Gold Rising Despite Strong US Dollar

Here is a preview of an article posted over at Gold Eagle yesterday. It is positive to see gold continue to hang above the $1,100 mark (and continue to move up this week) while the US dollar remains strong. There are some predictions, like from Rick Ackerman, of a much higher US dollar but it seems to have stalled below the 100 point level on the dollar index. It may continue to trend sideways but I am looking for a break in one direction by the second full week of February.

…

The price of gold has been rising in 2016 despite the strong greenback. What does it imply for the gold market?

The US dollar has appreciated more than 1.7 percent against the euro this year so far. Despite this appreciation, the London P.M. spot price of the shiny metal has risen 3.4 percent in January so far. It means that other factors have to explain the rebound in gold prices. Undoubtedly, the pace of the U.S. dollar’s appreciation is slowing down, but the major drivers are the decline in interest rates and the rise in risk-aversion among investors.

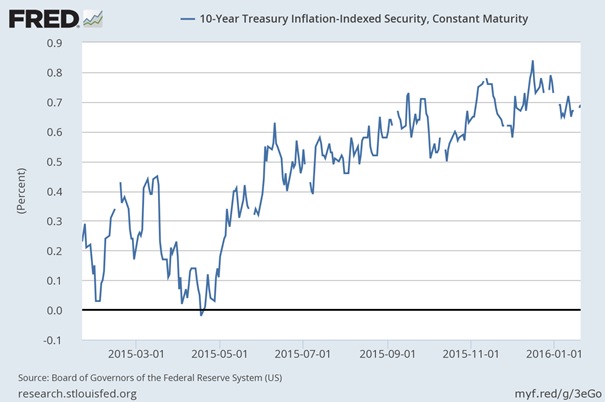

US Real Interest Rates Declining

The chart below shows U.S. real interest rates (gauged by yields on 10-year Treasury Inflation-Indexed Securities) has been declining since December. It means that investors assume a slowdown in the U.S. economy and that they believe that the Fed’s monetary policy will be more gradual than expected. It also shows that U.S. real interest rate may affect the gold market independently of the U.S. dollar.

Chart 1: U.S. real interest rates (yields on 10-year Treasury Inflation-Indexed Security) over the last twelve months.

The Federal Open Market Committee (FOMC) two-day meeting ended Wednesday afternoon with no change in U.S. interest rates. No change was expected. The FOMC statement, however, was deemed a bit dovish. The statement intimated that the risks to the U.S. economy are no longer in balance due to recent financial and stock market instability. However, the statement did not say outright that Fed members are worried about the recent world stock market sell-offs. Other market watchers just called the statement confusing, or neutral.

I made good $ on both sides of gold miners last year. This year I am getting my butt kicked! I am out about $150 on stop-outs on NUGT. I currently have 4 positions in NUGT trying to take profits on 2 of them to cut my losses for the month. Any new traders out there you should keep track of your trade in Excel. It is a good tool when swing trading a bear market.