Millennial Precious Metals Hits Long Mineralized Gold Intercept With High-Grade Intervals Below The Pit Shell at Mountain View Project

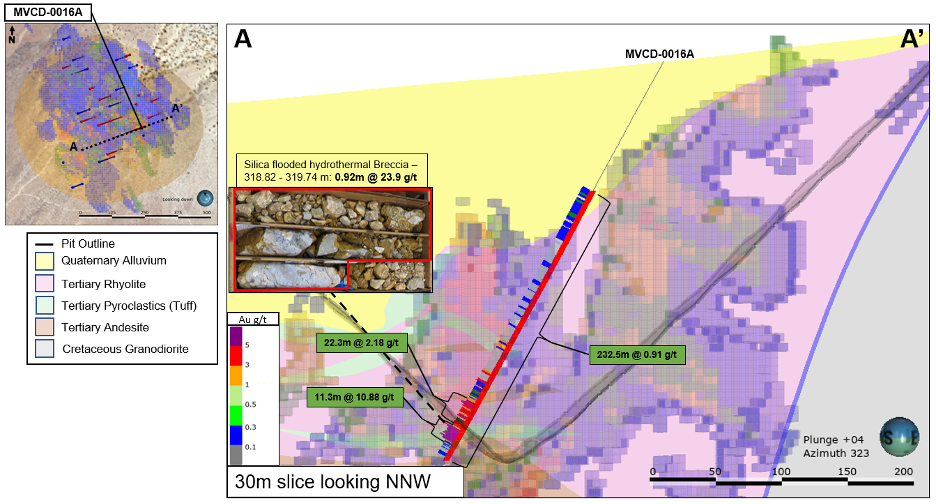

Jason Kosec, President and CEO of Millennial Precious Metals (TSX.V:MPM – OTCQB:MLPMF), joins us to review the recent drill results at the Mountain View Project in Nevada. Drillhole MVCD-0016A returned an intercept of 0.91 g/t oxide Au over 232.5m including a high-grade intercept of 10.88 g/t Au over 11.3m and 2.18 g/t Au over 22.3m.

We discuss how the high-grade portion of the hole at depth, and 30 meters below the current pit shell provides further evidence of the potential bonanza grade feeder zone which could significantly augment project economics at Mountain View. We discuss the company plans to continue to test these deep structures, and that if the grade does keep increasing that it may be potentially amenable for underground mining at depth, similar to the nearby Sleeper deposit. In 2021, the Company drilled 21 holes at Mountain View totaling 5,256m. The 2022 drill program at Mountain View consists of 2,700m with the objective of confirming RC grades, validating grade continuity, and extending the mineralization laterally to increase the pit size.

Next we have Jason explain the attractive low strip ratio, and that when that is factored in to the potential economics, that the grade after dilution is very attractive when stacked up against other similar projects in the Great Basin that are in production or in development. The Company has 7 projects in total, but currently has 1.2million oz total gold resource, from the 2 primary flagship properties: the Wildcat Property (~776,000 oz at 0.40g/t gold) and Mountain View Property (~427,000 oz at 0.57g/t gold).

If you have any follow up questions for Jason, or want more information on any aspect of Millennial Precious Metals, then please email us at Fleck@kereport.com or Shad@kereport.com.

The metals are off to a fairly good start today:

Gold @ $1824

Silver @ $23.86

Copper @ $4.47

Platinum $1013

Palladium $1963

Update:

Gold @ $1841

Silver @ $24.15

Platinum @ $1034

Palladium @ $2024

.

Looking good for the Precious Metals complex.

BBBBrrrrrrreeeeeaaaaakkkkkkkkoooooouuuuuutttttttttttt!!!!!!!!!!!!!!!!!

SIL, DEF, ELEF, IPT, all up over 10%, I own ’em all…

Congrats, Dan. I hope they go huge for you.

Add SCZ to that list, my apologies for gloating but this is more a sign of money seeking the best and brightest investment of the year, let’s go for a ride!

I think you’re celebrating, not gloating, and there’s nothing wrong with that!

Agreed Dan and Matthew – nothing wrong with a little celebration on a positive green day in the PMs.

.

Dan out of those you listed I also hold SIL, DEF, IPT, and SCZ and enjoyed the surge higher. There were many more up bigly on the day in my portfolio, and it was the largest percentage increase I’ve seen in my portfolio in about a year or so.

.

Ever Upward!

Some up … some down and two hits already. Currently negative. I think it will be a good day once they are through with the daily routine.

Positive for the 3rd time in 20 minutes.

Millennial down…account break even. Gold up $24…silver, copper, Platinum, Palladium, Oil also up. Matters not…yet.

oh yes, in like flint. Next consternation at nov high me thinks

Kevin O’Leary talks up buying luxury watches as a hedge against inflation. DT

Which luxury watch companies does Kevin O’Leary own?

Kitco also had a two part interview with Rob Niederhoffer, mostly about bitcoin.

Santacruz showing a sign of life…

Yes I have SCZ as well as IPT mentioned above.

