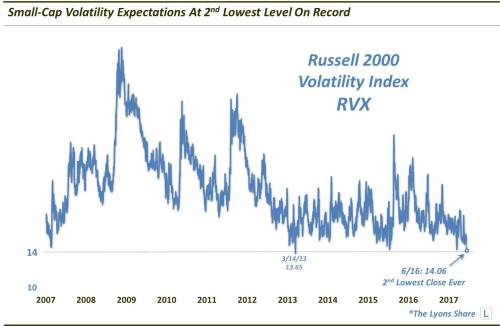

Volatility expectations in the small-cap space just hit their lowest level on record.

We are not the first to note that one of the hallmarks of the latest stage of the bull market in U.S. stocks has been extremely subdued volatility (the recent tech wreck, notwithstanding). Articles covering the historically low levels of the S&P 500 Volatility Index, or VIX, have been commonplace. Subdued volatility expectations are not unique to large-cap stocks, however. It has been a characteristic of other assets, like bonds and gold, as well as other areas of the equity space, such as European and small-cap stocks.

Specifically, regarding the latter, volatility expectations in the small-cap space recorded their 2nd lowest closing reading on record last Friday, based on the Russell 2000 Small-Cap Volatility Index (RVX). At 14.06, the only lower reading since the inception of the RVX in 2006 was 13.65 on March 14, 2013.

Now, it’s no secret that markets top amid low volatility. Such low volatility can correspond to investor complacency. However, it should also be well understood that low volatility expectations do not necessarily mean that a top is imminent. The low-volatility environment can persist for awhile prior to any serious price declines. So how concerning really is this all-time low in small-cap volatility expectations?

In a premium post at The Lyons Share, we take a stab at identifying just how much of a concern this RVX reading is by studying prior low extremes, in conjunction with other conditions in the Russell 2000, and notint the subsequent performance of the index.

If you want this “all-access” version of our charts and research, we invite you to check out our new site, The Lyons Share.

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

Here are a few press releases from Tinka to Zinc about….

https://www.tinkaresources.com/news