Anaconda Mining intersects 62.01 g/t over 1.5 metres and 23.24 g/t over 2.5 metres at Goldboro

Here are the latest round of drill results from Anaconda Mining at the Goldboro Gold Project. We are continuing to see some good grades with narrow widths but if you look at the figures in the release the Company seems to have a pretty good understand of the continuity.

I will be chatting with the team at Anaconda next week. If you have any questions or comments on the news please email me at Fleck@kereport.com.

Click here to listen to the most recent interview on Anaconda.

…Here’s the news…

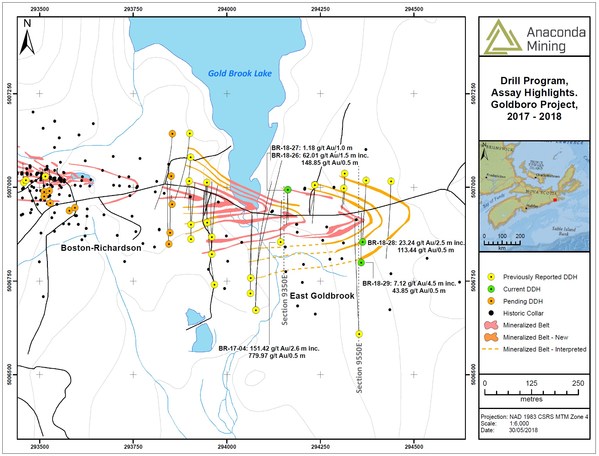

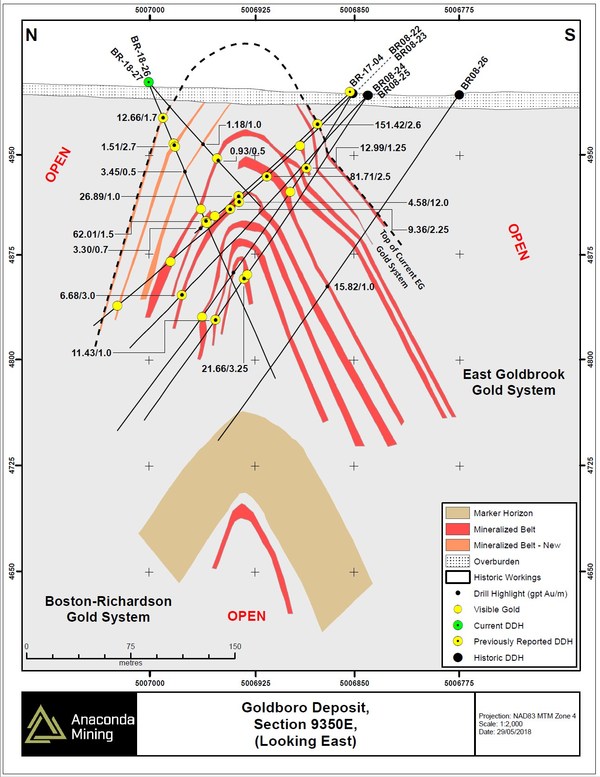

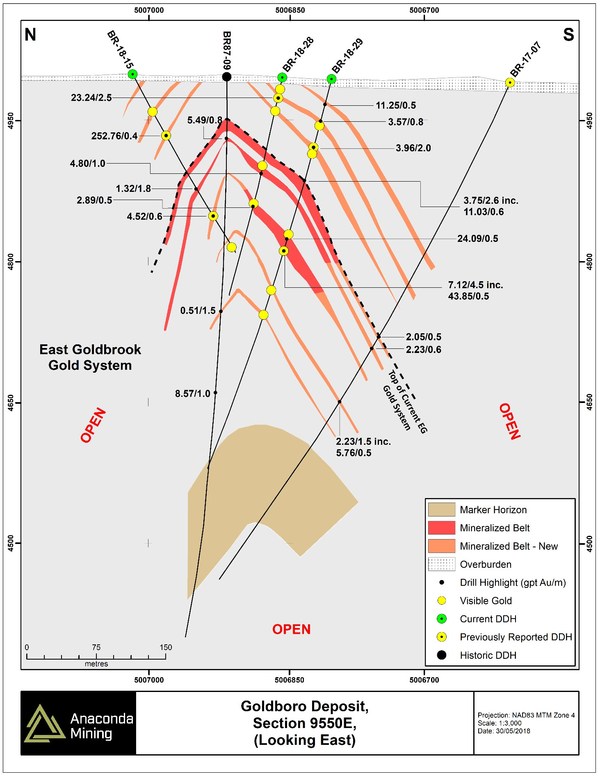

TORONTO, May 31, 2018 /CNW/ – Anaconda Mining Inc. (“Anaconda” or the “Company“) (TSX: ANX; OTCQX: ANXGF) is pleased to announce assay results from four drill holes (1,043 metres), as part of 9,753 metres of diamond drilling completed since October 2017 (the “Drill Program“) at the Company’s Goldboro Gold Project in Nova Scotia (“Goldboro“). Two drill holes (BR-18-26 and -27) targeted cross section 9350E and two holes (BR-18-28 and -29) targeted cross section 9550E located in the eastern portion of the Goldboro Deposit within the East Goldbrook Gold System (“EG Gold System“) (Exhibit A, B and C). Drilling within both section 9350E and 9550E are part of an infill and expansion drill program designed to better define specific areas of the EG Gold System as part of the work outlined within the Goldboro Preliminary Economic Analysis filed on SEDAR on March 2, 2018.

