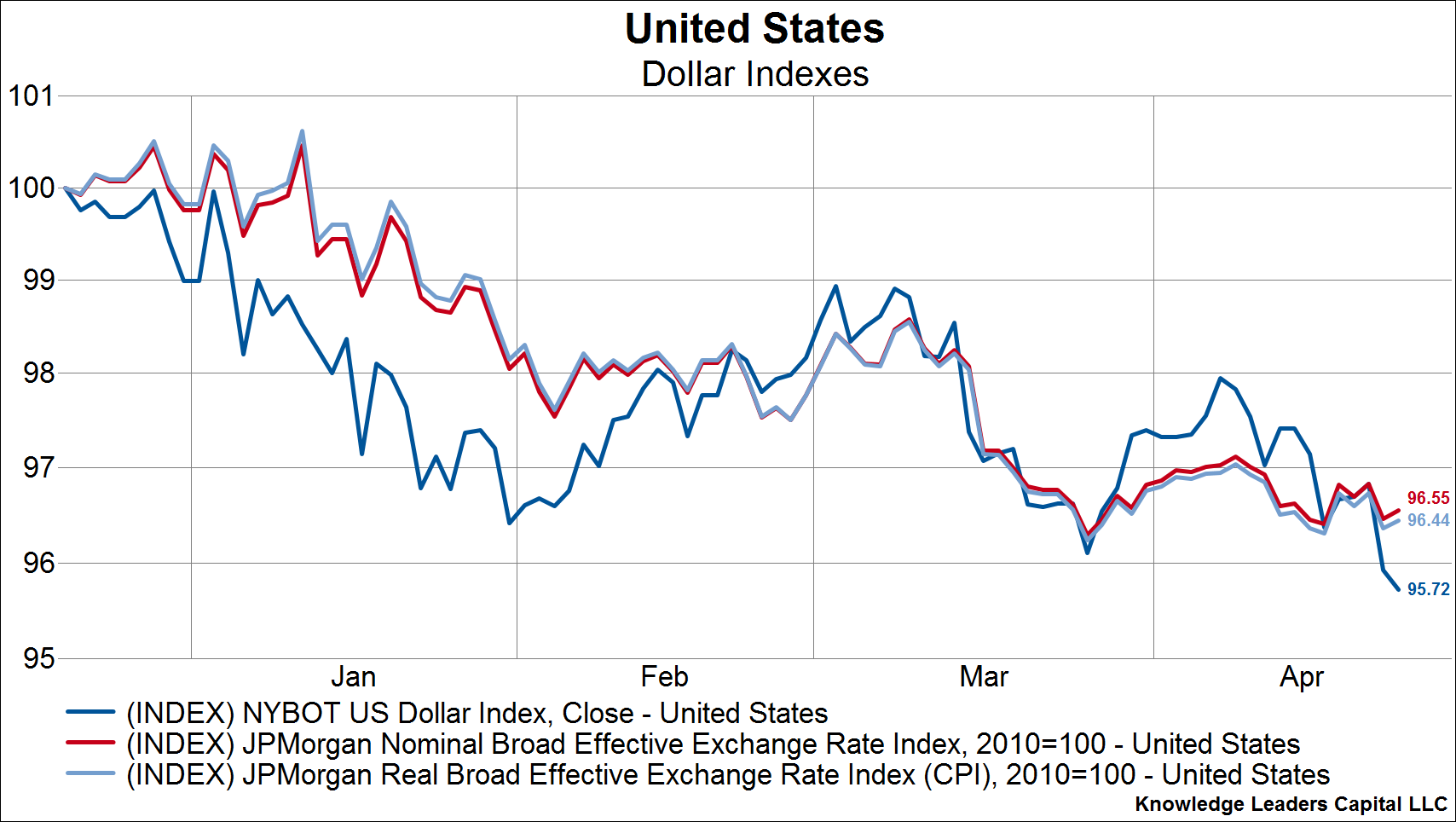

Is the USD Bull Market Over

This is a short breakdown of the USD vs other currencies this year and what it might mean for moves in the markets.

