Goldfinger – Gold Champion Newmont Engineers Earnings Beat Despite Lower Production

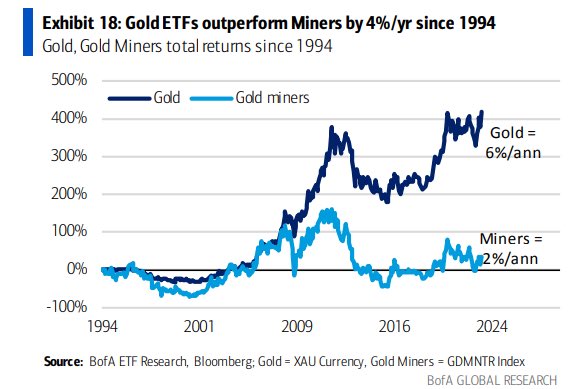

Below is an email Robert Sinn, AKA Goldfinger send out to his subscribers this morning. As the title states it’s a rundown of Newmont’s earnings. There are some very interesting points he isolates within these earnings plus the chart at the bottom comparing gold’s returns to the miners since 1994 that jumped out to me. Please let us know your thoughts and what jumps out to you.

A big thanks to Robert for giving me the go ahead to post this for all of you.

Be sure to stay up to date with Robert on Twitter (click here) and on CEO.ca (click here).

… Here’s the email …

Newmont Corporation (NYSE:NEM) managed to engineer a better than expected quarterly earnings bottom line despite lower than expected gold production. Newmont generated $481 million of cash from continuing operations while reporting negative $45 million of free cash flow. Free cash flow was impacted by lower production volumes, timing of working capital changes and higher capital spend.

- AISC (all-in sustaining cost) of production from its Nevada operation (NGM in combination with Barrick) rose to US$1,405 per ounce.

- Once again Newmont is pointing to a back half weighted year with 55% of its annual production coming in the 2nd half of 2023.

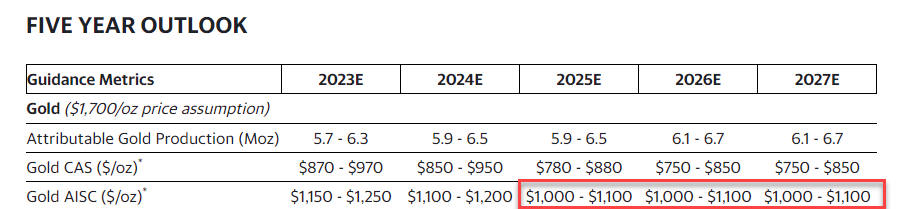

- Newmont sees AISC moderating to a range of $1,000-$1,100 per ounce and staying flat through 2027

Agree ! That’s being the case ever since fall 2015, gold’s last low …. The lure of quick crypto gains grabbing so much of that loose money we us ‘old farts’ use to play with on the VSE 40 years ago… let’s be patient (again) !

I bought some Nevada King Gold (NKG) today, some great drill results came out this morning and my spidy senses told me it’s time. Same management as Newfound Gold, the Atlanta pit is in Nevada, can’t beat a jurisdiction like that. Anyway, have a read: DT

Agnico Eagle – EPS of $3.86, revenue of $1.51B beats by $20M

Apr. 27, 2023

https://seekingalpha.com/news/3961776-agnico-eagleeps-of-3_86-revenue-of-1_51b-beats-20m

I don’t own any of the largest gold majors (unless you consider Equinox a budding smaller major)…, but I’d much rather hold Agnico Eagle over Newmont, as AEM is a much better run company with more compelling growth assets. Over the last 6-7 months, since sector bottomed in Sept/Oct, the overall performance of the PM producers, especially down in the mid-tiers has varied widely with some sideways, but most having trended higher, and some have moved quite handsomely to the upside.

Pull up the charts for Alamos, or Silvercorp, or Calibre, or Equinox, or Karora, or Hecla or plenty of other PM mid-tiers and they’ve doubled or in some cases tripled in price off their Sep/Oct lows, just in the last 6-7 months.

This is precisely why building a basket of high quality companies with some upside torque to the metals can regularly outperform the GDX or GDXJ, that often overweight behemoths like Newmont, Barrick, that don’t typically have as much leverage and yet are much more widely followed and held.

It’s also why being in high-quality producers near turns in the metals prices can be quite rewarding as a recurring strategy. Yes, eventually some of tinier microcap or even microcrap juniors will go scorching higher, but at turns in the sector, like we saw in the Fall of 2022, then or in the Winter of 2016, or the Fall of 2018, or the Spring of 2019, or the after March Pandemic crash of 2020, etc… then having a solid allocation of producing companies makes good strategic and investing sense.

If gold and silver are going to head higher over the short-term to medium-term, then you definitely want to have some companies with guaranteed gold & silver in the ground that can instantly monetize the moves higher in the metals prices. As the bull market then really starts to picks up the pace, then one can gradually rotate funds out of producers that have doubled and tripled off their lows, into junior explorers and developers that may not have moved much yet, in anticipation of the improving sector sentiment.

NEM is my biggest holding, although I never bought it, after getting NEM shares for my old FNV and GG shares, and soon my Newcrest shares. I think I’ll hold it as it pays a nice dividend and Pierre Lassonde says that as NEM is the only gold stock in the S&P 500 it will be the “go to” gold stock for the big funds in a roaring bull market. I plan to sell my NEM for $500 a share when gold goes to 10K. Then I will bask out in the sun and strum my guitar as I wait for the postman to bring my dividend checks from my blue chip stocks. Ann-Margret turns 82 today!

“The Newmont chart leaves a lot to be desired, especially considering that gold is trading near $2,000/oz.” Agreed, even though some of the majors are moving up as I type. NEM up over $1. PAAS up almost 4%. Very possible that investors will begin in the latter 1/2 to notice that miners (many of them) are one of the few sectors with profits. Tech, retail, real estate and others are not projected to throw off any profits during the upcoming recession. Hopefully, it’s cost of fuel won’t eat into it’s profits in the later months. Possibly might happen. If I had excess funds I wouldn’t hesitate to grab some NEM at this time. JMO

One of mining’s biggest issues in the trillion $$ + devoted to cryptos. A large part of those funds in previous years would have probably landed in our space.