The Drill Program testing sections 9350E and 9550E has successfully extended known mineralization identified by historical drilling and new zones identified by Anaconda’s recent drilling. Within section 9350E (Exhibit B) holes BR-18-26 and -27 successfully extended three mineralized zones of the EG Gold System on the northern limb of the fold structure by 150 metres. Within section 9550E (Exhibit C), holes BR-18-28 and -29 extended three recently discovered mineralized zones of the EG Gold System down the southern limb by 200 metres and confirmed the down plunge extension of these mineralized zones. Holes BR-18-28 and -29 also confirmed the extension of the two deepest mineralized zones of the EG Gold System down plunge. Thirteen separate occurrences of visible gold were observed in the four reported drill holes.

Highlight assays from the Drill Program on section 9350E and 9550E include:

- 62.01 grams per tonne (“g/t”) gold over 1.5 metres (108.5 to 110.0 metres) in hole BR-18-26;

- 12.66 g/t gold over 1.7 metres (27.8 to 29.5 metres) in hole BR-18-26;

- 23.24 g/t gold over 2.5 metres from (21.5 to 24.0 metres) in hole BR-18-28;

- 7.12 g/t gold over 4.5 metres from (193.5 to 194.0 metres) in hole BR-18-29; and

- 151.42 g/t gold over 2.6 metres (33.1 to 35.7 metres) in hole BR-17-04 (previously reported).

Highlight assays from historic drilling on section 9350E include:

- 81.71 g/t gold over 2.5 metres (85.5 to 88.0 metres) in hole BR-08-22;

- 66.89 g/t gold over 3.0 metres (83.5 to 86.5 metres) in hole BR-08-22;

- 21.66 g/t gold over 3.25 metres (156.75 to 160.0 metres) in hole BR-08-25;

- 4.58 g/t gold over 12.0 metres (103.0 to 115 metres) in hole BR-08-22 including 61.50 g/t gold over 0.5 metres; and

- 6.68 g/t gold over 3.0 metres (197.5 to 200.5 metres) in hole BR-08-24.

Highlight assays from previously reported and historic drilling on section 9550E include:

- 252.76 g/t gold over 0.4 metres (76.6 to 77 metres) in hole BR-18-15 (previously reported); and

- 8.57 g/t gold over 1.0 metres (344.5 to 345.5 metres) in hole BR-87-09.

A full table of composited assays is presented below.

“The Drill Program continues to yield consistent, strong results in terms of grade and width. As with other sections drilled in the Goldboro Deposit, we have extended sections 9350E and 9550E down dip and down plunge. We’re building off robust historical drill results and seeing that there is continuity across sections, both down and up plunge. The overall predictability of the deposit is increasing our confidence that we can efficiently grow the mineral resource. Future drilling within sections 9350E and 9550E will focus on going deeper to reach the prolific Boston-Richardson Gold System and demonstrating that Boston–Richardsoncontinues down plunge beneath the EG Gold System.”

~Dustin Angelo, President and CEO, Anaconda Mining Inc.

Anaconda is currently drilling an additional 2,000 metres to follow up on the success of the Drill Program to date. The primary purpose of the additional meterage is to drill adjacent to Section 9100E from which the BR Gold System contained broad zones of high-grade mineralization associated with displacement of the existing deposit along a fault system. The Company is testing the hypothesis that it has encountered a new, fault related setting for gold mineralization within the Goldboro Deposit as has been observed in similar deposits within the Victorian Gold Fields of Australia. Anaconda is also allocating approximately 500 metres to infill certain areas of the Mineral Resource that form part of the Company’s planned underground bulk sample, which is expected to occur later in 2018.

Table of composited assays from cross section 9350E:

