Is Bitcoin In A Bubble?

Jesse Felder has some comments about Bitcoin and it’s almost historic rise just this year.

I personally see why Bitcoin is getting more attention and is being viewed as another investment sector but the massive move up has some people questioning whether it can be sustained. We also have to consider what (or if) governments will step in and try to limit the use and value of cryptocurrencies in a broad sense. We need to remember that Bitcoin is still a relatively small market when compared to other currencies but it is quickly catching up…

Here are Jesse’s comments on Bitcoin. Click here to visit his site. Jesse has some great content on a wide range of markets.

Yes, Bitcoin Is A Bubble And It’s About To Burst

The popularity of trading Bitcoin has now reached the point where none other than the New York Times sees fit to declare cryptocurrencies, or more specifically initial coin offerings, “The Easiest Path To Riches On The Web.” Not to be left out, CNBC this week published a brief tutorial on trading crypto with your smartphone and MarketWatch featured a teenage bitcoin millionaire who now forecasts a $1 million price target.

These are exactly the sort of headlines and stories that characterize a speculative mania otherwise known as a “bubble.” For anyone who was around during the dotcom mania this should quickly bring back memories of all the folks who flocked to day-trading tech stocks. But to really understand the mania you need to look no further than the primary argument in buying crypto in the first place. Investors here claim the value comes from the limited supply. The trouble is there is an unlimited number of types of coins that can be created!

The coin universe keeps expanding https://t.co/1xcCACxaX8 by @VisualCap pic.twitter.com/69ONfdMeyc

— Jesse Felder (@jessefelder) May 28, 2017

What makes the “initial coin offering” craze that much crazier than the day-trading mania is that these are essentially nothing more than very thinly-veiled ponzi schemes. In fact, someone saw fit to to actually create a PonziCoin (at least they’re up front about it).

‘Unlike the IPO bubble, ICO token holders do not own any direct claim or share in the profits of these mechanisms’ https://t.co/ZhvKgn5ICn

— Jesse Felder (@jessefelder) June 19, 2017

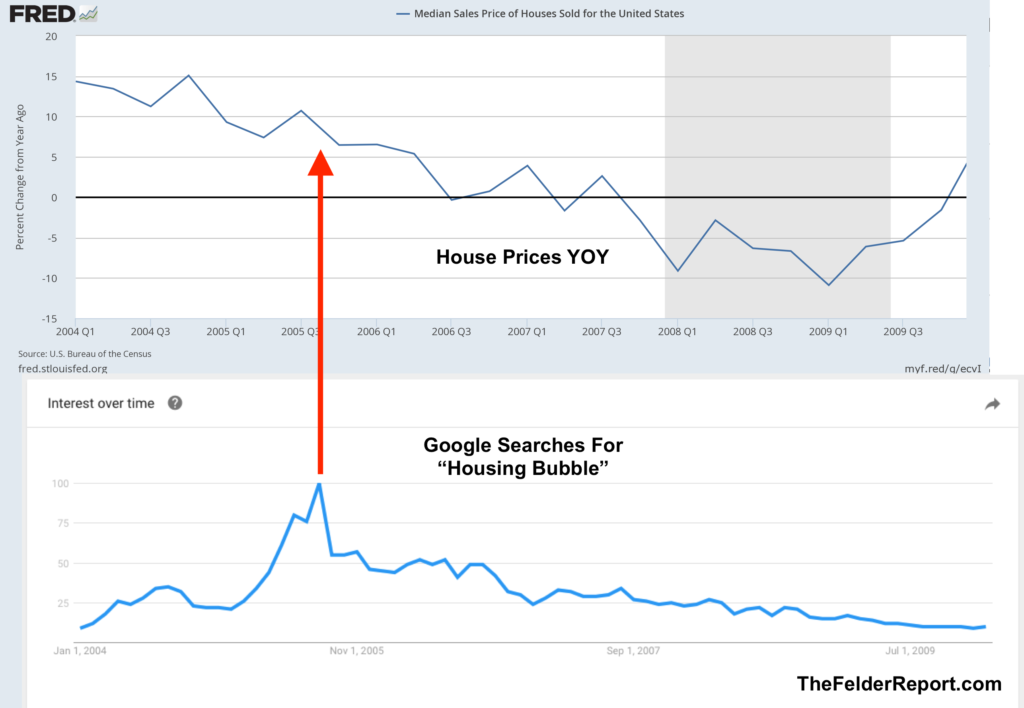

Now some will make the argument that it can’t be a bubble when so many are calling it a bubble. These folks should have learned this lesson during the housing bubble. The fact is it’s only a bubble once everyone acknowledges it’s a bubble. And by the time they do the game is up.

