A Presidential Bump (In The Road) For Stocks?

I found this article by Dana Lyons a great recap of historic market moves timed with presidential terms. The recent shakiness in the markets has come a quarter early. Whether this means next quarter will be worse is still yet to be seen. I know some people dismiss the seasonality factors but as Dana points out this is one of the more consistent patterns. Keep in mind the first year of the presidency is usually one of the best and smoothest for the markets.

Click here to visit Dana’s free blog site for a wide range of valuable market comments.

…Here’s the posting…

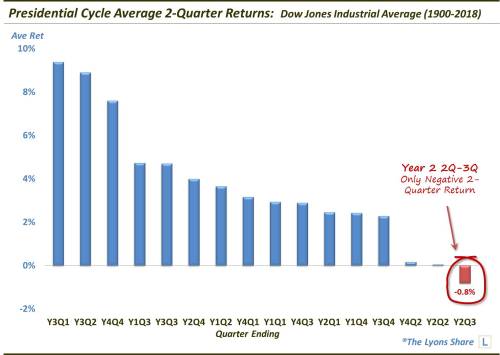

Historically, the next 2 quarters represent the worst 2-quarter stretch for stocks in the entire Presidential Cycle.

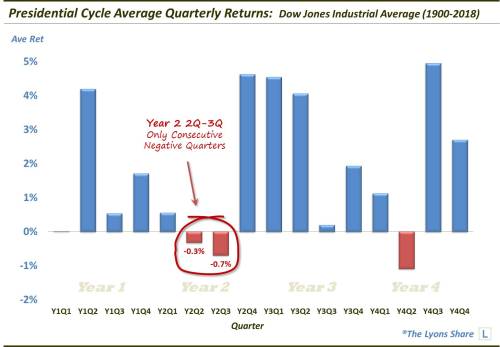

The Presidential Cycle refers to the pattern of behavior in stock prices throughout the four years of a presidential term. While there are many factors influencing stock prices during a particular period of a particular presidential term, it has been one of the more historically consistent seasonal patterns. Specifically, stocks tend to be strong during certain periods of a president’s term and weaker during others. And, historically, the worst 2-quarter stretch of the presidential cycle is the period spanning the 2nd and 3rd quarters of the second year of a president’s term. The stretch began this week.

Over the past 100 years, average returns in the Dow Jones Industrial Average for both the 2nd and 3rd quarters of “year 2’s” have been negative, the only consecutive negative quarters of the entire cycle.

Furthermore, in aggregate, the 2-quarter stretch ending with the 3rd quarter of year 2 of the presidential cycle is the only 2-quarter stretch with a negative average return in the entire cycle.

Of course, seasonality is only one factor affecting stock prices. Therefore, this negative historical tendency should only be treated as a gentle headwind. However, after a lengthy stretch in which bulls seemed to have just about everything going their way, more and more of these potential headwinds seem to be popping up of late.

If you’re interested in the “all-access” version of our charts and research, please check out our new site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

Watching some of the bear instruments (SQQQ, QID, etc. )but the bears don’t seem to eager to push the averages past the 2.5% mark or so. Probably looking for a major reversal on Monday. Surprise could be though in the last half hour, another couple hundred points selloff in the Dow. Guess we’ll see.

Meant to tell you Cory Thanks for posting the above charts. Very interesting and likely the picture we will see going forward………..I’m a bear so the next two quarters could be fun to watch on the conventional markets. JMO

We are a Zimbabwe, in my opinion, with a difference……our size and position in the world.

If something csn’t happen, it won’t happen.

Thus, as much as the Fed says it wants to increase interest rates, no one can afford higher rates, so they cannot increase much. ….. So they won’t.

As the world economy is dragged down by the millstones of excessive debt created around the world, Central Banks will continue to print worldwide, and eventually inflationary increases of prices will occur.

As people, institutions, and countries realize this, real things will be bought.

Relative currencies will not change much (relatively) because all the world’s Central banks are in collusion. And so it will go on until/if/when the system collapses or is changed. Those are CFS viewpoints.

Sprott’s weekly wrap below:

https://www.sprottmoney.com/Blog/when-the-big-ones-start-going-you-better-head-for-the-hills-eric-sprott-on-volatile-markets-weekly-wrap-up-april-062018.html

TFMetals with Mickey Fulp on Trade wars, mining, etc.

https://media.tfmetalsreport.com/audio/07A2AMickeyFApr18.mp3

looks to be a weak close over 2618 spx does not seem doable

Grant Williams chats with Felix Zulauf:

https://www.youtube.com/watch?v=wfzmgfYiMYM