|

Drillhole |

From |

To (m) |

Interval (m) |

Gold |

Gold System |

Visible Gold |

Current |

|

BR-18-26 |

15.0 |

18.0 |

3.0 |

1.92 |

EG |

||

|

and |

27.8 |

29.5 |

1.7 |

12.66 |

EG |

v.g. |

|

|

and |

47.8 |

50.5 |

2.7 |

1.51 |

EG |

v.g. |

|

|

including |

50.0 |

50.5 |

0.5 |

7.15 |

EG |

v.g. |

|

|

and |

68.5 |

70.0 |

1.5 |

1.33 |

EG |

||

|

including |

69.5 |

70.0 |

0.5 |

3.45 |

EG |

||

|

and |

96.0 |

99.5 |

3.5 |

2.24 |

EG |

v.g. |

|

|

including |

98.5 |

99.0 |

0.5 |

10.00 |

EG |

||

|

and |

108.5 |

110.0 |

1.5 |

62.01 |

EG |

v.g. |

|

|

including |

108.5 |

109.0 |

0.5 |

148.85 |

EG |

v.g. |

|

|

and |

135.0 |

135.5 |

0.5 |

1.44 |

EG |

||

|

BR-18-27 |

42.5 |

43.5 |

1.0 |

0.68 |

EG |

||

|

and |

58.5 |

59.5 |

1.0 |

1.18 |

EG |

||

|

and |

74.0 |

75.0 |

1.0 |

0.55 |

EG |

v.g. |

|

|

and |

76.7 |

77.2 |

0.5 |

0.93 |

EG |

||

|

BR-17-04 |

33.1 |

35.7 |

2.6 |

151.42 |

EG |

v.g. |

Previously Reported |

|

including |

33.1 |

33.6 |

0.5 |

779.97 |

EG |

v.g. |

|

|

and |

64.5 |

65.2 |

0.7 |

1.66 |

EG |

||

|

and |

67.4 |

69.2 |

1.8 |

1.61 |

EG |

||

|

and |

75.7 |

76.2 |

0.5 |

1.22 |

EG |

||

|

and |

79.4 |

82.4 |

3.0 |

3.14 |

EG |

||

|

including |

79.4 |

80.9 |

1.5 |

5.75 |

EG |

||

|

and |

110.0 |

111.0 |

1.0 |

26.89 |

EG |

v.g. |

|

|

and |

118.0 |

118.5 |

0.5 |

1.42 |

EG |

||

|

and |

125.3 |

125.8 |

0.5 |

0.52 |

EG |

||

|

and |

132.4 |

133.0 |

0.6 |

0.15 |

EG |

v.g. |

|

|

and |

144.8 |

145.5 |

0.7 |

3.30 |

EG |

||

|

BR-08-22 |

39.5 |

42.0 |

2.5 |

1.07 |

EG |

Historic |

|

|

and |

50.0 |

53.5 |

3.5 |

9.54 |

EG |

v.g. |

|

|

including |

51.5 |

52.0 |

0.5 |

27.60 |

EG |

||

|

including |

52.5 |

53.0 |

0.5 |

5.16 |

EG |

||

|

including |

53.3 |

53.5 |

0.3 |

63.30 |

EG |

v.g. |

|

|

and |

65.0 |

66.0 |

1.0 |

0.86 |

EG |

||

|

and |

74.5 |

77.0 |

2.5 |

0.65 |

EG |

||

|

and |

81.0 |

82.0 |

1.0 |

1.05 |

EG |

||

|

and |

85.5 |

88.0 |

2.5 |

81.71 |

EG |

v.g. |

|

|

including |

86.0 |

86.3 |

0.3 |

800.00 |

EG |

v.g. |

|

|

including |

86.5 |

87.0 |

0.5 |

5.62 |

EG |

||

|

and |

103.0 |

115.0 |

12.0 |

4.58 |

EG |

v.g. |

|

|

including |

113.3 |

113.5 |

0.3 |

76.00 |

EG |

v.g. |

|

|

including |

114.0 |

114.5 |

0.5 |

61.50 |

EG |

||

|

and |

121.8 |

124.0 |

2.3 |

9.36 |

EG |

v.g. |

|

|

including |

121.8 |

122.0 |

0.3 |

74.90 |

EG |

v.g. |

|

|

and |

129.0 |

140.5 |

11.5 |

1.59 |

EG |

||

|

and |

133.5 |

134.0 |

0.5 |

22.00 |

EG |

||

|

and |

150.5 |

151.0 |

0.5 |

6.47 |

EG |

||

|

and |

159.5 |

160.5 |

1.0 |

0.70 |

EG |

||

|

and |

163.0 |

163.5 |

0.5 |

1.76 |

EG |

||

|

and |

177.0 |

177.5 |

0.5 |

1.65 |

EG |

||

|

and |

181.0 |

183.5 |

2.5 |

1.53 |

EG |

||

|

including |

181.0 |

181.5 |

0.5 |

5.72 |

EG |

||

|

and |

188.0 |

189.5 |

1.5 |

1.01 |

EG |

||

|

and |

193.0 |

204.5 |

11.5 |

0.53 |

EG |

||

|

and |

216.5 |

217.0 |

0.5 |

4.15 |

EG |

||

|

and |

228.3 |

228.5 |

0.3 |

1.26 |

EG |

v.g. |

|

|

and |

241.0 |

242.0 |

1.0 |

0.91 |

EG |

||

|

BR-08-23 |

48.5 |

49.5 |

1.0 |

1.37 |

EG |

||

|

and |

62.0 |

63.3 |

1.3 |

12.99 |

EG |

v.g. |

|

|

including |

63.0 |

63.3 |

0.3 |

63.30 |

EG |

v.g. |

|

|

and |

76.0 |

77.0 |

1.0 |

2.24 |

EG |

||

|

and |

83.5 |

86.5 |

3.0 |

66.89 |

EG |

v.g. |

|

|

