Maple Gold responds to misleading statements made by newsletter writer

There has been a lot of attention recently on Maple Gold Mines after the slide Brent Cook presented at the recent conference in Vancouver. We now have a response from the Company which is outlined below.

I am a shareholder and continue to hold even though the shares have been pulling back recently. There should be some more news coming out with more drill results which I will follow up on.

Click here to visit the Maple Gold website for more Company information.

… Here’s the letter to shareholders…

It has come to our attention that a newsletter writer, while participating in a recent conference in Vancouver took Maple Gold Mines to task for the Company’s May 2, 2018 press release, which disclosed drill results for drill-hole DO-18-216. Not surprisingly, many of you were disturbed (as were we) by the conclusions he drew about the results disclosed in the above-mentioned release. As quoted in the first paragraph of the press release “DO-18-216 intersected 52m grading 3.53 g/t Au (uncut), within a broader, 158.2m interval grading 1.25 g/t Au (uncut) from 335m downhole (estimated vertical depth of ~220m) within the south-central part of the Porphyry Zone.” The higher-grade 52m interval was clearly disclosed throughout the press release and was unfortunately overlooked by the newsletter writer in the assessment.

Maple Gold agrees that investors need to read all press releases carefully and critically as the newsletter writer correctly advocates, but these same critical standards need to be applied when reading newsletters or listening to panelists’ discussions. In Maple Gold’s opinion, this newsletter writer erred in several ways on this occasion, which resulted in several erroneous conclusions that the Company believes had a potentially negative impact on the Company’s recent share price:

- Inadequate context was provided about the deposit characteristics and exploration stage

- The conversation was limited to focusing on a single aspect of the press release, i.e. the presence of a 1.5m high grade interval within a broad, lower grade interval

- The use of an interval calculator to obtain a “residual” interval (156.5m) and grade (0.44 g/t Au) described by the newsletter writer as “all waste”, overlooking the 52m long interval averaging 3.53 g/t Au (uncut) shown at the bottom of the broader interval (headlined in the release, highlighted in the first paragraph, table and shown on the cross section).

- The current largely inferred resource cut-off was confused with an eventual mine reserve cut-off to support the declaration that the average “residual” grade as calculated corresponded to waste. For reference, the closest analogue geologically to Douay in the Abitibi, the Malartic mine, has used mine cut-offs of 0.28 to 0.35 g/t Au (Agnico Eagle August 13, 2014 News Release).

Maple Gold appreciates the intention of the newsletter writer to help educate investors, but the way this example was used was not balanced or fair to the Company and resulted in misleading takeaways for investors. The Company acknowledges that, while a significant portion of the drill hole clearly carried robust grade distribution, portions of the top ~100 metres of the drill-hole may not make a pit-constrained resource estimation depending on the cut-off grade applied. Determining what material will be mined, stockpiled or considered waste is premature at this point and will be something considered in a PEA in the future.

In this note, we would also like to set the record straight and show that Maple Gold Mines respected all of the NI-43-101 disclosure and best practice standards, including those that the newsletter writer explicitly outlined in his conversation as being good indicators of a proper press release:

- Provide context for the press release, as well as key related data: We provided hole objective, interpreted drill plan, interpreted geological cross section, table of assay breakdown etc.

- Provide a plan map and geological/analytical cross section: The plan map (Fig. 1 below) clearly showed how the intercept released related to existing mineralized zones within the Douay resource area, and the section (Fig. 2 below) clearly showed both geology and gold grade distribution down the hole using a histogram format.

- Provide a table showing not only the intercept quoted, but also the higher grade intervals within it: This also formed part of the press release, and together with the grade distribution on the geological section again clearly showed that the higher grade portion of the intercept occurred in the last 52m. NI-43-101 standards require disclosure of any higher grade intervals within broader lower grade intercepts, as well as of location, azimuth and plunge of drill-holes, location of sample downhole, an estimate of true width vs downhole width, analytical methodology as well as the name of the lab where assays were completed, all of which were provided (see Table 1 below to view table that was included in the May 2, 2018 press release).

