The “End of the World” History Stock Market Chart

This article was posted on the Rambus Chartology site a couple weeks back but I just came across it last night. As a little background Rambus is a great chartist. If you are a technical trader, or just interested in straight forward charting I recommend checking out his site (click here for his site)

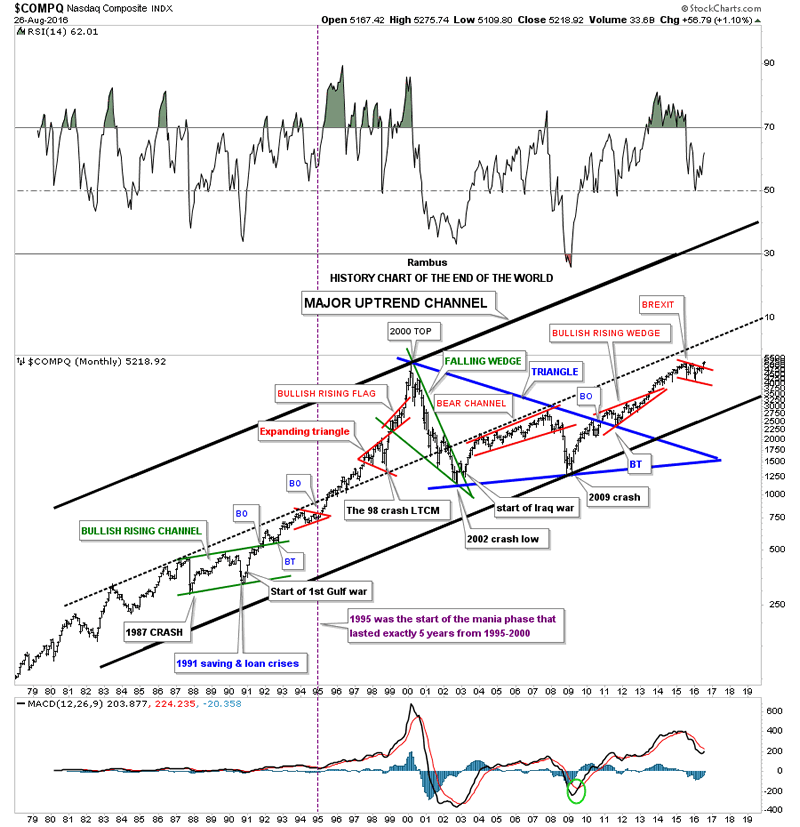

In this article we get a look at a major long term (almost 40 years) chart of the NASDAQ. This chart is taken in the context of the constant “we are about to suffer a major crash” narrative. I like the overall message presented not just in terms of investing but his positivity around society continuing to move forward and advance in a positive way.

Click here to visit Rambus’s site and consider signing up for his service.

…

Tonight I would like to show you a long term 40 year monthly chart for the $COMPQ which I call the history chart. Some of you were not even born when some of these significance events happened. At the time they seemed significant enough that most thought the end of the world as we knew it was near. Some of the older members will remember some of these events like they just happened yesterday.

I was personally involved in the stock market during each one of these times, and I can assure you it did feel like the world was coming to an end. When one observes some of these stock market events from a distance they hardly matter in the big picture. Perspective is everything.

Take the 1987 crash for instance. The $INDU was down over 500 points in a single day, but in 1987 that was over a 20% drop.The world didn’t come to an end and the markets began to rally off that historic low for several years. Then in 1991 there was the savings and loan crisis, and the market crashed again on the magnitude of the 1987 crash but this time it took a little longer to complete the move down. Also what made the 1991 low so dramatic, besides the saving and loans crises, was the start of the first Gulf war.

I still remember most of the analyst were taking about what could happen to the stock market if the war didn’t go well. Crash was the most widely used term back then as no one really knew what would happen as the US was going up against the 5th largest army in the world. After the first night of bombing, it was very clear the next day that the Iraqi army was no match for the US. That was the first time I heard the word smart bomb. As you can see on the chart below the 1987 crash low, and the 1991 low, marked the two lower reversal points in the green bullish rising channel. That green bullish rising channel or flag really was the beginning of one of the biggest bull markets in history for the $COMPQ – tech stocks.

How many remember the LTCM, Long Term Capital Management debacle which occurred in 1998? It’s only a blimp on this chart, but at the time the word crash was being thrown around as no one knew what would happen. What happened was the continuation of the parabolic run 1995 to the bull market high in 2000.

