Revival Gold Unveils NI 43-101 Gold Resource at the Beartrack Gold Project in Idaho, USA

Please read below for the much anticipated resource from Revival Gold and the Beartrack Gold Project. The market likes the resource pushing the stock up around 20%. The headline numbers of 1,214,000 ounces of gold (Indicated) at 1.13 g/t and 765,000 ounces of gold (Inferred) at 1.41 g/t are some good numbers for an open pit resource.

I will be chatting with Revival President and CEO Hugh Argo later this week so please send me your questions and comments ASAP to Fleck@kereport.com.

Click here to listen to the most recent interview when the resource was right around the corner.

…Here’s the news…

Toronto, ON – May 29, 2018 – Revival Gold Inc. (TSXV: RVG, OTCQB: RVLGF)(“Revival Gold” or the Company), a growth-focused gold exploration and development company, is pleased to announce a NI 43-101 mineral resource estimate (“Mineral Resource”) for the past producing Beartrack Gold Project (“Beartrack”) located in Lemhi County, Idaho.

Highlights

- At a gold price of US$1,300/ounce, a 0.61 g/t gold mill cut-off and a 0.26 g/t cyanide soluble gold heap leach cut-off, the pit-constrained Beartrack Mineral Resource contains:

- A total Indicated Mineral Resource of 33.4 million tonnes at 1.13 g/t gold containing 1,214,000 ounces of gold; and,

- A total Inferred Mineral Resource of 16.9 million tonnes at 1.41 g/t gold containing 765,000 ounces of gold.

- Beartrack was previously operated as an open pit, heap leach operation exploiting leachable ore. The mine produced 609,000 ounces of gold before it was shut down in 2000 when the price of gold was below US$ 300/ounce.

- Significant infrastructure from the historic operation remains. For this Mineral Resource, Revival Gold has conceptualized an initial heap leach restart with a mill operation to follow.

- The Mineral Resource is defined by 458 core and reverse circulation drill holes totalling approximately 71,000 meters.

- Revival Gold has now resumed exploration drilling with 8,000 meters planned for Beartrack this year and an additional 2,000 meters being permitted to drill later this year at the neighbouring Arnett Creek Project (“Arnett Creek”).

- In addition, Revival Gold has initiated a program of modern metallurgical test-work for Beartrack by submitting six composite samples to SGS Laboratories Inc. in Vancouver, Canada with initial results expected in the third quarter.

Details

Table 1 outlines the pit-constrained Mineral Resource for Beartrack with cut-off grade sensitivity shown in Table 2.

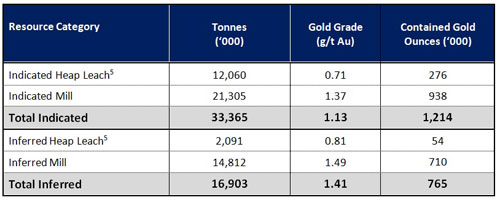

Table 1: Summary of Beartrack Project Indicated and Inferred Mineral Resources by Material Type (0.61 g/t gold mill cut-off and 0.26 g/t cyanide soluble gold heap leach cut-off grade)1-4

1 Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. It is reasonably expected that most of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

2 Mineral Resources were tabulated for model blocks with positive net value that lie within an optimized conceptual pit. Table 3 summarizes the various economic parameters that were used to generate the Mineral Resource pit. The price, recovery and cost data translate to a breakeven gold cut-off grade of approximately 0.61 g/t gold and 0.26 g/t cyanide soluble gold for mill and heap leach respectively.

3 Rounding may result in apparent discrepancies between tonnes, grade, and contained metal content.

The estimate of mineral resources may be materially affected by geology, environment, permitting, legal, title, taxation, socio-political, marketing or other relevant issues.

4 The effective date of the mineral resource estimate is April 18, 2018.

5 Heap Leach material defined by cyanide soluble grade leach characteristics.

Table 2: Sensitivity Analysis of Grade and Tonnage at Varying Pit-Constrained Cut-Off Grades for the Beartrack Project

1 Base case cut-off grades at US$1,300/ounce gold are approximately 0.61 g/t gold and 0.26 g/t cyanide soluble gold for mill and heap leach respectively. Heap leach cut-off grade varies as does mill cut-off grade based on gold price.

2 Includes both heap leach and mill material.

“This NI 43-101 gold resource sets a solid foundation for Revival Gold’s 2018 exploration and metallurgical test-work plans for Beartrack”, said Hugh Agro, President & CEO. “This year we will build on the potential at Beartrack and at the neighbouring Arnett Creek with a program of 8,000 meters of drilling, now underway at Beartrack, and a further 2,000 meters currently being permitted for drilling later this year at Arnett Creek. In addition, Revival Gold has initiated a program of modern metallurgical test-work at Beartrack by sending six composite samples to SGS Laboratories Inc. in Vancouver, Canada, with initial results expected in the third quarter”.

The Mineral Resource is defined by 458 core and reverse circulation drill holes totalling approximately 71,000 meters. This includes 424 core and reverse circulation drill holes totalling approximately 57,450 meters drilled from 1990 to 1997 and 34 core drill holes totalling 13,737 meters drilled from 2012 to 2017 after the cessation of historic mining operations. Statistical analyses comparing pre-2012 assay data with more recent core hole results revealed no distinct biases between the older and the more recent assay data. Based on those comparisons, and favorable quality assurance-quality control (QA-QC) results for the 2012-2017 drilling data, Beartrack drill hole data from the period 1990 through 2017 were considered appropriate for estimating Mineral Resources.

