Scottie Resources – Recapping A Number Of High Grade Intercepts From The Blueberry Contact Zone In The Golden Triangle

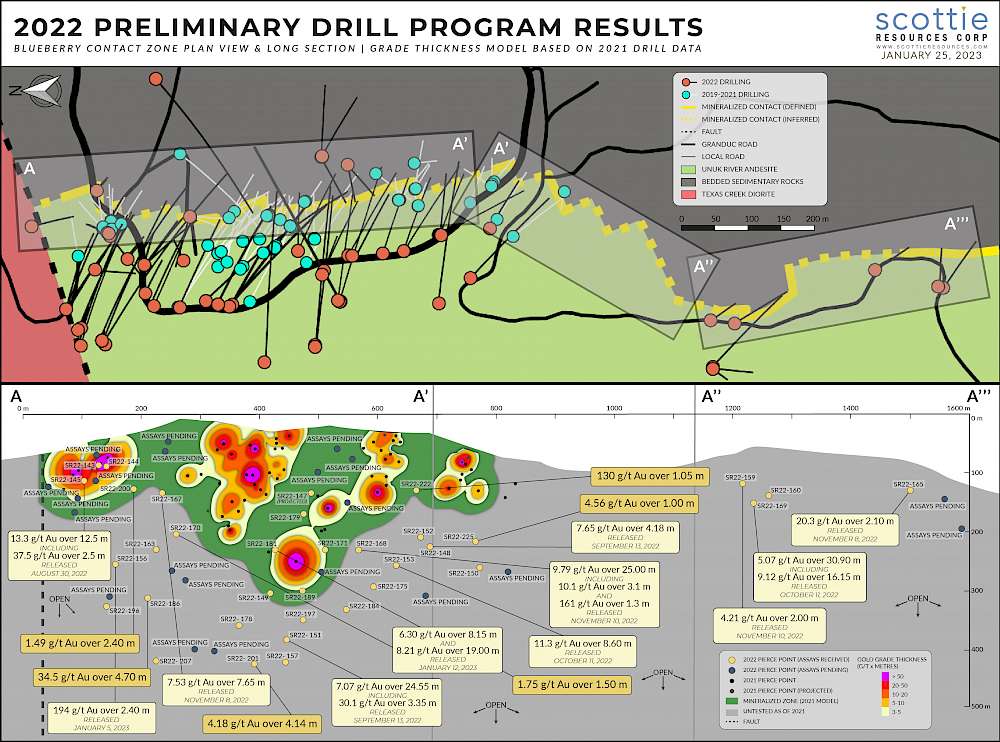

Brad Rourke, President and CEO of Scottie Resources (TSX.V:SCOT – OTCQB:SCTSF) joins us to recap three news releases from January reporting drill results from the Blueberry Contact Zone at the Scottie Gold Mine Property, in the Golden Triangle of BC. Every news release reported high grade gold intercepts. The headline numbers being 34.5g/t gold over 4.7m, 8.21g/t gold over 19m, 194g/t gold over 2.40m.

We have Brad summarize the 2022 drill program and focus on the consistent nature of the high grade mineralization. Refer to Figure 1 of the recent news release, that is also posted below. We also discuss the size of mineralization and how it could fit into a much bigger area play with some larger companies beside the Scottie Resources land package.

If you have any follow up questions for Brad please email us at Fleck@kereport.com and Shad@kereport.com.

Click here to visit the Scottie Resources website and read over all the news from January.

Yep, lots of green on the screen today post Fed meeting.

Gold is up to $1967 and Silver is up to $24.09. Gotta love it!

The only concern is that this surger higher in the aftgernoon could always be the initial head fake coming out of the Fed, where they come out and talk hawkish tomorrow to try and talk the markets into submission, thus causing a reversal. We’ll see if this move sticks, but nice to see the green for today.

The Federal Reserve Authorities are in an unhappy predicament that they caused. The inflation of credit is clearly sapping the economic prowess of The United States of America, but The Fed thinks it is reassuring the markets that all is okay. Not only are they backed into a corner that everyone can see, but their statements of calm are telling the public we aren’t part of what you see. The veil has been lifted. DT😉

It has been quite comical to see the Fed point the finger of blame everywhere else except themselves as far as their supposedly “transitory” inflation that they did a big part in creating.

Their financial media cronies and other banksters, of course, rarely push back on their nonsensical narratives and call them out on the excessive liquidity injections for a dozen years, and their backstopping of debt from insanely large fiscal programs as the real culprits of inflation.

Brad and team have done a great job as explorers and I have owned them in the past !!!

………but at 76 Million FD, and maybe pushing 1/2 a million ounces, I would rather take down RKR.V who have close to 3 million OZ, AU eqv, are only 14 million market cap FD, and are going to deliver a PEA by PDAC……….and have a spinnout to boot in about 3 months !

RKR.V is my breakout stock pick for Feb…………..DYODD ! Sticking with most undervalued a possible !!!

Brad mentioned in that call that he thinks they likely will have over a million ounces now, and discussed moving the goal posts on how big they think the deposit is, so viewing them through the lens of only 1/2 a million ounces is missing all the solid drilling they’ve released over the last 2 years.

I like the color green! LOL! DT