Comments on possible Fed policy 1-2 years forward

This is an excerpt of our good friend Peter Boockvar’s comment pre-Fed statement today. His expectations for a change in policy in 2022 and possibly in 2021 could be a major turning point for a wide range of sectors, especially the precious metals. Who knows what will happen but I agree with Peter that we can’t go into the next couple years thinking more QE is a guarantee. It will be in the short term but possibly not 1 or 2 years out.

Here’s what Peter had to say… Click here to visit Peter’s site where you can read over the full posting.

In talking about the Fed ahead of the afternoon statement and press conference I want to start by saying while we of course have a difficult few months ahead, the vaccine is here so I encourage the Fed to be now focusing more on reversing the 2020 Covid playbook and look to what the post Covid world will look like as economic activity ramps up again. The fiscal side it looks like will be what will help until the Spring.

To the debate over whether the Fed should sit tight today or announce a QE5 policy change where they would extend out maturities, I argue this:

I want to reiterate my belief that all Fed policy is doing at this point is only helping those large companies that have access to the capital markets, those that own stocks and bonds (or Wayne Gretzky hockey cards), those that own a home and they are monetizing the US budget deficit. All of this is fine if you’re included in this group. If not, sorry. Via the loan margin squeeze on regional banks, they are hindering loan growth to small business as it is not the cost of money that is the issue but the access to it. To this and a quote from a Fed staffer himself named Matthew Plosser in yesterday’s FT said “The terms for smaller firms are much more constraining, the maturities of the loans are shorter, the loans more likely require collateral, the interest rates are higher and the covenants are more binding.” The Fed is also again creating a wide differential between the value of asset prices and the underlying earnings power of publicly traded companies and the economy. And they are making it more challenging for that young, first time home buyer to save up for a downpayment who are seeing 6-7% annual home price gains and are also competing against private equity firms and all cash investors that are buying homes to rent. As for the financing of the exploding US budget deficit and debts, the US dollar continues to bleed lower with the DXY now approaching 90, hurting the purchasing power of those least able to afford it.

So when thinking about whether the Fed today should announce extending the average maturity of their asset purchases, I think flattening the yield curve and further squeezing loan margins would be a bad idea. Further goosing the housing market more than the current aggressive annual price increases via even lower long rates and more MBS purchases would make it tougher for that 1st time buyer. Further inflating valuations creates growing financial instability risks where the entire US economy has never been more dependent on the value of stocks and bonds. The weakness in the dollar is becoming really glaring and the inflation it is creating will hurt further lower income earners. Again, large companies and holders of assets, including ones home would love more from the Fed. Those smaller companies who need a bank loan, those that rely on a bank account for their savings, that young family who wants to own a home, the family living paycheck to paycheck, and those that are concerned with the never ending bubble blowing would not.

The vaccine is here. It’s time for the Fed to start looking to the other side but we can all agree on this, when the Fed eventually raises rates again, likely in 2022 I believe, notwithstanding the inflation I expect to flare in 2021, and begin the tapering of QE, it will for sure not be like watching paint dry.

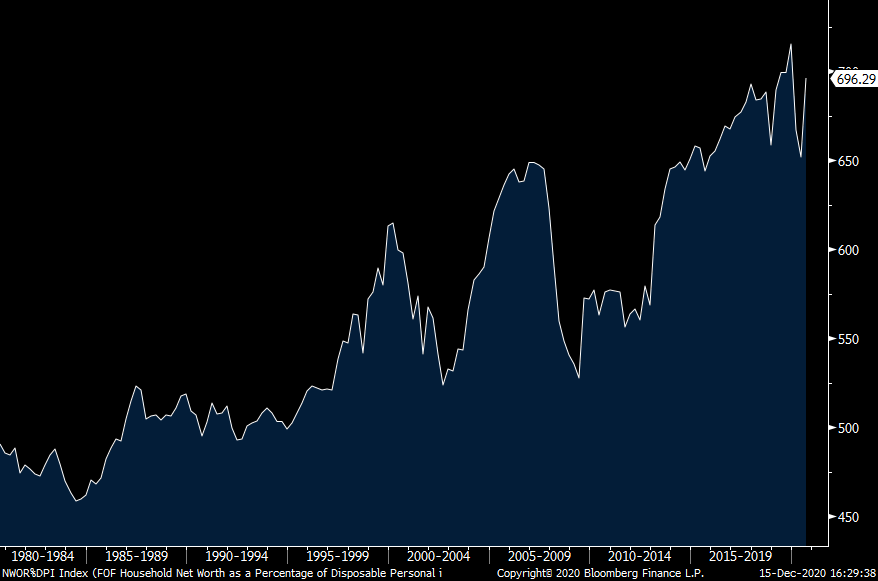

An updated chart from the Fed showing net worth (much of which is the value of real estate and equities) as a percent of disposable income

Click here to visit Peter’s site where you can read over the full posting.

This agrees with my previous comment- Quote” they are hindering loan growth to small business” – “The terms for smaller firms are much more constraining”

Why is the stock market melting up during a global pandemic driven collapse?

Because there are two economies one is being expanded by the fake pandemic and one is being destroyed by the pandemic. Every day is black Friday at Amazon and Walmart. Google, Apple, Microsoft, IBM, big pharma and most large cap companies on the stock exchange have explosive growth. Fueled by the consumption of the Small Business and middleclass market share. The illusion is that these large cap companies in the stock market are American Companies. They are not. They are Globalist companies. CCP is the gold standard, the perfect model of the globalist economy. This means that these Globalist companies are actually Chinese companies. They are anti-nation state anti-American companies. They are hostile foreign companies. They have bought and paid for our government. China is open for business. (GDP up 13%) The globalist corporate largest market(china) and manufacturing plants are expanding in China. It is the US that is shut down with unconstitutional draconian shutdowns and ridiculous regulation imposed by the UN and WHO. Which are also Chi-Com run. The stimulus is being used to expand Chinese communist companies with American taxpayer funds. This is the art of war at its Zenith.