US Citi Surprise index vs S&P – A big change

The chart below was sent to me by our friend Peter Boockvar as well as posted on his site BoockReport.com as part of a larger posting.

The US Citi Surprise Index is a measure of US economic data either exceeding or missing expectations. This measure can swing wildly but as you can see in the chart below has been fairly well correlated to the S&P over the past two years. This could be predicting a short term pullback for the markets or a general uptick in positive economic data very shortly. We already saw better than expected ADP job numbers today but let’s see what follows the rest of the week.

Here’s the chart and what Peter had to say…

We enter the last two days of the week with really important US economic data with jobless claims, the ADP and payroll reports, the ISM manufacturing index and auto sales. We do so with the US Citi Surprise index sitting at just above the lowest level since February 2016 and here is an overlay of it vs the S&P 500 over the past two years. Notice any disconnect?

Alternatively here is an article from the Financial Times posted on May 8th that tries to dismiss any worries investors would have from the chart above…

Points for honesty from Citi, with our emphasis:

While the collapse of the domestic Citi Economic Surprise Index has investors worried, there are still many reasons to push against the skepticism in economic reflation.

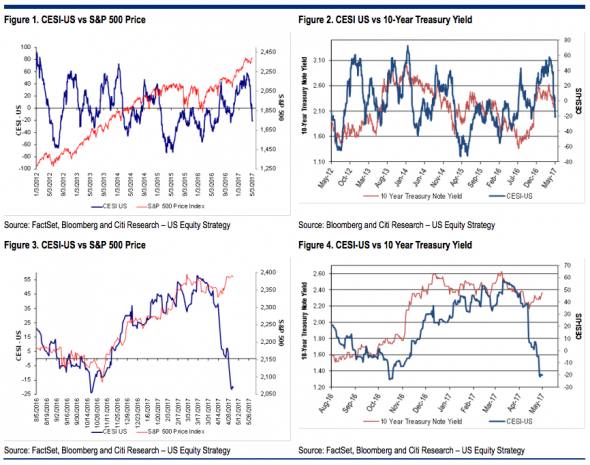

The investment community arguably is supposed to make educated decisions when it comes to buying securities, but that sensible approach sometimes misses the mark when people opine on issues in which they have little or no knowledge. The Citi Economic Surprise Index is a perfect example of unique proprietary design which has almost no bearing on those who discuss it. The models were built by quantitative analysts in Citi’s FX unit and were structured for currency trading. Thus, if the CESI wiggles one way or another, investors get signals to buy the yen or the euro or the loonie, etc. It was not meant to be used for stock prices or for Treasuries, but coincident rather than causal relationships are relied on even if they have no consistency whatsoever. For example, Figures 1 and 2 show the relationship between the S&P 500 and the 10-year yield versus the CESI over the past five years. If one looks at just nine months, the gap looks worrisome for stocks (see Figure 3) but not necessarily for 10-year Treasuries (shown in Figure 4). Unfortunately, we find that the narrative becomes the dominant feature, not the historical trading evidence.

It’s not a bad fit, but it’s not something to look at in isolation:

As we have mentioned here before, the index is also mean reverting — that means it’s designed to come back in as it has a natural pull towards zero. So, as Citi say of the US Surprise Index charted above, since “it was near a five-year high six-to-seven weeks ago and was vulnerable to a pullback.” That’s at least one reason to not get too excited about said pullback. It’s also something to keep in mind when considering the path of the European edition:

We’ve gone six months without a resident gloating windbag who loves to set up straw men and knock them down. I guess it was too good to last.

+1 GH

going to be very interesting on a global scale directly with US based companies and indirectly global companies who are effected by the Paris climate accord if Trump pulls out….we will know in minutes his decision…GLTA

thanks gh ….I see you add so much value…..nothing I post is based on my opinion just FACTS…sorry you cant deal with truth-reality

GH has posted some of the better charts, facts, and articles to complement his comments/opinions since he started posting on the KER. His posts are greatly appreciated by many on this site, and he does it without being insulting or cocky.

GH keep up the great work.

OJJ – I always appreciated your comments & charts, and have agreed with you from day 1 about the Yen/Gold correlation. You are a sharp guy, but you really are hostile and insulting to others in a way that isn’t warranted and is based on your own rose-colored glasses of how you imagine the world of resource investors to be.