Chris and Rick are on the road today but I do have a new guest joining me for the market wrap. I hope everyone had a great weekend! In the meantime enjoy this posting from the Knowledge Leaders Capital website.

Click here to visit the site for some other informative articles.

Is the USD Bull Market Over and What That Would Mean for Your Portfolio

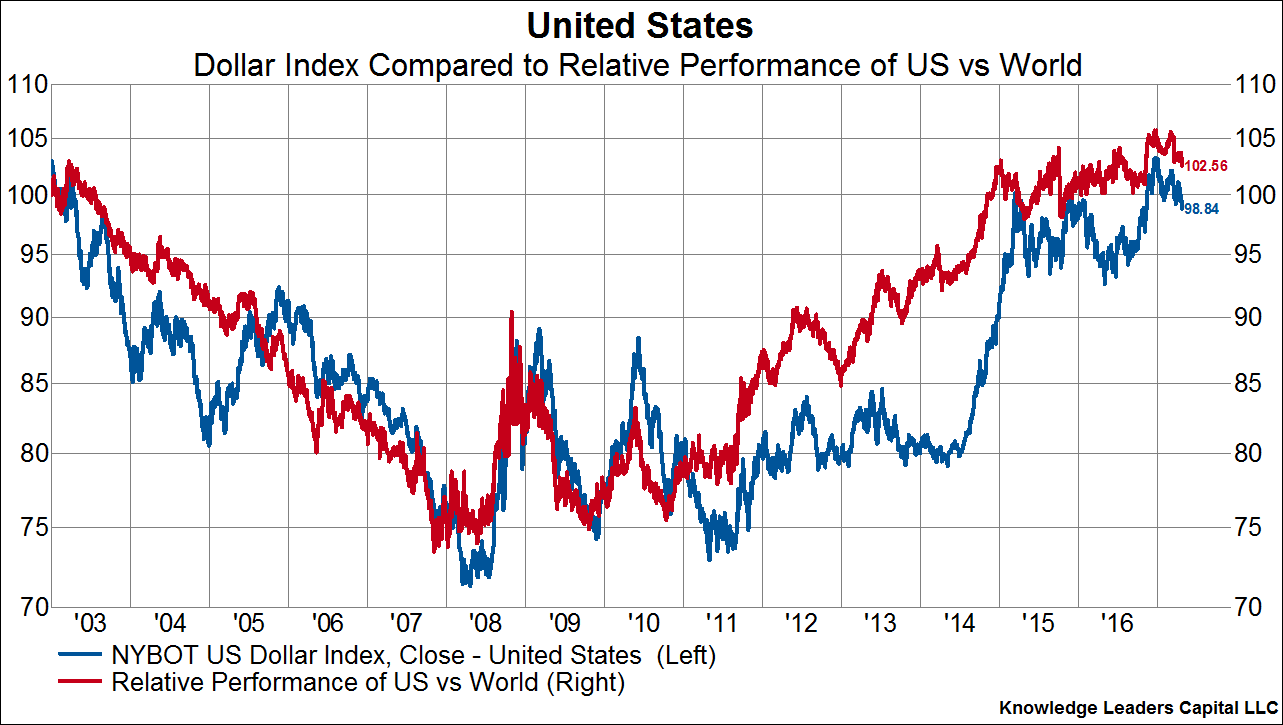

So the question now becomes, if the USD bull market is over, what does that mean for my portfolio? The answer to this question is relatively simple. When the USD rises, US stocks tend to outperform foreign stocks in USD terms. When the USD falls, US stocks tend to underperform foreign stocks in USD terms. Therefore, if we have indeed seen a peak in the US dollar – as the charts would suggest and the US government would like to affect – we’ve likely just seen the beginning of foreign equities outperforming US equities after a decade of the opposite occurring.

I disagree with your sentiments completely, Spanky. (Big surprise!)

Even if you are right and we are in a new bull, the mining stocks are going to be dead money for a few months until the bollingers on the monthly chart tighten up. Between now and then, they can take the miners anywhere they want, and probably will.