including |

83.5 |

84.0 |

0.5 |

8.09 |

EG |

v.g. |

|

|

including |

84.0 |

84.3 |

0.3 |

709.00 |

EG |

v.g. |

|

|

including |

86.0 |

86.5 |

0.5 |

36.70 |

EG |

||

|

and |

93.0 |

93.5 |

0.5 |

1.72 |

EG |

||

|

and |

96.5 |

98.0 |

1.5 |

1.14 |

EG |

||

|

and |

101.5 |

102.0 |

0.5 |

0.76 |

EG |

||

|

and |

104.0 |

111.0 |

7.0 |

0.51 |

EG |

||

|

and |

115.0 |

115.5 |

0.5 |

2.60 |

EG |

||

|

and |

117.5 |

118.0 |

0.5 |

2.55 |

EG |

||

|

and |

119.5 |

120.0 |

0.5 |

0.70 |

EG |

||

|

and |

133.0 |

135.5 |

2.5 |

0.72 |

EG |

||

|

and |

138.5 |

146.0 |

7.5 |

1.01 |

EG |

||

|

and |

153.0 |

154.0 |

1.0 |

0.50 |

EG |

||

|

and |

154.8 |

155.0 |

0.3 |

158.50 |

EG |

v.g. |

|

|

and |

165.5 |

166.0 |

0.5 |

0.85 |

EG |

||

|

and |

185.0 |

186.0 |

1.0 |

0.92 |

EG |

||

|

and |

191.5 |

195.5 |

4.0 |

0.67 |

EG |

||

|

including |

193.8 |

194.0 |

0.3 |

5.27 |

EG |

v.g. |

|

|

BR-08-24 |

45.5 |

46.0 |

0.5 |

0.70 |

EG |

||

|

and |

54.5 |

55.0 |

0.5 |

0.55 |

EG |

||

|

and |

61.0 |

62.0 |

1.0 |

0.50 |

EG |

||

|

and |

70.5 |

73.0 |

2.5 |

0.67 |

EG |

||

|

and |

77.5 |

78.0 |

0.5 |

0.75 |

EG |

||

|

and |

79.0 |

79.5 |

0.5 |

0.91 |

EG |

||

|

and |

80.5 |

81.0 |

0.5 |

0.77 |

EG |

||

|

and |

87.0 |

94.0 |

7.0 |

0.65 |

EG |

||

|

including |

90.0 |

91.0 |

1.0 |

1.85 |

EG |

||

|

and |

114.0 |

116.5 |

2.5 |

1.30 |

EG |

||

|

and |

128.0 |

129.0 |

1.0 |

0.98 |

EG |

||

|

and |

132.0 |

132.5 |

0.5 |

3.06 |

EG |

||

|

and |

135.0 |

135.5 |

0.5 |

0.92 |

EG |

||

|

and |

142.0 |

143.0 |

1.0 |

2.33 |

EG |

||

|

and |

152.0 |

155.0 |

3.0 |

0.99 |

EG |

||

|

and |

178.0 |

178.5 |

0.5 |

7.38 |

EG |

v.g. |

|

|

and |

197.5 |

200.5 |

3.0 |

6.68 |

EG |

v.g. |

|

|

including |

198.3 |

198.5 |

0.3 |

68.40 |

EG |

v.g. |

|

|

BR-08-25 |

20.0 |

21.0 |

1.0 |

0.84 |

EG |

||

|

and |

52.0 |

52.5 |

0.5 |

0.91 |

EG |

||

|

and |

64.0 |

67.0 |

3.0 |

0.50 |

EG |

||

|

and |

77.0 |

91.0 |

14.0 |

0.49 |

EG |

||

|

including |

87.0 |

89.0 |

2.0 |

0.99 |

EG |

||

|

and |

100.0 |

102.0 |

2.0 |

1.84 |

EG |

||

|

and |

114.0 |

129.0 |

15.0 |

1.55 |

EG |

||

|

including |

127.5 |

129.0 |

1.5 |

11.67 |

EG |

||

|

including |

118.0 |

118.5 |

0.5 |

5.58 |

EG |

||

|

including |

127.5 |

128.0 |

0.5 |

30.60 |

EG |

||

|

and |

137.5 |

141.0 |

3.5 |

1.80 |

EG |

||

|

including |

137.5 |

138.0 |

0.5 |

8.07 |

EG |

||

|

and |

152.0 |

152.5 |

0.5 |

0.72 |

EG |

||

|

and |

156.8 |

160.0 |

3.3 |

21.66 |

EG |

v.g. |

|

|

including |

156.8 |

157.0 |

0.3 |

18.50 |

EG |

v.g. |

|

|

including |

159.8 |

160.0 |

0.3 |

262.00 |

EG |

v.g. |

|

|

and |

178.5 |

179.0 |

0.5 |

5.85 |

EG |

||

|

and |

181.0 |

182.0 |

1.0 |

3.45 |

EG |

||

|

and |

196.0 |

213.0 |

17.0 |

0.94 |

EG |

||

|

including |

196.0 |

197.0 |

1.0 |

11.43 |

EG |

v.g. |

|

|

including |

196.5 |

196.8 |

0.3 |

41.70 |

EG |

v.g. |

|

|

and |

280.0 |

280.5 |

0.5 |

0.60 |

EG |

||

|

BR-08-26 |

83.0 |

83.5 |

0.5 |

2.52 |

EG |

||

|

and |

104.0 |

104.5 |

0.5 |

0.61 |

EG |

||

|

and |

120.0 |

120.5 |

0.5 |

0.59 |

EG |

||

|

and |

125.0 |

126.5 |

1.5 |

0.72 |

EG |

||

|

and |

130.0 |

130.5 |

0.5 |

0.79 |

EG |

||

|

and |

134.0 |

134.5 |

0.5 |

1.36 |

EG |

||

|

and |

165.5 |

166.5 |

1.0 |

15.82 |

EG |