Yeah… SCZ was very peppy today indeed. Nice to see!

been a while with my option play of gold calls and puts on tech to avoid weeks of market boredom, well time to cover the tech put side as gold calls paid for in spite of time erosion. Sticking with the calls for a while longer as this pop up looks to have legs.

So ignore your weekend spiel. Got it.

Does the gap bother you?

Only slightly since SLV only tracks the silver contract which doesn’t show a gap.

I like Door #2 better.

No answer necessary but is there a negative correlation between the price of physical metals and the price of miners? Time to go walk the dog.

This is an important time for the stock market.

Nasdaq weekly:

https://stockcharts.com/h-sc/ui?s=%24COMPQ&p=W&yr=3&mn=11&dy=0&id=p64571144372&a=942652907

Nice charts as always Matthew…..on the individual stocks themselves would you consider the lack of volume even today a concern???

That depends on the stock. Among those that populate GDX, HUI, XAU, SIL, maybe so. Among the highly speculative tiny caps, especially the pure explorers, not at all.

Thanks Matthew. As I said on the weekend, my scope has narrowed so much I’m concerned I might be getting a biased view of things.

OR, you might be well-tuned and dead-on. I know the feeling though. There are always risks and tradeoffs in attempting to maximize performance.

You lost me at “maximize performance”. Lol…I’ve really liked hecla as a potential play utilizing just going long options. Cheers

Yeah, I’ve got a nice weighting to Hecla and it was up 11.8% today, so very encouraging to see the larger silver stocks moving with the torque of the juniors on a big up day in PM sector.

I’ve been watching the following Dow-gold quarterly chart for almost a year and it looks like we are finally going to get the bearish resolution (for stocks) that seems logical.

https://stockcharts.com/h-sc/ui?s=%24INDU%3A%24GOLD&p=Q&yr=50&mn=0&dy=0&id=p25869032081&a=954530030&r=1642617209712&cmd=print

Fantastic chart. Great action today. Hope it holds into the weekend!!

Based on multiple factors, I’d be pretty surprised if this move falls apart. It has a lot going for it.

Yea I agree. Time and the long slow drain with a lot of starts/stops along the way should have sentiment pretty bombed out.

There are 8 more sessions this month but gold is very well positioned technically to give us what we want for a monthly close.

https://stockcharts.com/h-sc/ui?s=GLD&p=M&yr=10&mn=11&dy=9&id=t6785983268c&a=637761983&r=1642617611798&cmd=print

Hecla looks excellent and its RSI has already exceeded the peak readings of October and November despite price still being a long way from exceeding the price highs of those months.

https://stockcharts.com/h-sc/ui?s=HL&p=D&yr=0&mn=7&dy=0&id=p47946995161&a=1084873463

An important speed line has been reacquired along with multiple moving averages. Get ready for a potentially huge short squeeze as “sophisticated” money like Bob Hoye and followers rush to cover.

https://stockcharts.com/h-sc/ui?s=HL&p=W&yr=3&mn=11&dy=0&id=p69333049858&a=1089581432

To be fair, I don’t know that Hoye was/is short but would bet on it if he is currently very bearish the stock market.

HL also looks fantastic versus gold and stocks.

HL:GLD

https://stockcharts.com/h-sc/ui?s=HL%3AGLD&p=D&yr=1&mn=5&dy=0&id=p46648614479&a=857421585

Account went negative for a 4th time. Some up … some down all day long.

IPT vs Gold (up 18% this week so far)…

https://stockcharts.com/h-sc/ui?s=IPT.V%3A%24GOLD&p=W&yr=7&mn=2&dy=0&id=t9566225856c&a=455579182&r=1642622550588&cmd=print

Compared to the recent volumes of IPT it is encouraging today but I’d still like to start seeing +500,000 days returning occasion

Those days are coming soon but I’m perfectly happy with today’s volume especially considering the volume of the last two weeks.

https://stockcharts.com/h-sc/ui?s=IPT.V&p=D&yr=1&mn=0&dy=0&id=p20068644721&a=1069198996

SILJ is up 43% versus Netflix in just over 3 months…

https://stockcharts.com/h-sc/ui?s=SILJ%3ANFLX&p=D&yr=1&mn=1&dy=0&id=p89841810129&a=992357275

SILJ vs GDX is bullish for the sector.

https://stockcharts.com/h-sc/ui?s=SILJ%3AGDX&p=D&yr=1&mn=3&dy=0&id=p43129354615&a=1050579291

Reducing net exposure to the sector because of today’s strength is probably a big mistake.

https://stockcharts.com/h-sc/ui?s=%24HUI&p=D&yr=1&mn=3&dy=0&id=p56507499488&a=982826709

My account down -1.82 %, with shorts jumping in last couple of minutes. Physical did well. Santacruz had good finish. That was about it for me.

Hmmm…. This was the biggest up day I’ve had in about a year (since the SilverSqueeze phenomenon). My overall portfolio was up 7.7% on the day, which is a big move for that basket of stocks.

