Is the US Dollar going to lose its reserve status?

Axel Merk was recently on Bloomberg for a discussion regarding the new money market rules coming this Friday on October 14th. He brings up some great points on the changes that we have been and will continue to see in the LIBOR rates. Watch the video below and the included post.

Click here to visit the original posting page over at Bloomberg.

…

A $7 Trillion Moment of Truth in Markets is Just Three Days Away

What will Libor do once the dust settles?

If the London Interbank Borrowing Rate was a musical artist, or an actor, or a sports team, we’d be calling 2016 its comeback year.

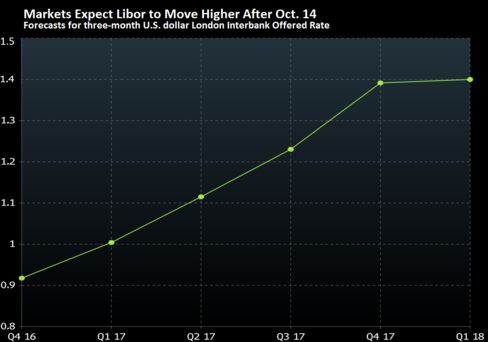

Not since the financial crisis of 2008 has Libor, to which almost $7 trillion of debt including mortgages, student loans and corporate borrowings, is pegged — experienced such a surge. The three-month U.S. dollar Libor rate has jumped from 0.61 percent at the start of the year to 0.87 percent currently — a 42 percent rise — ahead of money market reform that’s due to come into effect on Oct. 14.

The new rules require prime money market funds — an important source of short-term funding for banks and companies — to build up liquidity buffers, install redemption gates, and use ‘floating’ net asset values instead of a fixed $1-per-share price. While the changes are aimed at reinforcing a $2.7 trillion industry that exacerbated the financial crisis, they are also causing turmoil in money markets as big banks adjust to the new reality of a shrinking pool of available funding.

Some $1 trillion worth of assets have shifted from prime money market funds into government money market funds that invest in safer assets such as short-term U.S. debt, according to Bloomberg estimates. The exodus has driven up Libor rates as banks and other corporate entities compete to replace the lost funding.

Now, analysts are debating whether the looming Oct. 14 deadline will mark a turning point for the interbank borrowing rate, as money markets acclimatize to a new reality.

While analysts at Deutsche Bank AG believe that Libor may be poised to tighten when compared to other benchmark interest rates after Oct. 14, their counterparts at TD Securities speculate that Libor will “head higher” and the spreads won’t “compress anytime soon.” Meanwhile, Goldman Sachs Group Inc. thinks Libor will reach a 3.6 percent by the end of 2019 — or about 270 basis points more than its current level.

“We are inclined to think that the midsummer Libor pain has fully run its course, and three-month Libor could begin to set tighter against [Federal Reserve expectations as measured by the overnight index swap rate],” Deutsche Bank analysts led by Dominic Konstam wrote in a note published late last week.

Complicating such forecasts is the vast array of moving parts involved in money markets. These range from the liquidity operations, currency swaps, and monetary policies of central banks, to the behavior of investors, bank treasurers, and money market fund managers.

At TD Securities, analysts led by Priya Misra note that market pricing currently suggests an expectation that the spread between Libor and the overnight index swap (OIS) rate will begin to compress sharply following the October deadline.

“Libor should continue to head higher due to impending money fund reform. After the deadline, we expect Libor to stay high,” the analysts said, noting that investors may be less than eager to return to prime funds which are currently offering a “low” pick-up in returns compared to government bond funds. Meanwhile, prime fund managers may well opt to keep their liquidity buffers high ahead of a December interest rate increase by the Federal Reserve, further depressing the returns they’re able to generate for their investors.

Goldman Sachs said that lower Libor may materialize as banks switch to turn to new sources of dollar funding, though the bank assumes that interest rate hikes by the U.S. central bank will likely push the rate even higher over the longer-term.

“The trend toward higher Libor could eventually be partially reversed as banks develop alternative funding sources, but this process would likely take months to occur,” Goldman’s Marty Young wrote in a note published last week. “Further, we expect short-end rates in general to be dragged up as the Federal Reserve resumes its hiking cycle.”

Higher rates are encouraging the entry of new buyers for the short-term debt sold by banks including offshore funds, securities lenders, some bond funds, big companies and even retail funds with excess cash, JPMorgan Chase & Co. analysts said in August. Meanwhile, assets held by foreign banks in the U.S. have fallen by $440 billion over the past year, according to Deutsche, lessening the need for dollar funding.

“To be sure, none of the factors above is strong enough to bring Libor back lower after next week – especially when a December rate hike has yet to be fully priced,” Deutsche Bank concluded. “But what they do suggest is that FRA/OIS and the Libor bases could have already peaked in this episode.”

Big Al, I do not know your ability to understand Russian, but ….

Straight from the horse’s mouth!

The Daily Star is a Communist, Pro-Russian Newspaper published in the UK, which, unlike the US, actually still has freedom of speech, mostly. (Except for D-notices)

http://www.dailystar.co.uk/news/latest-news/552839/russia-recalls-officials-deputies-family-children-abroad-return-fatherland-ww3-world-war-3

I still agree with Axel and it looks like the dollar is putting in at least a short term high here:

http://stockcharts.com/h-sc/ui?s=UUP&p=D&yr=2&mn=0&dy=13&id=p44054800200&a=481500765

The US can determine the timing of its loss of petrodollar status.

It WILL happen over time; that is inevitable.

It is in China’s best interest for it to happen slowly as China continues over a few years to use its vast accumulation of US dollars to buy up resources.

However, if the US continues to sabre-rattle and annoy China and Russia sufficiently, it is within China’s power to expedite the decline of the dollar.