||

|

and |

180.0 |

185.0 |

5.0 |

0.74 |

EG |

||

|

including |

183.5 |

184.0 |

0.5 |

0.57 |

EG |

||

|

including |

184.5 |

185.0 |

0.5 |

0.64 |

EG |

||

|

and |

194.5 |

195.0 |

0.5 |

0.71 |

EG |

||

|

and |

197.5 |

198.0 |

0.5 |

0.72 |

EG |

||

|

and |

213.0 |

213.5 |

0.5 |

2.94 |

EG |

|

Drillhole |

From |

To (m) |

Interval (m) |

Gold |

Gold System |

Visible Gold |

Current |

|

BR-18-28 |

21.5 |

24.0 |

2.5 |

23.24 |

EG |

v.g. |

|

|

including |

22.5 |

23.0 |

0.5 |

113.44 |

EG |

v.g. |

|

|

and |

37.2 |

39.7 |

2.5 |

1.40 |

EG |

v.g. |

|

|

and |

48.4 |

49.0 |

0.6 |

0.61 |

EG |

||

|

and |

105.7 |

106.7 |

1.0 |

4.80 |

EG |

||

|

and |

140.0 |

140.5 |

0.5 |

2.89 |

EG |

v.g. |

|

|

and |

177.6 |

178.1 |

0.5 |

1.03 |

EG |

||

|

BR-18-29 |

18.0 |

19.0 |

1.0 |

0.49 |

EG |

||

|

and |

28.5 |

29.0 |

0.5 |

11.25 |

EG |

||

|

and |

46.5 |

47.3 |

0.8 |

3.57 |

EG |

||

|

and |

75.5 |

77.5 |

2.0 |

3.96 |

EG |

v.g. |

|

|

including |

76.5 |

77.5 |

1.0 |

6.93 |

EG |

v.g. |

|

|

and |

80.5 |

81.1 |

0.6 |

1.23 |

EG |

||

|

and |

84.1 |

84.7 |

0.6 |

0.76 |

EG |

v.g. |

|

|

and |

94.5 |

96.0 |

1.5 |

1.75 |

EG |

||

|

and |

116.6 |

119.2 |

2.6 |

3.75 |

EG |

||

|

including |

116.6 |

117.2 |

0.6 |

11.03 |

EG |

||

|

and |

125.4 |

125.9 |

0.5 |

2.53 |

EG |

||

|

and |

131.6 |

132.2 |

0.6 |

1.37 |

EG |

||

|

and |

163.7 |

167.2 |

3.5 |

1.07 |

EG |

||

|

and |

175.4 |

175.9 |

0.5 |

24.09 |

EG |

||

|

and |

193.5 |

198.0 |

4.5 |

7.12 |

EG |

v.g. |

|

|

including |

193.5 |

194.0 |

0.5 |

43.85 |

EG |

v.g. |

|

|

and |

197.0 |

197.5 |

0.5 |

14.70 |

EG |

||

|

and |

238.5 |

239.0 |

0.5 |

0.58 |

EG |

v.g. |

|

|

and |

266.7 |

267.2 |

0.5 |

1.28 |

EG |

v.g. |

|

|

and |

363.5 |

364.0 |

0.5 |

1.06 |

EG |

||

|

BR-17-07 |

219.5 |

220 |

0.5 |

0.80 |

EG |

Previous |

|

|

and |

245.9 |

246.4 |

0.5 |

0.96 |

EG |

||

|

and |

313.4 |

313.9 |

0.5 |

2.05 |

EG |

||

|

and |

329 |

329.6 |

0.6 |

2.23 |

EG |

||

|

and |

351.6 |

352.1 |

0.5 |

0.79 |

EG |

||

|

and |

358.7 |

359.2 |

0.5 |

0.61 |

EG |

||

|

and |

378.9 |

381.9 |

3 |

1.46 |

EG |

||

|

and |

384.9 |

385.6 |

0.7 |

1.45 |

EG |

||

|

and |

386.6 |

388.1 |

1.5 |

2.23 |

EG |

||

|

including |

387.6 |

388.1 |

0.5 |

5.76 |

EG |

||

|

and |

407 |

407.5 |

0.5 |

0.87 |

EG |

||

|

and |

417.9 |

418.8 |

0.9 |

0.57 |

EG |

||

|

and |

449.2 |

449.7 |

0.5 |

0.69 |

EG |

||

|

and |

547.9 |

548.5 |

0.6 |

0.83 |

EG |

||

|

and |

579 |

579.5 |

0.5 |

0.71 |

EG |

||

|

BR-18-15 |

76.6 |

77.0 |

0.4 |

252.76 |

EG |

v.g. |

|

|

and |

139.0 |

142.6 |

3.6 |

0.88 |

EG |

||

|

including |

140.8 |

142.6 |

1.8 |

1.32 |

EG |

||

|

and |

177.0 |

177.6 |

0.6 |

4.52 |

EG |

v.g. |

|

|

and |

188.0 |

189.0 |

1.0 |

1.74 |

EG |

||

|

and |

209.0 |

209.5 |

0.5 |

0.75 |

EG |

||

|

BR87-09 |

66.5 |

67.4 |

0.8 |

5.49 |

EG |

Historical |

|

|

and |

255.1 |

256.6 |

1.5 |

0.51 |

EG |

||

|

and |

344.5 |

345.5 |

1.0 |

8.57 |

EG |

||

|

and |

346.7 |

347.2 |

0.4 |

3.33 |

EG |

Table of composited assays from cross section 9550E:

This news release has been reviewed and approved by Paul McNeill, P. Geo., VP Exploration with Anaconda Mining Inc., a “Qualified Person”, under National Instrument 43-101 Standard for Disclosure for Mineral Projects.

