Chart Freak comments on US Markets, USD, and Precious Metals

Robert Alexander over at Chart Freak has some great technical analysis on a wide range of markets. In the post below he shares a large portion of his weekend report he sent to subscribers. Since the moves this week have been very muted I thought it is appropriate to post his outlook. He breaks down what he is expecting for the S&P and NASDAQ, then moves to the USD and crude, and wraps it up by looking at the precious metals.

…

Have you ever heard someone say, “In the back of my mind, I was thinking about…” ? Well, in this weekend report I’m going to discuss my analysis ( technical / Cycles / etc) and the conclusions that are drawn from that, but I also wanted to mention a few things that have subconsciously been ‘ in the back of my mind ‘ in a few areas.

SPX – Friday I pointed out that we could bounce here, but I still expect a bit more of a drop after a bounce.

We did get the bounce at multiple support areas after filling a lower gap & ‘buy the dip’ has been working. Now we could fill the overhead gap.

These patterns do look similar with a continuing rally, and some may think that it would lead to further rally upside…

But ‘ in the back of my mind ‘…

I expect a deeper dip for now due to cycle timing, eventually into an ICL. I pointed that expectation out here on May 12th.

I would be expecting maybe something a little like this.

UPDATE: I added this chart to my Wednesday report, where we see a flush like slam that cleans the plate of sellers short term, and then a gradual bounce and dip.

XLF – The fact that the financials still haven’t recovered the 50sma is always ‘in the back of my mind’ too. I have pointed out this weakness, because the markets can still make higher highs for now, but if Financials fail, I would expect the general markets to follow sooner than later.

But by now you definitely know that also ‘ in the back of my mind ‘, I believe that these markets could have the potential to turn parabolic . They look very similar to the non stop rise in the NAsdaq 1999.

USD – The USD continues to down trend – putting in lower highs and lower lows. The daily cycle counts have extended to almost 40 days so we may have a dcl/ ICL ahead. ( See the chart). I expect an ICL in the USD soon. The inverse relationship between GOLD & THE USD has not been present lately, but a solid move higher soon could still drop Gold into the ICL move.

As mentioned, the relationship between GOLD & USD has disconnected from their normal inverse relationship. That adds a trickiness to the analysis too, because you used to be able to gauge one with the other. ‘In the back of my mind’, I feel that this constant drop in the USD should have pushed Gold a lot higher, and in my analyses this backs up the idea that we still have a drop in Gold coming. More on that later.

.

My WTIC march 17th chart – I thought that Oil could drop as far as $42 – $44 area. Most of my charts back then showed a $42-$44 target last spring, as shown here.

WTIC – Oil did hit $43.76. Is this rally the real deal, with Final lows in place? I have my doubts, because many of the Energy & Oil stocks are still lingering at the lows. On MAY 25th there is a meeting that will discuss the possibility of more Oil cuts & that meeting could affect Oil. So far the blue line is a potential target this week.

OIL WKLY – It looks like a shake out and a bullish recovery, but we will see what happens on that MAY 25th meeting. That blue line could be the lower high top before another drop in oil.

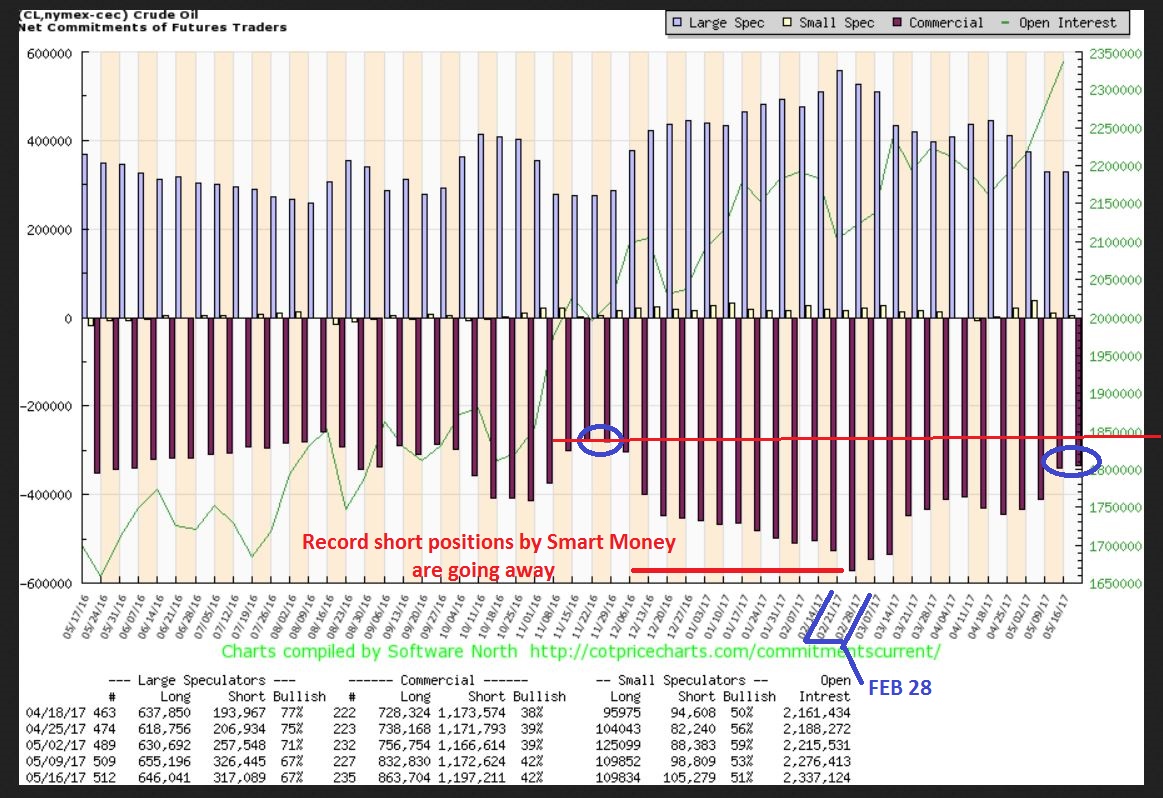

Look how much the OIL COT has improved as OIL dropped down seeking out an ICL! One more drop is possible and it could get it to the red line and put in an ICL.

SO lets look at Energy / Oil stocks now.

XLE – There was a false break out in April, and we can see that the blue trend line has now been broken again. The 50sma has not been broken yet, but it is close. ( I accidentally used the 30 on this chart, but the 50sma is also still holding price down).

OIH UPDATE : I used this chart in the report WEDNESDAY May 24- we are seeing that Energy stocks are NOT rallying like Oil, just like we saw this spring when Oil rallied. At this point, I am thinking that we get 1 more drop in Oil and the energy stocks bottom out.