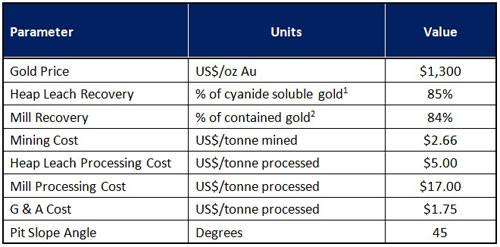

The Mineral Resource includes all oxide, mixed oxide-sulphide and sulphide material within a conceptual open pit shell that was based on a gold price of US$1,300/ounce along with the cost, recovery and slope parameters summarized in Table 3. Heap leach resources are primarily composed of oxide and mixed oxide-sulphide material and mill resources are primarily composed of sulphide material. Two separate net values were calculated for each block based on heap leach and mill parameters. The conceptual resource pit was generated from the maximum of the two conceptual block net values. The mill parameters shown in Table 3 translate to a breakeven gold cut-off grade of 0.61 g/t gold. The heap leach parameters shown in Table 3 translate to a breakeven gold cut-off grade of 0.26 g/t cyanide soluble gold.

Table 3: Conceptual Pit Parameters

1 Gold grades based on cyanide soluble methods.

2 Gold grades based on fire assay methods.

As presently conceived, Beartrack would be mined by conventional open pit methods and the mineralized material potentially processed by heap leach and milling methods. Mill flotation concentrates would be pressure oxidized and cyanide leached to produce gold doré on site. Oxide material from mill tailings would be cyanide leached to produce gold doré on site.

Beartrack was previously operated as an open pit, heap leach operation exploiting leachable ore. The operation shutdown in 2000 when the price of gold was below US$300/ounce.

The historic Beartrack operation involved open pit mining by truck and shovel at a rate of 13,600 tonnes per day of ore, with two-stage crushing to minus two inches, conveyed to a heap leach pad with gold recovered in an Adsorption, Desorption, Regeneration plant. A total of 21,880,000 tonnes at 0.98 g/t cyanide soluble gold were processed producing 609,141 ounces of gold, yielding an average recovery of 88% of the cyanide soluble gold.

Significant infrastructure from the historic operation remains. An initial heap leach restart at Beartrack could enhance the economics of a mill operation and encompass other potentially leachable targets in the Beartrack-Arnett Creek vicinity.

Mineral Resources were estimated for the Beartrack deposit using several different interpolation processes including inverse distance weighted, ordinary kriging, and nearest neighbor methods. Mineral Resources are based on the inverse distance weighted cubed grade model which compares favourably with the ordinary kriged model. Blocks in the block model measure 25 feet (7.62 meters) in each direction. This block size was selected to conform to historical production models for detailed reconciliation comparisons and was deemed to be appropriate by the Qualified Person given the current drill hole spacing. Block grades were estimated using Imperial units (ounces/short ton) and then converted to metric units.

Gold mineralization is associated with a large, northeast-trending regional structure known as the Panther Creek Fault Zone (“PCFZ”). At the southern end of the property, gold mineralization tends to be associated with the Proterozoic Yellowjacket Formation and the PCFZ and a Proterozoic quartz monzonite intrusive and the PCFZ at the northern end of the deposit. The estimate of gold resources was constrained by a combination of lithologic and gold grade wireframes. Block gold grades were independently estimated using fire assays and cyanide soluble analyses. The grade models were validated using visual and statistical methods. In addition, the grade models were extensively compared to historical cyanide soluble and fire assay blast hole data and historical production reports. The estimated block grades were classified as Indicated and Inferred categories based on drill hole spacing and continuity of mineralization.

In addition to exploring for additional leachable material in the Beartrack-Arnett vicinity, Revival Gold intends to explore for additional sulphide material and assess advancements in sulphide processing technology since the original Beartrack metallurgical test-work was completed nearly 30 years ago. Ultra-fine grinding of sulphide material and alternative oxidative processes prior to cyanide recovery of gold will be investigated.

The Mineral Resource for Beartrack was completed by Resource Modeling Inc. (RMI) based in Stites, Idaho with Mr. Michael Lechner, P. Geo. serving as the Qualified Person for this Mineral Resource estimate. A NI 43-101 Technical Report will be filed on SEDAR within 45 days.

Michael Lechner, P. Geo., President of Resource Modeling Inc., is the Qualified Person for this maiden Mineral Resource estimate within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects and has reviewed and approved its scientific and technical content.

Steven T. Priesmeyer, C.P.G., Vice-President Exploration, Revival Gold Inc., is the Company’s designated Qualified Person for the non-resource portion of this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects and has reviewed and approved its scientific and technical content.

About Revival Gold Inc.

Revival Gold Inc. is a growth-focused gold exploration and development company. The Company has the right to acquire a 100% interest in Meridian Beartrack Co., owner of the former producing Beartrack Gold Project located in Lemhi County, Idaho. Revival also owns rights to a 100% interest in the neighbouring Arnett Creek Gold Project.

In addition to its interests in Beartrack and Arnett Creek, the Company is pursuing other gold exploration and development opportunities and holds a 51% interest in the Diamond Mountain Phosphate Project located in Uintah County, Utah.

Additional disclosure of the Company’s financial statements, technical reports, material change reports, news releases and other information can be obtained at www.revival-gold.com or on SEDAR at www.sedar.com.

For further information, please visit www.revival-gold.com or contact:

Andrea Totino, Investor Relations Manager

Telephone: (416) 366-4100

Email: info@revival-gold.com

Cautionary Statement

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This News Release includes certain forward-looking statements which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company’s objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify mineral resources, failure to convert estimated mineral resources to reserves, the inability to complete a feasibility study which recommends a production decision, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

WOW : unstable leadership in an unstable world . Vote for sane people not nut cases. Pray S

I don’t have any skin in the game but those are brilliant numbers. This will be a mine if the locals allow.