy to a model driven by consumption and services, and the U.S. Federal Reserve raises interest rates without “undue turbulence,” Basu said. The bank forecasts global growth will accelerate to 3.1 percent next year.

The report noted that the benefits to consumers and business from lower oil prices have been “surprisingly muted.” However, a stabilization of prices at low levels could “release pent-up demand,” causing the global economy to grow faster than expected.

Still, global risks are tilted to the downside, according to the bank. A slowdown in China, coupled with widespread weakness in other major emerging markets, “could have substantial spillovers on other emerging and developing economies,” the bank warns.

“The simultaneous slowing of four of the largest emerging markets — Brazil, Russia, China, and South Africa — poses the risk of spillover effects for the rest of the world economy,” Basu said.

Yes, its bad everywhere. Everywhere but Africa. Still booming here in case nobody noticed. No big change to speak of and no recession on the horizon. The problem is most of you can’t invest here unless you actually come here.