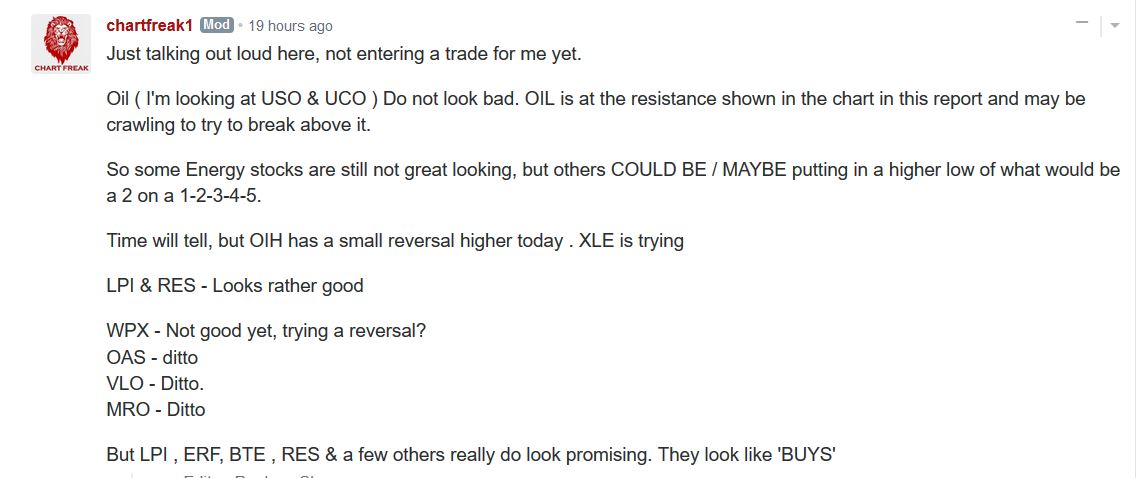

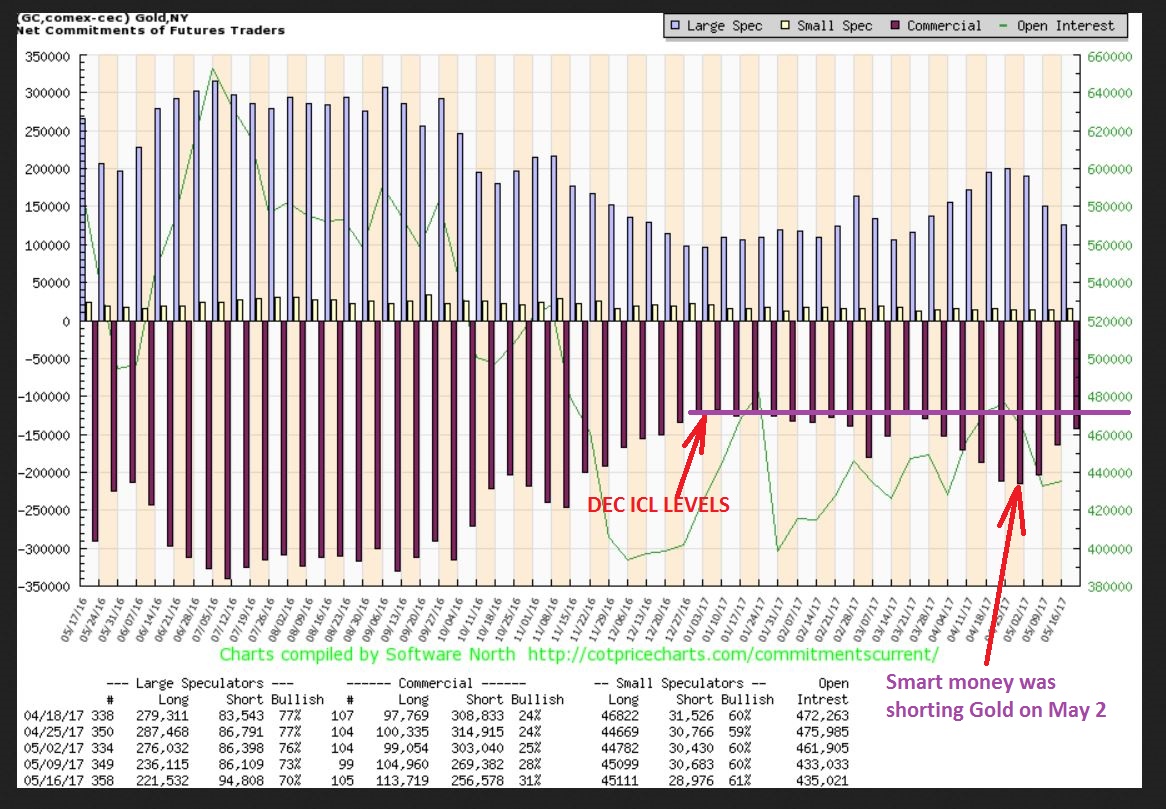

So you may recall this comment Thursday in the premium comments section. I stated that some ENERGY OIL stocks are improving while others are not. I mention here that RES, BTE, ERF actually look like BUY candidates, so do we have some leaders forming? Read the comment…

.

Let’s look at RES, BTE, & ERF and see if they had further follow through on Friday.

.

YES, follow through

YES – Still a nice set up

Yes – so some areas may be shaping up quicker than others. I am now going to watch this sector closely for more signs of improvement. The Thursday MAY 25th Oil meeting may hold the key for Oil & Energy.

NATGAS WEEKLY – I did not re-enter my Long NATGAS position, and now I will not unless I see a drastic change. Why not? As mentioned on this chart last week, the break out on the daily chart was invalidated and…

NATGAS WEEKLY -This still could be a H&S, but more importantly …

Look at the NATGAS COT NOW. SMART MONEY REALLY ADDED TO THEIR SHORT POSITIONS.

Commercials ( Smart money) The final brown bar on this chart occured Last week and Smart money went VERY SHORT . I have to heed this warning for now.

PRECIOUS METALS

.

GOLD, SILVER, and MINERS

From Thursday, Gold & SILVER were on day 7 and reversed lower. I did not go short yet and mentioned that the reason I didn’t go short yet is because we can still bounce and even peak on day 10, 11, 12 or around there, and still put in a left translated daily. Look at the drop & bounce in April ( Blue Box). I drew a possible bounce similar to Aprils bounce for Silver, but I might go short after watching things play out.

So Silver did reverse on Friday as I expected. I wanted to see what happens Sunday night & Monday before I go short. I’ll discuss my plan to possibly short when discussing the Miners.

GOLD – GOLD is now at resistance, but it can still slide higher along that magenta line. Eventually a move higher by the USD could drop Gold ( Though the inverse relationship is not exactly in tact, it could reemerge). I expect a drop in Gold soon.

Some have asked if that was an ICL in May. This weekly chart does not stand out as an ICL like almost all of the other ICLs shown. Only the MAY 2016 ICL was slightly similar, but it had 4 weeks of red candles, we just saw 2 weeks. Gold is now at resistance on the weekly chart too. The big volume last week does look bullish, but we’ll see if there is follow through.