- Additional relevant information: Maple Gold provides high resolution core photographs so investors can view the nature of the host rock associated with mineralization.

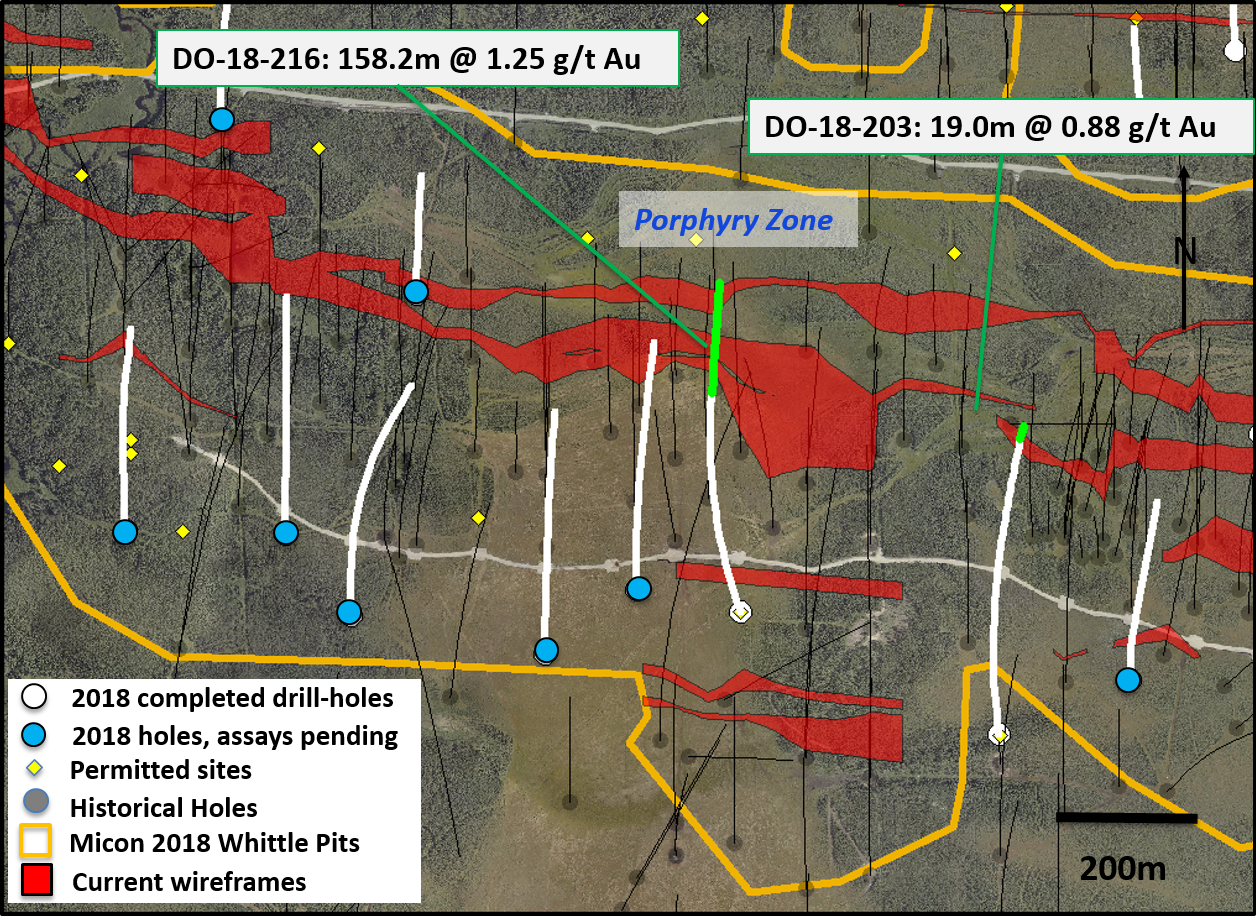

Fig 1: Plan view, with context for the broader DO-18-216 mineralized envelope (Porphyry Zone). Wireframes defined at 0.1 g/t Au cutoff. Note distribution of historical drillholes, with a spacing of over 150m in several areas, used to estimate an InferredMineral Resource – by definition not “drilled out” as claimed by the newsletter writer.