The $HUI for example–the lower monthly bollinger band is currently at 120 and rising. I don’t think it is going to just run to that number but it could get very close in the next few months. Also, in the very short term, we are due for some sort of short covering bounce, but I don’t think it will be anything more than a tiny blip. It’s down for the next month or so. Then likely a large pop and then fade back down.

The monthly stochastics are also nearly oversold on $hui. While it is possible that they just reverse here, given where we are in terms of the 20 month MA and the width of the bollinger bands still, there is more red on the horizon. At best we will roll allong the bottom for a couple of months.

The monthly Bollinger bands weren’t exactly narrow before the moves up from the lows of 2015/16, 2008, or 2000. The fact that the lower BB is riding sharply is what you should be focused on. Notice how similar ’16/’17 lower BB is to the ’01/’02 BB?

http://stockcharts.com/h-sc/ui?s=%24HUI&p=M&yr=20&mn=11&dy=30&id=p80133609410

Last year’s mean mean reversion was just a warm-up. Whatever wait we still have will be worth it.

Remember, fundamentals make charts, not the other way around.

Big difference in 2015/16’s rise is it was composed of just a few giant candles and then when it peaked, the retracement was massive. Futhermore, it would have been a very very good sign if the initial rebound after the December low got us back near the 2016 peak, but we didn’t even come close. That is a far less bullish condolidation than if we had gotten even remotely close. As it looks now, I think we are going to spend a significant amount of time below the 20 month MA in the next 3-6 months.

The move off the 2015 low is so much uglier than the prior bull runs. If anything, it looks like a classic sucker’s rally. Extremely rapid (instead of building relentlessly like back in 2000).

Again, I disagree. Those “few giant candles” were a good thing. They showed POWER and should be expected at this stage of a secular gold bull. Furthermore, there is nothing wrong with the pullback when viewed on the monthly chart. In fact, it would look worse had the February high matched the August high. After a 189% move in just 6 months (which dwarfs the 2001 move) and spending 5 months against the upper monthly BB, a significant pullback to the 20 month MA is just what the bull market needed to kill bullish sentiment.

I think it has killed bullish sentiment too much.

I am still holding my silver miners, but like I said, I expect them to get bent over much more before we ever see new highs. I think the miners are far far more likely to touch the lower monthly bollinger band before making new highs. Whatever course in terms of price and time that takes to play out is the only thing open in my mind. Too much chart damage for us to not swing the other way now in terms of sentiment–i.e. things to get extremely bearish again. Monthly MACD is about to roll over two. Maybe its only for a month or two, but that alone could entail a severe pummeling before a recovery.

There’s no such thing as killing sentiment too much.

GDXJ reclaimed the 200 week MA at the beginning of January; what’s bearish about retesting it now? Not much, in my opinion.

http://stockcharts.com/h-sc/ui?s=GDXJ&p=W&yr=2&mn=5&dy=13&id=p93922101276&a=520220622

I don’t know if the HUI’s monthly MACD will give a sell signal or not but it has been bullish that it has gone flat for the last 7 months.

Food joints are starting to disappear…….Clothing retailers have gone bye, bye.

Just saw a sign ……Hair cuts..$7.99 special, looks like hair and beauty are next.

It is a sign of an ugly market.

Hey Jerry..greetings from Sanford Fl. home of the $3.00 hair cut. Couldn’t believe the sign.

Guess I need to glue on a wig just to take part in the special price. I don’t know how long he will last but he is getting plenty of work in the meantime.

Hello Gator………now that is cheap…..$3.00 ….maybe that is one side only…….

that is a positive sign………maybe he is not playing gopher for the deep state…..

OOTB,

He who controls the military industrial complex ” with the context of America First ” can bring back freedom. We just might be able to celebrate the 4th of July in ernest this year. That my hope!

what concerns me with the IMC, is the deep state is not stupid, and most do not even know who, what and when……let alone why and how much…… 🙂

I know.. But it looks like the pendulum has swung, and they all are being exposed… It’s happening on all levels. No one in this nationalism or freedom shift is immune to exposure. Time is up, for the oligarchy.