GOLDs BASIC CHART – $1285 max?

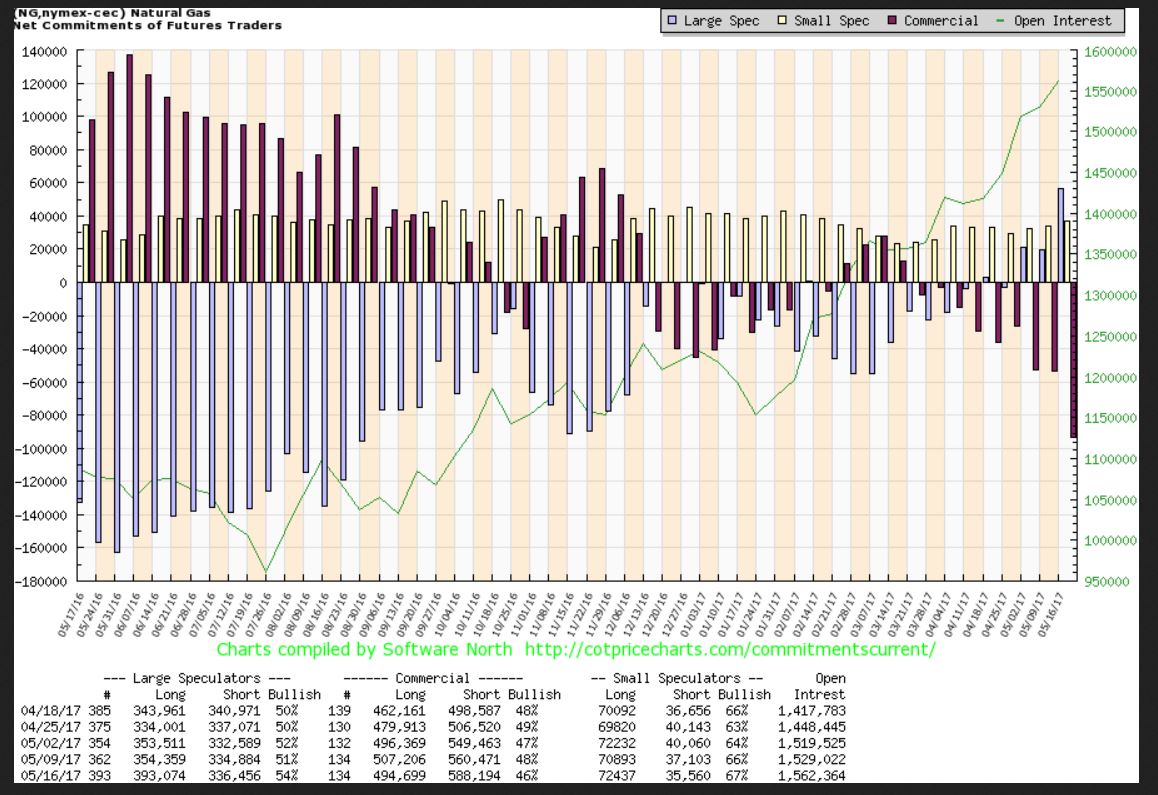

GOLDS COT is getting bullish again, but is not at Dec ICL levels yet.

SILVER – Amazing how the bounce stopped right to the 38% fib number. It ‘could’ tag the 50% & 50sma at $17.35ish, but I wasn’t really expecting it to get there.

SILVER – Honestly, this long relentless sell off did look more like a drop into an ICL for Silver, but since Gold held up very well while Silver crashed down, I still expect Gold to drop into an ICL

SILVER WEEKLY – Silver also looks like a shake out / recovery on a weekly chart. A spike in volume makes this bullish looking too. Occasionally I get mixed analyses as things play out like this and it leaves me patient and watching for follow through one way or the other. Basically Silver looks like it crashed to a low, Gold does not.

GDX – Read the chart. Miners had 2 steep sell offs, one in Feb and one in April. I played the DCL bounce and am Out of Miners now both long or short. I need time to watch things unfold, but I have to expect that unless GDX bursts through the 200sma, this is resistance and will roll over into another sell off like the last few tags( ICL, possibly around the next Fed Meeting).

GDX – I drew in a sell off using the same length arrow as the Feb drop and it takes us to Dec lows. Miners are now already slightly overbought here. GDX may tag the 200sma & I may try to short that. Note: A strong break out above that 200sma is unexpected, but we have to say that if it happened, it would be a change in observation. Above that 200sma is where ‘shorts’ have stops, however a small break above the 200sma, like in February, is normal.

GDXJ – Same story here with the 50sma acting as resistance. The top of this daily cycle could be in, or a bounce & tag and drop.

So this is our weekend review with a few extra observations and some of the things that are in the back of my mind. There is still room to the upside in Precious Metals, as shown, but if the drop into an ICL is ahead, it is very limited and I may go short this week. I will add a few other charts that I found interesting at the end of this report. Monday I will have about 10 trade ideas and low risk set ups to consider. Have a great weekend!

.

If you think that this analysis , along with your own trading experience, would benefit you on a daily basis, why not sign up for a month or a quarter and give us a try? I think that a great buying opportunity is coming up in both the precious Metals and Oil / Energy, and my analyses will allow readers to capture some great %-Gains when that time comes. We did that last Dec at the lows in Precious metals. Stay tuned for updates along the way.

Chart Freak Premium

Chart Freak members receive up to 5 premium reports per week covering a wide array of markets. Come and join the ChartFreak community as we trade the new Gold Bull Market and various trending sectors.

PALLADIUM – This looks like a rising wedge that is breaking down. So we expect Gold to sell off, and Palladium looks like it started to also. That’s good.

