Differing signals from the the Indian stock market

I hope everyone is having a great Memorial Day long weekend. If you are sitting around looking for something to read here is an interesting post by Dana Lyons. We talked a lot about how emerging markets were taking it on the chin over the past year and a half but now we are seeing a little breakout in the Indian stock market. As Dana points out on a longer term chart the market is still below the uptrend line. This correction could be over (which would be good for a number of other emerging markets) but the market still has a little more to prove.

Click here to visit Dana’s site for other great posts.

…

Indian Stocks Finally Join The Breakout Party

The Indian stock market finally broke above the down trendline stemming from its early 2015 highs, a positive development in the near-term.

If there was one theme in global equities this week, it was the (for-now) successful reaction of markets to the test of their April breakout levels. Both around the globe as well as domestically, many markets had broken key resistance or downtrends last month which helped give a lift to the post-February equity rally. As we covered in a number of posts already this week, many of those markets had since dropped back down to test their respective breakout levels. Based on the action this week, these tests appear to have been successful, almost across the board. One market that had not yet broken its post-2015 downtrend, however, was India. As we noted a month ago, Indian stocks rallied up to key resistance but, as yet, had been unable to surmount it. That changed yesterday.

Specifically, Indian stocks broke above the Down trendline originating from the March 2015 highs, as demonstrated here by the S&P BSE Sensex Index.

This break of the downtrend line that has held the Sensex in check for the past 14+ months should provide a boost for the index in the near-term. Indeed, after breaking the trendline yesterday, the Sensex showed solid follow-through again today, rising more than 1%.

Of course, there are various potential resistance points pertaining to the 14-month downtrend in Indian stocks. Therefore, we would not expect a straight shot back to the former highs around 30,000 in the Sensex. In particular there is the 61.8% Fibonacci Retracement of the decline, which sits around the low-27.000′s, or about 3% above current levels. That also coincides with the short-term top of last October. Above that is the 78.6% Retracement which coincies with last July’s highs near 28,500.

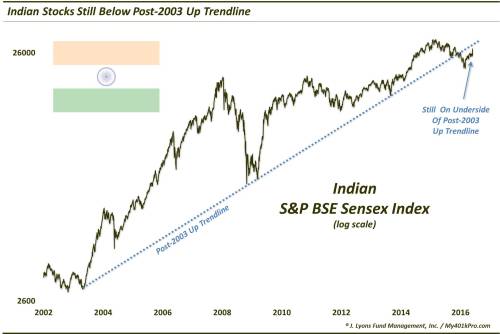

From a longer-term perspective, the most interesting potential challenge to a quick recovery comes in the form of the broken post-2003 Up trendline (on a log scale).

This line, in our work, was broken last December which theoretically turned this former support into resistance. Now, the line is obviously still rising (currently, it’s at around 28,000). Therefore, it does not need to be reclaimed in order for Indian stocks to advance. However, failing to do so would at least put a limit on the trajectory of the recovery in Indian stocks.

Lastly, we keep in the back of our mind the possibility of a test of the Sensex’s massive breakout to all-time highs back in early 2014. The index does not have to test the area (around 21,300) in order to sustainably rally. However, should it do so, we will be waiting.

** On a separate note this weekend, we want to express our gratitude to all of the members of America’s armed forces, past and present. We especially honor those who paid the ultimate sacrifice in service to our nation. As a small token of our appreciation, through June 5, we are doubling (to 6 months) the length of a trial subscription to My401kPro (our online investment service for retirement investors) for all military personnel, active or retired. Just drop us a note at info@My401kPro.com after signing up to let us know of your military service. Thank you again and have a wonderful Memorial Day weekend!

_________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.