In March of 2000 the great bull market was over and one of the strongest bear markets for the $COMPQ began. Many tech stocks that were bid up to astronomical levels during the mania phase went bankrupt . The bull market in the $COMPQ ended in 2000 at 5200 and just over two years or so later it crashed all the way down to 1100 before the bear market ended. It didn’t help that 9 11 2001 happened in the middle of this crash however that bear market low was also accompanied by the second Iraqi war.That massive bear market, which seemed like the end of the world back then, was actually the beginning of the ten year blue triangle consolidation pattern.

The last reversal point in the ten year blue triangle consolidation pattern was another end of the word event that most investors still haven’t gotten over yet, which was the 2009 housing bubble crash low. Only the great depression compared to it. That 10 year blue triangle consolidation completed in late 2010 with a nice clean breakout and backtest. That was over seven years ago and the markets haven’t looked back.

The last consolidation pattern on this chart is the red bull flag which I labeled as the BREXIT pattern. This little shakeout was very mild compared to some from the past. Maybe this little red bull flag is going to finally be the pattern that is going to end the world as we know it, but from a Chartology perspective it looks just like another consolidation pattern in the ongoing major bull market uptrend channel.

Maybe I’m being to optimistic but I don’t see the end of the world coming anytime soon, but just the opposite. I believe we’re entering into a new period of human ingenuity where technology is going to change the way we live from biotechnology, green energy, robotics, nano technology, artificial intelligence, super computers that will make today’s computers look like slide rulers from the past, space travel and exploration, and a host of other things that the best science fiction writers haven’t even thought of yet.

This is all possible because of the bull market that started in 1982, which in hindsight was the birth of the information age. Many tech stocks during that bull market went up multiple times of their initial public offerings and had many splits. If only some of our precious metals stocks, over the course of the now 16 year secular bull market had moved even a fraction of what some of the tech stocks did back then, it would be an amazing sight to behold.

One never knows when a black swan event may strike that turns our civilization into a Mad Max society. Maybe tomorrow or in 5 years, 20 years or maybe never. My point is I’m not going to live my life waiting for a Mad Max event that may or may not happen. There are enough people out there that will keep a close eye on it if does happen. I’m more interested in what the future holds and how society and the economy progresses moving forward.

I’m not painting a world without problems as that would be foolish. Since the beginning of time human society has moved two steps forward and one step back always gaining a little ground each time to get to where we are today. I realize that many members are fearful that the world monetary system is going to implode any day now but we have been hearing a variation on this theme from the doom and gloomers for as long as I have been alive. I grew up in the Vietnam era. Now if that didn’t feel like the end of the world I don’t know what does. And before that my early childhood was during the depths of the cold war (think backyard bomb shelters). These times make the present seem like a walk in the park. Regardless of what many of the naysayers may think on how bad everything is today, I can’t think of a better time to be alive than the present. I see a future that will astound us in what the human species will achieve. Good or bad changes will come whether we like it or not.

I’m hopeful society will benefit from the changes that are going to take place, just as we have benefited from all the previous changes that happened before us. To leave this world just a tad better than when we entered it would be a great accomplishment. For me personally the future looks bright and full of wonder on what will be achieved by the human race. You may call me naive, ignorant or whatever else you want, but I’m going to embrace the future with eyes wide open.

All the best

Gary (for Rambus Chartology)

What’s Rambus smoking?

Maybe his positivity has to do with the era he grew up in. At that time we did not have Ebola, Aids, MRSA and so many other viral infections as exist now. At that time, the worlds most powerful nations did not stockpile diseases to be unleashed on each other during a time of war.

Nor was there a threat of complete antibiotic resistance such as we are seeing with a new tuberculosis variant that has become a huge killer in Africa and simply cannot be treated successfully.

But these issues barely scratch the surface of what are genuine threats to the mega cities and the worlds interconnected population centers. Maybe Rambus has not seen the global population hockey stick chart. He might be less sunny after reviewing that.

But he could be right in some regards. Maybe the world will be better down the road. You just have to survive what is coming first and live long enough to get to the other side where robots will do all the heavy lifting and the world once again have plenty of fresh air and lots of elbow room to enjoy for the genetic winners.