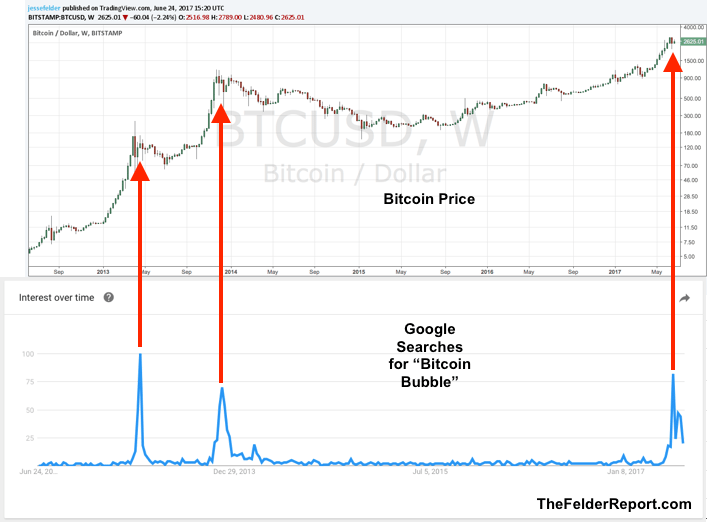

We’re seeing the very same thing in Bitcoin today. Crypto traders know it’s a bubble. Like every bubble (or ponzi scheme) they’re counting on a greater fool paying an even more insane price so they can realize a profit. But it looks like we may have already reached the point of maximum foolishness. Time will tell.

Header image via Bitcoin.org

Should I sell USAS and buy bitcoins?

NO!

Bitcoin has first mover advantage. All cryptos have fundamental or intrinsic value based on their utility.

ETH may have, at this moment in time the best blockchain platform, but BTC has the greatest current value as a method of transfer of value trans-nationally.

The speed of BTC is a problem which will lead to a soft fork or hard fork or both soon.

Until that happens other cryptos will gain relatively against BTC.

Perhaps Litecoin, or others may gain relatively.

The main problem with all cryptos is that governments will tend to enact laws against exchanges between fiat currencies and cryptos in order to retain national control.

We are, however, not even close yet to the peak of crypto use.

Good commentary CFS :

Also I think it should be said that crypto currencies are a direct reflection of a growing distrust of the coterie running the esoteric monetary systems of this world.

governments are looking into the block chain, Japan announced bitcoin would be accepted as legal payment, wont be long and they all will.

crypto is going to go ….forget the moon ..look to other galaxies.

who ever it was that said 1 bitcoin could end up at 1 million, he could be right.

Currency is going digital, we already see a cup of coffee cant be purchased with gold or silver.

Silver hoarders better hope for tech advances, is no way we gonna see a shtf scenario where silver becomes barter.

Well, unless we discover werewolves, ya need silver to get those guys.

No thing has intrinsic value. Intrinsic value is a make-believe property used by liberals to steal real goods from private property owners. For example, the intrinsic value of your specific possession is worth more than your life and, therefore, your rights; therefore, it may be seized to realize that higher value. Pure garbage.

Wayne:

Now that you have entered Liberals into the discussion,would you please take some time to explain what we would consider George H W Bush after he came out and supported Hillary Clinton for President?

I was referring to the fact that BC is not a physical thing that has a use. Commodities like gold and silver were valued for what they already were before they became money. Each commodity has obvious value based on what it is used for – whether it’s industrial or for food.

JohnK – Bush and all the neocons are lefties. They like big government and are just as guilty of transferring the people’s wealth to the state and cronies as any Democrat.

