Perfect Storm!

Our friend John Rubino over at Dollar Collapse posting this article earlier today. He does point to the many issues that investors could look at around the world which has to leave them worried. I would say that there are a couple standout issues that are more important for long term trends. These are dangers out of the emerging markets, the slowdown in China and a continued currency war around the world.

There are three aspects that will make turning this sinking ship around … Not saying it can not happen but it will be hard…

- Interest rates near zero or negative around the world.

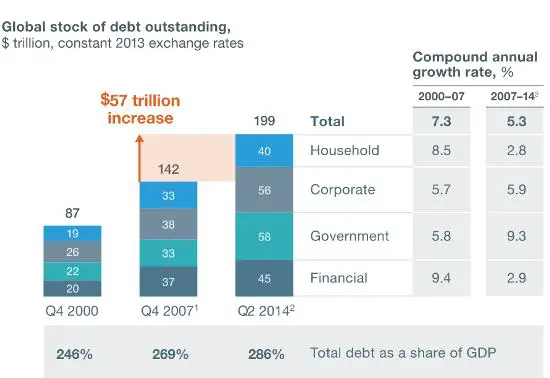

- Larger amounts of debt than in 2008 held throughout the system.

- The lack of impact any money printing has had recently.

Click here to read the post on the original posting page – Click here to visit John’s site for some other great posts.

…

One of the (many) fascinating things about this latest global financial crisis is that there’s no single catalyst. Unlike 2008 when the carnage could be traced back to US subprime housing, or 2000 when tech stocks crashed and pulled down everything else, this time around a whole bunch of seemingly-unrelated things are unraveling all at once.

China’s mal-investment binge is crashing global commodities, an overvalued dollar is crushing emerging markets (most recently forcing China to devalue), the pan-Islamic war has suddenly gone from simmer to boil, grossly-overvalued equities pretty much everywhere are getting a long-overdue correction, developed-world political systems are being upended as voters lose faith in mainstream parties to deal with inequality, corporate power, entitlements, immigration, really pretty much everything. For one amusing/amazing example of the latter problem, consider Germany’s response to the mobs of men that suddenly materialized and began molesting women: Cologne mayor slammed after telling German women to keep would-be rapists at arm’s length.

Why do causes matter at times like this? Because where previous crises were “solved” with a relatively simple dose of hyper-easy money, it’s not clear that today’s diverse array of emerging threats can be addressed in the same way. Interest rates, for instance, were high by current standards at the beginning of past crises, which gave central banks plenty of leeway to comfort the afflicted with big rate cut announcements. Today rates are near zero in most places and negative in many. Cutting from here would be an experiment to put it mildly, with myriad possible unintended consequences including a flight to cash that empties banks of deposits and a destabilizing spike in wealth inequality as negative interest rates support asset prices for the already-rich while driving down incomes for savers and retirees.

And with debt now $57 trillion higher worldwide than in 2008, it’s not at all clear that another borrowing binge will be greeted with enthusiasm by the world’s bond markets, currency traders or entrepreneurs. Here’s that now-famous chart from McKinsey:

Easier money will have no effect on the supply/demand imbalance in the oil market, which is still growing. The likely result: Sharply lower prices in the year ahead, leading to a wave of defaults for trillions of dollars of energy-related junk bonds and derivatives.

As for stock prices, in the previous two crises equities plunged almost overnight to levels that made buying reasonable for the remaining smart money. Today, virtually every major equity index remains high by historical standards, so the necessary crash is still to come — and will add to global turmoil as it unfolds.

The upshot? It really is different this time, in a very bad way. And this fact is just now dawning on millions of leveraged speculators, mutual fund and pension fund managers, individual investors and central bank managers. Right this minute virtually all of them are staring at screens, scrolling over to the sell button, hesitating, pulling up Bloomberg screens showing how much they’ve lost in the past few days, calling analysts who last year convinced them to load up on Apple and Facebook, getting no answer, going back to Bloomberg and then fondling the sell button some more. Think of it as financial collapse OCD.

What happens next? At some point — today or next week or next month, but probably pretty soon — the dam will break. Everyone will hit “sell” at the same time and find out that those liquid markets they’d come to see as normal have disappeared and yesterday’s prices are meaningless fantasy. The exits will slam shut and — as in China last night where the markets closed a quarter-hour into the trading session — the whole world will be stuck with the positions they created back when markets were liquid and central banks were omnipotent and government bonds were risk-free and Amazon was going to $2,000.

And one thought will appear in all those minds: Why didn’t I load up on gold when I had the chance?

Speaking of gardens, I’m about to build my 5th one. Just moved to a new area last month. With a full back yard totally dirt, about seven or eight 3′ X 10′ raised beds is my first priority when it quits raining. Lots of physical work and even a bit of investment but with a long pay off! There is nothing quite like eating one’s own produce like spinach, squash, tomatoes (5 kinds), potatoes (3 kinds), chard, carrots, lettuces (4 kinds), etc. In fact, having done this for the last 35 years, I give full credit to that fresh produce as to why I’ve reached 74 and still have my health and strength to build another garden. I agree completely that everyone ought to raise part of their food supply and stay away from the commercial food that is slowly killing many of us.

ditto on the stay away from commercial foods….

What? You don’t approve of chemically induced growth? How ridiculous of you!