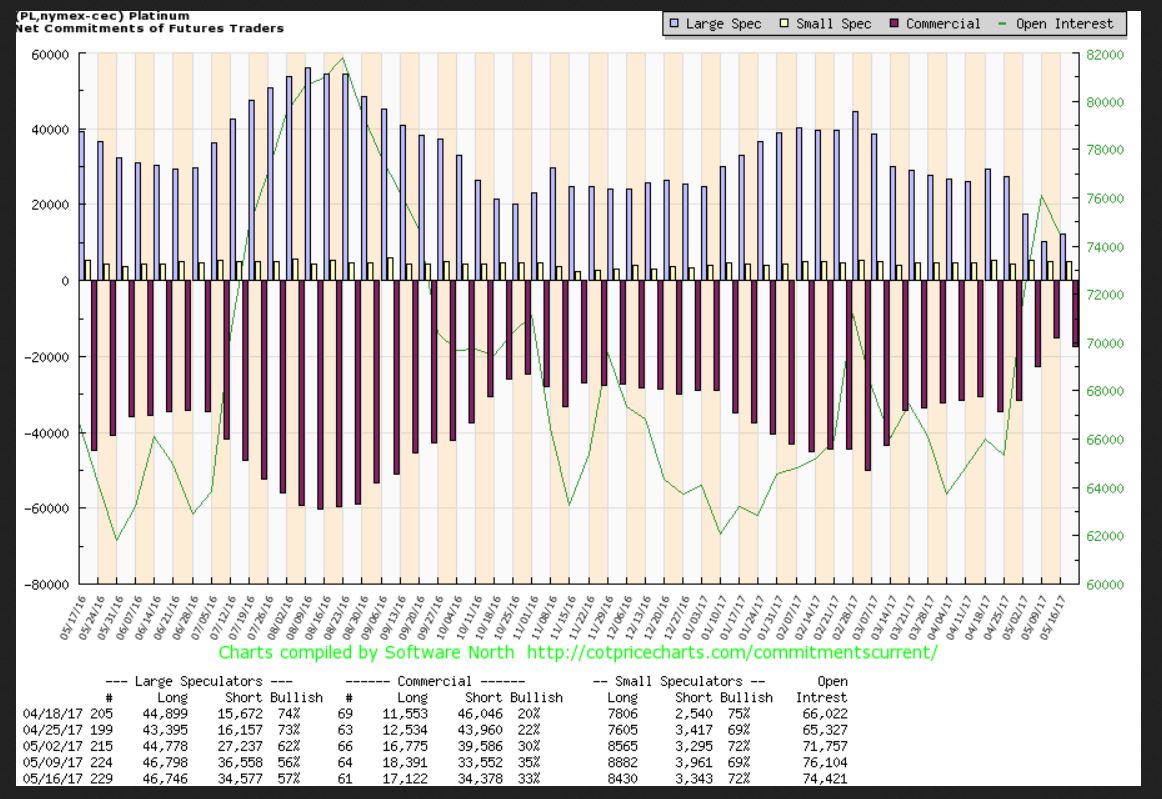

PLATINUM caught my eye.

PLATINUM CHART #1 – Somewhat related to GOLD & SILVER. Does it want to drop or break out here? A final drop would match what I expect for Gold.

PLATINUM CHART #2 – I could see PLATINUM drop into an ILC with a 1-2-3-4-5 wave move. This matches a final sell off in Gold, However…

PLATINUM COT LOOKS QUITE BULLISH – Smart money is barley shorting Platinum at this point, open interest has run higher. If I am seeing this correctly, Smart money is now less short Platinum than it has been for many years. Think about that, that could be very important. The relationship between Platinum & Gold is an interesting story in recent years. I remember ( And most woman that buy jewelry would too) that Platinum used to be MUCH more expensive than Gold. Platinum is now $940 and the Smart money has withdrawn there shorts. Hmm? Imagine if it plays catch up?

FROM MONDAYS REPORT WE HAD CLF & AKS to name a few trade ideas. They were actually mentioned in Fridays report, so this was an update of progress.

CLF MAY 17th – Coming off of the lows and breaking from a descending wedge…

CLF MAY 23rd – Now even regaining the 20sma for the first time in a while, a run to the 50sma would be a nice %-Trade.

AKS At the lows of $5.47. Maybe a run to the 50sma near $6.80. A good % trade.

AKS – a 10% pop on Tuesday

The 50 has crossed above the 200 day for gold and gold is holding a bit higher than the averages. It could rally from here if it can hold above 1250.

Miners getting HAMMERED today! I am up about 6% on a DUST play and climbing.

My juniors are up almost 4% today.

The kitco list does have 1 or 2 that are up a penny, a couple are even, the vast majority are down.

Miners are getting hammered today.

Im pretty much out right now, but i do own a couple, one i own is up 20% today, sounds good, but its up a whopping 1 cent.

I think its a tuff market to play,……. cryptos has been the place to be, obviously.

$100 in bitcoin in may 2010 is 73 million today, all ya had to do was hang on.

PMs and other resource or the dow doesnt even come close to comparing

The REAL smart money has been in cryptos.

We keep hearing about “smart” money. lol

REAL smart money knows that 20% is 20%. What matters is the volume and whether or not you can lock it in.

When you look at the caliber of people promoting bitcoin all over youtube, it is crystal clear that dumb money is taking it higher.

The performance of BC since 2010 means nothing. Those who bought it were gambling and they know it whether they were smart or dumb. Even if it were a stock with something to analyze, one win does not make someone “smart money.” You get to be smart money when you have a history of more wins than losses.

Leave it to you to call Warren Buffet dumb money. El-oh-El

“The future of the cryptocurrency industry is still clouded with doubt since Warren Buffett (Trades, Portfolio) has been one of the biggest critics of the market. Bitcoin is, by far, the leading unit in the cryptocurrency market and based on Buffett’s comments over time, it is fair to say the legendary investor does not value it at all, let alone imagine a bright future ahead.”

https://finance.yahoo.com/news/warren-buffett-wrong-bitcoin-205400770.html

Im certain anyone making the money they have from getting into bc early are not too concerned about being called “dumb” by gold bugs.

I didnt run across it until it was $2 cdn.

Gambling on it…for sure, is there anything in markets that isnt?

The bc gamble paid huge.

Of course they’re not concerned about being called dumb money, why should they be? I’m just attempting to educate you on what smart money really is and I’m sure I’ve failed.

You’re hopeless if you think Vegas odds are the same as mine with the miners.

Your funny Mat.

Nobody mentioned Vegas tho.

Yes, there are ways to make odds more favorable, as in poker (since ya mentioned vegas)

when a pot pays 10-1 and your draw odds 5 to 1,(once youve determind the hand actually wins should ya hit) the 1 time you hit, pays, a winning bet.

= odds in your favor.

We had a fellow here, for awhile, that explained the same thing with ponies.

Gold bugs like to use the word “speculate”, its still gambling.

“Smart money” is a smart bet, pure and simple, the markets a gamble.

We gamble the whole thing doesnt just shut down, accounts are not “hacked”, mines dont collapse, management tells the truth (big one) on and on.

We look for big payoffs is why we gamble and bc paid huge, infinitely superior to mining shares since 2010 May, as long as you were in early.

Im sure your familiar with getting in early.

I have no idea why you would argue the point that bc was the place to be.

Alot easier simply to say, “I didnt see it,I missed it”

I do think someone should make you a corporal, you can defend an indefensible position.

Thx for explaining “smart” money tho.

If done right, speculating is nothing like what most people call gambling. It’s really more like driving a car – a little effort and know-how goes a long way toward keeping you out of trouble.

If your definition of gambling is too loose, then practically everything you do is a gamble and the word is no longer useful.

Miners up nicely today. DUST down over 4% and falling.