Both parties are made of collectivists who are happy to sacrifice the individual and his/her rights for the “greater good.”

Being “socially” left or right doesn’t matter if both parties are fiscally and economically left.

There’s No Political Freedom Without Economic Freedom

https://mises.org/library/there%E2%80%99s-no-political-freedom-without-economic-freedom

It is perverse and most likely by design that the first liberals would be considering the most right-wing by today’s standards. The classical liberal has to be distinguished from the modern liberal because the word “liberal” was hijacked and thoroughly corrupted by the latter. Modern liberals are tyrants while Ron Paul is an example of a classical liberal.

Mathew:

If Bitcoin doesn’t have any fundamental value ,are you telling us that intellectual property is therefore worthless?

What I am saying is that there is no way to determine what a fair value is for Bitcoin. We don’t know if three grand will be considered cheap one day or, conversely, if five bucks will be considered steep. Its price history is way too short to offer any clues so we’re stuck with price chart analysis. From that perspective, I think it is safe to say that there is a sentiment bubble of at least some significance right now. Whether we’ve seen THE top or just the first of many to come, we can’t know. Since human nature is the same, no matter the underlying asset or era, my guess is that it won’t make a new high for quite awhile, if at all. If I am wrong about that and it happens soon, and decisively, it would be extremely bullish as the implication would be that this is still just the beginning of a much larger advance.

Mathew:

Fair value is what the market is offering at the present time.

Future value is what the market is willing to offer in the future.

You are correct that traditional valuations will not work with cryptos as cryptos are not traditional.

This time you have to think out of the box.

This right here is akin to saying you’ve seen an alien spacecraft.

Re: “Fair value is what the market is offering at the present time.”

John, that’s the same as saying there’s no such thing as a bubble.

Re: “This time you have to think out of the box.”

That’s what people say at every major market top. What you are really saying is: “This time is different” – the most dangerous belief in investing.

“Stock prices have reached what looks like a permanently high plateau.” — Yale economist, Irving Fisher, just before the crash of 1929

Many were completely unafraid of the dot-com bubble because it was “a new paradigm” and “the internet was the future.” Both statements were true but tech stocks collapsed anyway.

In addition, when you look at the number of regular people pumping Bitcoin on youtube compared to those who understand markets, you have to be ready for a serious decline sooner rather than later.

“In the short run, the market is a voting machine, but in the long run it is a weighing machine.” — Benjamin Graham

Most investors investors do poorly because they never stop voting and start weighing.

Ditto on OOTB

Mathew:

Where was Microsoft before the internet?

Sure there was a dot com bubble,but also Bill Gates is a Billionaire.

This time is different. Crypto currencies are different.

What part of different don’t you understand?

If your perception of the market is not making you money,maybe it’s time to change your perception.

I am long Bitcoin and have been for over three years.

How about you?

John, you apparently don’t understand the context of “this time is different.” It was said in reference to market/human behavior not changes to the landscape. So, in the proper context, I hope you now understand that it is never different this time. Never.

P.s – my “perception of the market” has been phenomenal for my entire portfolio.

The four most expensive words in the English language are “this time it’s different.”

— Sir John Templeton

Value is extrinsic, it is assigned. People do the assigning. A sale is when two people, the buyer and the seller, agree to assign the same value.

Assigning the liberal moniker is pretty easy when you know the law or the Constitution. The Bushs have always been liberals. My favorite test is Marx’s tenth plank. If you are for public education, you are for gubmint skooling: letting gubmint goons with state-certified badges rock your baby’s cradle.

Wrong Wayne. The classical liberals were the most consistent with the constitution. The modern liberal is left but not liberal at all.

As for people assigning value, NO KIDDING! Do you think I’m speaking from the viewpoint of some other mammal? Life as you know it would end without food or even silver, hence, both have obvious intrinsic value (to humans!).

CFS – How do you value that utility? Unless there’s a way, you can’t use that metric to determine whether or not there’s a bubble.

BTC’s utility can be measured via the speed and cost of transferring a sum of money in fiat in one country to another fiat in a different country and in what can be bought by BTC.