Funny, we just started talking about this again at home over the weekend. The diseases and common cold seem to linger much, much longer than they did before. More immigrants, more disease variants mixing from different continents. Now it is finally hitting the local medias here about antibiotic resistant bacteria, which most common folk are unaware of.

It is very serious Richard, particularly here in Africa where medical services are so poorly developed and quality care difficult to obtain. I have personally known two people who died of the TB variant here in the past two years. Both were in their thirties and healthy prior to the onset. Antibiotics made no difference at all. It is frightening stuff. I stay away from crowded closed spaces and pooled taxies as one outcome.

TB is now the worlds number one infectious killer — It is a global Pandemic

http://www.tballiance.org/why-new-tb-drugs/global-pandemic

I almost don’t want to say it….but I have another of the megaphone charts that are so prevalent everywhere lately. These things are all peaking incidentally and all around the same time which just means a shit storm is going to be unleashed fairly soon.

This one refers to assets correlated to 10 year yields. Notice we are at the peak? The drop should take us into a region quite unlike what we are now enjoying. In other words….the era of non correlation.

Which is just another way of saying you better be prepared to adjust your thinking about what goes up or down in sympathy with something else because the relationships themselves are going to break.

Put another way….time to reset the algos.

Asset correlations to 10 year Treasury Yields (note the megaphone pattern)

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2016/09/14/GS%2010Y%20correlation.jpg

CFS, if you read that goofy article from Gary he is asserting that the dollar is going to break BELOW the 200 week moving average. Does that really sound likely to you? It is an odds on bet the dollar stages a strong rally as it bounces from the 200 wma and I am indeed betting on that happening.

Excuse me…..that GOLD was going to break below the 200 week.

See how nicely I turned back to a bull. Like changing a suit. I am a new man today.

Brazil economic activity edges down in July

http://www.reuters.com/article/us-brazil-economy-activity-idUSKCN11P19E

Brazilian airlines shaken by Ireland tax haven listing

http://uk.reuters.com/article/brazil-airlines-ireland-idUKL2N1BV0G4

Petrobras expected to cut investment, output in 2017-21 plan

http://www.dailymail.co.uk/wires/reuters/article-3796066/Petrobras-expected-cut-investment-output-2017-21-plan.html

But Brazil stock market nicely up today.

Guess they don’t believe Reuters.

Stock markets and economies don’t necessarily move together.

The simple fact that a Wall Street tool took Dilma’s place after the legislative coup could be enough to goose the stock market.

Economies in South America are doing poorly in general. Bolivia has remained fairly strong, perhaps due to the large portion of its GDP derived from cocaine, but it is getting squeezed now too.

Colombia central bank says ‘very likely’ 2016 growth below estimate

http://www.reuters.com/article/colombia-economy-minutes-idUSL2N1BS1AG

Maduro revels in support from Zimbabwe, Iran

http://www.reuters.com/article/us-venezuela-nonaligned-idUSKCN11P016

Obama also supports Maduro.

Peru central bank trims 2017 growth outlook on political risks

http://www.reuters.com/article/peru-cenbank-idUSL2N1BS112

Very nice Rambus chart! It looks like the bottom blue line of the triangle hits around 1650. And that’s probably where it’s going. Very nice chart! Wow

Your above article is interesting; however, don’t you think the information age has run it’s course for the time being?

Internet shopping. File downloads. Company connectivity. Internet speed.

The pace of the advancement has slowed considerably and now time is focused on more and more non-productive nonsense such as social media, selfies, etc. The internet is now becoming a source for a waste of time.

Businesses and companies have already taken the advantages of the internet information age. Sure, they will continue to build on this but the advancements have peaked. Now, it is a double edged sword because the internet is promoting false information, increasing crime (cybersecurity), lowering productivity, and is becoming a valuable resource to terrorism players. These expansion periods, this one roughly about 20 years will now be subject to government intervention (already seeing this), more regulation, more suppression (seeing this too), and most likely taxation.

Seems more like a corrective period to me.

Back on Doc’s Friday thread (Sept 16th) I was warning that the recent massive 14 billion dollar Department Of Justice penalty levied against Deutsche Bank was so severe that it might actually imperil their solvency and at that time I referred you all to the annual report of highlighting their reserves.

Today, Zero Hedge came out with a story on that exact topic (thanks ZH!)