All samples and the resultant composites referred to in this release are collected using QA/QC protocols including the regular insertion of standards and blanks within the sample batch for analysis and check assays of select samples. All samples quoted in this release were analyzed at Eastern Analytical Ltd.(“Eastern”) in Springdale, NL, for Au by fire assay (30 g) with an AA finish.

Samples analyzing greater than 0.5 g/t Au via 30 g fire assay were re-analyzed at Eastern via total pulp metallic. For the total pulp metallic analysis, the entire sample is crushed to -10mesh and pulverized to 95% -150mesh. The total sample is then weighed and screened to 150mesh. The +150mesh fraction is fire assayed for Au, and a 30 g subsample of the -150mesh fraction analyzed via fire assay. A weighted average gold grade is calculated for the final reportable gold grade. Anaconda considers total pulp metallic analysis to be more representative than 30 g fire assay in coarse gold systems such as the Goldborodeposit.

Reported mineralized intervals are measured from core lengths. Intervals are estimated to be approximately 75-100% of true widths of the mineralized zones. In section 9350E holes BR-17-04, BR-88-22 and -23 encounter the northern limb of the fold at approximately 75 meters, where the true width of the mineralized zones may be less than 50%.

A version of this press release will be available in French on Anaconda’s website (www.anacondamining.com) in two to three business days.

ABOUT ANACONDA MINING INC.

Anaconda is a TSX-listed gold mining, development, and exploration company, focused in the prospective Atlantic Canadian jurisdictions of Newfoundland and Nova Scotia. The Company operates the Point Rousse Project located in the Baie Verte Mining District in Newfoundland, comprised of the Stog’er Tight Mine, the Pine Cove open pit mine, the Argyle Mineral Resource, the fully-permitted Pine Cove Mill and tailings facility, and approximately 5,800 hectares of prospective gold-bearing property. Anaconda is also developing the Goldboro Project in Nova Scotia, a high-grade Mineral Resource, with the potential to leverage existing infrastructure at the Company’s Point Rousse Project.

The Company also has a pipeline of organic growth opportunities, including the Great Northern Project on the Northern Peninsula of Newfoundland and the Tilt Cove Property on the Baie Verte Peninsula, also in Newfoundland.

FORWARD-LOOKING STATEMENTS

This news release contains “forward-looking information” within the meaning of applicable Canadian and United States securities legislation. Forward-looking information includes, but is not limited to, the Company’s future exploration, development and operational plans. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects”, or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “does not anticipate”, or “believes” or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might”, or “will be taken”, “occur”, or “be achieved”. Forward-looking information is based on the opinions and estimates of management at the date the information is made, and is based on a number of assumptions and is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Anaconda to be materially different from those expressed or implied by such forward-looking information, including risks associated with the exploration, development and mining such as economic factors as they effect exploration, future commodity prices, changes in foreign exchange and interest rates, actual results of current production, development and exploration activities, government regulation, political or economic developments, environmental risks, permitting timelines, capital expenditures, operating or technical difficulties in connection with development activities, employee relations, the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of resources, contests over title to properties, and changes in project parameters as plans continue to be refined as well as those risk factors discussed in Anaconda’s annual information form for the seven months ended December 31, 2017, available on www.sedar.com. Although Anaconda has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. Anaconda does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE Anaconda Mining Inc.

Here is an interesting stockhouse (MAE) (MRTMF) Maritime Resources thread where a combative MAE shareholder Mike Precious, shot off a number of mistaken notions and misstatements about the Anaconda (ANX) (ANXGF) bid, and was full of crap on many of his arguements against the merger.

> The responses back from user @DoumDiDoum were fair, more on target, and definitely more grounded in reality. Each point was addressed one by one, and MikeyPrecious got schooled.

It is interesting to see just how misinformed so many of the MAE shareholders are about the fairness of the offer, the success Anaconda has been having, the clear synergies of the combined company that would be a boon to shareholders of both companies, and how much rubbish there is in many chatrooms. It’s the same with some of the MAE shareholders on ceo, that are oblivious to what Anaconda has been up to, or how well the Orex acquisition worked out for both sides on the prior merger.

It is also wild and sinister how much the current Maritime management is trying to entrench themselves and their lifestyle company, diluting the crap out of existing MAE shareholders with continuous capital raises, a half-baked strategy with many questionable assumptions, and they are advising current shareholders not to tender their shares for the ANX offer.

What a freakin’ circus:

http://www.stockhouse.com/companies/bullboard?symbol=v.mae&postid=28076207

Then again, my favorite schooling of Mike Precious was by our very own @MickeyMantle:

KD answers each point below the Mike Precious nonsense very well. Thanks Mick!

___________________________________________________________

@MickeyMantle

Post from MAE stockhouse board $MAE

MikPrecious wrote: Totally agreed. Things that make you ponder why MAE should consider this management?