For other cryptos their utility will depend more on what applications can be developed on their platform and what can be bought with that cryptocurrency.

An example of ethereum applications currently under development:

https://dapps.ethercasts.com/

You will be shocked by the number of developments and probably by the number of cryptos (>800)

So what’s a Bitcoin worth? Unless we have an idea, we can’t know if it is in a bubble or not.

Off Topic:

Greg Hunter’s weekly wrap:

https://www.youtube.com/watch?v=qJcbAEs3_f0

Back in January there was significant talk about Chinese use of Bitcoin to transfer money internationally, and ALSO of its promotion by the Chinese Government.

e.g. https://www.youtube.com/watch?v=ACsvjA0vDKk

There not many articles written about Chinese Government promotion of BTC, but it was clearly used by wealthy Cinese people to move their money out of China.

One of the problems with cryptocurrencies is these ease with which new cryptos may be started.

Many are simply get rich quick schemes, semi-fraudulent in their claims to utility.

Many, when first introduced can double in apparent value in a day.

e.g. Agoras tokens just went up over 150% in the last 24 hours.

Most new crpytos will fail ultimately, but the blockchain technology is here to stay and many tokens will survive for years.

Trade Volume

Trending

Currencies

Assets

USD

# Name Market Cap Price Circulating Supply Volume (24h) % Change (24h) Price Graph (7d)

56 Agoras Tokens Agoras Tokens $50,715,000 $1.21 42,000,000 AGRS * $6,555,430 153.32% sparkline

96 Quark Quark $23,959,980 $0.095801 250,101,047 QRK $4,190,410 39.13% sparkline

17 Gnosis Gnosis $379,557,007 $343.62 1,104,590 GNO * $41,596,100 34.64% sparkline

73 Viacoin Viacoin $37,764,491 $1.66 22,709,609 VIA $2,460,840 23.98% sparkline

22 Augur Augur $326,176,400 $29.65 11,000,000 REP * $4,728,390 9.46% sparkline

97 Skycoin Skycoin $23,306,494 $4.05 5,751,452 SKY * $154,233 8.52% sparkline

55 Asch Asch $51,653,700 $0.688716 75,000,000 XAS $1,818,750 6.88% sparkline

91 GridCoin GridCoin $25,747,176 $0.065965 390,312,753 GRC $490,863 6.24% sparkline

80 vSlice vSlice $33,589,503 $1.01 33,390,496 VSL * $228,446 5.21% sparkline

68 MonaCoin MonaCoin $40,410,858 $0.779650 51,832,050 MONA $195,117 3.72% sparkline

27 Byteball Byteball $229,306,297 $897.51 255,492 GBYTE * $922,503 3.28% sparkline

44 PIVX PIVX $103,507,481 $1.93 53,740,528 PIVX * $706,260 2.95% sparkline

88 Blocknet Blocknet $28,586,523 $7.22 3,956,815 BLOCK * $125,029 2.88% sparkline

92 TokenCard TokenCard $24,921,781 $1.05 23,644,056 TKN * $446,879 2.82% sparkline

54 LEOcoin LEOcoin $52,436,513 $0.610969 85,825,161 LEO ** $301,812 2.68% sparkline

90 EarthCoin EarthCoin $28,441,957 $0.003043 9,346,468,332 EAC $3,087,610 2.54% sparkline

95 Quantum Quantum $24,215,180 $0.293681 82,454,023 QAU * $93,742 2.32% sparkline

7 Dash Dash $1,353,229,120 $183.02 7,393,806 DASH $47,468,100 1.88% sparkline

84 Etheroll Etheroll $31,807,391 $4.54 7,001,623 DICE * $73,380 1.71% sparkline

28 Ardor Ardor $226,039,620 $0.226266 998,999,495 ARDR * $4,258,610 1.20% sparkline

5 Ethereum Classic Ethereum Classic $1,788,789,434 $19.21 93,104,047 ETC $123,211,000 1.08% sparkline

20 BitConnect BitConnect $355,661,666 $52.25 6,806,622 BCC $2,380,660 0.68% sparkline

13 AntShares AntShares $467,997,500 $9.36 50,000,000 ANS * $55,679,700 0.34% sparkline

32 Komodo Komodo $179,401,370 $1.78 100,945,510 KMD $310,742 -0.16% sparkline

51 Lykke Lykke $61,057,715 $0.376333 162,243,850 LKK * $605,843 -0.20% sparkline

31 Tether Tether $216,313,471 $1.01 214,980,591 USDT * $68,909,900 -0.75% sparkline

4 Litecoin Litecoin $2,151,733,968 $41.55 51,781,757 LTC $244,514,000 -0.80% sparkline

3 Ripple Ripple $10,234,828,460 $0.267288 38,291,387,790 XRP * $70,042,300 -0.85% sparkline

30 MaidSafeCoin MaidSafeCoin $216,808,357 $0.479079 452,552,412 MAID * $2,161,970 -1.02% sparkline