My gdx got sold out early as the advanced dashboard screen prices were frozen for a while gdx started a spike up.

excellent chart work, unfortuately Robert is not aware of the importance of $yen and Tnx 10yr money that are key to golds trend not the US$ as he waits for the $ and gold to reconnect yet $ yen and gold have never disconnected in ten years

The dollar and gold don’t have to reconnect. The two can rise together easily.

It’s funny that the yen is down 80% vs gold since gold bottomed about 15 years ago despite the correlation. Yet people still think it’s a safe haven.

exactly my point Matthew. Robert thinks they must trend in opposite directions for guidance but both have and will rise and fall together at times yet we dont know when that action begins or ends (reasons why) yet no guess work with $yen…..dont get hung up on labels as Wall St suggests safe haven trades its more a function of global positions held in $yen which provides the liquidity these big players need.

The labels that so many talking heads use to explain away any and all market moves are just funny.

Regarding the last gold chart above, it’s the 233 week MA that’s been capping gold for the last 11 months…

http://stockcharts.com/h-sc/ui?s=%24GOLD&p=W&yr=1&mn=9&dy=0&id=p82298357834

if you blow that chart out 20 years you will see the 233 was resistance back thru 96-2001…a trend line off the 2011 high across the 2012 high has the 2016/17 highs all capped

Danielle Dimartino Booth on Trump’s budget:

The Canadian dollar continues to improve:

http://stockcharts.com/h-sc/ui?s=%24CDW&p=D&yr=1&mn=5&dy=0&id=p00389392149&a=521484960

I do really appreciate your charts! I live in Arizona, but keep some $$$ at BMO for use…whenever. Would like a stronger C$, but don’t see it with the current government unless the resource sector really takes off.

I’m not extremely bullish but I do think that the C$ will do much better than most expect — and probably soon.

http://stockcharts.com/h-sc/ui?s=%24CDW&p=W&yr=4&mn=2&dy=0&id=p06727604659

USD/JPY up. Gold down.

your on it David weaker yen weaker gold….US ten year is the reason driving yen-gold

KDX buyers are likely to get a better deal very soon:

http://stockcharts.com/h-sc/ui?s=KDX.TO&p=W&yr=4&mn=2&dy=0&id=p91993995210&a=519193700

Good. I’ve been waiting for GDXJ selling to subside and for a good entry point. I was in and out in a few days last month, but still believe this looks like a nice optionality producer. Waiting for the carnage to run it’s course though….

The 233 Week EMA looks like a good spot, or the 61.8% Fib retracement level.

SLV:GLD weekly is trying to get through MA resistance:

http://stockcharts.com/h-sc/ui?s=SLV%3AGLD&p=W&yr=3&mn=0&dy=0&id=p98483107966

Watch the May 10 gap:

http://stockcharts.com/h-sc/ui?s=GDX&p=D&yr=0&mn=5&dy=13&id=p75127885665&a=525589600

A modified Schiff fork based on gold’s 2011 top:

http://stockcharts.com/h-sc/ui?s=%24GOLD&p=W&yr=6&mn=5&dy=22&id=p33108126716&a=452999702

FOMC minutes today which could effect US 10 year TNX and result in a further weakness of $yen gold or reverse the trend we will see

If the action of 2003 and 2010 are any guide, then silver should do very well in the year ahead.

http://stockcharts.com/h-sc/ui?s=%24SILVER&p=W&yr=7&mn=7&dy=0&id=p47619534526&a=521147109

K92 Mining Discovers High Grade Extension of Kora Deposit in First Completed Exploration Hole

Marketwired – May 24, 2017) – (KNT) (KNTNF)

> 5.4 metres at 11.68 g/t Au, 25.5 g/t Ag and 1.33% Cu including 0.75 metres at 71.94 g/t Au, 168.7 g/t Ag and 8.51% Cu intercepted in first completed exploration hole targeting extensions of the Kora Deposit

> Intersection reported is above the average grade and thickness for the Kora Deposit and is approximately 500 metres along strike and 150 metres down dip from the closest point of the currently defined Kora Deposit

> Kora is a large and high grade deposit, open for expansion in every direction and strongly mineralized at the extent of all drilling, with a current Inferred Resource of 4.36 million tonnes of 7.3 g/t Au, 35 g/t Ag and 2.23% Cu

Galane Gold has remained extremely well-bid following yesterday’s news and subsequent high-volume big gain…

http://stockcharts.com/h-sc/ui?s=GG.V&p=W&yr=3&mn=3&dy=22&id=p52707982557&a=525523030

That was an interesting acquisition for GG.

The market sure likes the idea!

Congrats Matthew. Looks like a few of the stocks we both hold in the small Gold producer category ended up having a nice green day:

Ticker – Small Gold producer – % Gain today

GG.V Galane Gold Ltd. +16.67%

MYA.V Maya Gold and Silver Inc. +11.54%

RZL.V Rizal Resources Corporation +10.00%

MLN.V Marlin Gold Mining Ltd. +9.72%

SGN.V Scorpio Gold Corporation +7.14%

KNT.V K92 Mining Inc. +6.38%

TMM.TO Timmins Gold Corp. +4.84%

PG.TO Premier Gold Mines Limited +3.60%

WDO.TO Wesdome Gold Mines Ltd. +3.22%

GSS Golden Star Resources Ltd. +0.91%

GORO Gold Resource Corp +0.84%

ORA.TO Aura Minerals Inc. +0.57%

SFR.AX Sandfire Resources NL +0.16%

Some of the Mid-Tier Gold producers also did OK today:

Ticker – Mid-Tier Gold Producers – % Gain today

DPM.TO Dundee Precious Metals Inc. +7.08%

PAF.L Pan African Resources PLC +3.13%

PPP Primero Mining Corp. +3.11%

EDV.TO Endeavour Mining Corporation +2.86%

BTG B2Gold Corp. +2.49%

AR.TO Argonaut Gold Inc. +2.48%

RIC Richmont Mines Inc. +2.14%

IAG IAMGOLD Corporation +1.86%

MUX McEwen Mining Inc. +1.82%

PRU.TO Perseus Mining Limited +1.72%

MND.TO Mandalay Resources Corporation +1.64%

AGI Alamos Gold Inc. +1.59%

CGG.TO China Gold International Resources Corp. Ltd. +1.49%

GCM.TO Gran Colombia Gold Corp. +1.40%

EGO Eldorado Gold Corporation +1.18%

OGC.TO OceanaGold Corporation +1.16%

DNG.TO Dynacor Gold Mines Inc. +0.50%

SMF.TO SEMAFO Inc. +0.35%

TXG.TO Torex Gold Resources Inc +0.09%

The Advanced stage Gold Development companies also had some Green shoots today:

Ticker – Gold Development Stage – % Gain today

BEX.V Benton Resources Inc. +11.76%

GEO.L Georgian Mining Corporation +8.81%

AGG.V African Gold Group, Inc. +7.14%

THM International Tower Hill Mines Ltd. +6.84%

WKM.V West Kirkland Mining Inc. +6.25%

PLG.TO Pilot Gold Inc. +5.81%

HUM.L Hummingbird Resources PLC +5.18%

PVG Pretium Resources Inc. +4.38%

GOM.V Golden Dawn Minerals Inc. +3.64%

TMR.TO TMAC Resources Inc. +3.57%

MXL.V MX Gold Corp. +3.33%

GWA.V Gowest Gold Ltd +3.23%

GRR.V Golden Reign Resources Ltd. +2.04%

WAF.V West African Resources Limited +1.85%

CNL.TO Continental Gold Inc. +1.78%

NG NovaGold Resources Inc. +1.75%

PGM.V Pure Gold Mining Inc. +1.75%

GSV Gold Standard Ventures Corp +1.29%

XRA Exeter Resource Corporation +1.25%

ICG.V Integra Gold Corp. +0.89%

VGZ Vista Gold Corp. +0.66%

SA Seabridge Gold Inc. +0.48%

One correction is that (TMR) TMAC has now graduated up to the small producer category.

USD/JPY just headed negative and gold reversed to positive. Just sayin…

David $yen was at 112.08 and gold $1253 before minutes release then yen strengthened as yen hit 111.59 and gold $1257 …..and now yen is weakening back towards 112 as gold weakens to $1252….do try and keep up…you obviously dont have stockcharts which you should to have a valid opinion…US ten year move in the opposite direction after minutes reflecting yen golds move

Here are some thoughts that have nothing to do with charts. http://www.marketwatch.com/story/the-contrarian-investors-best-bet-is-coming-down-the-pike-2017-05-24

GCC looking very ugly on the weekly chart.

GG hanging on by a thread FWIW.

http://stockcharts.com/h-sc/ui?s=GG&p=W&b=5&g=0&id=p23885382147&a=525745210&listNum=1

Right now the miners are looking ugly as hell. Late 2012 ugly. Again, even if this is a new bull, look what the $sugar bull did between 1999 and 2002–basically a powerful, quick move up in 1999 followed by a near full retracement going into 2002. It took until 2005 before the peak reached in 2001 was taken out. I actually think it is the closest analogue to what we might see in the miners given the declining 50 month MA and death cross on the monthly chart.

Speaking of UGLY on the chart…… Check out (Robert Friedland’s) Cordoba Minerals:

I decided to finally pick some up today while it’s on clearance sale 😉

http://stockcharts.com/h-sc/ui?s=CDB.V&p=D&b=5&g=0&id=p00133221911

Wildcats U G L Y

Actually, I just deployed some dry powder in a number of stocks. Some are just looking too intriguing at these low valuations.

OK – I just finished reshuffling the deck in about a dozen companies.

Commence o festival!

Would love it if we could see the metals and miners fly higher from here. I just can’t see it happening. A first step would be to take out 1265, which I don’t think is going to happen for months.

Look how the 200 and 50 week EMAs have bound the price action in $CDNX over the last year. For the love of god, can it stay above the 50 week EMA, or at worst tag the 100 week EMA intraweek?

http://stockcharts.com/h-sc/ui?s=%24CDNX&p=W&yr=2&mn=0&dy=0&id=p68028401443&a=525747438&listNum=1

This doesn’t give me warm fuzzies:

http://stockcharts.com/h-sc/ui?s=ISVLF&p=D&yr=2&mn=0&dy=0&id=p73267776113&a=525749857&listNum=1

Well, Impact has sure been waaay more resilient than most of the Silver stocks. Thank goodness it wasn’t entangled in the $GDXJ madness.

Personally, I’m still very constructive IPT and believe they’ll continue to outperform most of the larger producers, and will keep pace with the higher torque smaller producers like EXN, ASM, SCZ, USA, and the developers like AXU BCM AUN and BHS if we get a turn to the upside in the Silver pricing later this year.

It looks like a healthy consolidation masquerading as an ugly head and shoulders top…

http://stockcharts.com/h-sc/ui?s=IPT.V&p=W&yr=4&mn=2&dy=0&id=p21582127681

I agree with the healthy consolidation part, but it looks more like a compression triangle to me. The question is will it break out or break down?

It also looks like a big bull pennant (which is typically bullish for another breakout leg higher). It’s just hard to get enthusiastic with the miners under so much pressure across the board.

When does Impact’s exploration program kick off this year. We need some nice drill results to hit the market soon.

If I’m right about the healthy consolidation, then a breakdown should not be dramatic.

All things considered, I am not worried at all, and a move into the .50s would be fine with me.

It would be good to see it hold above the Dec 19th low of $.55. I’m old school with TA and still like to see higher lows and higher highs. 🙂

In this case, I don’t think it will fall apart even if it takes out that .55 low.

I’m going to try to paste your chart that I annotated with the compression triangle, and it would make me jollier if we stayed inside of it and then broke to the upside on the next move up in the metals.

Not sure if this will work but here goes…..

http://cdn.ceo.ca/1cibrdp-IPT.V%20-%20SharpCharts%20Workbench%20-%20StockCharts.pdf

I think you’re better off using it’s “real” listing on the TSX-V.

http://stockcharts.com/h-sc/ui?s=IPT.V&p=W&yr=4&mn=2&dy=0&id=p85123437487&a=525754307

IPT is still above it’s Dec 2016 low, so even that fork resistance has kept it contained, it is still putting in a higher high if things take off from here. That’s more encouraging that some of the mid-tier Silver producers for sure.

David for you and your gata buds…..if the 10 year trend in yen gold is about to change it would take an opposite direction confirmation on the weekly chart comparison which its not done for 10 years ….correctly nailing golds trend yet gata is right about gold for maybe 10 hours….here is a simple chart you can follow showing yen in red gold in gold and tnx in green….if anyone thinks the $yen market and the 10 year money can be manipulated you have no clue about markets…1 divided by 89.59 will give you 111.61 depending on how you look at yen vs US$

I bought a bunch of PPP today at an average of .44253

It made a new low before reversing and now looks good to go…

http://stockcharts.com/h-sc/ui?s=PPP&p=D&yr=1&mn=0&dy=13&id=p89951092796

I bought some more (PPP) yesterday at a little over $.45 but still need a nice 40% move up from here to get me back above water on Primero.

I was wondering if anyone else was picking up PPP. With today’s addition, it’s now my second largest holding, behind IPT. Tempted to grab some more.

I may need to rotate some profits on other shares into PPP to average down one more time, but am considering waiting until closer to the June 17th rebalance date in GDXJ to see if there is any remaining selling that must be done.

This is going to be one hell of a turnaround story a year from now 🙂

Oh, love those comments………….

Thanks all for your comments on PPP. I have position average in at about 58 cents & think I should a add a bit down here someplace :>)

THE TREND IS YOUR FRIEND. And right now the trend is Crypto. I banked 2% net average this week on USLV, DUST, and AGQ. My TLTFF, ASM, PALAF, and UWTIF along with other trades are not moving. On Crypto I am sitting on 60% profits with stops in place. The trend is your friend.