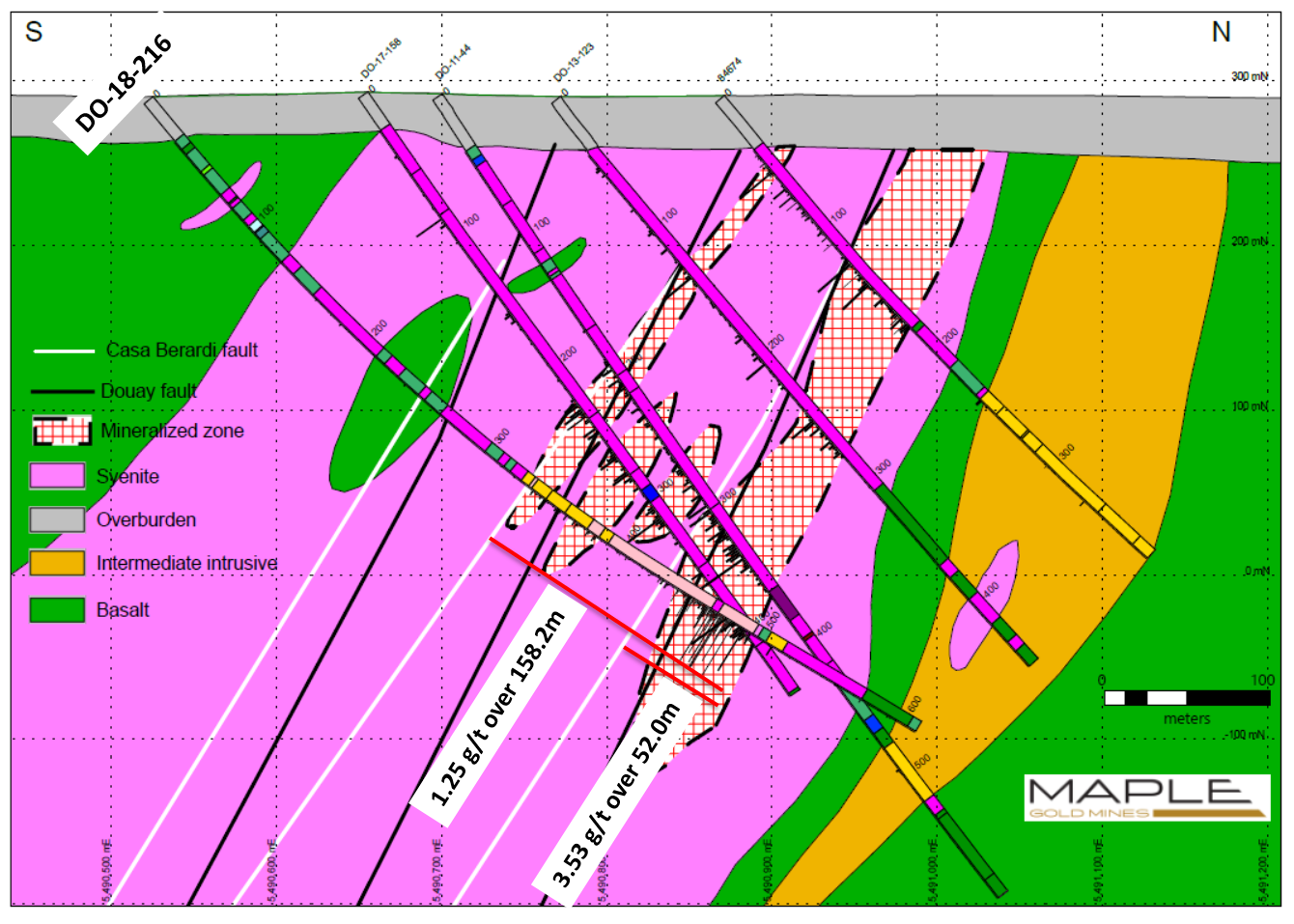

Fig. 2: (above) Geological cross section for DO-18-216. Note multiple mineralized zones at general cutoff of 0.1g/t Au, within broader 158.2m envelope. Gold grades expressed as black histogram bars that range from 0.1 to a maximum of 6.0 g/t Au for presentation purposes; clearly the lower 52m are higher grade, show a robust grade distribution and does not represent waste, although portions of the top 106m may not be part of a pit-constrained resource depending on the cut-off grade.

