The FANG stocks are no longer a beacon of light

Only a couple weeks ago investors were talking about the FANG stocks in a positive light. They were the main reason why the major indices closed the year anywhere close to even. But 2016 has changed that narrative.

Some of the FANG stocks are down over 10% in only one and a half weeks! We do not need to worry about these companies going out of business but the pullbacks are showing a much larger movement of capital away from equities.

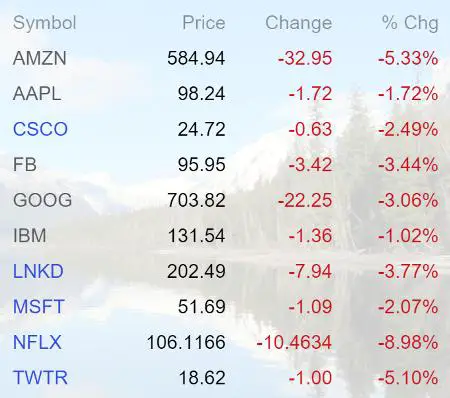

Our friend John Rubino from the Dollar Collapse website posted this breakdown of the FANG and related stocks. It is not hard to see that investors are exiting these stocks at rates that have not been seen in many years.

– Dollar Collapse

If this selling continues the overall markets will be further weighed down. With no sign of investors starting the buy the dips this all has the potential to result in a liquidity trap for all investors… but if and when is a very tough thing to call. I continue to believe it is best to not be in these stocks as the downward trend is accelerating today.

Click here to read what John had to say.

It is also interesting to note that since the August correction in the market that TLT (long term treasuries), the Japanese Yen, and the Gold price have tracked fairly closely due to the fear trade and are acting like safe havens again.

This is the way things were before 2014, and then for almost 2 years the Yen and Gold fell out of bed; while the Long Term Treasuries and the USD were the assets getting the “safety bid.” However, starting in August, Long Term Treasuries, the Yen, and Gold all seem to be getting more in sync and rallying when there are market jitters. Look at August, late Sept/early October, and the beginning of 2016.

http://stockcharts.com/h-sc/ui?s=TLT&p=D&yr=0&mn=6&dy=0&id=p50572697663

Safe Havens Regain Appeal As Volatility Continues

Wednesday January 13, 2016 – Gary Wagner

http://www.kitco.com/commentaries/2016-01-13/Safe-Havens-Regain-Appeal-As-Volatility-Continues.html

Thanks Cory!

There’s real bifurcation between those that are holding on for the market to recover and charge higher, and those that are reallocating out of the high flyers and into more defensive stocks and bonds since the end of last year.

Check out how TLT has done since November, and notice the last spike in August when the first bigger correction hit the markets.

http://stockcharts.com/h-sc/ui?s=TLT&p=D&yr=0&mn=6&dy=0&id=p08039326108