Interesting Ex. Of my 20 or so stocks, only Santacruz exceeded your 7%. Maybe tomorrow when the other half of my stocks go up.

Well, I’m pretty heavily weighted to the producers and larger developers, and the vast majority of Gold and Silver producers and developers had a really good day. Both GDX and GDXJ were up a little over 7% on the day, SIL (the ETF) was up 7.9%, and SILJ was up 9%. The vast majority of the sector was up bigly today by most accounts.

.

Of course, I am rooting for your success though Lakedweller, and if your holdings didn’t have a big day today, maybe they will play catchup tomorrow. It could just be because they are more earlier stage drillplays, and marching to the beat of their own drums, instead of being more tethered and leveraged to the moves in the metals. As we’ve discussed on here many times, the moves usually start in the producers & royalty companies, then move into the developers, and then eventually move down the food chain to the explorers. Their time will come!

Purchased some more positions today. Gold reached the $1840 mark that I mentioned last week that was a good possibility by the end of the month. February is going to be a very pivotal month for the PMs and should tell us the direction in the medium term due to the BBs narrowing as much as they have. There are some technicals looking somewhat bullish for the first time in a long time—-just be careful yet since those with memories should know we were up here in November and most stocks were higher then they are after this move. The other problem is it appears the conventional market is ready for a good “puke” and if it does, will gold an the PM stocks fight the trend?

I posted the following CRB vs Silver chart about 5 weeks ago and it looks like my target worked.

https://stockcharts.com/h-sc/ui?s=%24CRB%3A%24SILVER&p=W&yr=5&mn=0&dy=0&id=p17394409764&a=1077794175

GLD “climbed” the same support from March until December when it ran into an important steeper support and started rising again.

https://stockcharts.com/h-sc/ui?s=GLD&p=W&yr=6&mn=6&dy=0&id=p18102622240&a=683083655

Maybe the “print” feature will show the whole thing:

https://stockcharts.com/h-sc/ui?s=GLD&p=W&yr=6&mn=6&dy=0&id=p18102622240&a=683083655&r=1642627823147&cmd=print

As pointed out recently, gold has been stronger than the bears realize for the entire correction.

https://stockcharts.com/h-sc/ui?s=%24GOLD&p=M&yr=9&mn=0&dy=0&id=p03937989311&a=1073871759&r=1642628432068&cmd=print

There are at least three technical magnets pulling gold to around 1970 and it should get there more quickly than most expect.

https://stockcharts.com/h-sc/ui?s=%24GOLD&p=M&yr=15&mn=8&dy=11&id=t1580095018c&a=967843124&r=1642628814034&cmd=print

Gold has a small channel resistance at about 1855 tomorrow and 1857 the next day.

https://stockcharts.com/h-sc/ui?s=%24GOLD&p=D&yr=0&mn=9&dy=22&id=p25089976842&a=1074272560

The bears and scared wannabe bulls have been consistently myopic since August.

https://stockcharts.com/h-sc/ui?s=%24GOLD&p=W&yr=7&mn=3&dy=0&id=p48319972938&a=716061806&r=1642629277510&cmd=print

The September low was a great time to buy and so was the December low. There’s no good technical reason to worry about a repeat of the November high that happened in between.

https://stockcharts.com/h-sc/ui?s=%24GOLD&p=W&yr=6&mn=6&dy=0&id=t1583232412c&a=931873171&r=1642629941237&cmd=print

Gold just had its best and strongest close versus the Dow in about 6 months.

https://stockcharts.com/h-sc/ui?s=%24GOLD%3A%24INDU&p=D&yr=0&mn=11&dy=0&id=p01323084928&a=592778070

Silver has been too strong to fully retrace its vertical move of 2020 or even to backtest the 2016 high that it broke above in 2020 and I pointed it out no more than 2 or 3 weeks ago.

https://stockcharts.com/h-sc/ui?s=%24SILVER&p=W&yr=6&mn=1&dy=0&id=p01527933618&a=426943004&r=1642631362214&cmd=print

There’s important resistance just above 24.50 tomorrow but it doesn’t worry me. If it stops silver for a day or two, that will be fine (though it probably won’t).

https://stockcharts.com/h-sc/ui?s=%24SILVER&p=D&yr=1&mn=3&dy=0&id=p04191234480&a=500462915

SILJ had its best volume since June as it closed above its 150 MA and a fork resistance.

https://stockcharts.com/h-sc/ui?s=SILJ&p=D&yr=0&mn=9&dy=11&id=p77328045393&a=1099936819

Looks like melt-up time. GDXJ just had its largest volume day in 17 months.

https://stockcharts.com/h-sc/ui?s=GDXJ&p=D&yr=1&mn=1&dy=0&id=p46295348000&a=1081065591

still waiting for sign of ignition on gold with close above 1830 or so, then quick nov high breach, silver seems to be sending the message first. Would help if US buck would cooperate to resume downside.

Let’s see what happens and just maybe pile in.