Here’s a different take that says GDXJ is a buy

People can look at charts in many different ways. That is one reason why I think it is so valuable to figure out a method that you think works and stick to it. I wanted to present this by posting this article right after Rick’s interview. The author Michael Ballanger presents his argument that GDXJ is a buy at current levels. I am curious to read what all of you think of his outlook compared to Rick’s…

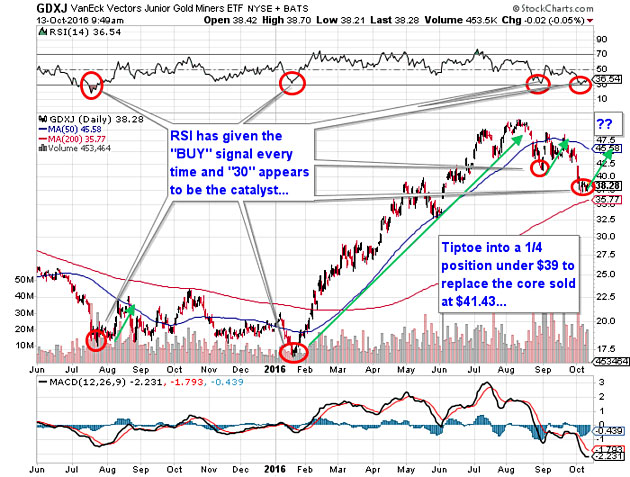

Cutting directly to the chase, the correction in the gold and silver stocks and, more importantly for us, the miners (GDXJ) is rapidly coming to a close. Without embarking on a flight of verbosity and overstatement, here in a nutshell is why I see a bottom in the cards—and possibly a solid, tradeable bottom.

1. Sentiment: In January of this year, I couldn’t even get a meeting with any fund manager or investment banker, let alone secure an order for financing. By July, I had those same people begging me for a piece of ANY gold/silver-related financing I could offer. Mining brokers went from the outhouse to the penthouse in record time, and with unprecedented velocity by the summer of 2016. Today, in October, we are right back to where we were in January. Those big managers of other people’s money now own “too many issues,” the quality of which was noticeably suspect in the late stages of the January-July advance. When my phone stops ringing for at least two weeks, I know we are near the lows.

2. Relative Strength (“RSI”): Nothing more to say here other than “Observe the chart posted above.”

3. COT: The Commitment of Traders report for tomorrow is going to see another sharp improvement as gold open interest has shrunk to 500,328, and that is down from 544,824 on October 4. This is the large Commercials unwinding their massive short position in gold futures and is normally a precursor for a reversal. However, it is not to be used as a timing tool as the unwinding can take weeks to play out.

4. Deal Flow: The number of financings for the junior exploration companies has suddenly and sharply dropped off a cliff as the mania that engulfed the space in the spring and summer has evaporated into nervousness and despair. Declining deal flow is normal into any correcting market but the severity of the plunge is bullish.

5. Strong U.S. Dollar mantra: Everyone and their hairdresser has now assumed a rate hike in December, and that, combined with the crashing British pound and the surging dollar-yen, has sealed the fate of all currencies against the Almighty U.S. dollar. But it should be noted that the U.S. is the largest debtor nation on the planet and that its purchasing power continues to erode against everything. For a superb primer on the state of affairs in the good ol’ US of A, follow this link to yet another fabulous Michael Mahoney video called “USA’s Day of Reckoning,” where he talks about an economics term covered in this space numerous times over the past ten years—the velocity of money.

The vehicle of choice for me is the Gold Junior Miners ETF (GDXJ), and having completely missed the top in July-August above $50, I was stopped out two weeks ago at $41.43, triggering a lovely and very well-earned capital gain. Sadly, not having 75% of my net worth on the proverbial line every day was disturbing, and for the past three weeks, the lack of stress has transformed me into a slovenly “gentleman of leisure,” complete with weight gain and addictive behaviors. Accordingly, in an effort to restore my spouse-annoying, dog-harassing self to normalcy, I am going to tiptoe back into the GDXJ market by buying the opening this morning with 25% of allocated capital. I might be early or I might be dead on, but the only “technical” tool I am using is the RSI numbers. Every other technical “tool” is veritably useless, as are the geeks that read tea leaves from the bottom of the cup.

Now I have to go drag Fido out from under the shed and unscrew the bolt locks on the powder room door. We need normalcy in order to allow the Gold and Silver Gods bless us with $1,400 gold by Christmas.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

http://zealllc.com/2016/gsscrbuy.htm

Gold stocks, screaming buy….

I think Adam Hamilton is right. Bob Moriarty thinks highly of him. Anyone who has taken his advice over the last year has done very well.

One guy says buy, another says sell.

One mans garbage is another mans treasure.

You say tomato I say tomato let’s call the whole thing off

Anyone can look at a chart and spin it anyway they want

You can always just follow momentum.

Another thing ya can do is use a live chart, that shows exactly where to buy and sell.

If ya use a volitile and cheap share it can be profitable, ya gotta be glued to the screen tho.

As a value oriented speculator, I consider this a time to buy but disciplined traders who use Rick’s hidden pivot method won’t miss much, if anything, when the market turns and will do better than a “knife-catcher” like me until it does.

If speculating in plays that are liquid enough for the size of position you want, the hidden pivot method is all most people need but much of what I buy is best accumulated on extreme weakness in order to get a good chunk at a decent price.

Love of Country does not mean love of politicians.

The older I get, the more I believe the majority of politicians are just lying scum.

And the longer they are in power, the more corrupt they become.

I believe in citizen government enforced by term limits.

Since Congress would not permit such a limitation, I see a Convention of the States as the only possible solution.

+1 Making a career of it is the chief problem. However, another issue is electing ’empire builders’ who haven’t got the b…s to ever simply say “No! I’ve had some experience in local government and believe me, saying no was almost impossible for many of those in charge. JMO

Auryn Resources starts exploration at Peruvian projects

2016-10-14 07:09 ET – News Release

Mr. Shawn Wallace reports

AURYN RESOURCES COMMENCES WORK ON PERUVIAN PORTFOLIO

Auryn Resources Inc. has initiated exploration programs on its Peruvian portfolio of projects focused in southern Peru. The focus of the exploration programs will be a combination of extensive surface sampling, trenching, mapping and geophysics to advance the projects to drill-ready stage in 2017.

The company’s exploration focus will start on the Huilacollo and Banos del Indio oxide epithermal gold systems. These two projects are considered by Auryn to be part of the same structurally controlled epithermal system.

Hey Corey! These Canadian Luna Smores bars are quite tastey!

“People can look at charts in many different ways.” – Amen

TA = The science of explaining tomorrow why the predictions you made yesterday didn’t come true today.