Also, you continue to deal out plenty of OPINION and continually paint all the contributors and commentators and brainless gold bugs that all said buy and the top and all held on to all their shares and rode them down. You also seem to believe that nobody here has had any capital allocated to the general markets the last 8 years, which is rubbish.

The insults you continually hurl at people actually do NOT apply to 80-90% of the people on here, so those repetitive swipes are far from facts and bordering on the absurd. Give it a rest man and focus on quality posts over this displaced gold bug bashing that seems to cloud your mind and comments on a daily basis.

EX the experts have been wrong about gold and oil and uranium and US equites thats fact not my opinion. Sorry I pointed out with my chart today how anyone tdading PPP could have saved a lot of money…again the chart doesnt lie yet so many continue to look for opinions vs reality…im no OJJ…

I stand corrected then J (OJJ was actually a very good chartist and was obsessed with the Yen/Gold correlation and ripping on Gold bugs every chance he could get, so I thought you had just shortened it to J).

J – I’d agree with you that many of the “experts” have been wrong about gold/oil/uranium/and US equities. Look at Dennis Gartman, the guy is the ultimate counter-indicator.

However, very few of the resource “gurus” were saying the exact same things (expect people like Peter Schiff/Marc Faber/David Morgan/Bo Polony). There are plenty of Newsletter Writers, Economists, and Pundits that have had various cycles, or wave counts, or projects that were on-track for periods of time. There have been a lot of good sell-offs or corrections noted, and some good calls on counter-trend rallies. Just like nobody is right 100% of the time, there are also few that are wrong 100% of the time (except Harry Dent/Bo Polony) 🙂

I was wrong on several tranches I purchased in PPP, but was using charts and technical indicators in my decision making progress. I am underwater on my growing position, it has stung in the moment, and I’ll fall on the sword for making a bad call on that trade in my portfolio. However, I’m still holding my position and really am not concerned about it in the medium term, and expect to still make nice returns off of Primero. I’ll admit that the very small Moving Averages (like the 5 day or the 9 day you mentioned recently) are not something I usually take into consideration, but will broaden my horizons.

All we can do is learn from our mistakes, share good ideas, and make better decisions on a move-forward basis.

projects = projections

For the record – Kitco has a stock picking contest that starts next week, and I have selected (PPP) Primero as one of the companies I believe will outperform it’s peer group on a percentage basis.

Maybe I’m destined for more punishment, but remain bullish on the turn-around going on with the old CEO back in the captain’s chair. The strike is over at theior San Dimas mine and they are working on expanding the Black Fox mine through exploration to replace the depleted ore mined. Fundamentally there is far more upside opportunity than downside risk, but as the adage goes…. “the market can stay irrational for longer than one can stay solvent.”

Facts are one thing j, style is another.

omg how old are you?…. what its ok to pump BS as long as its done in style….grow up!!

I feel like we’ve had this conversation already…your were here before, originally under a different moniker, no?

I’ll give you the benefit of the doubt and assume you are a successful trader. If so, then you could make a positive contribution. But all your comments have a snide side that really detracts.

Kinda funny you would begin a comment asking me how old I am like a valley girl. OMG! Thanks for the lol 😉

Anyway, I know you’re no spring chicken, so if you can’t recognize your snideness now, I won’t hold my breath.

Enough said.

its really so sad that a correct additude with snarkiness is upsetting to you yet you have been taken down the garden path by all these experts who politely bend investors over as they are nothing but fear mongering cheerleaders..enjoy and thanks for the giggles!…GLTY

OJJ – Give it a rest. Your personal trolling of GH is ridiculous, and you have absolutely no basis or knowledge in your assumptions of what GH has done in his trading, nor the constant remarks about “fear-mongering cheerleaders” that you keep claiming are the sole inhabitants of this site.

I’ve listened to almost every interview and weekend show on the KER since 2011 and read the majority of the blog comments on a daily basis. Have there been a few perma-bulls that had their blinders on? Sure; but they are the minority. Most of the investors here were not saying buy, buy, buy in 2011 (excluding Franky) and most didn’t just sit on their stocks since 2011 all the way down. Many on here rotated in an out of positions a number of times, or waited until 2015/2016 to position in force. That is true of many other commodities, energy, and general sectors that investors on the KER trade and invest in.