35 Nxt Nxt $166,049,781 $0.166216 998,999,983 NXT * $7,529,000 -1.23% sparkline

1 Bitcoin Bitcoin $41,683,151,328 $2538.67 16,419,287 BTC $851,991,000 -1.31% sparkline

As usual the table did not display correctly, but the “column” at the right side gave the % gain in the last 24 hours

Project veritas on CNN with Stefan Molyneux:

My teenage friend is intobitcoin and has mined one. then he bought and sold fractions of Bit . he also likes ETH ripple , and dash . I almost bought dash at 25 , but i was to nervous to buy. SOME USERS ARE drug kingpins . But most are in tax avoidance or wealthy transfering money out of weak curency countrys . I can see tax suthoritys trying to ban or tax coins , but there is no way for them to know who is trading now. S

There is a way to know who is trading cryptocurrencies.

All first world crypto exchanges are keeping track of identities, internet addresses and bank accounts of their users.

Do you seriously think any major exchange in the U.S. would not give up that information when hit with a government subpoena?

Individuals, on the other hand, cannot track or know with whom they are dealing.

The situation is ripe for undercover government scams to track bigger dealers; just wait for the I.R.S. to do so.

I would be shocked if a subpoena is necessary.

The last time there was a significant pullback in Bitcoin,the price retraced to around $670.00.

The question now is not how much Bitcoin will appreciate,rather will Bitcoin pullback to a level below $670.00.

This latest rise was pretty predictable, as defined in Japanese candle sticks theory,breakouts usually have three surges until a pullback.

bitcoin has definitely been a more profitable place to be than pms John.

The banks are playing anyone who thinks a crypto currency we be left alone, unless they are in control.

b:

You are correct .I have found that this can be a pretty tuff site to be bullish cryptos.

Some times it gets a bit much for me.

That’s ok, to each their own.

JohnK – it shouldn’t be tuff to hear an honest opinion. Any chart that looks like BC’s should cause a bull to be concerned.

D.T:

I got played alright.

All the way to the bank.

That’s not true unless you’ve sold some.

Mathew:

Of course your right.

Just having some fun with D.T.

You know that I don’t own Bitcoin for myself.

The chart for Bitcoin is steep and if you read my previous posts you will see that I expect a substantial pullback.

At that time I’m sure you’ll be at the front of the parade proclaiming the crash,along with everybody else who doesn’t own any crypto proclaiming their genius for not buying any.

Long term that will not change my view on the cryptos.

Well you have it wrong, John. Whether BC crashes or continues higher doesn’t change the fact that it is an extremely risky speculation. That’s been my point all along when people try to compare it to gold. There couldn’t be a more idiotic comparison. In fact, BC is riskier than the average junior miner and much riskier than the good ones. Its fantastic rise supports that claim since the higher the risk, the higher the potential gain (or loss).

You’d be hard-pressed to find a bigger Bitcoin fan/promoter than Jeff Berwick (the Dollar Vigilante), yet even he recently pointed out that maybe 5% of your money should be in Bitcoin while up to 95% should be in gold/silver. He completely gets it. You, on the other hand, are showing the typical signs of an investor who’s fallen head over heels for an asset for precisely the wrong reason — because it went up a lot. Your antagonism toward my honest opinions proves it. You don’t want to believe that my opinion would be the same whether I owned BC or not. I can guarantee that I would have sold at least 75% by now just as I did with Impact Silver by the time it reached 1.28 last year (from 11 cents).