MM – You are serious here? Which management got awards in the last years? (I will give you a hint: it’s not MAE’s for sure!)

MikPrecious wrote: 1. Why has Anaconda refused Confidentiality agreement for MAE to see their asset?

MM – Listen to the recent interviews done by Dustin Angelo and you will know the reason: at the time the offer was done, all documents required for te due diligence were public (and still are).

MikPrecious wrote: 2. Why has Anaconda not showing profitibility over the years?

MM – Because the reinvest in development and, I do not know if you are connected with the market, but gold was a really tough market in the last years. In fact, it is quite impressive to see That ANX passed through these tough years!

MikPrecious wrote: 3. Where did their debt come so high and why there Management expenses so high?

MM – Could you provide the debt amount? Why do you consider it “high”? Do you own a house? If so, did you buy it cash? As for the management expenses, can you compare with MAE’s management expenses? Do some research about it and I do not think you will use this argument again…

MikPrecious wrote: 4. Is it worth taking all the debt for MAE from Anaconda?

MM – Again, tell us the debt amount and do some basic calculations proving your point and we could answer your question after.

MikPrecious wrote: 5. Is there present asset really all its worth out to be which makes sense for their hostile bid?

MM – I invited you in a previous post to come out with your objective assessment base on a simple formula. You did not answer and you are trying again to argue with unsubstantial and subjective arguments. Go read the post back and plug your numbers in the formula and you will see that getting near 40% of ANX for your shares is really interesting.

MikPrecious wrote: 6. Are MAE shareholders prepared for huge dilution into the merger?

MM – Again, explain what is HUGE dilution with some numbers to back you up.

MikPrecious wrote: 7. ANX is trying to buyout cheap with desperation completely is a fact.

MM – A takeover bid is often done when the share price is near the bottom. THAT is a fact. If MAE management was not able to get a better valuation for their properties in the last years, it is not ANX’s fault at all. So you need to complain to MAE’ management, not ANX’s one in my opinion. And 60% premium is not cheap in my book.

MikPrecious wrote: Read the circular as its completely simple to read english. If your an ANX shareholder I advise for you to get a copy so you know the apparent situation you fall yourself under. MAE should not have to forgoe this big burden that lies upon ANX. MAE will soon come out with more I am sure.

MM – Sure, read it but make sure to read the one front ANX and listen to the different interviews Dustin Angelo has done recently. This way, you will be able to take the best solution for your investment.

The stockhouse user @DoumDiDoum replied to MikePrecious well regarding the debt, but this precious whiner doesn’t seem to get it. they have the money to pay off their debt if they wanted to, but they are choosing to put it into growth instead and their strategy makes sense on magnifying their revenues and then paying it back on the larger production profile.

__________________________________________________

> MikePrecious wrote: My earlier statements indicated the miliions of dollars in debt . Look it up yourself.

>> @DoumDiDoum – ” Looking at Anaconda’s latest financial statements ending on December 31 2017 (posted on March 1st 2018), current assets were at $11,661,225 (with over $4M in cash and cash equivalent et $7,1M in inventory). Current liabilities were at $5,158,031 (with $4M in debts). So, current assets is more than twice the current liabilities! Jeeze, Anaconda could pay his debt right now with the cash they have on hand. So, I do not think that your argument about Anaconda’s debt is worth debating here.”

“Moreover, if we continue the comparison with AGB, AGB has a long term debt of more than $100M and ANX has no such long term debt!”

(ANX) (ANXGF) Anaconda Mining investor presentation by Dustin Angelo at CMS 2018

The Northern Miner – May 15, 2018 #VIDEO

“Anaconda Mining president, chief executive officer and director Dustin Angelo gives an investor presentation at the Canadian Mining Symposium in London on April 25, 2018.”

Excellon also had some monster drill hits today, but it is interesting that almost nobody seemed to notice. If this had been a new exploration story and a first drill hit most resource investors would be losing their minds with excitement.

___________________________________________

Excellon DrillS 3,428 g/t Silver Equivalent Over 10.2 Metres At Platosa

May 31, 2018 – Excellon Resources Inc. (EXN( (EXLLF)

High-grade results from existing mantos include:

– 2,148 g/t Ag, 19.2% Pb and 9.7% Zn or 3,428 g/t AgEq over 10.2 metres

– 1,153 g/t Ag, 8.2% Pb and 3.4% Zn or 1,662 g/t silver equivalent over 5.3 metres

– 870 g/t Ag, 13.3% Pb and 12.4% Zn or 2,034 g/t AgEq over 6.7 metres

http://www.excellonresources.com/news/details/index.php?content_id=187

Zinc concentrate terms at 5-mth high, lead conc TCs dip on open arbitrage

May 30, 2018 – Archie Hunter, Julian Luk, Hui Li

“Zinc concentrate treatment charges (TCs) rose to their highest level this year in May, with smelters refraining from purchases of spot tonnages. And the upward trend in lead concentrate TCs reversed after an import arbitrage opened up in China.”

Car Ride Confessions of a CEO | Keith Neumeyer |

First Majestic Silver & First Mining Gold

Cambridge House International – May 29, 2018

Justin Hayek is the creator and host of Car Ride Confessions of a CEO.