To paint everyone with the same broad brush is the thing to giggle at, only it isn’t that funny, and serves 0 value to anyone on here. It’s a shame because it detracts from some of your posts that really do have good information or insights in them.

J – I saw up above that you are not OJJ and stand correct. My comments below that stated why I felt you may be the same person. (there aren’t many chartists, that obsess over the Yen/Gold relationship, that also take swipes at all Gold bugs in sweeping statements….. so I though initially you just shortened it to J).

I stand by my comments above that you are sizing up GH in a way that is inconsistent with his history of posts, and I personally like to read every comment I see GH post. As far as charts go, GH is one of the better technicians on this site, although, there have been a few with some many trend-lines, moving averages, and overlays that I could not see the underlying asset being charted (lol).

GH – Keep up the great work.

correct = corrected in first sentence.

I stand corrected, and apologize for making an assumption of who you were. You just really remind me of him for the reasons outlined and both have a short moniker with a J in it.

Regardless, I look forward to learning from your technical analysis and your posts but believe you’d get more traction if you weren’t insulting all the posters on here consistently. Just a thought.

EX if I was trading silver I would still be long as silver did not close below its sma of 9….NFP reaction will be interesting

That’s good to hear on Silver staying above the 9 day SMA. I’m likely over-exposed to Silver and Gold miners at the moment in my portfolio, considering the lackluster results in the miners as of late. June/July are seasonally not the best months for Gold or the PM stocks, but Aug – Oct is typically very constructive.

The GDXJ rebalancing created an unusual amount of uncertainty in the Mid-Tiers and larger Jrs, that added more selling pressure than most anticipated in many of the more followed names. This didn’t help investor sentiment with weathering the storm the last 2 months.

It is possible that this excessive selling and bearish sentiment may have exhausted the selling earlier than normal this year. We’ll see how things play out after June 17th with the GDXJ rebalancing is completed.

Yes, I’ll be interested to see the reaction to Non-Farm Payroll numbers as well tomorrow. I find their affect to be only transitory in nature though, but it may kick off an overdue rally.

Ex, don’t be fooled. It is definitely jj.

Thanks, Excelsior. I do try to provide some value. And I also try to know what I don’t know and learn from those who know more.

Insults coming from a guy like j are like water off a duck’s back.

Certainly he has the style of Original JJ. I’d be surprised if it isn’t him.

I agree with you, Matthew, about the meaningless generalities. It doesn’t take any talent or goodwill to point out late in a long bull cycle that naysayers have missed it. Nor to point out that prices in a cyclical sector were in the same place years ago, without any regard to the path it has traveled meanwhile. Just peacocking, without impressing anyone.

what are you guys nuts!! your attacking me because you think Im somebody else … wow this place is the loonie bin

I’ll give Zappa the last word:

His facts amount to meaningless generalities.

it does require a decent iq…cant help you with that Matthew….its amazing how hatred towards those who are correct blinds one from the facts-truth-reality as the weak huddle together…sad

Lol, I wonder what “decent” means to a guy that hurls 80 IQ insults! What a dipshit.

an iq you obviously dont have and your narcissistic personality would never allow you to accept that fact….I guess now your not a chart wizard any longer as my charts show reality vs BS…lol

Thank you, Matthew, for all the charts you post.

While I don’t always understand their implications (not being a chartist), I am sure you have a high IQ.

CFS – I agree.

Matthew most of us appreciate your charts and do understand the data points, trends, and support/resistance levels you are highlighting in most of them. (a few I don’t have visibility to).

* Since charts plot out market open/close high/low data points, that are the same for anyone that pulls them up on their own chart, then I fail to understand the criticism above that they are not reality?