In all markets, you should be fearful when everyone is greedy and be greedy when everyone is fearful. You are greedy when everyone is greedy. I haven’t seen any fear from any BC holder yet. It’s been nothing but the opposite all over youtube. Most of the “experts” don’t know a thing about markets so the gains have gone straight to their heads resulting in some embarrassing behavior.

Mathew:

Once again your trying to gloss over the fact that your were totally oblivious to the crypto phenomenon. Was it luck that I got in when I did,probably,but the fact remains that I recognized the potential and put some of my hard earned cash into the possibility that this could materialize into something.

I do not compare Bitcoin to Gold and I never have.Long before Bitcoin I had 10% of my personal wealth in Gold thanks to Big Al.

You trying to tell me that I’ve fallen head over heals for an asset for precisely the wrong reason is laugh a BULL.

The crux here Mathew is I took the leap.

I’ve had to come out against many people whom I admire and never met concerning Bitcoin.You,Big AL,Bob M to name a few.

I even took a two week break from posting last month because I was amazed by the complete lack of understanding by some,but yet they still felt they needed to offer their limited knowledge.I can handle being wrong,things I don’t understand I keep my mouth shut.

The ultimate reward for me has never been the money,the reward is rather in the knowledge of being right and watching it come to fruition.

You can quote who ever you want,the bottom line is to be on the right side of the markets.

I have no fear with Bitcoin,as I was totally prepared to lose everything I invested and still am.

Say I were to sell the Bitcoin,what can you offer as a long term alternative that has the potential to provide the return Bitcoin has to offer in the long run.?

Just for the record,the last eight trades I’ve put on with the junior miners I’ve been stopped out of six of them.

I’m not glossing over anything. Good for you, JohnK, that you took the leap. Guess what? I would have too if I could have on my trading platform. I was not as oblivious as you think and considered buying in mid 2010 during a very busy time in my life. I considered it a worthy spec but didn’t take the time to do it. Is it “the crux” of anything as you claim? No. It is meaningless to my assessment of it.

My point remains unchallenged by anything you’ve stated. The chart shows a bubble in sentiment and no one knows what one BC’s fair value is because it is not possible to know. As for its utility, that is easy to understand. Your willingness to lose your whole investment rather than take a big gain is negatively impressive in my book and shows that I shouldn’t bother with your posts in the future.

I’m glad you have no fear where you should and plenty of fear where you should have little. I’ve been scooping up a lot of shares in the juniors and haven’t been stopped out once because I don’t consider using stops on illiquid juniors to be very smart.

Mathew:

No one here is asking you to reply.

Once again there is no wrong answer with you.

There was a way to buy Bitcoin. I did,you didn’t.

Your trading platform reply doesn’t pass the smell test.

I have my “buy and hold shares” and I also do some trading.What you consider smart is of little relevance to me Mathew.

With all the “nibbling” going on here,one would think there in Iowa at a corn feed.

No nibbling here. I own many millions of shares in the juniors.

Mathew:

I’m just a small fish in a big pond.

I’m still here.

I’m not exactly a big fish either.

Whether you like crypto’s or you hate them, it won’t matter one whiff. The block-chain in all its future forms for use in smart contracts or the movement of virtual money are here to stay. The vast uses for this technology have not even scratched the surface.

The Ginnie is out of the bottle and its not going back in.

Tyrannical governments like the US can try to threaten everyone who uses it with prison time and confiscation of assets because that’s all they know. But that will only embolden the world populations to advance Bitcoin and other related cryptos and the related tech’s rapid implementation and use.

The crypto’s are already subject as a taxable item in the form of (property) not currency, so you better damn well be paying you’re taxes on profits made. But understand clearly, there is no stopping it.

V

Since BC has no fundamental value, we have to look at the charts to determine whether or not it is in a bubble. So, it is, but that doesn’t mean it can’t go higher.