Only as a hair treatment……………

China as hair treatment?

Very good for you Silverdollar!

You ever tried growing tomatoes in a bag Silver Dollar? That was one of my garden experiments last year and it came out pretty good. We hung sacks of dirt off the eaves and pierced holes in the bag for young plants. The only real problem is that they swung around in the wind too much and were hard to water. Otherwise it worked great.

No, have never tried it. Don’t see the point. I don’ like to have to feed plants. I try to keep it organic, building the soil from manure, old hay and leaves. When the worms show up in numbers, you can be assured you have it right. I do use ground up egg shells with each tomato when I plant, using an old coffee grinder. Lack of calcium will bring on tomato end-rot and the egg shells cures that. Otherwise most minerals are in the deeper sub-soils and is the main reason I stick with the garden beds. Happy gardening to you BM.

Wayne, most people are not willing to do what it takes. And, therein lies the problem.

Dumbest Rubino article EVER.

That last paragraph was just classic gold bull hymn singing. Get out the incense boys! Clasp your prayer beads close to your heart! Chant in unison you buggers! Soon gold will go…….

To-da-moooooooon!!!!!

Funny, I feel that this Rubino article is one of his best. He adds up the problems for one to consider and repeats the warnings on debt by all holder components. You must admit he sees the problems. What remains is the outcome. I’d say his thoughts are as rational as any other. We’ll see, perhaps in the very near future.

Yeup, some people will only see what used to be a forest after the trees have all burned to the ground.

When all that bad stuff listed above happens I can pretty much assure you that gold will not save the day. Nice try though with the forest analogy.

At least to Mars.

By the way, I have a lot of time for John R.

Who doesn’t? Great guy. But that has nothing to do with my disagreement with his article. Thanks for contributing.

🙂 Forgot the smiley face!

BM:

All things change.

True enough Bob. Maybe this time the stopped clocks will be correct. I don’t want to put a damper on the party because I am bullish on metals and miners too. But I still don’t think we have seen the final bottom in gold. In the meantime, these kinds of gloomy-doomy articles are sounding too melodramatic.

I can almost hear the weeping in the background.

It is all about the “Show” V!

V?

V key right next to the B key.

Re Saudi Arabia: It’s not that the Saudis aren’t making money. They’re just not making enough money to buy off their public. See McAlvany report:

http://sgtreport.com/page/2/

We will have a textbook key reversal for SLV:GLD if we can get a closing price above .1288 today. This would be good for the miners. Either way, things are shaping up very nicely.

http://schrts.co/DTC6LO

I predict that those who provide absolute proof of manipulation and market rigging will be laughed at and condemned as kooks and conspiracy theorists until their detractors perish from the earth or close to it due to starvation, plague and criminal or official violence largely due to their own foolishness. This is probably the most accurate prediction possible or one of them. It is difficult to reason with people who have a 2 minute attention span and need to be medicated and entertained constantly and are loyal to the opinion of the government and MSM. They can not be reasoned with and educated due to their profound life long brainwashing. They have to find out the hard way and stare physical and economic death in the eye before they will admit to there being a problem. Ladies and Gentlemen that is how it is. Warn people once and see that your own affairs are in order. This is the best you can do.

Steven, I have to maintain that the manipulation argument all centers are “definition” Some people refuse to admit that short selling (naked or not) is manipulation.

Steven:

Alas, all those who claim manipulation and market rigging in gold making gold go from $252 to $1923 before going to $1045 have never bothered showing any absolute proof of anything other than the manipulation that every single financial market has gotten throughout history. They are condemned as kooks and conspiracy theorists because they are.

Bob, it is all about semantics as I posted earlier. Shorting (naked or not) would be considered manipulation by some.

By the way, I will look at your book, but right now my discussion group and I are head over heals in some of Tom Robbins stuff. Incredibly good reads. I have now read five of them. (Even Cow Girls Get the Blues,Tibetan Peach Pie, Another Roadside Attraction, Half Asleep in Frog Pajamas and B is for Beer.) Turns out we used to hang out in the same bar (The Blue Moon) in Seattle before I finally regained my sanity.

Great way to get out of the bs of the current events!

I have read a bit of Robbins too. Years ago now. Where do you find the time though?

Big Al:

If you don’t laugh until you cry, literally, I will donate the $2.99 to your favorite charity. Really, I didn’t think I had that sort of talent but maybe I do.

For the rest of the group, if you are sick of doom and gloom, here is a little light entertainment.

http://www.amazon.com/gp/product/B01A7BXEQI?*Version*=1&*entries*=0

I’m surprised by that last line, Bob. I thought you, of all people, would know that the real kooks are those who think conspiracies are rare.

You learn by experience Matthew. I would say that Bob has plenty.

Matthew:

The real kooks are the people who think aliens rule the world, everything is a product of manipulation, Cheerios contain fluoride and a car thief in San Francisco stealing a car at the same time as a car thief in San Antonio is proof of a conspiracy.

I my business I see so many able-bodied, able-minded people apparently not working but living off checks from various sources. It is amazing to me as I know this cannot continue indefinitely. Soon I think many will have to start working. Many will resist and resort to stealing. Change will not happen until the pain of remaining the same exceeds the pain of change. Split wood, grow a garden, be productive now. Every little bit will help when reality comes flooding back.