Jason – Paladin has major economic issues (as I had previously mentioned before it was halted, released, and cut in half).

Avino was about 2% today. ASM will do just fine one the Silver miners get moving again.

Hey, at least one person agrees with me.

The last time jr mining paid (as far as Im concerned) was Jan? 1/2 shares I was in paid 2500% in what? 2 weeks, a month?

right after that was real quick profits in potshares.

Since that time miners and pot have been just about dead.

(other than some up and down of some shares)

A traders dream I guess.

January 2017 bc price was 800-900, today about 2200?

Trading not required.

no shock b this is a pm promotional site as who here enjoyed the awesome gains in US equities these past 8 years as crash and top calls we made at every pause always buying the pm or as doc says nibbling away….these guys either have insanely deep pockets or an investment/position is considered holding a $1000 worth of shares….nobody ever shorts the pm sector regardless of being so called chart experts who only see buy buy buy yet pass up on great gains during declines….your a lone wolf here b

That’s simply not the case. There have been plenty of times where traders here discussed shorting the Miners, shorting Oil, or shorting the General Equities when the charts were set up for it.

Shorting the miners worked better in the bear markets than it does now in the Bull market that started in Dec 2015 in Gold or Jan 2016 in the PM miners. In a bull market, most traders would be better off buying the dips and accumulating on weakness, so that is why Doc and wise investors are “nibbling” into the weakness.

There are also plenty of people here that have money in the general markets or other sectors besides just Gold and Silver. You are correct that the site focus has been on PMs for about a decade as are most of the show Sponsors (ding ding ding). It helps to have a focus for any website, even if the general macro trends in Currencies, Bonds, and the General markets are regularly reviewed. There a tons of venues for discussing the S&P 500 or DOW, but very few for reviewing the Junior Miners and the KER shines years later because it meets a need for investors.

how many audios have been based on short positions in the miners even back in the day when it was obvious on the charts off the 2011 highs … how many charts have you or Matthew posted proving the negative trend in the miners as huge gains were made being short. How many audios have you heard suggesting yet another crash in the $ or US equities ….many miners made their lows way ahead of gold or silver so waiting for confirmation the bull has returned is pointless….theUS equity market has been in a clear bull market for years yet you guys speak of its demise over and over again so take your own advice and dont short a bull. Doc has been nibbling for years.lol…a need for buy only pm investors not true traders

There have been many interviews with Doc, Rick Ackerman , Chris Temple, Gary Savage, Peter Brandt, Chris Vermuelen, Rick Rule, Jeffrey Christian, or whoever that have been bearish on the PMs or Bullish on the general markets for periods of time.

We’ve posted plenty of bearish charts for the PMs or individual stocks, projecting where we thought support may come in after the downtrend played out.

Personally, I have plenty of money tied up in the general markets in Mutual Funds and Blue chip stocks in my retirement account, and have been very happy to see that account grow in value coming out of the 2008-2009 market meltdown. You’d be hard pressed to find any posts where I was claiming we weren’t in a bull market in the general markets and I only shorted the markets or Oil or Currencies in very overbought conditions. They were trades not a philosophy or dogma.

Yes there are some contributors past and present that have been pining for the markets to fall apart, but I’d hardly call that the majority. It’s unwise to paint everyone with a broad one-sized-fits-all brush, and is out of touch with the commentary from the guests or on the blog. This isn’t KWN after all.

Again, there has been commentary about Bonds, various Currencies, specific high-flying Social Media or Restaurant stocks, Tanker companies, Oil producers, Oil service companies, REITs, Biotech stocks, Tech stocks, Identity Theft stocks, Agricultural stocks (Fertilizers & Soft Commodities) Uranium, Lithium, Solar, Wind, Geo-thermal, Hydro electric, Emerging Markets, Base Metals, Specialty Metals, Real Estate, etc… I’d hardly call that only investing in PM stocks, but then again, I actually listened to most of the shows and read most of the comments on here the last 6-7 years.

The focus of the show Sponsors has been and still is clearly the Jr Miners, so much of the discussion revolves around that. To assume everyone is only buying Gold or Silver stocks those is fallacy.

Experts are Hilariously Bad at Forecasting Solar Installations

JEFF DESJARDINS – May 24, 2017 – The Visual Capitalist

http://www.visualcapitalist.com/experts-bad-forecasting-solar/

J, other than to hedge larger long positions, I’ve never have been very interested in playing the short side of any asset class. I do it here and there but betting on the success of a company has always been more appealing to me. There are always long-side opportunities if you look for them and long bets have unlimited potential gains.

I nailed the big lows in the miners throughout the bear market and had several multi-baggers (in addition to 20 – 60% repeated gains trading GDXJ) including Primero warrants (700% in a few months), Constantine (500%+/- in less than a year, and I bought a lot of Claude at well under 20 cents — to name a few.

More importantly, I knew it was a cyclical bear and not a secular one. So, while most people were freaking out and selling out, I traded the short term and kept positioning for the longer term. That paid off hugely last year and I don’t know anyone, expert or otherwise, who came close to my gains on a portfolio that always had between 12 and 18 companies during that time.

Conventional stocks are fine if “gambling” isn’t your thing but how long do you think it might take for most S&P investors to make five to seven times their money? (From January 2016 to January 2017, my whole portfolio went up nearly 7x and is currently over 5x.)

I’m a trader Matthew therefore I trade both sides and have made 500% gains from long and short positions in pm’s and energy using leverage over the years as I dont care about bull or bear market labels just making money. I bought a 6fig position in IPT starting at .15 with my last purchase at .30 everything else I trade but I don’t need to brag about my success or make

a point of posting my previous comments that later prove my opinion was correct….you should sell some shares and get a life coach to teach how to deal with your conceitedness and learn some humility as we have a skill that few traders do but I dont need to tell every cyper stranger that comes along how great I am…..you must be a lonely individual

You shouldn’t be so sensitive, J. Only small characters are envious of others’ successes. I wouldn’t be turned off in the least if everyone here reported that they made a ton of money.

I’m sure you have made 500% gains but I was talking about the whole portfolio. My “bragging” was in response to your silly criticism. The point is to make money and it’s easier to make big money from the long side if you’re a speculator in the junior miners.

It looks like you’re the conceited one with your attitude that only your way is the right way.

right back at you Matthew why so sensitive always feeling the need to highlight your success…signs of insecurity, oh look at me! I’ve been a professional trader since the 70’s and there is a code of humility amongst pro traders you obviously are an amateur.Traders trade from both the long and short side removing allegiance to a one dimensional approach. Such an amateur response suggesting its my way or the highway while professionals respect what works. Do you actually read what you write. my god what an ego…you must be american…typical in every measure…..you continue to enjoy being the big fish in your little pond

This site is about making money, JJ, so track records matter if you’re going make market calls. It’s that simple. Call it bragging if it makes you feel better, but I’m not going to tip-toe around those who insist on being offended.