So naturally I have to wonder if ZH also reads The KE Report. Ha! Pretty damned funny. But you read it here first folks and the nice people at ZH have now put some detail on the thought. (and as an aside, how can anybody on this site really say with a straight face that all my posts are worthless…..talking to you Shad)

ZeroHedge writes:

“Things are going from worse to worst once again for Deutsche Bank as equity and credit markets deteriorate further as analysts warn Germany’s biggest (and the world’s most systemically dangerous bank) would be “significantly undercapitalized” even if an eventual settlement with the DoJ can be covered by the bank’s reserves. Despite multiple capital raises over the past few years, as Bloomberg notes, any likely settlement would imply a capital increase – just to pay the fine”.

——————————————-

Yes, it really is that bad.

And what will make matters significantly worse is if the Euro does break down this year from its coil as I have asserted. That event would imply a significantly higher penalty in conversion as the penalty is denominated in US dollars.

So to ask again….did the DOJ just break Deutsche Bank? Is this the straw that will break the camels back? I would not touch that company’s shares with a ten foot pole and the rest of you here thinking that the stock is cheap (thus a good buy) might want to reconsider.

Personally, I think they will bust in the next fiscal and set off a financial contagion across Europe. There are just too many interconnections and you can be sure the Italian banks CANNOT sustain any added losses never mind those the size implied by Deutsche’s continental reach.

So yeah, time to buy more gold…and Treasuries…and Yen…..

Deutsche Bank Extends Losses Near Record Lows: “Significantly Undercapitalized”

http://www.zerohedge.com/news/2016-09-19/deutsche-bank-extends-losses-near-record-lows-significantly-undercapitalzied-even-wi

Listen people, we need to start talking about this.

It has just occurred to me that the trigger for a Euro collapse may be none other than Deutsche itself. We have all been reading about that banks troubles of course but nobody is really adding up two and two and concluding that the end result might in fact lead directly to a currency crisis.

As I have tried to point out to no avail, the Euro chart on a monthly is actually terrifying if you examine it closely. That sucker is about to break and by my reckoning its going down this fall.

And its going down hard.

I have also tried to point out that the impetus that will eventually send gold soaring is when the Euro crashes although it was not until a few moments ago I realized that Deutsche was the obvious candidate to make that happen.

Has that thought popped into anyone else’s mind recently?

Well if it hasn’t then get it front and center because this is not some airy-fairy vague far-distant threat that can worry about a few years down the road. I believe the threat is imminent, obvious and of extreme danger for those positioned incorrectly.

If you are short dollars….well good luck to you because you are going to get your arse handed you on a platter.

There are so many triggering factors in markets and government structure, it’s crazy.

There are 3 types of people.

1. People who make things happen ( central banks )

2. People that follow and adjust to what’s happening.

3. People that wonder WTF just happened.

Bob M was saying awhile back that when Deutsche Bank goes under we might have a week to get cash out of the bank.

I wonder what would happen to the brokers, even if shares went up it doesnt do much good if they close down.

I hope Bob’s wrong but I won’t bet against him on that call. Interbank lending and the overnight would freeze instantly and come to a head-on collision stop. It will be worst in Europe but the infection could stretch everywhere the bank is working. Be careful if you are using any of the ETF’s they sponsor. Your money could be tied up for a long….lonnnng time.

A reason to keep a shoebox of cash around.

I just wonder if banks are not ready for this, China is about to be part of the SDR, Deutsche Bank could be bailed out with SDRs, that would establish the SDR as a world reserve currency and voila, we have our change.

Recall that China wants the SDR partially backed by gold.

Stuff like that might sound crazy, but they only have to get people to accept a currency, and people havnt got a clue, so I dont see it as difficult for them.

lol, Im listening to an interview, they just said people are moving to the Ruble, think I just mentioned that.

The Russian economy just might be one of the most stable for its size.

Who blows up first?!

I mentioned China a year ago…was in for a total meltdown. Their well.on their way!

Unbelivable…..and me no debt go figure.

http://www.aljazeera.com/programmes/101east/2016/09/china-economy-160913081105227.html

All debts get paid. They get paid either by the borrower or by the lender. In the world today there is more debt that the value of all the gold, silver, platinum, palladium, rhodium, bonds and stocks.

It is not mathematically possible to spend your way to prosperity. All debt will get paid. And when it does the world will shake.