*Intervals given are all down-the hole lengths, which are about 90% of true width for DO-18-203 and essentially identical to true width for DO-18-216. Coordinates are NAD83 Zone 17N. All assays were performed by ALS Laboratories by AU-ICP21, i.e. 30 g fire assay with ICP finish with over limits (>10 g/t Au) done by AU-GRA21, i.e. gravimetric analysis of 30g sample weight.

In summary, Maple Gold remains very encouraged by the results from DO-18-216 and the early returns from the recently completed drill campaign. The Company strives for industry best practices and respect for all NI-43-101 guidelines. If any investors are ever in doubt, investors are encouraged to contact the Company directly for further clarity.

Best regards,

Qualified Person

The scientific and technical data contained in this press release was reviewed and prepared under the supervision of Fred Speidel, M. Sc, P. Geo., Vice-President Exploration, of Maple Gold. Mr. Speidel is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Speidel has verified the data related to the exploration information disclosed in this news release through his direct participation in the work.

Quality Assurance (QA) and Quality Control (QC)

Maple Gold implements strict Quality Assurance (“QA”) and Quality Control (“QC”) protocols at Douay covering the planning and placing of drill holes in the field; drilling and retrieving the NQ-sized drill core; drill-hole surveying; core transport to the Douay Camp; core logging by qualified personnel; sampling and bagging of core for analysis; transport of core from site to the analytical laboratory; sample preparation for assaying; and analysis, recording and final statistical vetting of results. For a complete description of protocols, please visit the Company’s QA/QC page on the website at: http://maplegoldmines.com/

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS PRESS RELEASE.

Forward Looking Statements:

This news release contains “forward-looking information” and “forward-looking statements” (collectively referred to as “forward-looking statements”) within the meaning of applicable Canadian securities legislation in Canada, including statements about the prospective mineral potential of the Porphyry Zone, the potential for significant mineralization from other drilling in the referenced drill program and the completion of the drill program. Forward-looking statements are based on assumptions, uncertainties and management’s best estimate of future events. Actual events or results could differ materially from the Company’s expectations and projections. Investors are cautioned that forward-looking statements involve risks and uncertainties. Accordingly, readers should not place undue reliance on forward-looking statements. Forward-looking statements include, but are not limited to, statements regarding timing and completion of the private placement. When used herein, words such as “anticipate”, “will”, “intend” and similar expressions are intended to identify forward-looking statements.

Forward-looking statements are based on certain estimates, expectations, analysis and opinions that management believed reasonable at the time they were made or in certain cases, on third party expert opinions. Such forward-looking statements involve known and unknown risks, and uncertainties and other factors that may cause our actual events, results, performance or achievements to be materially different from any future events, results, performance, or achievements expressed or implied by such forward-looking statements. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Maple Gold Mines Ltd.’s filings with Canadian securities regulators available on www.sedar.com or the Company’s website at www.maplegoldmines.com. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

The market has been opened for about 30 minutes (Thurs). MGM is down 1.5 cents to another 52 week low. It appears in the early going that the market supports BC vs MGM. As normal, time will tell as to what party is more accurate in their assessment.