P.s. – You’ve been trading since the ,70s but still blew it like everyone else in early 2013 when gold plunged. Or did you forget?

One more thing. If you were paying attention in recent months, then you know that I also pointed out, at least twice, that Galane Gold was my biggest blunder of last year. It dropped another 40% after I had already accumulated 1.5 million shares. Was I bragging or disclosing part of my record?

Don McAlvany interview (David McAlvany’s father)

lol, thats funny j, but true I suppose.

There were some people here that shorted gold, they got “run off” tho. lol

“We dont need their kind around here”, so funny.

You’re imagining things, b. No one was “run off’ for shorting gold, the miners, or anything else.

B that narrative is just plain silly. The people that were run off this site like crazy Mark, Franky, Heavy Hitter, and birdbrain were not shorting gold, and that had absolutely nothing to do with they got booted. JTL left on his own accord after insulting the hosts and everyone on the site.

It was their complete lack of respect towards the community here, personal attacks on the posters and the speaking guests, the constant name-calling, and negative and trashy comments that got them blocked.

* Have you noticed there has been hardly any drama for the last year and 1/2 since the problem posters went bu-bye? Good riddance to them.

BTW – There are a number of posters on here that have mentioned shorting the Miners or Oil or the General Stock Markets if there is a good setup on the charts, so there’s never been an issue with shorting any sector. The market moves in 2 directions and can be traded either way.

Lastly, there have been plenty of comments for years from a number of contributors discussing many other sectors besides the precious metals….(like Oil, Lithium, Uranium, Agricultural stocks, Renewable energy, Biotech, Emerging Markets, Bonds, Currencies, etc..). However, most of the sight sponsors are Precious Metals companies so clearly that has been the focus for almost a decade.

Great entry points for JNUG and JDST:

http://www.trendlinemagic.com/2017/05/jdst-this-time.html

Such shallow angles are also found in daily and weekly charts, though usually not as dramatic.

Meaning daily and weekly stock charts, not just ETFs.

Around 9th May 2014, Gold averaged about 1300.

On that date the Dollar Index bottomed at 78.91.

Gold is now at about 1260, about 97% of 3 years ago.

The Dollar Index is at 97.05 now, 23% above 3 years ago.

Effectively, over time, the Dollar and Gold are rising together!

Iron ore price drops to 7-month low

Frik Els | about 2 hours ago

Shell speeds up exit from oil sands, selling stake in Canadian Natural Resources

Cecilia Jamasmie | about 11 hours ago

http://www.mining.com/shell-speeds-exit-oil-sands-selling-stake-canadian-natural-resources/

Silver price: Hedge funds and retail investors part ways

Frik Els | about an hour ago

http://www.mining.com/silver-price-hedge-funds-retail-investors-part-ways/

Workers block access to First Majestic’s La Encantada mine in Mexico

Cecilia Jamasmie | about 9 hours ago

http://www.mining.com/workers-block-access-first-majestics-la-encantada-mine-mexico/

This was an interesting read from across the pond.

BitMania: Why Cryptocurrencies are Having a Bubble

‘Bitcoin is a classic mania’

Criminals selling drugs on the darknet will see the currency delivering the same kinds of profits today as the sale of cocaine. But will it deliver the same rush, and the same addiction – and will it end with cardiac arrest?

There is no doubt that bitcoin is right now exhibiting all the signs of being a bubble. Indeed, this appears to be part of the attraction. Joshua Rosenblatt, a US based lawyer and bitcoin investor, said: “The returns have been unreal and there’s an aspect of not wanting to miss out on a bubble.”

Adam Button, a currency analyst with ForexLive.com, is clear. “Bitcoin is a classic mania. There is no fundamental underpinning for it, other than it’s a compelling technological story. But the only people using bitcoin are nerds and criminals, and far more the second category than the first category.”

The South Sea Bubble

Charles Haytar, the CEO of market analysis platform CryptoCompare, agrees. “Lots of inexperienced investors are surging into the market, and it’s causing a bit of a bubble” he said, before making a comparison to the South Sea Company.

Investment bubbles are indeed as old as capitalism itself. They have been a recognised menace since the Dutch Tulip Bubble ruined the foolhardy of Holland in 1637. The price of a tulip grew 20-fold and eclipsed the price of a grand manor house before suddenly collapsing and losing 99 percent of its value.

Then followed the South Sea Bubble when a single firm was granted a monopoly in trade with South America by the British state. Shares in the South Sea Company lept from £128 in January 1720 to £1050 by the following June, before suddenly collapsing and causing an economic crisis.

The Value of an Ounce of Gold

In living memory we have also experienced the dotcom bubble. The NASAQ Composite rocketed from 500 in early 1990 to 5,000 in March 2000. And then the index crashed in October 2002, causing a recession. And then of course the 2007 collapse of the housing bubble.

The question for investors, large and small, is, where are we in the Bitcoin bubble cycle? Can money still be made? The question for the rest of us is, how important is bitcoin and how might all this affect us?

The growth of Bitcoin in the last few months is phenomenal. In March, the price of a single coin exceeded the value of an ounce of gold, according to the BBC. Since then it has nearly doubled.

https://www.opendemocracy.net/neweconomics/bitmania-cryptocurrencies-bubble

Well Steele, as I speak it is now more than double the price of an ounce of gold. This bitcoin business is off the charts. Talk about a mania being chased higher by late comers. Rob Moriarty suggested a couple of days ago that this is destined to crash and burn like all other bubble investments. I agree, its just a matter of how high this gets before it comes back to earth. $5000, $10,000?… surely not in the immediate future?

Since Sunday, its gained over $700. WOW!!!

Yes, markets tend to go to extremes, then double from there. And these cryptocurrencies always thrive when there are capital controls. Who knows how high bitcoin could go. The demand for alternative currencies vs. traditional financial assets is not just a passing fad.

Now………over $4000…………

Its a good point you make about demand for alternative currencies vs traditional ones. However, I tend to think that many in the bitcoin market at the moment are either part of the feeding frenzy at the top or using it as a convenient transaction vehicle for goods and services. Plus you cant discount the lure of anonymity for the illegal players across all corners of the globe.

“the lure of anonymity”…Reminds me…… like the advantage the FED has enjoyed for 100 yrs, like who are the owners of the FED…, Turn about is FAIR PLAY……. 🙂

Klepto maniac FED, vs….Crypto

Crypto currencies are not going away…….

I agree with STEELE on “this is not a passing fad”

What is interesting to me, is the fact Large corporations are now using them.

BITCOIN EXPLODES ……to $4000………in South Korea………..zh

I am making more money in one week than I can in one month on Wall St trading block chain.