Keith is one of the better ones……….JMO

He is a prominent, confident, and vocal CEO for sure, but I agree that he is more capable than many of the charlatans parading around as mining CEOs or corporate officers in this sector. The First Majestic crew has executed on their turnaround strategy the last few years fixing their balance sheet, investing into their mines to set up the production over the next few years, the pick up of San Dimas from Primero, and the huge roaster they are putting in place to process tailings.

KN is also a character and the kind of guy that would be fun to drink a beer or two with and then wind him up and let him go on a topic. It would be educational and funny to boot!

With the skyhigh cost of beer, ….Keith will have to buy………….THE BOOT…..

That would be fine with me 🙂

Cory, thanks for the detailed post………appreciate it….

Ditto.

(MTO) (MEAOF) Metanor Reports Its Financial Results for the Quarter Ended March 31, 2018

May 31, 2018

Pascal Hamelin, President and Chief Operating Officer states: “Our results are in line with our rebuilding strategy. The robust increase in exploration has added a completely new dimension to the Bachelor Mine with the Moroy Zones extending continuously from surface to depth below 600 metres and the encouraging results at Barry lead us to believe that our strategy will pay off as we move towards significantly increase our production profile.”

https://ceo.ca/@nasdaq/metanor-reports-its-financial-results-for-the-quarter

Metanor is following through with the corporate refocusing aimed at simultaneously increasing production and exploration programs while leveraging and enhancing our existing infrastructures as Metanor has the only permitted and operating facility in the extremely prospective Urban Barry camp. The Company continues to develop new mining areas to increase mining tonnages in the short term.

Gold production of 6,654 ounces of gold leading to gold sales of 6,764 ounces from Bachelor Mine;

$9,533,399 in gold sales, after sales of ounces in the stream agreement, at an average realized price of $1,683 per ounce sold (US$1,331/oz using an exchange rate of US$0.791/C$1.00);

In conjunction with Metanor’s robust exploration programs (29,940 metres drilled during the quarter), we are moving along with the public consultations, as part of the permitting process, to increase the daily capacity of the mill from 800 tonnes per day to 2,400 tonnes per day. This increased capacity at Bachelor would allow feed from the Barry project, the Bachelor mine and Moroy sector. Management expects that the Moroy Sector could generate enough ore in the short term to increase the tonnes milled per day to 800 tonnes from the current milling rate of approximately 500 tonnes per day which would have a significant positive impact.

The Company began the construction of a new camp at the Barry project in the quarter, which was completed in May, to accommodate the additional workers required to proceed with the 50,000 underground bulk sample scheduled to be completed by the Q4 in 2018.

(MQR) (MRQRF) Monarques Undertakes a Feasibility Study for its Wasamac Gold Project

May 31, 2018

– “The BBA study for the custom milling option was positive and identified several processing plants able to provide the service.”

– “Based on those results, the Corporation has retained BBA to conduct a feasibility study whose base scenario includes a mill and tailings facility near Wasamac, which will also allow to better assess the custom milling option.”

– “The goal is to maximize the value of the Wasamac deposit, which contains a measured and indicated resource of 2,587,900 ounces of gold, and to bring it into production at the lowest possible cost.”

https://ceo.ca/@newswire/monarques-undertakes-a-feasibility-study-for-its-wasamac

Youth say , not going to take it anymore……….Facebook down 30%……

https://www.zerohedge.com/news/2018-05-31/facebook-use-among-teens-plummets-30-three-years

Big Brother , bye, bye……..

Does anyone really believe the numbers…………

https://www.zerohedge.com/news/2018-06-01/may-jobs-jump-223000-smashing-expectations-hourly-earnings-beat

BLS……….your govt hard at work…………lol

Well, if AXU closes at 1.32 or below the black candle on the weekly chart from will negated, so that makes me feel better.

I’m watching EXK as the leader at the moment. I think it can drop below the 50 dma for a week, but it should not really lose touch with that MA. I don’t anticipate it doing so.

I am leaning heavily towards a slow grind higher over the next 2-3 years. I would expect EXK to exceed it’s 2016 high sometime in 2020.

After 2020 I think this sector is going to rocket higher.

I know some here will say they can move much more in a much shorter time span, but the more I think about it, in order to generate 10, 20 or 50x returns in the next 5 to 10 years, the rise could take its sweet time.

After a low is reached in $hui on this correction (it may have already occurred or within the next 1-2 weeks) I expect it to finally make a higher high on the weekly chart and never look back. Again, it may not be a rocket ride, but we will finally get a real durable sustained bull trend where you can feel confident in buying the dips. IMHO.

$hui:gdx ratio is set up to rally finally, after drifting lower for 2 years. There is a giant double bottom/base on the weekly chart spanning back to 2015.

A rising ratio means the bull is in full effect.

AXU 5 week RSI is finally oversold. The rising 144 WMA is at $1.28. The 233 WMA is at $1.13. The lower weekly BB is coming in at $1.22.

No matter what happens in the next 2 weeks. Every red day should be bought. Any tag of the lower BB or the 233 WMA should be aggressively bought. We could most certainly see a big scary dip but I think it will be recovered relatively quickly.

SILJ 20,2 daily BBs are the tightest they have been in its history.

Nice drill hits from Anaconda in that news release.

Over and over this team keeps delivering on both Exploration and Production results.

Keep up the great work ANX.