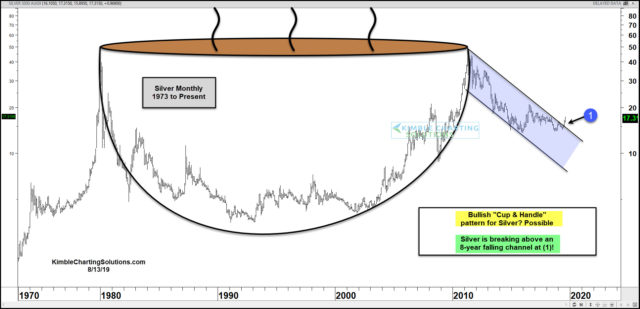

Silver Creating A Huge Bullish Cup & Handle Pattern?

Is Silver creating a multi-decade bullish Cup & Handle pattern? Possible!

Silver peaked at $50 in the early 1980s and then proceeded to fall for years. It peaked again at $50 in 2011 and it has declined for the past 8-years.

The two peaks at the $50 level could be the top of a bullish cup and handle pattern.

One this is for sure, Silver has been very weak over the past 8-years, as it has declined over 65%! The 8-year decline in Silver has created a uniform falling channel.

The move higher in Silver of late does have it breaking above the falling channel at (1). This breakout sends a bullish message to Silver owners.

The next important resistance test for Silver comes into play at the $17.64 level!

What would it take to determine if Silver has created a multi-decade bullish cup and handle pattern? A clean break above the $50 level, which is still a “long, long” way off!

Money in the bank at 16cents………

oops wrong area…..put it down under Kootenay and sprott investment ….

Kootenay Announces $5 Million Investment by Strategic Investor Eric Sprott

http://pdf.reuters.com/htmlnews/htmlnews.asp?i=43059c3bf0e37541&u=urn:newsml:reuters.com:20190813:nCNWm9GKla

More great input …

The problem is that JPMorgan can also read charts, and they know when manipulation is critical.

Another problem is that way too many people assume that they know what JPM is up to. The bankster set could well be the biggest bulls of all and GATA would never detect it.

The Central Banks that are supposed to be the nasty guys suppressing gold and silver have been net buyers of gold since 2010 but you will never hear GATA mention it because it pokes a big hole in their fantasy.

Matt: The value of the dollar in 1980 when silver was $50 was totally different than the value of the dollar in 2011 when silver touched $50 again. So $50 in 1980 is not $50 in 2011. Doesn’t that make such formations as Kimble write about pretty meaningless? Isn’t it like comparing silver in Pounds in 1980 compared to silver in Euros in 2011?

The difference between 1980 and now is that even the man without a dollar is fifty cents better off than he once was.

LOL! than he once was should read than he is now

I don’t think the value/merit of these formations requires or assumes the stability of the currency or even the stability of the real value of the item in question (silver’s real price also fluctuates). Yet, I can’t explain it. The list of variables that *should* throw a wrench into things is endless. I just know that I’m routinely blown away by what I see on all kinds of charts across all time frames. It doesn’t matter if I’m pricing gold in NFLX, AAPL in copper or even gold priced in silver priced in the dollar index.

Thanks to our fractal universe, a pattern works the same regardless of the scale, 10 minutes or 100 years. It makes no difference.

So the appearance of a legitimate pattern seems to be what matters and the things that prevent a pattern from forming might not be discussed since there’s no pattern to question in the first place.

Matt:

I don’t often disagree with you but I’ll make an exception. If you looked at the same dates and commodity but quoted it in English pounds, the chart would be totally different. Basically that suggests that using that chart is no different than reading tea leaves.

Bob, the vast majority of the population would agree with you and, as we both know, the majority is almost always wrong. I have way too much experience with charts to even entertain the tea leaf comparison. Talk to Jeff Kern about his SKI system or Rick Ackerman about his method (as well as countless others) and they’ll tell you the same thing.

In my experience, those who aren’t wired for it unanimously doubt the charts, never their of understanding of the charts.

Like I said previously, the changing value of the currency is far from the only variable that you could choose to base your claim on. You don’t need a chart spanning 50 years to perceive an insurmountable problem. Yet countless people consistently make money with charts. All information is accounted for in the formation of chart patterns regardless of the time frame.

Yes, the pound gold chart would look totally different because the pound is a different currency. Patterns produced would yield different targets, all immaterial to the fate of the USD vs gold.

On a related note, a given charting tool/technique/system works best when few people know about it. This is the opposite of the usual assumption by those who don’t use charts. Those who owned a ruler to plot a simple trendline in the 1920s would have been ahead of virtually everyone — not so, today.

I have to add that I would probably give up my speculating if I couldn’t use my charts. The advantages they provide me are far greater than even a KER regular might guess.

The DSI leaves something to be desired from what I’ve just seen:

https://stockcharts.com/h-sc/ui?s=%24GOLD&p=D&yr=1&mn=0&dy=9&id=p78220361893&a=682393066

What do you think………. 🙂

I think today’s action provides a great opportunity to take profits (but I haven’t sold a share).

Now see, I was thinking about how this is a great buying heads up……..

Just considering, that if, you look at the long term chart,…..this puppy, could run

right back up to $2.50……with a little help from some deep pockets…….. 🙂

Well we’re both correct, it’s just a matter of time frame. I haven’t sold a share because I’m more interested in your way of looking at it.

Btw…..Never thought you were wrong……..far from it…..you are about the only one , that I would consider consulting on any chart…..PERIOD< .

And that is NO BS……

Thanks Jerry. I just worded it wrong; I knew you weren’t calling me out. 👍

No problem…….Hard to express thoughts on a machine…… 🙂

Kitco……starting to get some real scum bags on……jmo

Dumb question: If one doesn’t really know if it was a bullish cup & handle pattern until the price is past $50, does it really matter? Or………is the target so far above $50 that it would still be valuable advice? Just wonderin’.

Only problem…..the handle is failing ……

According to what I learned from IBJ……back in 2000…… 🙂

But, …..according to IBJ……it would need to be 1/8 over….the $50…..for the handle…

to mean anything…….But, I am far from a chartist…..leave that to Matthew….. 🙂

Jerry, I think that there is a very good chance that the cup and handle is for real.

I see the cup and handle., and I think it is for real,……just the handle is a little screwed up

But…….for a fact…..I AM NO CHARTIST….. 🙂

It matters due to the implied target.

All I know is the CON men like to take the GOLD historically, and that is what they are doing through all the Con Men Illuminati, NWO……so……Hang on…..

GOLD going up…….LONG TERM….and will return 9%….just on an inflation basis….since 71

Thanks Jerry; Matthew. Anybody here listen to Faber anymore? FWIW: https://palisaderadio.com/marc-faber-financial-turmoil-ahead-gold-is-my-largest-single-holding/

No, not lately……..I still like Faber…….thanks for the post…..

I like Faber but haven’t heard him a quite awhile. He always knows what he’s talking about.

Well, end of the day…….and crimex has managed to hold the lid on……

Another bullish message to silver owners comes from the performance of the “risk-on” junior silver miners relative to silver itself. SILJ gained as much 37% vs SLV since bottoming two months ago and has been bullishly consolidating the gain for the last month:

https://stockcharts.com/h-sc/ui?s=SILJ%3ASLV&p=W&yr=3&mn=11&dy=0&id=p82348009120&a=682187418