Gold, Silver and USD charts – Short term PMs hanging on by a thread

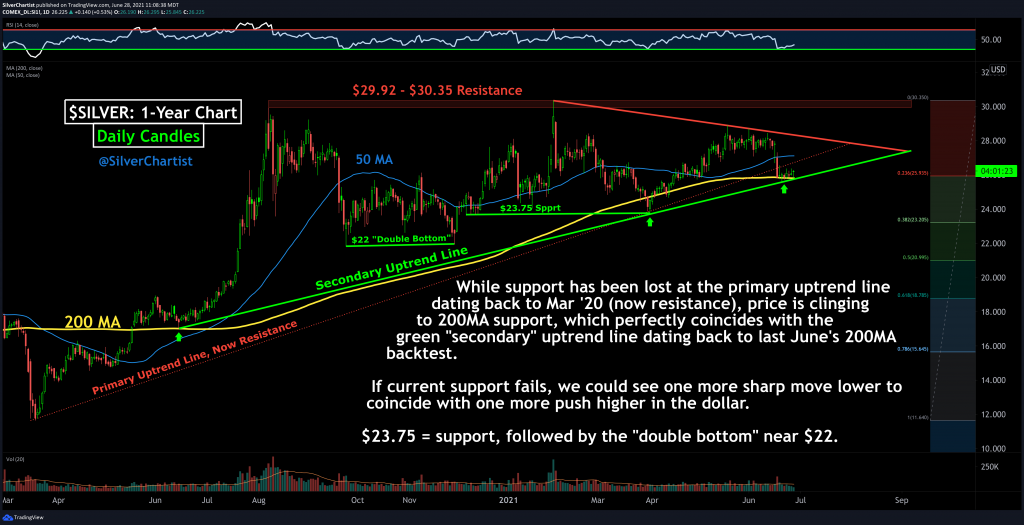

Steve Penny, Publisher of the SilverChartist Report joins us to share some key charts for the precious metals. we start with the US Dollar bounce and if there is another leg higher in the near term. Recently the dollar and metals have been inversely correlated so this could be another short term headwind for gold.

We then shift to a daily chart for gold and silver to outline some key downside levels that both are at. The short terms are showing very oversold levels while the long term bullish trends are still in tact. We discuss what a breakdown further in gold and silver would do to the charts and where a reasonable bounce would take us.

Click here to visit Steve’s site and learn more about the SilverChartist Report.

Stink bid NOVRF HIT @ 2.08

Sold NOVRF @ 2.37 for an 14% inter day gain

That’s a nice Novo day trade Marty. You made a better percentage trade on that trade today, than many generalist investors will make all year sitting in their mutual funds and bonds.

England just beat Germania 2-0 at Wembley !!! 1st time since 1966 that England has knocked the Germans out of a major tournament. William and Kate and Beckham were there without masks. Is Erik at the Sweden-Ukraine game? Go Sweden!

ASA is oversold for the first time in over 15 months based on the daily RSI(14)…

https://stockcharts.com/h-sc/ui?s=ASA&p=D&yr=1&mn=1&dy=0&id=p21178277132&a=982748961

The royalty companies and NEM are holding up well.

Pyrite to that point…

__________________________________

SwingTrading_for_Wealth @SwingTr74597686 8:54 AM · Jun 29, 2021· Twitter

“$NEM and $FNV still showing relative strength to $GDX. These are the ones to watch for an early indicator that the bottom is in. They’re both still above their previous DCL.”

https://twitter.com/SwingTr74597686/status/1409903021467832324

Interesting Matthew. I’ve never heard of ASA as a close-ended gold fund. Thanks!

Hundreds of locked-down miners at epicentre of Covid outbreak threaten to RIOT if they don’t get more water and food – saying they’d have more rights if they were in jail

Funny, the above does not show up under NEM news on my trading platform.

Australia has turned into one of the most fascist countries with gun control and forced vaccinations.

It’s happening everywhere and the sheeple are too dumbed-down to recognize tyranny when they’re living it.

Agreed. It is like fish being unaware of water when they are surrounded by it and swimming in it.

Nothing to do with fish and water. More about a corrupt government in Victoria and Chinese arm twisting in Canberra.

It has everything to do with fish in water, in the sense that fish are so inundated in water that they are unaware of it, and people that vote in these ridiculous politicians and policies in the first place, are unaware of how entrenched in collectivist nanny state erosion of individual liberties.

My comment was simply an analogy to compliment the point Matthew had made that the fascist policies are “happening everywhere and the sheeple are too dumbed-down to recognize tyranny when they’re living it.” I couldn’t agree more, and most of the sheeple are either openly embracing the tyranny or are not thinking critically about how these decisions and turning over of more power to the federal governments are going down the wrong direction, as they are now oblivious to it going on around them.

Thank you for those further two paragraphs. Much better to leave out the animal comparisons, which is done too often by those who spend their time pouring over graphs, trying to make sense of those dots, not realizing that they are sheeple too.

Oh look, an offended sheep who doesn’t know what to do with a graph or who’s really behind his country’s problems.

Victorians got it bad but we Queenslanders won’t wear it.

I just reviewed today’s editorial again today with Steve P. @SilverChartist, and really appreciated getting his support & resistance levels in the Dollar, Gold, Silver, and thoughts on the miners. It is very nice for him to come on and share his technical analysis with the KER family, and hopefully others are enjoying getting perspectives like this and from the other guests we are bringing onto the show.

Yeah, Steve Penny is a sharp guy & has made a big splash here in 2021.

It is unfortunate that June has sucked for Gold, Silver and Uranium.

Agreed on both points 4 oz.

Really appreciate the kind words!

Jeff Clark @TheGoldAdvisor on Twitter 8:51 AM · Jun 29, 2021

“Well lookie there (date of low)” [June 29th]

Chart: Average Silver Gain/Loss Throughout The Year (based on 1975-2020 seasonality)

https://twitter.com/TheGoldAdvisor/status/1409902404187791363

Fortuna Silver Shareholders Approve Acquisition of Roxgold

Jun. 29, 2021

(SAND) (SSL) Sandstorm Gold Royalties Acquires Multiple Cash-Flowing Stream and Royalty Assets For US$138M, Increases 2021 Guidance

29 Jun 2021

“The addition of the VGML Stream and Vale Royalties has strengthened our immediate and long term cash flow projections and fortified our producing royalty portfolio,” stated Nolan Watson, President and CEO of the Company. “The Vale Royalties provide Sandstorm shareholders exposure to high-quality assets with reserve weighted mine lives of several decades, while the VGML Stream adds fixed gold deliveries with operational and exploration upside.”

Anyone has DSI number for GOLD today?