I hope so……8500 people need to be in jail…….instead of 3.2 million on drug charges from the state

8500 might be a little heavy…..but, you get the point

Chartster, Trump has had little success at getting any of his ideas implemented, it will probably take an economic crash before anything moves on that front. Just my thought, but his hands are tied with the likes of Paul Ryan and other Republican and Democrat stalwarts that oppose him.

DT..I agree..the budget did not have one of his campaign promises as far as cuts and the wall was not included. The problem is the lobbyists..they write the bills and Ryan pushes them through committee. Trump needs to write his own legislation and take it directly to the House. If this continues I am changing my affiliation to Independent.

SLV 3 day RSI approaching zero. I am sure we will get a decent 1-2 pop soon, but given this ridiculous selling and the still extreme CoTs, I expect another $1 to be shaved off in the next month or so at a minimum. More like, they will break SLV below its 100 WMA again, which is currently at 15.75. When that MA is broken yet again, it will cause a massive cascade. Again, I don’t expect this to play out in the next week or anything, but eventually after whatever sucker’s rally is ginned up after this weeks FOMC is going to be shorted heavily. SLV’s december low is definitely getting taken out. It’s just too tempting a stop not to be breached.

Meant to say “1-2 day pop soon”

GCC also putting in a reversal candle today. Last day to go short before the train leaves the station.

SLV:GLD ratio has also broken down out of the ichimoku cloud on the weekly chart–a terrible sign and is below every key long term moving average. Again, expect some sort of sucker rally very soon, but it will be very very short.

Bitcoin 1375.65 U S. “C’mon and join the joyride”

https://www.youtube.com/watch?v=WE45t-t0caU

wait till the electric grid goes down……… 🙂

if gold is rigged….make you wonder about bitcon…….

makes……not make

Silver down $2 bucks from its highs, yet the CoTs were barely down last week from the record high commercial short positions. This is going to be extremely painful over the next 6 weeks. I honestly don’t think there will be any hope of a final bottom until the June 14 FOMC. Before then, expect a severe drop. Again, I am expecting some sort of 1-2 day pop to reset the RSI somewhat, which may come on this weeks FOMC meeting on Wednesday. This happens in front of every single FOMC like clockwork. A relelentless slide into the meeting and then a bottom afterwards. Except this time I don’t expect the pop after the FOMC to be the bottom this time. June 14 should be a better bounce, but god only knows from what level. I am certain we are going to see crazy low numbers in silver before we get any relief.

SLV is down 1.8% yet SIL is down only 2.4%. That’s a positive divergence and we’ve been seeing that for the last several days.

Notice the narrowing weekly BBs:

http://stockcharts.com/h-sc/ui?s=SIL&p=W&yr=5&mn=10&dy=0&id=p95668634248&a=491088089

Got to hand it to you Matthew..you still continue to battle the 3 alarm fire with a thimble and bucket…it may end up in ashes…

I love hysterical bearishness, Gator, and have been a buyer for the last week in select names.

For example, I picked up a couple hundred thousand more shares of Scorpio Gold in the last few days at .075 and .08 and today it closed at .09 on good volume (average gain is about 16% but I won’t be selling). I mentioned it to Excelsior when I started buying with 80,000 at .075 and 20,000 at .08 last week.

Today was a good day overall for my bunch of juniors at +3%.

This year is going to be a good one.

The Fed has said it expect higher growth this year. The Fed expects that any moves above or below 2% inflation to be transitory.

The Fed is telling you where to put your money for free capital gains–the US stock market. Commodities are dead money, at best. Look at the monthly CRB chart–it is a disaster. It will take years to base out once it bottoms, and we don’t even know if it has bottomed.

Dow to 25,000+ this year.

Kiss the metals good bye. There is literally zero reason for the Fed the want higher commodity (input) prices. The yen will continue to drop vs the USD, which is the only currency cross that matters for commodities and the PMs.

The PM bulls’ dream is over folks, and the Fed is going to make that painfully obvious in the next few weeks and months. Once silver gives up the 100 WMA, put a fork in the whole complex. Gold will head to the 200 month MA over time, but silver is going to get absolutely monkey hammered.