@Brent_Cook To clarify:

“$MGM’s May 2 NR headlined 158.2m @ 1.25g/t including 52m @ 3.53g/t. The interval included a very high-grade hit of 1.5m @ 86.2g/t beginning at a drill depth of 471m. There are a number of ways to parse the data provided; I chose to focus on the 1.5m @ 86.2g/t as w/out that single interval the remainder (residual) of the 158m interval averaged 156.7m @ 0.44g/t. IMO, this is a clear example of smearing grade, which could potentially lead shareholders to think the entire 158m would be economic. ”

“1.25g/t is above the average grade of the Porphyry Zone (1g/t) and 0.44g/t is just below the cutoff grade used in the resource (0.45g/t). At a vertical depth of about 300m and down hole depth of 335m, one might want to consider if this is going to be economic. ”

“Using my drill hole calculator (https://www.corebox.net/drill_interval_calculator/) one can further play with the data provided. The 52m @ 3.53g/t includes 21m @ 7.78g/t,. removing the 21m leaves a residual grade of 31m @ 0.59g/t. Focusing on the 21m @ 7.78g/t, by removing the 1.5m @ 86.2g/t, the residual is 19.5m @ 1.84g/t. Clearly the 21m interval is the important intersection. ”

“If we now remove the 21m @ 7.87g/t from the long 158.2 @ 1.25 we get a residual grade of 137m @ 0.23g/t. ”

“It’s probably also worth pointing out that in the resource estimate for the Porphyry Zone, extreme outlier assays in the database are capped at 13g/t (pg. 117) and a coefficient of variation of 20.76. I’m not going to go thru the exercise of capping 86.2 at 13g/t, but I can assure you the resource estimator will.”

“Now given 137m @ 0.23g/t begins at ~250m vertical depth, you tell me if this is ore or waste.”

“Clearly, one has to consider this hole in the context of adjacent drill holes, and we are just making educated guesses as to what may evolve as MGM continues to explore this property. I don’t know if there is an economic deposit here or not. MGM has a competent technical team that is spending money to determine this question. However I do know that in the current market there is no room for error in one’s due diligence.”

“That’s all I have to say on the subject”

Brent Cook

Brent_Cook To clarify:

“$MGM’s May 2 NR headlined 158.2m @ 1.25g/t including 52m @ 3.53g/t. The interval included a very high-grade hit of 1.5m @ 86.2g/t beginning at a drill depth of 471m. There are a number of ways to parse the data provided; I chose to focus on the 1.5m @ 86.2g/t as w/out that single interval the remainder (residual) of the 158m interval averaged 156.7m @ 0.44g/t. IMO, this is a clear example of smearing grade, which could potentially lead shareholders to think the entire 158m would be economic. ”

“1.25g/t is above the average grade of the Porphyry Zone (1g/t) and 0.44g/t is just below the cutoff grade used in the resource (0.45g/t). At a vertical depth of about 300m and down hole depth of 335m, one might want to consider if this is going to be economic. ”

“Using my drill hole calculator one can further play with the data provided. The 52m @ 3.53g/t includes 21m @ 7.78g/t,. removing the 21m leaves a residual grade of 31m @ 0.59g/t. Focusing on the 21m @ 7.78g/t, by removing the 1.5m @ 86.2g/t, the residual is 19.5m @ 1.84g/t. Clearly the 21m interval is the important intersection.

If we now remove the 21m @ 7.87g/t from the long 158.2 @ 1.25 we get a residual grade of 137m @ 0.23g/t. ”

“It’s probably also worth pointing out that in the resource estimate for the Porphyry Zone, extreme outlier assays in the database are capped at 13g/t (pg. 117) and a coefficient of variation of 20.76. I’m not going to go thru the exercise of capping 86.2 at 13g/t, but I can assure you the resource estimator will.”

“Now given 137m @ 0.23g/t begins at ~250m vertical depth, you tell me if this is ore or waste.”

“Clearly, one has to consider this hole in the context of adjacent drill holes, and we are just making educated guesses as to what may evolve as MGM continues to explore this property. I don’t know if there is an economic deposit here or not. MGM has a competent technical team that is spending money to determine this question. However I do know that in the current market there is no room for error in one’s due diligence.”

“That’s all I have to say on the subject”

Brent Cook – 7 Jun 2018

Well Cory,what do you think??I have a lot of shares and have not sold either.its shame that one persons “opinion” can have such an impact.Im using this to pick up incredibly cheap shares IMO.

I would not be suprised (with some more decent drills results) that their resource estimate coming out later this year won’t be 4million+

What are your thoughts?

Scott