Matthew – Thanks for all you contribute on here, and many people here have noted for years how much they appreciate your insights. Keep up the great work.

oh look its dumb and dumber….iq is in no way a reflection of success just look at all the smart well informed experts who have constantly called for a US equity crash and gold to the moon these past many years…come on guys wake up from your comas…these guys are the enemy not what you see on a charts

Stick to the truth,j. The stock exchange is extremely over-valued, and PMs are under-valued.

that chartster is an opinion which means nothing if your opinion was correct the chart data would confirm your opinion….it does not ….as everything trading can remain overbought and oversold for a very long time while your opinion is incorrect….perhaps Fri NFP will reverse the current trend and the chart will agree with your opinion….that is reality-fact

No, you little Martin Armstrong zombie, Chartster is correct. Stocks are historically very expensive and gold miners are cheap. Correct opinions DO matter to those who can think.

martin armstrong what??? so you hold on to that OPINION while the US equity chart suggests long positions and miss out on continued gains…..trade the chart data not opinions OMG

Even though PMs have a chance for a pretty big drop, those holding good stocks or phyz will be fine. The rebound in PMs will be very nice. But the folks that stay in the general markets are going to loose most of their principal for many years. When the general market does get ” let go “, it’s going to be U-gly!

chartster read again what you wrote!!!….thats exacty what Im preaching its the same old OPINION these last many years gold to break way higher and the US stock market to crash…WHY predict just set up your charts with the correct tools and you wont be long equities when they correct ir long gold when it does….I heard the same thing in the oil and gas and uranium sector just hold and you will be fine…..really ouch!!!

Matthew post any chart of what you currently own and I will prove my point which will have you all backing off attacking me for posting charts that show reality vs spin….any chart showing your fork approach….its not an attack on your charactor

Spin? Wtf are you talking about, jj? I post charts to show support/resistance levels and overbought/oversold readings. I often share what I’m doing but what everyone else does with those charts is their business.

So tell me, where’s the spin on the following chart?

http://stockcharts.com/h-sc/ui?s=%24SILVER&p=W&yr=5&mn=6&dy=0&id=p72541667274&a=518191349

wow Matthew your post is going to prove my point to a T…first off why so angry at me? the charts I have posted are even more simplified than ykur charts….you and I have a rare skill that we can remove opinions from our positions as we trade off the chart data not expert opinions….what you posted removes all the Spin and BS that so many fall prey too…you show key support and resistance regardless of where the experts suggest silver is headed….My charts provide the same so back off from attacking me and I will do the same!

well there you have it folks nobody here wants to deal in reality as you all protect each other and dont want to see chart work minus opinions…..enjoy your long and wrong positions and never bother to learn how markets really trade….what a crazy bunch huddled together pumping similar opinions vs reality ……Matthew what a dissapointment…..I’ll give you a clue I’ve been a proffessional trader my whole life and was a contributor at one of the regular speakers here web sites but now I know its a waste of my time with you lot…..sad

j,

Make a few (forward looking) predictions, please.

And be specific!

just remember Matthew you were not man enough to admit my chart observations as you might of learned a thing or two….ego kills and boy do you have it in spades….your approach would not make it on a trading desk only at blogs for simpletons…..enjoy

There you go with your assumptions and generalizations again. I don’t recall having a problem with your chart observations or even that you made me aware of any to discuss.

As for my approach, thanks for your concern but I use more than one and they work. Fyi, trading is not something I focus on here because, 1.) this site is not dedicated to traders and, 2.) many junior miners are too small and illiquid to trade in size. In those cases, buying weakness and selling strength is the only way to go as far as I’m concerned.

Btw, it’s ironic that you say you live in reality yet obviously don’t trust yourself to size-up a company’s value and/or prospects. If you only feel confident with charts, what do you do when buying a house, wait for the neighborhood to establish an uptrend? (lol)

In case you didn’t know, fundamentals make charts, not the other way around.

I recall similar, though less vitriolic, commentary at a day trader site around the turn of the century. There are often fireworks when traders and investors clash; however, PM market volatility makes it a great place for traders, and investors can play that game too – while pruning their portfolios.

Although steadily rising while the PMs hover in a trading range, there is comparatively little volatility in the general markets. Money can be made (and lost) in both areas.

The real problem arises when it becomes a religion of sorts. Then lines of belief and reality become blurred.

the key events of the dotcom bubble and rising interest rates that began in March 2000 along with the US financial crisis clearly show on the monthly chart while all the fearmongering BS these past 7 years have lead investors down the wrong path waiting for the crash …..funny how the goldbugs ( who have forecasted way higher prices )suggest buying against the herd while gold is still 30% off its highs yet the same experts apply the contrarian trade to US

equities while the joke is on them. How come every decline in US equites is the start of the next crash yet every decline in gold is another buying opp

https://tinyurl.com/y7omjueb