Weekend Show Preview – Chris Ritchie Provides An Update On SilverCrest Metals – Construction, Exploration And Inflation Impacts On Silver Producers

We hope everyone is having a good start to the Easter long weekend!

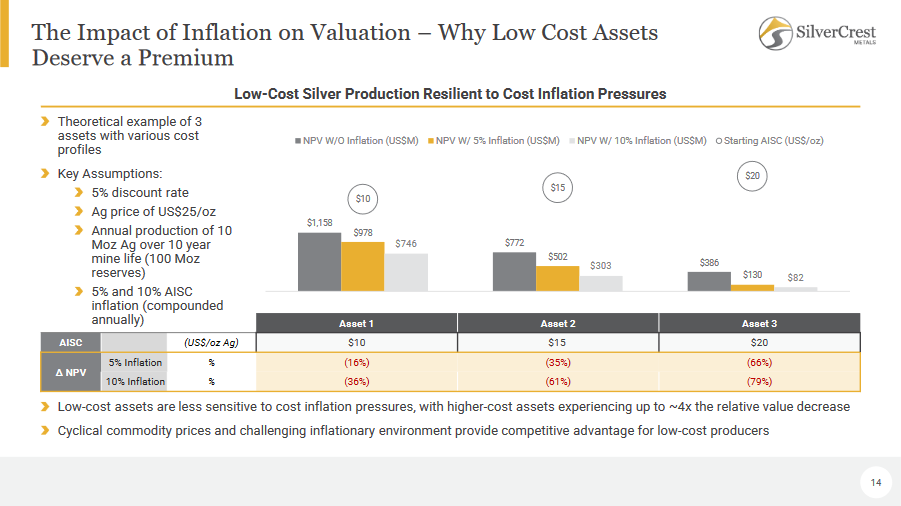

This is a preview to the upcoming Weekend Show where we feature Chris Ritchie, President of SilverCrest Metals (TSX:SIL – NYSE:SILV). We have Chris update us on the constructions progress at Las Chipsas as well as provide an exploration update on the back of the El Picacho drill results. Chris also shares some of the Company’s research on how inflation impacts silver producers, separated by the cost profile.

Click here to visit he SilverCrest website and read over the recent news.

Alasdair Macleod (at KWN) said: “As an indicator of the general bullishness in paper markets, Open Interest on Comex has been rising, and is above the bullion banks’ comfort zone of 500,000 contracts.”

I don’t know how he figures that’s “above the bullion banks’ comfort zone” and wonder if he realizes that OI was about 800,000 contracts right before the C-19 crash. I believe OI will see old record highs broken in the years ahead as more people than ever before wake up to what’s going on.

In 2018, 2019 and 2020 (pre-crash), silver hit 240,000 contracts; today it’s at 148,000. It would have to rise over 60 percent to reach 240,000 again and that’s good reason for optimism under the circumstances (technical and other).

I bet GDXJ will see 58 in under 3 weeks.

https://stockcharts.com/h-sc/ui?s=GDXJ&p=W&yr=6&mn=6&dy=0&id=t6995973596c&a=1040017498&r=1650054023519&cmd=print

Bitcoin tried and tried but couldn’t defeat fork resistance.

https://stockcharts.com/h-sc/ui?s=%24BTCUSD&p=D&yr=1&mn=1&dy=0&id=p50680317187&a=1102559533

Now it is bearishly stuck below two more forks.

https://stockcharts.com/h-sc/ui?s=%24BTCUSD&p=D&yr=1&mn=3&dy=0&id=p61876804203&a=1013900351

Its 7 year-old primary uptrend has been getting tested since January and it looks like this might be the month in which it breaks decisively.

https://stockcharts.com/h-sc/ui?s=%24BTCUSD&p=M&yr=9&mn=0&dy=0&id=p46187808679&a=1100715410&r=1650055179163&cmd=print

A weekly close below 36,000 would be a warning while a weekly close below 35,000 would would tell me that last year’s low near 29,000 will likely be broken.

https://stockcharts.com/h-sc/ui?s=%24BTCUSD&p=W&yr=6&mn=3&dy=0&id=p07558409925&a=1101103783

I posted this chart in January to show why this correction has much more bearish implications than the deeper correction of a year ago…

https://stockcharts.com/h-sc/ui?s=%24BTCUSD&p=W&yr=1&mn=11&dy=0&id=p97123417687&a=1102557845

This is one of my favorite stocks Core Asset’s (SYL-CC-CSE) Blue Property. Rick Mills does a wonderful job writing up what is going on, it is early days but Core Assets is being bought up ahead of the herd, which is also the name of Rick Mills articles. If you get a chance have a read, and remember Due Your Own Due Diligence. DT

Novo holders are about to get some relief…

https://stockcharts.com/h-sc/ui?s=NVO.TO&p=W&yr=3&mn=2&dy=0&id=p72519860289&a=1099549597

I was look at that weekly Novo chart on Friday and noticed that potential double bottom. Thanks for those forks.

New Found Gold just had its best YTD weekly close and looks ready for much more upside for many weeks to come…

https://stockcharts.com/h-sc/ui?s=NFG.V&p=W&yr=2&mn=0&dy=0&id=p05116540625&a=1144161325

From July 2016 until July 2019, silver was capped by the falling 50 month MA. Today’s setup is technically far superior. The difference is like night and day…

https://stockcharts.com/h-sc/ui?s=%24SILVER&p=M&yr=20&mn=11&dy=0&id=p46024205375&a=1144476450&r=1650145753087&cmd=print

Next week is likely to be a good one.

https://stockcharts.com/h-sc/ui?s=%24SILVER&p=W&yr=5&mn=0&dy=0&id=p59972552815&a=1144494201

Silver is likely to do well versus gold, too…

https://stockcharts.com/h-sc/ui?s=%24SILVER%3A%24GOLD&p=W&yr=5&mn=0&dy=0&id=p36256248777&a=1144482232

Price inflation’s impact on mining all in sustaining costs and the resulting stress it places on margins is a great argument to have a sound base in your commodity portfolio of royalty and streaming companies.

The above is especially the case when you are considering remote and/or infrastructure deprived projects.

Conversely, it is nice to look at pre-production projects that are situated proximate to producing mines that are building out infrastructure that benefits the proximate projects.

Another concern in this environment is governments irrationality.

What we once bandied about as ‘safe’ mining jurisdictions may need to be revisited from top to bottom.

Government overreach forces itself the forefront in ‘inflationary’ times.

I heard for the first time this week a politician utter, “windfall profits tax”.

Rinse, Lather, Repeat!

On Wednesday The Bank Of Canada raised the lending rate by .05%. This is going to add many thousands of dollars per year to the average mortgage cost in Canada. This is just the beginning. My last sentence makes sad reading because if you are caught in this vise you will be hit not only by more lending rate increases but also by inflation, and possible job losses, as people cut back their spending to meet necessary payments of food and shelter. I can smell a deflationary disaster approaching. Only when confidence has led to outrageous excesses can it be checked. Only when the memory of hard times has dimmed can confidence re-establish itself, and we are entering a period of hard times.

DT